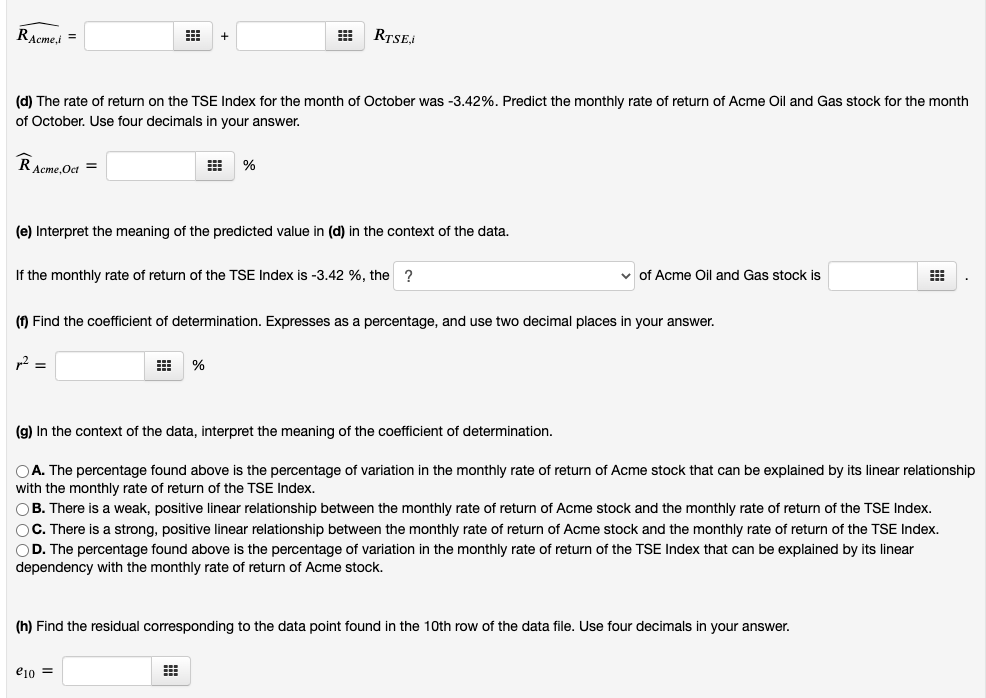

(1 point) The Capital Asset Price Model (CAPM) is a financial model that attempts to predict the rate of return on a financial instrument, such as a common stock, in such a way that it is linearly related to the rate of return on the overal market. Specifically, R Stock A,i = Bo + B, R Market,i + e You are to study the relationship between the two variables and estimate the above model: RStocka,i - rate of return on Stock A for month i, i = 1, 2, ..., 59. RMarketi - market rate of return for month i, i = 1, 2, ..., 59. Bi represent's the stocks beta' value, or its systematic risk. It measure's the stocks volatility related to the market volatility. Bo represents the risk-free interest rate. The data in the Download .csv file contains the data on the rate of return of a large energy company which will be referred to as Acme Oil and Gas and the corresponding rate of return on the Toronto Composite Index (TSE) for 59 randomly selected months. Therefore R Acme, i represents the monthly rate of return for a common share of Acme Oil and Gas stock; Rtse, represents the monthly rate of return (increase or decrease) of the TSE Index for the same month, month i. The first column in this data file contains the monthly rate of return on Acme Oil and gas stock; the second column contains the monthly rate of return on the TSE index for the same month. (a) Using R-Studio, create a scatter-plot of the data. What can you conclude from this scatter-plot? OA. There is a positive linear relationship between the monthly rate of return of Acme Oil and Gas stock and the monthly rate of return of the TSE Index. OB. There is a negative linear relationship between the monthly rate of return of Acme stock and the monthly rate of return of the TSE Index. OC. There is not a linear relationship between the monthly rate of return of Acme stock and the monthly rate of return of the TSE Index. (b) Find the value of the correlation coefficient. Enter your answer using four decimals. (c) Use R-Studio to find the least squares estimate of the linear model that expressed the monthly rate of return on Acme Oil and Gas stock as a linear functino of the monthly rate of return on the Toronto Stock Exchange Index. Use three decimals in each of your answers. R Acme,i = + RTSE. (d) The rate of return on the TSE Index for the month of October was -3.42%. Predict the monthly rate of return of Acme Oil and Gas stock for the month of October. Use four decimals in your answer. R Acme, Oa = % (e) Interpret the meaning of the predicted value in (d) in the context of the data. If the monthly rate of return of the TSE Index is -3.42 %, the ? of Acme Oil and Gas stock is (1) Find the coefficient of determination. Expresses as a percentage, and use two decimal places in your answer. r2 = % (g) In the context of the data, interpret the meaning of the coefficient of determination. OA. The percentage found above is the percentage of variation in the monthly rate of return of Acme stock that can be explained by its linear relationship with the monthly rate of return of the TSE Index. OB. There is a weak, positive linear relationship between the monthly rate of return of Acme stock and the monthly rate of return of the TSE Index. C. There is a strong, positive linear relationship between the monthly rate of return of Acme stock and the monthly rate of return of the TSE Index. OD. The percentage found above is the percentage of variation in the monthly rate of return of the TSE Index that can be explained by its linear dependency with the monthly rate of return of Acme stock. (h) Find the residual corresponding to the data point found in the 10th row of the data file. Use four decimals in your answer. e10 = (1 point) The Capital Asset Price Model (CAPM) is a financial model that attempts to predict the rate of return on a financial instrument, such as a common stock, in such a way that it is linearly related to the rate of return on the overal market. Specifically, R Stock A,i = Bo + B, R Market,i + e You are to study the relationship between the two variables and estimate the above model: RStocka,i - rate of return on Stock A for month i, i = 1, 2, ..., 59. RMarketi - market rate of return for month i, i = 1, 2, ..., 59. Bi represent's the stocks beta' value, or its systematic risk. It measure's the stocks volatility related to the market volatility. Bo represents the risk-free interest rate. The data in the Download .csv file contains the data on the rate of return of a large energy company which will be referred to as Acme Oil and Gas and the corresponding rate of return on the Toronto Composite Index (TSE) for 59 randomly selected months. Therefore R Acme, i represents the monthly rate of return for a common share of Acme Oil and Gas stock; Rtse, represents the monthly rate of return (increase or decrease) of the TSE Index for the same month, month i. The first column in this data file contains the monthly rate of return on Acme Oil and gas stock; the second column contains the monthly rate of return on the TSE index for the same month. (a) Using R-Studio, create a scatter-plot of the data. What can you conclude from this scatter-plot? OA. There is a positive linear relationship between the monthly rate of return of Acme Oil and Gas stock and the monthly rate of return of the TSE Index. OB. There is a negative linear relationship between the monthly rate of return of Acme stock and the monthly rate of return of the TSE Index. OC. There is not a linear relationship between the monthly rate of return of Acme stock and the monthly rate of return of the TSE Index. (b) Find the value of the correlation coefficient. Enter your answer using four decimals. (c) Use R-Studio to find the least squares estimate of the linear model that expressed the monthly rate of return on Acme Oil and Gas stock as a linear functino of the monthly rate of return on the Toronto Stock Exchange Index. Use three decimals in each of your answers. R Acme,i = + RTSE. (d) The rate of return on the TSE Index for the month of October was -3.42%. Predict the monthly rate of return of Acme Oil and Gas stock for the month of October. Use four decimals in your answer. R Acme, Oa = % (e) Interpret the meaning of the predicted value in (d) in the context of the data. If the monthly rate of return of the TSE Index is -3.42 %, the ? of Acme Oil and Gas stock is (1) Find the coefficient of determination. Expresses as a percentage, and use two decimal places in your answer. r2 = % (g) In the context of the data, interpret the meaning of the coefficient of determination. OA. The percentage found above is the percentage of variation in the monthly rate of return of Acme stock that can be explained by its linear relationship with the monthly rate of return of the TSE Index. OB. There is a weak, positive linear relationship between the monthly rate of return of Acme stock and the monthly rate of return of the TSE Index. C. There is a strong, positive linear relationship between the monthly rate of return of Acme stock and the monthly rate of return of the TSE Index. OD. The percentage found above is the percentage of variation in the monthly rate of return of the TSE Index that can be explained by its linear dependency with the monthly rate of return of Acme stock. (h) Find the residual corresponding to the data point found in the 10th row of the data file. Use four decimals in your answer. e10 =