Answered step by step

Verified Expert Solution

Question

1 Approved Answer

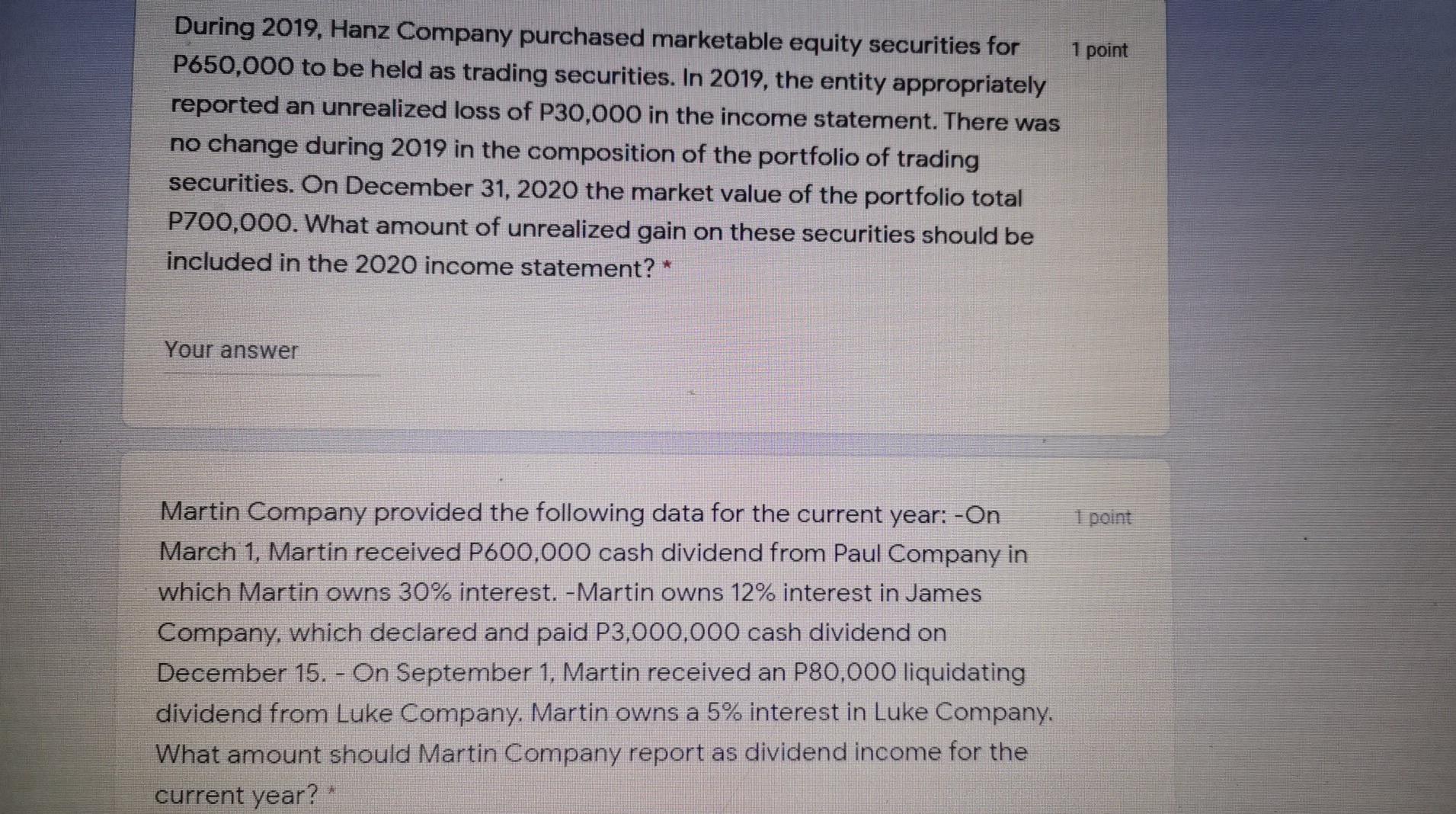

1 point During 2019, Hanz Company purchased marketable equity securities for P650,000 to be held as trading securities. In 2019, the entity appropriately reported an

1 point During 2019, Hanz Company purchased marketable equity securities for P650,000 to be held as trading securities. In 2019, the entity appropriately reported an unrealized loss of P30,000 in the income statement. There was no change during 2019 in the composition of the portfolio of trading securities. On December 31, 2020 the market value of the portfolio total P700,000. What amount of unrealized gain on these securities should be included in the 2020 income statement? * Your answer 1 point Martin Company provided the following data for the current year: -On March 1, Martin received P600,000 cash dividend from Paul Company in which Martin owns 30% interest. -Martin owns 12% interest in James Company, which declared and paid P3,000,000 cash dividend on December 15. - On September 1, Martin received an P80,000 liquidating dividend from Luke Company. Martin owns a 5% interest in Luke Company, What amount should Martin Company report as dividend income for the current year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started