Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Preferred Stock. Why would someone invest in preferred stock? What features would appeal to them, and why? (LO 12-1) 2. Change in Yield.

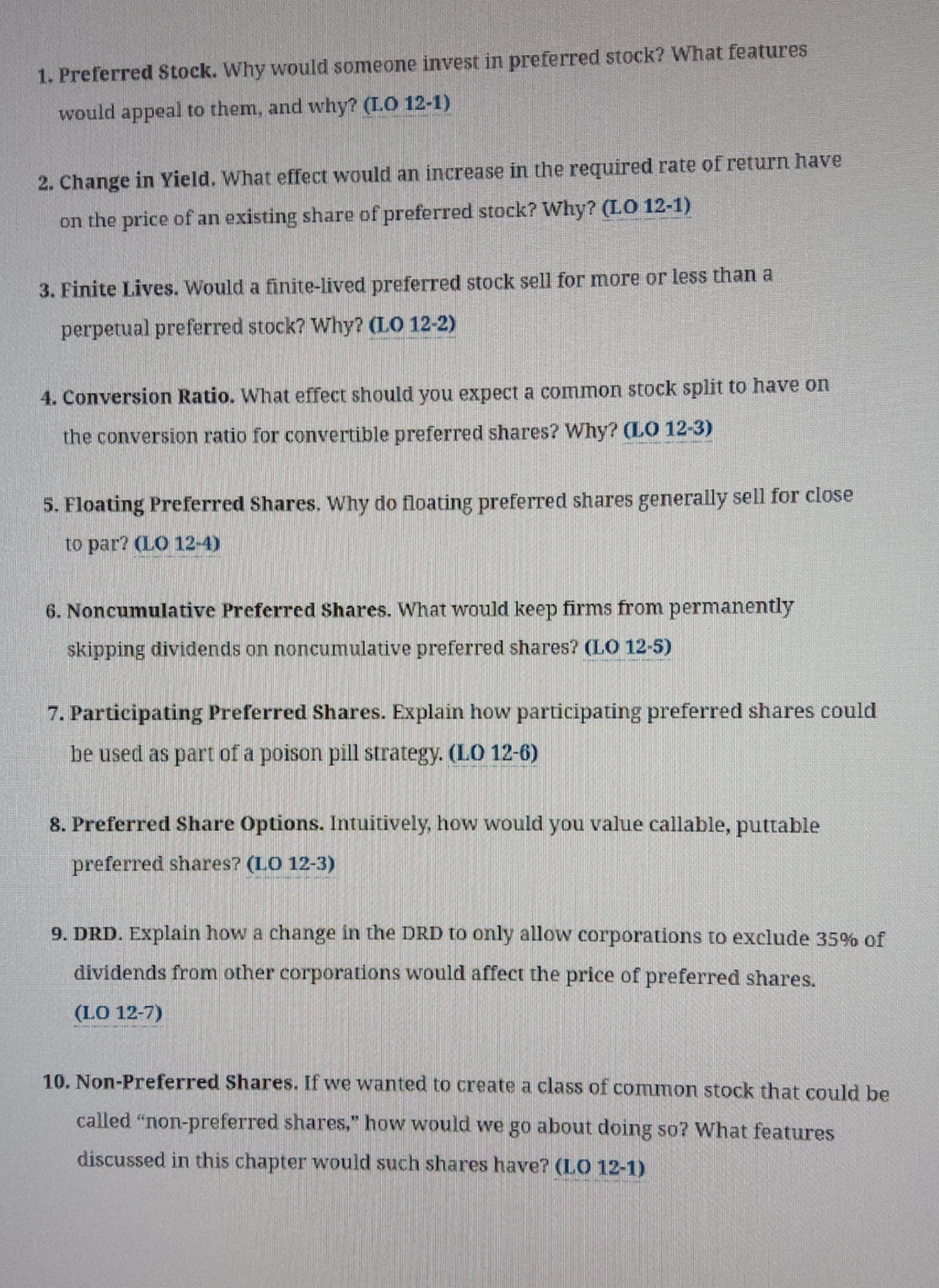

1. Preferred Stock. Why would someone invest in preferred stock? What features would appeal to them, and why? (LO 12-1) 2. Change in Yield. What effect would an increase in the required rate of return have on the price of an existing share of preferred stock? Why? (LO 12-1) 3. Finite Lives. Would a finite-lived preferred stock sell for more or less than a perpetual preferred stock? Why? (LO 12-2) 4. Conversion Ratio. What effect should you expect a common stock split to have on the conversion ratio for convertible preferred shares? Why? (LO 12-3) 5. Floating Preferred Shares. Why do floating preferred shares generally sell for close to par? (LO 12-4) 6. Noncumulative Preferred Shares. What would keep firms from permanently skipping dividends on noncumulative preferred shares? (LO 12-5) 7. Participating Preferred Shares. Explain how participating preferred shares could be used as part of a poison pill strategy. (LO 12-6) 8. Preferred Share Options. Intuitively, how would you value callable, puttable preferred shares? (LO 12-3) 9. DRD. Explain how a change in the DRD to only allow corporations to exclude 35% of dividends from other corporations would affect the price of preferred shares. (LO 12-7) 10. Non-Preferred Shares. If we wanted to create a class of common stock that could be called "non-preferred shares," how would we go about doing so? What features discussed in this chapter would such shares have? (LO 12-1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Preferred Stock Investors might be drawn to preferred stock for its combination of fixed dividend payments and priority over common stockholders in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started