Answered step by step

Verified Expert Solution

Question

1 Approved Answer

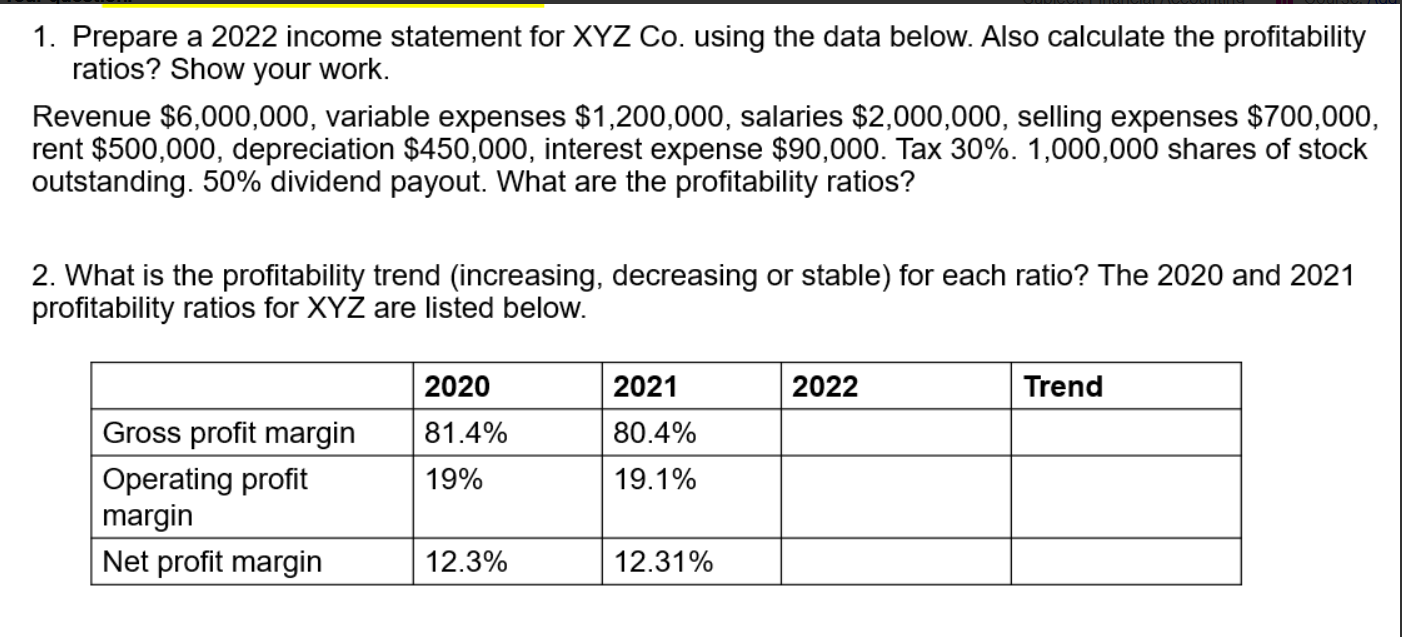

1. Prepare a 2022 income statement for XYZ Co. using the data below. Also calculate the profitability ratios? Show your work. Revenue $6,000,000, variable

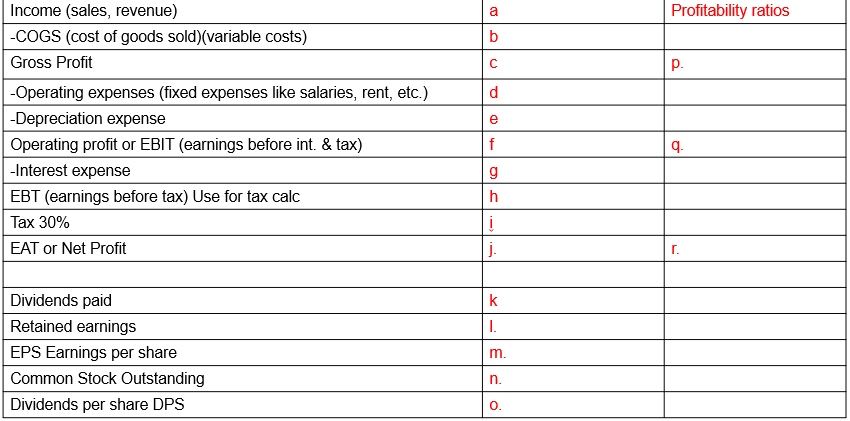

1. Prepare a 2022 income statement for XYZ Co. using the data below. Also calculate the profitability ratios? Show your work. Revenue $6,000,000, variable expenses $1,200,000, salaries $2,000,000, selling expenses $700,000, rent $500,000, depreciation $450,000, interest expense $90,000. Tax 30%. 1,000,000 shares of stock outstanding. 50% dividend payout. What are the profitability ratios? 2. What is the profitability trend (increasing, decreasing or stable) for each ratio? The 2020 and 2021 profitability ratios for XYZ are listed below. 2020 2021 2022 Gross profit margin 81.4% 80.4% Operating profit 19% 19.1% margin Net profit margin 12.3% 12.31% Trend Income (sales, revenue) -COGS (cost of goods sold)(variable costs) Gross Profit -Operating expenses (fixed expenses like salaries, rent, etc.) -Depreciation expense Operating profit or EBIT (earnings before int. & tax) -Interest expense EBT (earnings before tax) Use for tax calc Tax 30% EAT or Net Profit Dividends paid Retained earnings EPS Earnings per share Common Stock Outstanding Dividends per share DPS Profitability ratios a b p. C d e f q. g h j. r. k I. m. n. 0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started