Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Portfolio Theory and CAPM: The stock market comprises two stocks, A and B, and a risk-free asset. The return on the risk-free asset

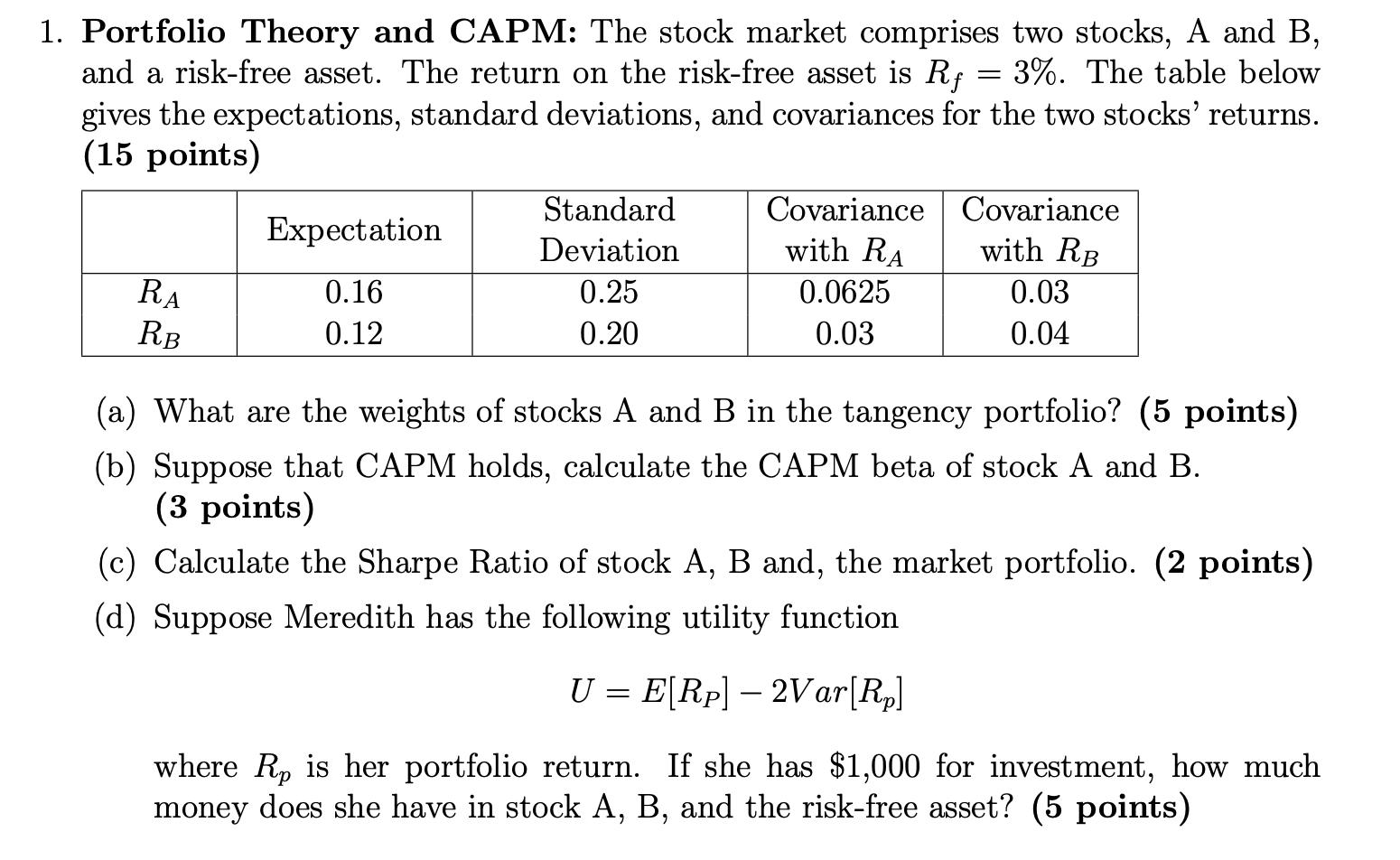

1. Portfolio Theory and CAPM: The stock market comprises two stocks, A and B, and a risk-free asset. The return on the risk-free asset is Rf 3%. The table below gives the expectations, standard deviations, and covariances for the two stocks' returns. (15 points) RA RB Expectation 0.16 0.12 Standard Deviation 0.25 0.20 Covariance with RA 0.0625 0.03 = Covariance with RB 0.03 0.04 (a) What are the weights of stocks A and B in the tangency portfolio? (5 points) (b) Suppose that CAPM holds, calculate the CAPM beta of stock A and B. (3 points) (c) Calculate the Sharpe Ratio of stock A, B and, the market portfolio. (2 points) (d) Suppose Meredith has the following utility function U = E[Rp] - 2Var[R] where Rp is her portfolio return. If she has $1,000 for investment, how much money does she have in stock A, B, and the risk-free asset? (5 points)

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started