Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Pledges amounting to $200,000 were received. Of this amount, $50,000 was restricted for a special education research program. All of the restricted pledges

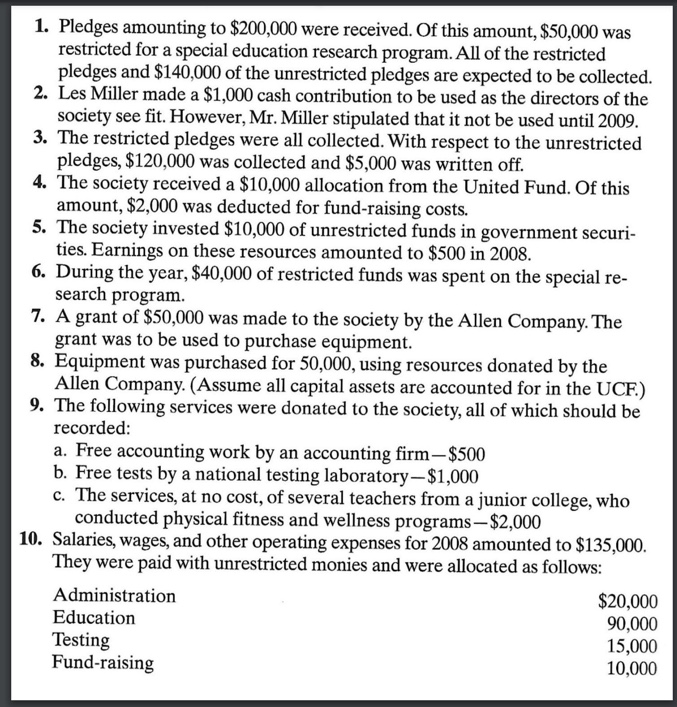

1. Pledges amounting to $200,000 were received. Of this amount, $50,000 was restricted for a special education research program. All of the restricted pledges and $140,000 of the unrestricted pledges are expected to be collected. 2. Les Miller made a $1,000 cash contribution to be used as the directors of the society see fit. However, Mr. Miller stipulated that it not be used until 2009. 3. The restricted pledges were all collected. With respect to the unrestricted pledges, $120,000 was collected and $5,000 was written off. 4. The society received a $10,000 allocation from the United Fund. Of this amount, $2,000 was deducted for fund-raising costs. 5. The society invested $10,000 of unrestricted funds in government securi- ties. Earnings on these resources amounted to $500 in 2008. 6. During the year, $40,000 of restricted funds was spent on the special re- search program. 7. A grant of $50,000 was made to the society by the Allen Company. The grant was to be used to purchase equipment. 8. Equipment was purchased for 50,000, using resources donated by the Allen Company. (Assume all capital assets are accounted for in the UCF.) 9. The following services were donated to the society, all of which should be recorded: a. Free accounting work by an accounting firm-$500 b. Free tests by a national testing laboratory-$1,000 c. The services, at no cost, of several teachers from a junior college, who conducted physical fitness and wellness programs-$2,000 10. Salaries, wages, and other operating expenses for 2008 amounted to $135,000. They were paid with unrestricted monies and were allocated as follows: Administration Education Testing Fund-raising $20,000 90,000 15,000 10,000

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries for the Societys 2008 Activities Based on the information provided here are the journal entries for the Societys 2008 activities 1 Ple...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started