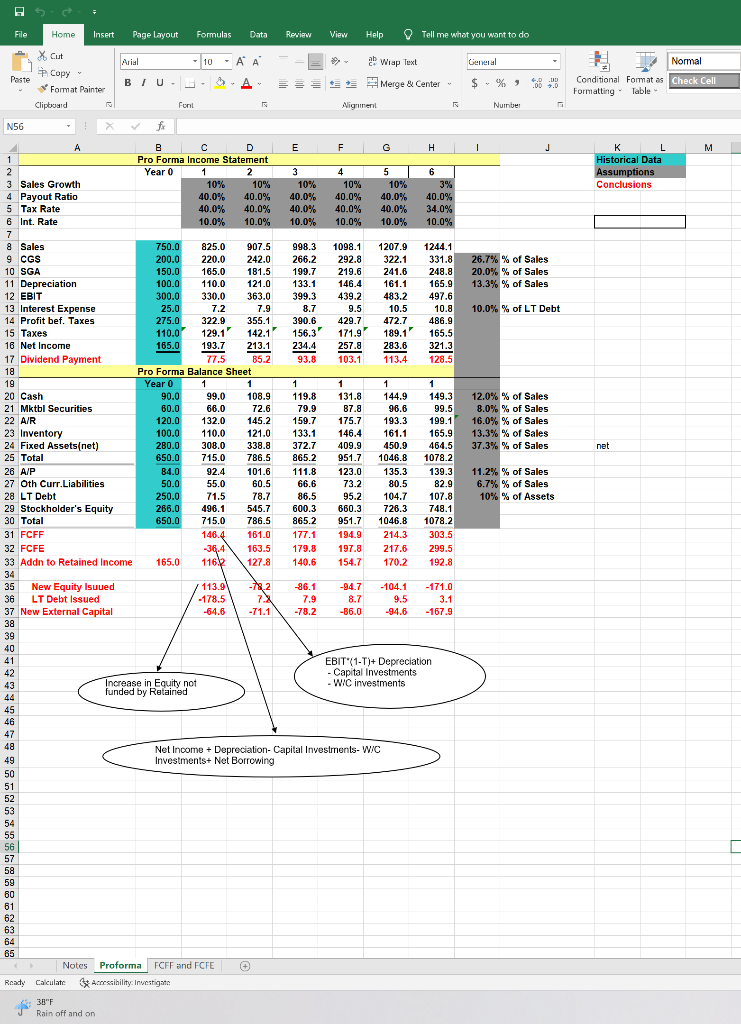

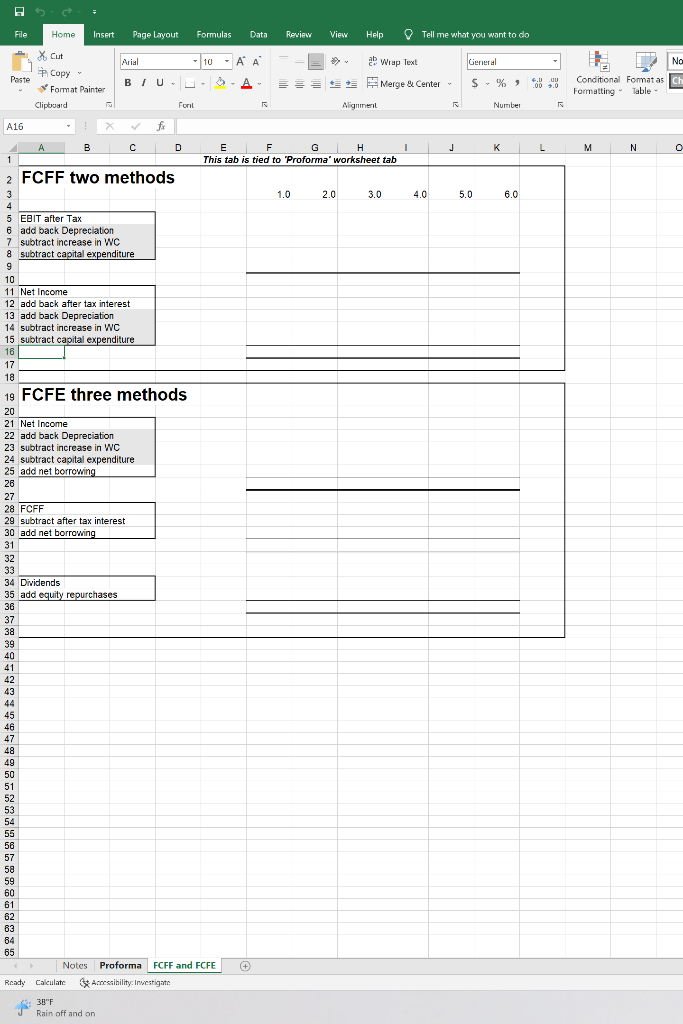

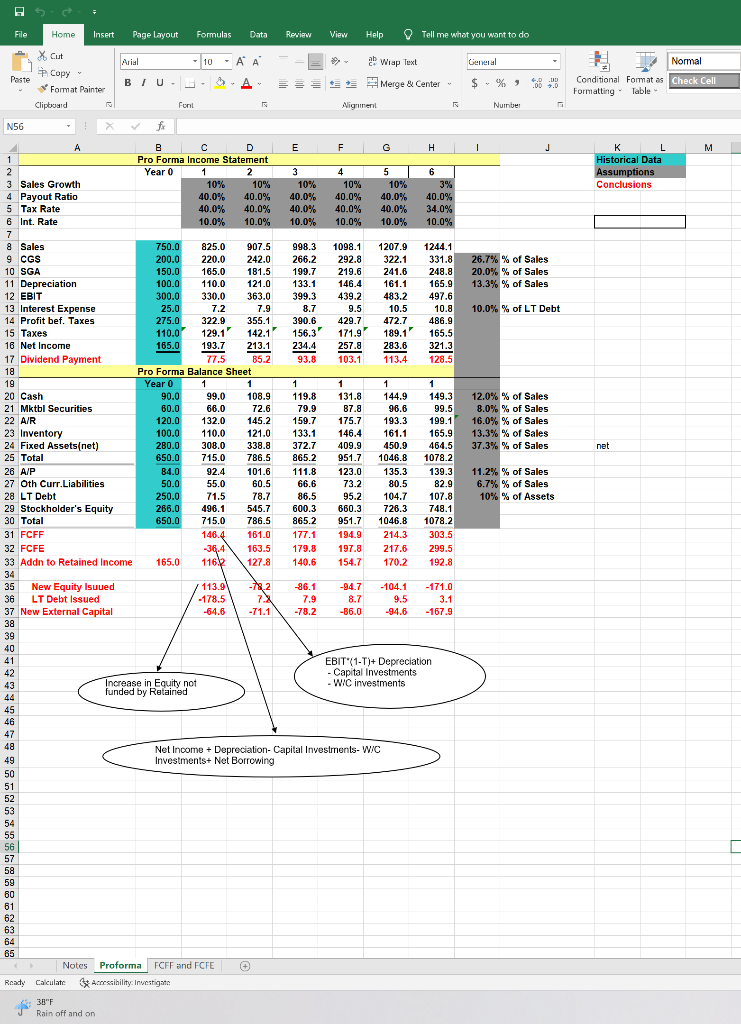

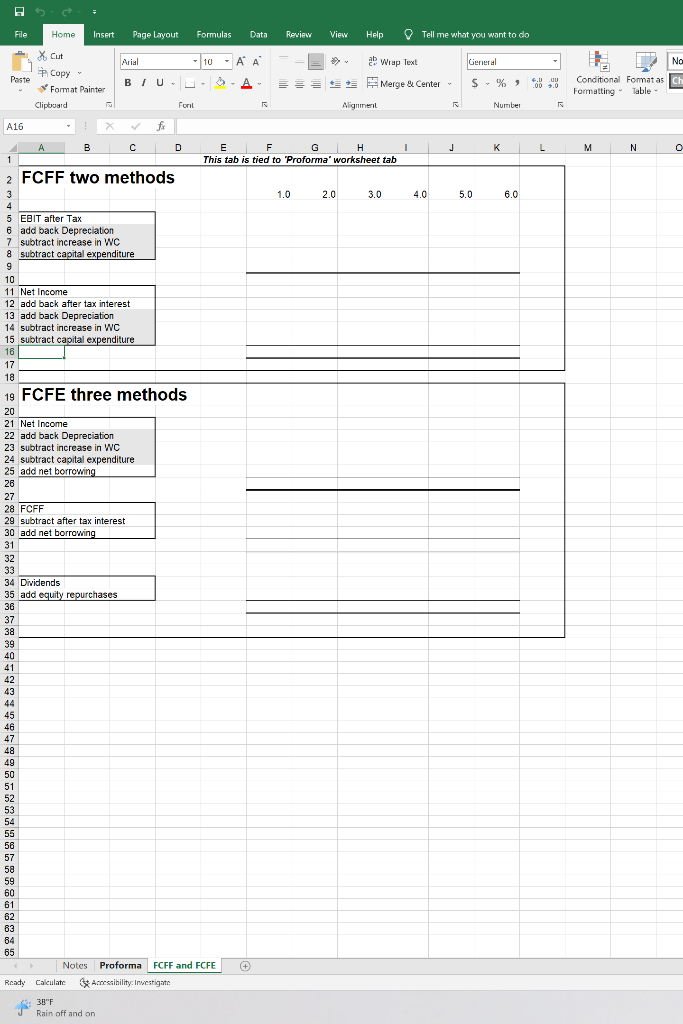

1) 'Praforma' tab has proforma data for income and balance sheet. Three color coded zones identify data, assumptions and conclusions. Historical data (Column B) is used to construct the proforma(Columns C to H ). You can change assumptions as needed. Play with the proforma spreadsheet to explore its construction. This will help later when we use real data for real companies. 2) 'FCFF and FCFE', tab provides a template to illustrate several alternative approaches to construct FCFF and FCFE. Use data from the 'Proforma' tab to apply this template. 10 To provide you some guideline, I have constructed estimates of FCFE, FCFF, External Financing Needed, LT Debt issued etc. in the 'Proforma' tab. 12 Note: Increase in fixed assets=change in gross assets=change in net fixed assets+current depreciation 13 This is because net fixed assets are net of accumulated depreciation. 14 Old net fixed+increase=new net fixed+current depreciation 15 So increase in assets=change in net fixed+ current depreciation. Soloct destination and pross ENIER or choose Pasto 382F Rain off and on 1) 'Praforma' tab has proforma data for income and balance sheet. Three color coded zones identify data, assumptions and conclusions. Historical data (Column B) is used to construct the proforma(Columns C to H ). You can change assumptions as needed. Play with the proforma spreadsheet to explore its construction. This will help later when we use real data for real companies. 2) 'FCFF and FCFE', tab provides a template to illustrate several alternative approaches to construct FCFF and FCFE. Use data from the 'Proforma' tab to apply this template. 10 To provide you some guideline, I have constructed estimates of FCFE, FCFF, External Financing Needed, LT Debt issued etc. in the 'Proforma' tab. 12 Note: Increase in fixed assets=change in gross assets=change in net fixed assets+current depreciation 13 This is because net fixed assets are net of accumulated depreciation. 14 Old net fixed+increase=new net fixed+current depreciation 15 So increase in assets=change in net fixed+ current depreciation. Soloct destination and pross ENIER or choose Pasto 382F Rain off and on