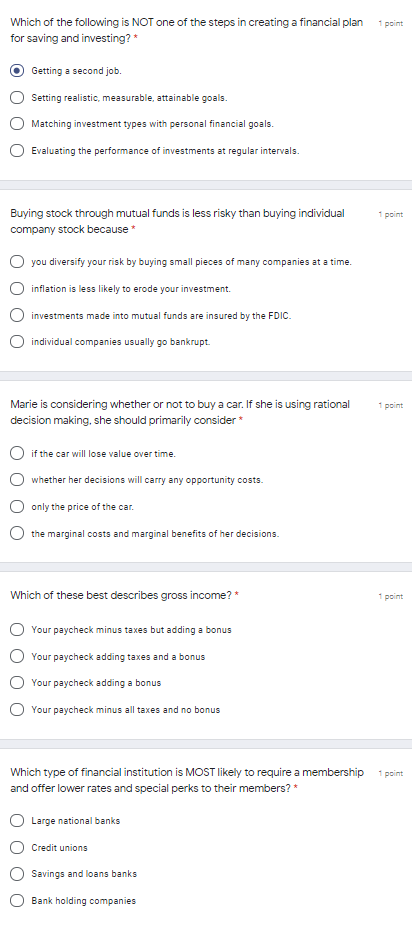

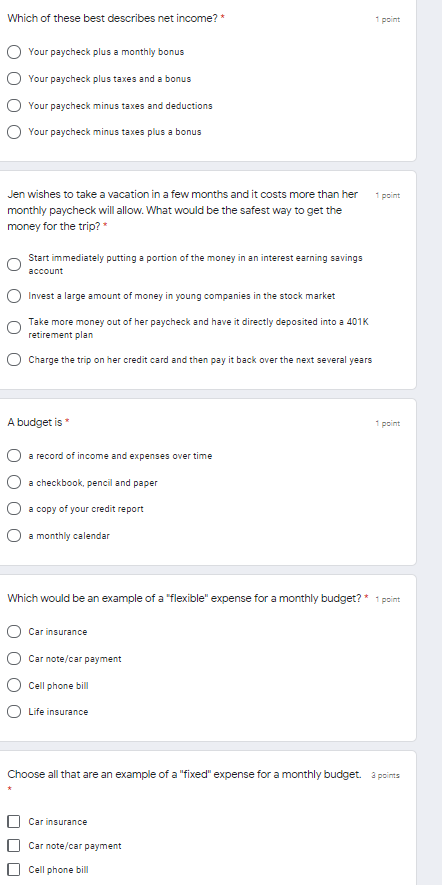

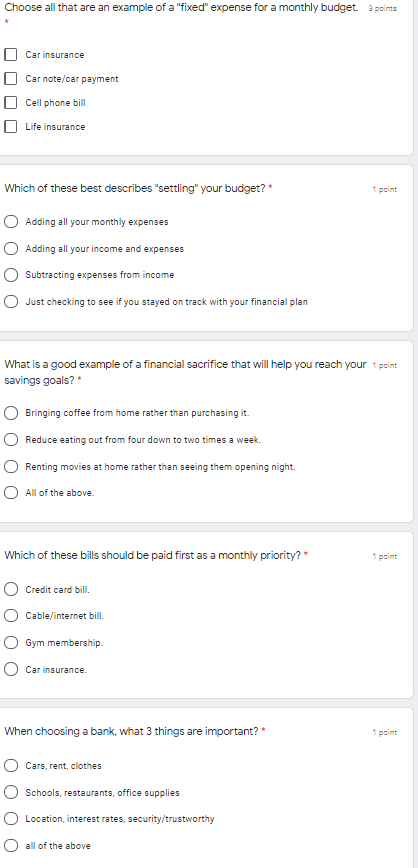

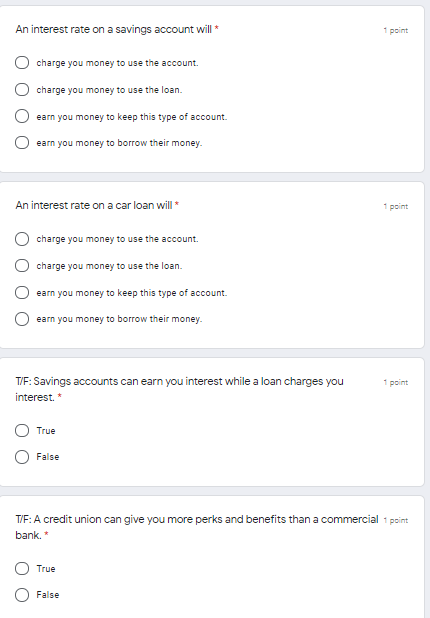

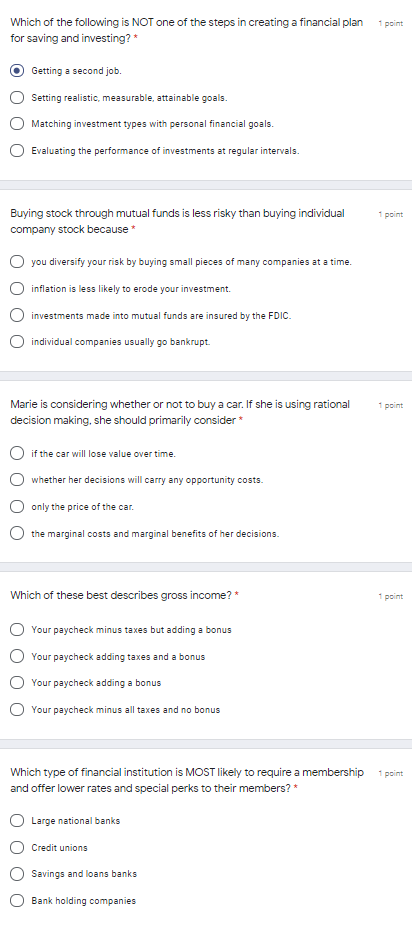

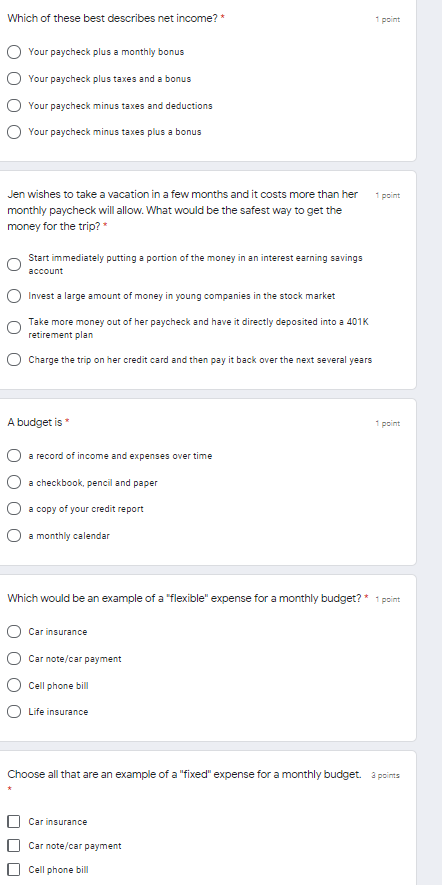

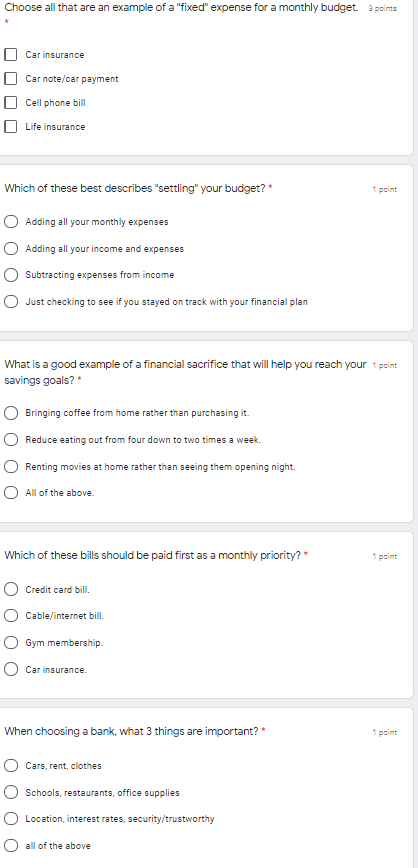

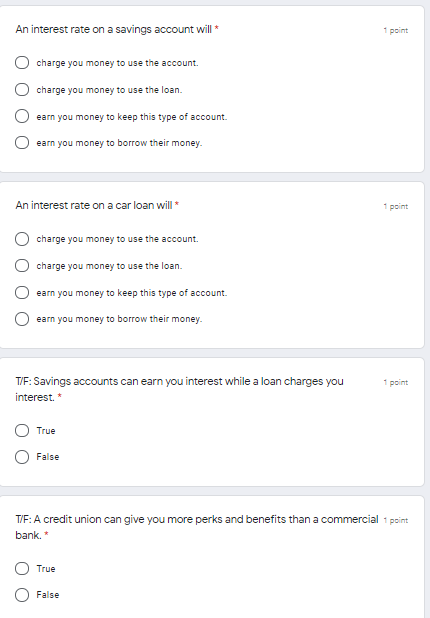

1 point Which of the following is NOT one of the steps in creating a financial plan for saving and investing?* Getting a second job. Setting realistic, measurable, attainable goals. Matching investment types with personal financial goals. Evaluating the performance of investments at regular intervals. 1 point Buying stock through mutual funds is less risky than buying individual company stock because * you diversify your risk by buying small pieces of many companies at a time. inflation is less likely to erode your investment. investments made into mutual funds are insured by the FDIC. individual companies usually go bankrupt. 1 point Marie is considering whether or not to buy a car. If she is using rational decision making, she should primarily consider* if the car will lose value over time. whether her decisions will carry any opportunity costs. only the price of the car. the marginal costs and marginal benefits of her decisions. Which of these best describes gross income?* 1 point Your paycheck minus taxes but adding a bonus Your paycheck adding taxes and a bonus Your paycheck adding a bonus Your paycheck minus all taxes and no bonus 1 point Which type of financial institution is MOST likely to require a membership and offer lower rates and special perks to their members? * Large national banks Credit unions Savings and loans banks Bank holding companies Which of these best describes net income? * 1 point Your paycheck plus a monthly bonus Your paycheck plus taxes and a bonus Your paycheck minus taxes and deductions Your paycheck minus taxes plus a bonus 1 point Jen wishes to take a vacation in a few months and it costs more than her monthly paycheck will allow. What would be the safest way to get the money for the trip? Start immediately putting a portion of the money in an interest earning savings account Invest a large amount of money in young companies in the stock market Take more money out of her paycheck and have it directly deposited into a 401K retirement plan O Charge the trip on her credit card and then pay it back over the next several years A budget is 1 point a record of income and expenses over time a checkbook, pencil and paper a copy of your credit report a monthly calendar Which would be an example of a "flexible" expense for a monthly budget? * 1 point Car insurance Car note/car payment Cell phone bill Life insurance Choose all that are an example of a "fixed" expense for a monthly budget. a points Car insurance Car note/car payment Cell phone bill Choose all that are an example of a "fixed" expense for a monthly budget. 3 points Car insurance Car note/car payment Cell phone bill Life insurance Which of these best describes "settling" your budget?* 1 point O Adding all your monthly expenses Adding all your income and expenses Subtracting expenses from income O Just checking to see if you stayed on track with your financial plan What is a good example of a financial sacrifice that will help you reach your 1 point savings goals? Bringing coffee from home rather than purchasing it. Reduce eating out from four down to two times a week. Renting movies at home rather than seeing them opening night. All of the above. Which of these bills should be paid first as a monthly priority?* 1 point Credit card bill. O Cable/internet bill O Gym membership Car insurance When choosing a bank, what 3 things are important?* 1 point O Cars, rent, clothes Schools, restaurants, office supplies Location, interest rates, security/trustworthy all of the above An interest rate on a savings account will 1 point charge you money to use the account charge you money to use the loan. O earn you money to keep this type of account. earn you money to borrow their money. An interest rate on a car loan will * 1 point charge you money to use the account. charge you money to use the loan. earn you money to keep this type of account. OO earn you money to borrow their money. 1 point TIE: Savings accounts can earn you interest while a loan charges you interest. True False T/F: A credit union can give you more perks and benefits than a commercial 1 point bank. True O False