Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Prepare a horizontal and vertical analysis of the Balance Sheet and the Income Statement. 2. Based on the results of your vertical and horizontal

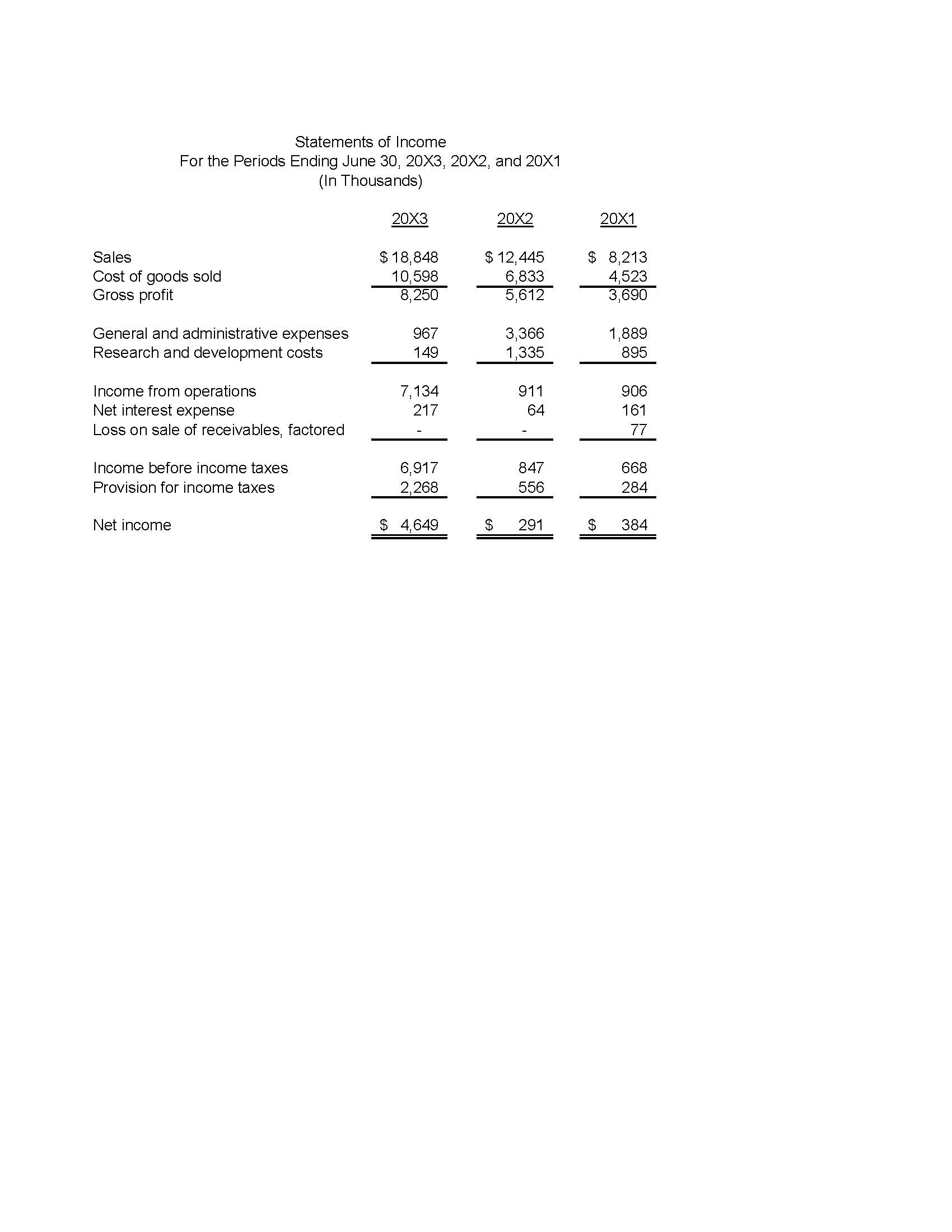

1. Prepare a horizontal and vertical analysis of the Balance Sheet and the Income Statement.

2. Based on the results of your vertical and horizontal analyses, which accounts appear out of alignment? Provide a brief analysis of the relationships between the accounts

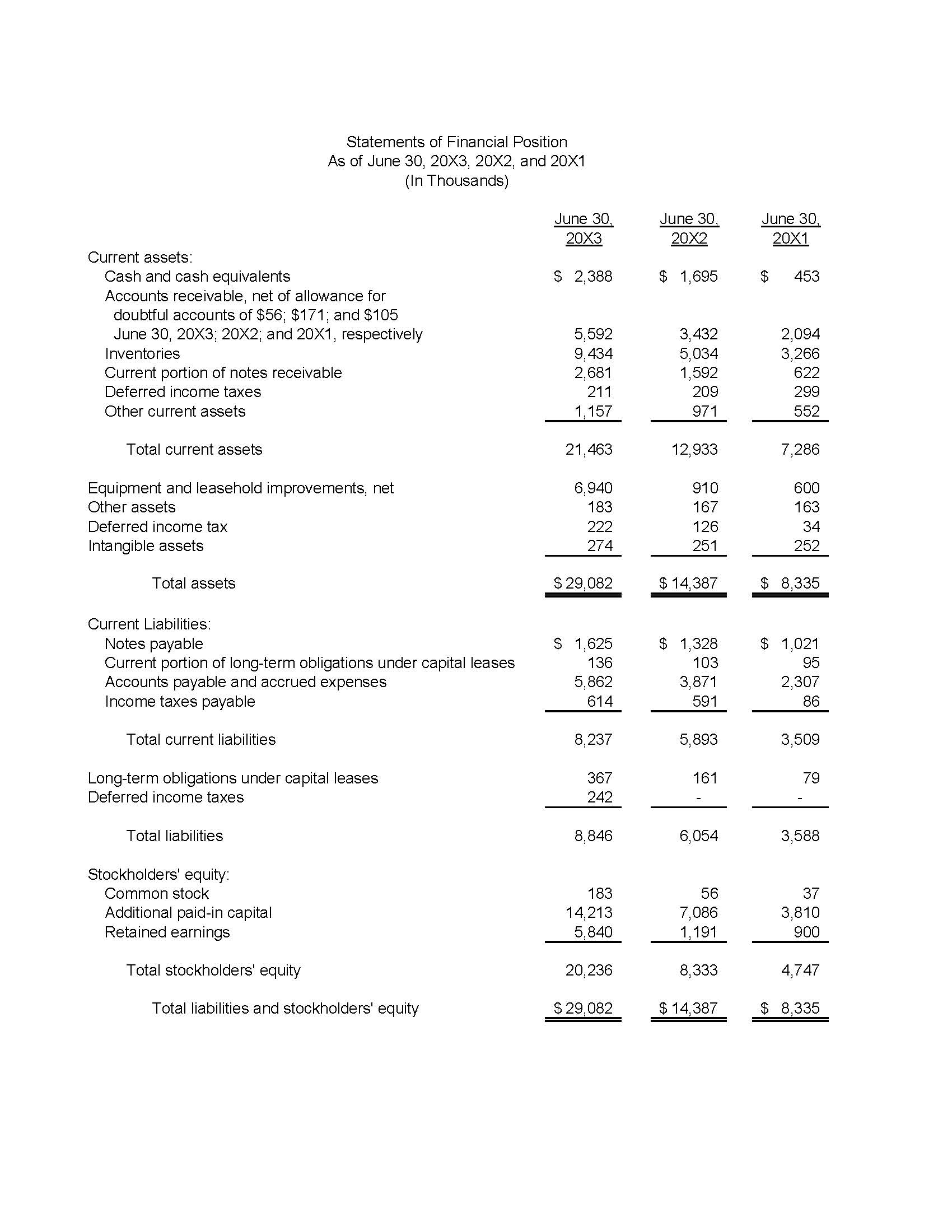

Statements of Financial Position As of June 30, 20X3, 20X2, and 20X1 (In Thousands) Current assets: Cash and cash equivalents Accounts receivable, net of allowance for doubtful accounts of $56; $171; and $105 June 30, 20X3; 20X2; and 20X1, respectively Inventories Current portion of notes receivable Deferred income taxes Other current assets June 30, 20X3 June 30, 20X2 June 30, 20X1 $ 2,388 $ 1,695 $ 453 5,592 3,432 2,094 9,434 5,034 3,266 2,681 1,592 622 211 209 299 1,157 971 552 Total current assets 21,463 12,933 7,286 Equipment and leasehold improvements, net 6,940 910 600 Other assets 183 167 163 Deferred income tax 222 126 34 Intangible assets 274 251 252 Total assets $ 29,082 $ 14,387 $ 8,335 Current Liabilities: Notes payable Current portion of long-term obligations under capital leases Accounts payable and accrued expenses $ 1,625 $ 1,328 $ 1,021 136 5,862 103 3,871 95 2,307 Income taxes payable 614 591 86 Total current liabilities 8,237 5,893 3,509 Long-term obligations under capital leases 367 161 79 Deferred income taxes 242 8,846 6,054 3,588 Total liabilities Stockholders' equity: Common stock Additional paid-in capital 183 56 14,213 7,086 37 3,810 Retained earnings 5,840 1,191 900 Total stockholders' equity 20,236 8,333 4,747 Total liabilities and stockholders' equity $ 29,082 $14,387 $ 8,335

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To prepare a horizontal and vertical analysis of the Balance Sheet and the Income Statement we will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started