Answered step by step

Verified Expert Solution

Question

1 Approved Answer

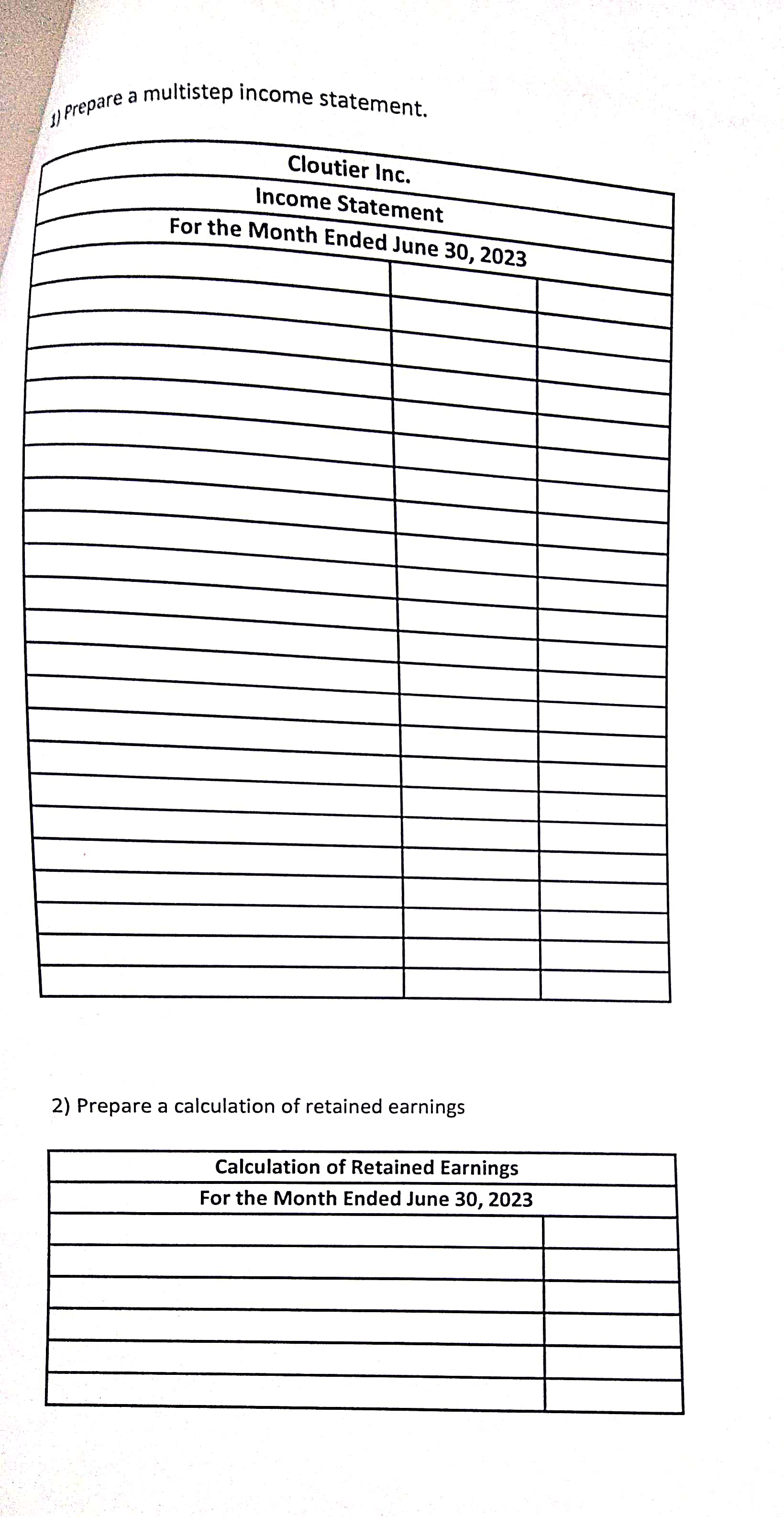

1) prepare a multistep income statement. 2) Prepare a calculation of retained earnings Required: Using the balances of the General Ledger accounts as of June

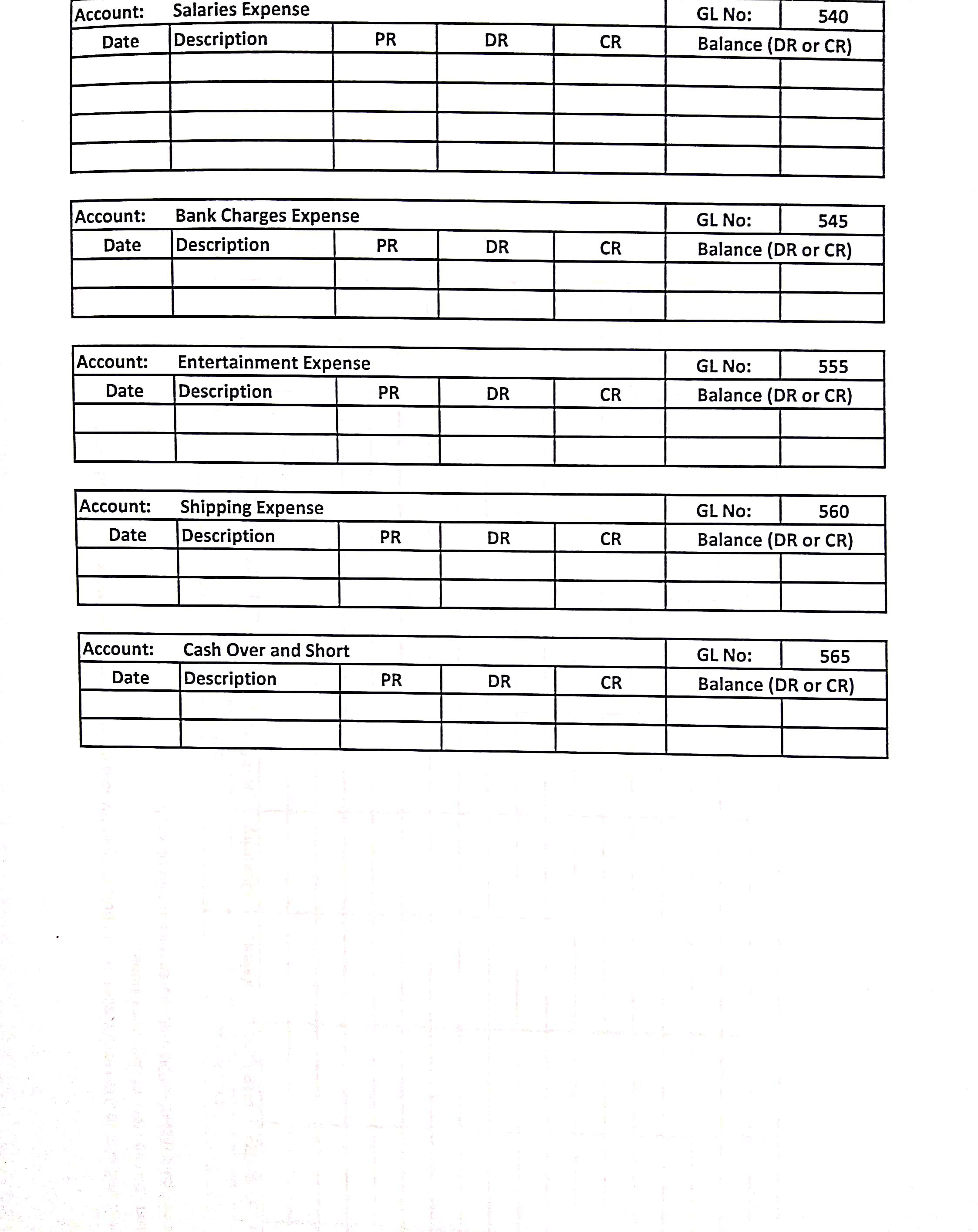

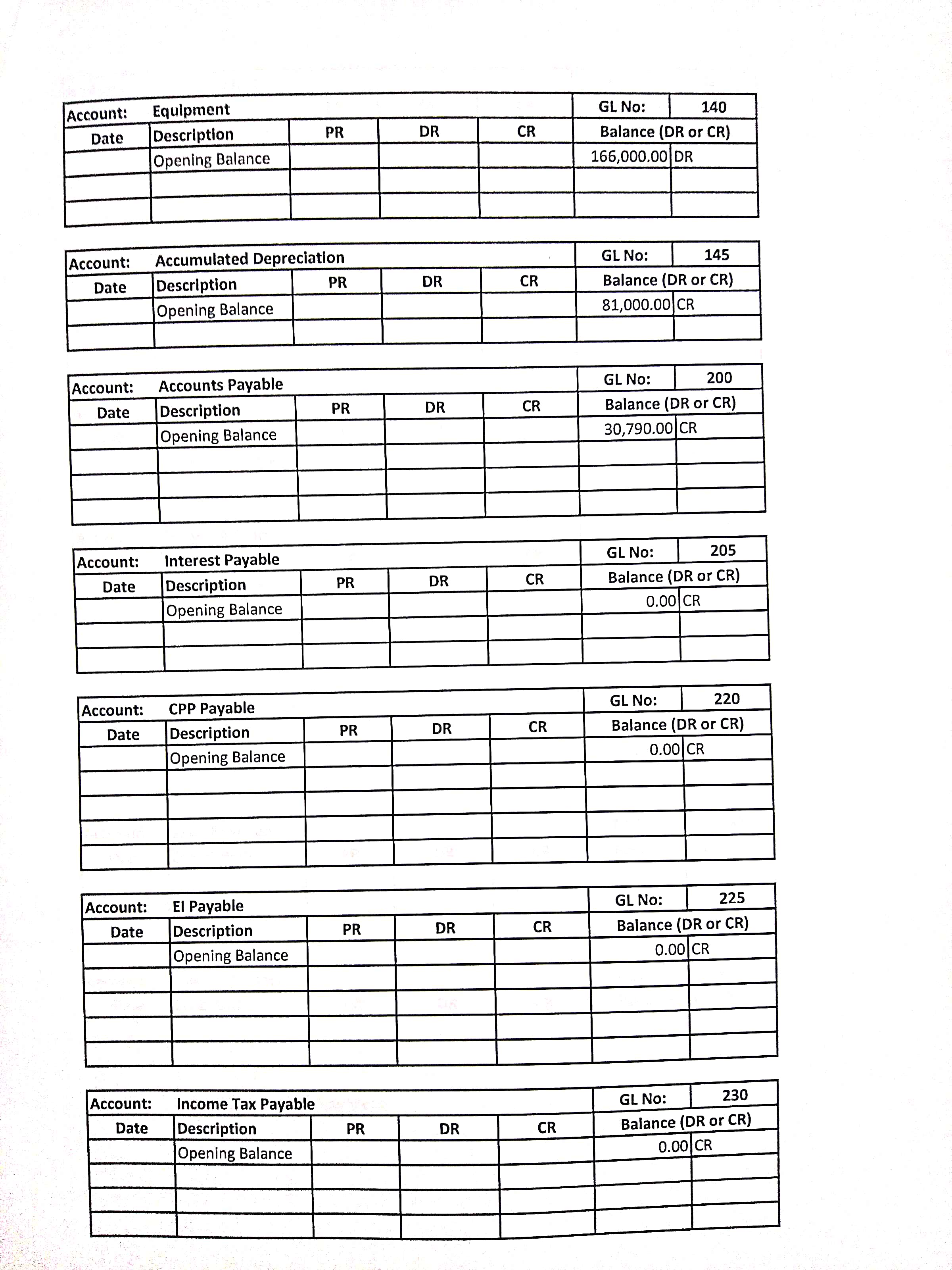

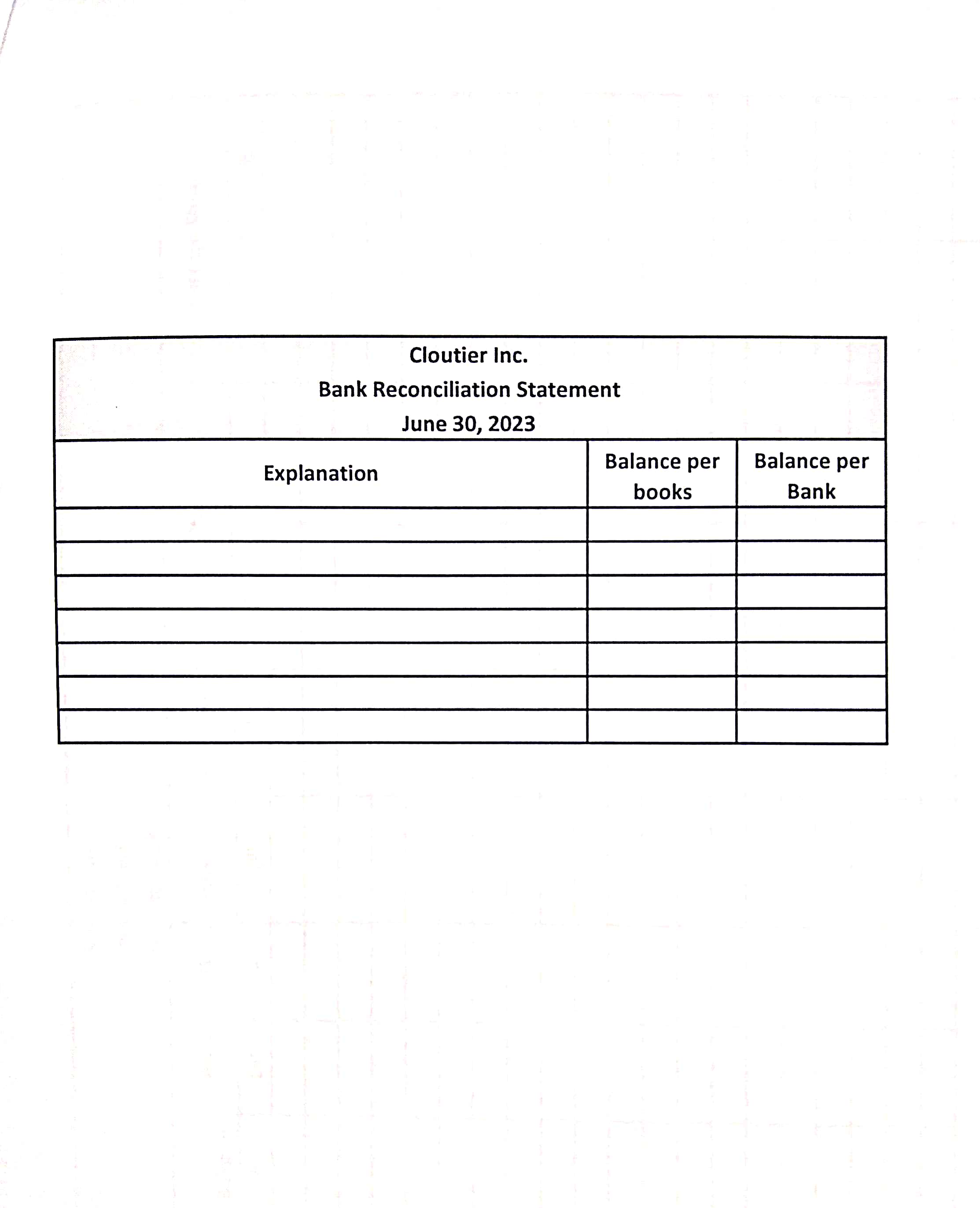

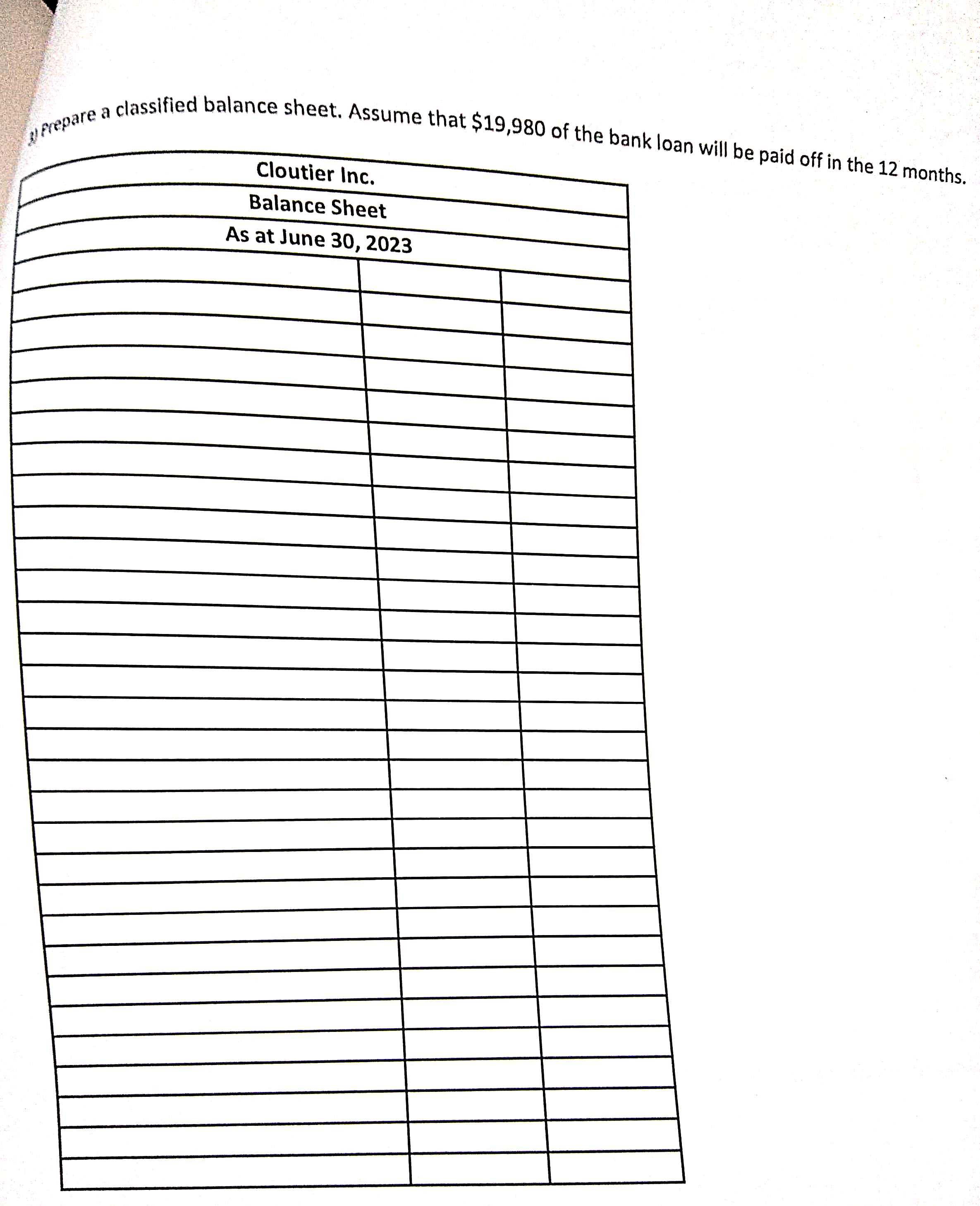

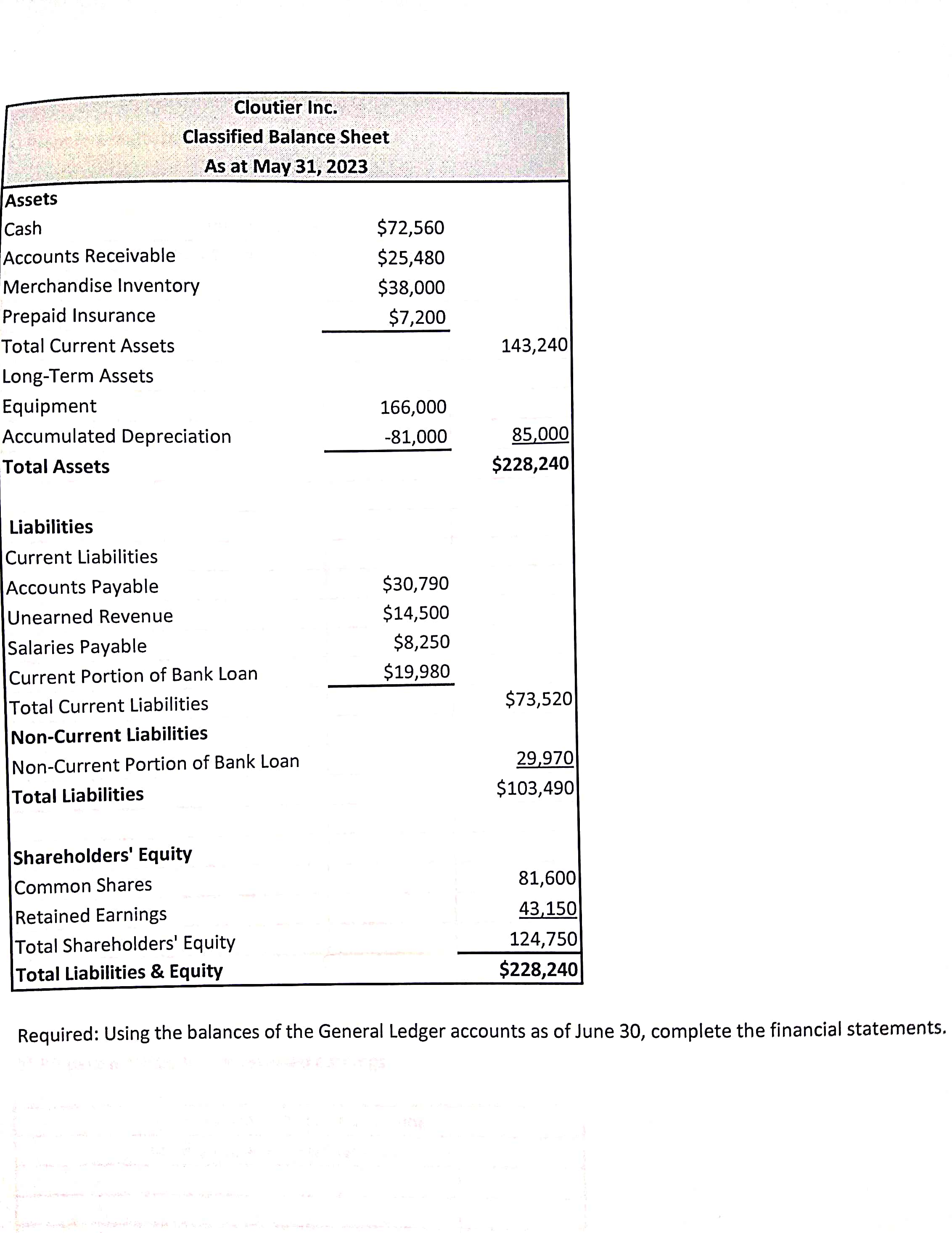

1) prepare a multistep income statement. 2) Prepare a calculation of retained earnings Required: Using the balances of the General Ledger accounts as of June 30, complete the financial statements. 1) prepare a classified balance sheet. Assume that $19,980 of the bank loan will be paid off in the 12 months. \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{|c|}{ Equipment } & GL No: & 140 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 166,000.00 & DR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Accumulated Depreciation } & GL No: & 145 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 81,000.00 & CR \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|l|} \hline Account: & \multicolumn{2}{l|}{ Accounts Payable } & \multicolumn{2}{|c|}{ GL No: } & 200 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 30,790.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Interest Payable } & \multicolumn{2}{|c|}{ GL No: } & 205 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 0.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l}{ CPP Payable } & \multicolumn{2}{|c|}{ GL No: } & 220 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 0.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|c|} \hline Account: & \multicolumn{2}{l}{ Salaries Expense } & \multicolumn{2}{c|}{ GL No: } & \multicolumn{2}{c|}{540} \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Bank Charges Expense } & \multicolumn{2}{c|}{ GL No: } & 545 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Entertainment Expense } & \multicolumn{2}{c|}{ GL No: } & 555 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Shipping Expense } & \multicolumn{2}{l|}{ GL No: } & 560 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Cash Over and Short } & \multicolumn{2}{c|}{ GL No: } & 565 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} 1) prepare a multistep income statement. 2) Prepare a calculation of retained earnings Required: Using the balances of the General Ledger accounts as of June 30, complete the financial statements. 1) prepare a classified balance sheet. Assume that $19,980 of the bank loan will be paid off in the 12 months. \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{|c|}{ Equipment } & GL No: & 140 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 166,000.00 & DR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Accumulated Depreciation } & GL No: & 145 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 81,000.00 & CR \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|l|} \hline Account: & \multicolumn{2}{l|}{ Accounts Payable } & \multicolumn{2}{|c|}{ GL No: } & 200 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 30,790.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Interest Payable } & \multicolumn{2}{|c|}{ GL No: } & 205 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 0.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l}{ CPP Payable } & \multicolumn{2}{|c|}{ GL No: } & 220 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 0.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|c|} \hline Account: & \multicolumn{2}{l}{ Salaries Expense } & \multicolumn{2}{c|}{ GL No: } & \multicolumn{2}{c|}{540} \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Bank Charges Expense } & \multicolumn{2}{c|}{ GL No: } & 545 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Entertainment Expense } & \multicolumn{2}{c|}{ GL No: } & 555 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Shipping Expense } & \multicolumn{2}{l|}{ GL No: } & 560 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Cash Over and Short } & \multicolumn{2}{c|}{ GL No: } & 565 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular}

1) prepare a multistep income statement. 2) Prepare a calculation of retained earnings Required: Using the balances of the General Ledger accounts as of June 30, complete the financial statements. 1) prepare a classified balance sheet. Assume that $19,980 of the bank loan will be paid off in the 12 months. \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{|c|}{ Equipment } & GL No: & 140 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 166,000.00 & DR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Accumulated Depreciation } & GL No: & 145 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 81,000.00 & CR \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|l|} \hline Account: & \multicolumn{2}{l|}{ Accounts Payable } & \multicolumn{2}{|c|}{ GL No: } & 200 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 30,790.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Interest Payable } & \multicolumn{2}{|c|}{ GL No: } & 205 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 0.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l}{ CPP Payable } & \multicolumn{2}{|c|}{ GL No: } & 220 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 0.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|c|} \hline Account: & \multicolumn{2}{l}{ Salaries Expense } & \multicolumn{2}{c|}{ GL No: } & \multicolumn{2}{c|}{540} \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Bank Charges Expense } & \multicolumn{2}{c|}{ GL No: } & 545 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Entertainment Expense } & \multicolumn{2}{c|}{ GL No: } & 555 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Shipping Expense } & \multicolumn{2}{l|}{ GL No: } & 560 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Cash Over and Short } & \multicolumn{2}{c|}{ GL No: } & 565 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} 1) prepare a multistep income statement. 2) Prepare a calculation of retained earnings Required: Using the balances of the General Ledger accounts as of June 30, complete the financial statements. 1) prepare a classified balance sheet. Assume that $19,980 of the bank loan will be paid off in the 12 months. \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{|c|}{ Equipment } & GL No: & 140 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 166,000.00 & DR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Accumulated Depreciation } & GL No: & 145 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 81,000.00 & CR \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|l|} \hline Account: & \multicolumn{2}{l|}{ Accounts Payable } & \multicolumn{2}{|c|}{ GL No: } & 200 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 30,790.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Interest Payable } & \multicolumn{2}{|c|}{ GL No: } & 205 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 0.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l}{ CPP Payable } & \multicolumn{2}{|c|}{ GL No: } & 220 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 0.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|c|} \hline Account: & \multicolumn{2}{l}{ Salaries Expense } & \multicolumn{2}{c|}{ GL No: } & \multicolumn{2}{c|}{540} \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Bank Charges Expense } & \multicolumn{2}{c|}{ GL No: } & 545 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Entertainment Expense } & \multicolumn{2}{c|}{ GL No: } & 555 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Shipping Expense } & \multicolumn{2}{l|}{ GL No: } & 560 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{l|}{ Cash Over and Short } & \multicolumn{2}{c|}{ GL No: } & 565 \\ \hline Date & Description & PR & DR & CR & \multicolumn{3}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started