Answered step by step

Verified Expert Solution

Question

1 Approved Answer

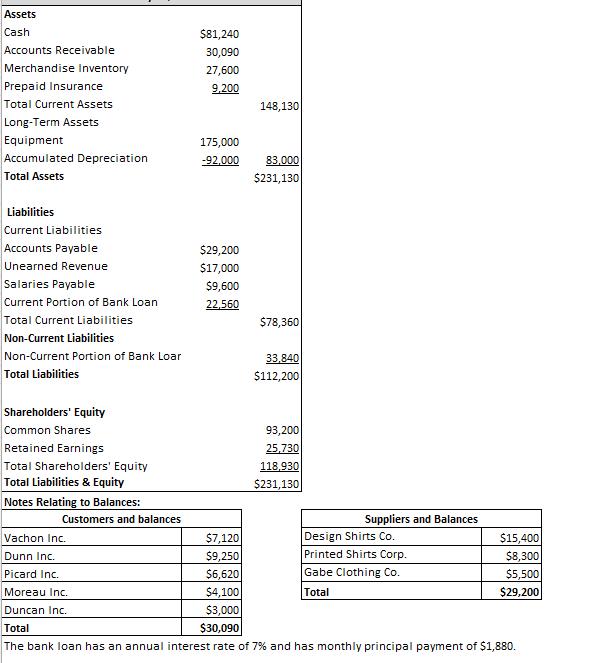

1) Prepare a multistep income statement. Goulet Inc. Income Statement For the Month Ended August 31, 2023 Assets Cash $81,240 Accounts Receivable 30,090 Merchandise

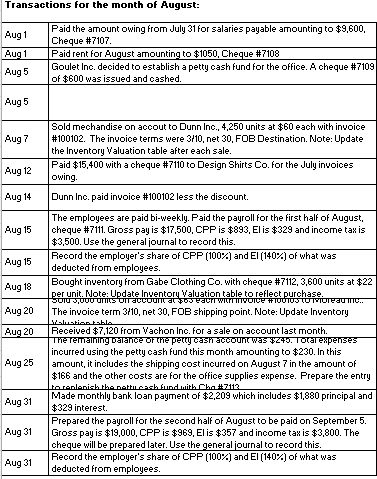

1) Prepare a multistep income statement. Goulet Inc. Income Statement For the Month Ended August 31, 2023 Assets Cash $81,240 Accounts Receivable 30,090 Merchandise Inventory 27,600 Prepaid Insurance 9,200 Total Current Assets 148,130 Long-Term Assets Equipment 175,000 Accumulated Depreciation -92,000 83,000 Total Assets $231,130 Liabilities Current Liabilities Accounts Payable $29,200 Unearned Revenue $17,000 Salaries Payable $9,600 Current Portion of Bank Loan 22,560 Total Current Liabilities $78,360 Non-Current Liabilities Non-Current Portion of Bank Loar Total Liabilities Shareholders' Equity 33,840 $112,200 Common Shares Retained Earnings Total Shareholders' Equity Total Liabilities & Equity 93,200 25,730 118,930 $231,130 Notes Relating to Balances: Customers and balances Suppliers and Balances Vachon Inc. $7,120 Design Shirts Co. $15,400 Dunn Inc. $9,250 Printed Shirts Corp. $8,300 Picard Inc. $6,620 Gabe Clothing Co. $5,500 Moreau Inc. $4,100 Total $29,200 Duncan Inc. $3,000 Total $30,090 The bank loan has an annual interest rate of 7% and has monthly principal payment of $1,880. g) Last month, the gross profit margin percentage was 63%. What could have caused this decrease in gross margin percentage? h) Calculate the inventory turnover as at August 31, 2023. i) If inventory turnover last month was 4.43 is the company holding on to inventory for a longer or shorter period of time? 2) Prepare a calculation of retained earnings Calculation of Retained Earnings For the Month Ended August 31, 2023 Transactions for the month of August: Aug 1 Aug 1 Aug 5 Aug 5 Aug 7 Aug 12 Aug 14 Aug 15 Aug 15 Aug 18 Aug 20 Aug 20 Aug 25 Aug 31 Aug 31 Aug 31 Paid the amount owing from July 31 for salaries payable amounting to $9,600, Cheque #7107. Paid rent for August amounting to $1050, Cheque #7108 Goulet Inc. decided to establish a petty cash fund for the office. A cheque #7109 of $600 was issued and cashed. Sold mechandise on accout to Dunn Inc., 4,250 units at $60 each with invoice #100102. The invoice terms were 3/10, net 30, FOB Destination. Note: Update the Inventory Valuation table after each sale. Paid $15,400 with a cheque #7110 to Design Shirts Co. for the July invoices owing. Dunn Inc. paid invoice #100102 less the discount. The employees are paid bi-weekly. Paid the payroll for the first half of August, cheque #7111. Gross pay is $17,500, CPP is $893, El is $329 and income tax is $3,500. Use the general journal to record this. Record the employer's share of CPP (100%) and El (140%) of what was deducted from employees. Bought inventory from Gabe Clothing Co. with cheque #7112, 3,600 units at $22 per unit. Note: Update Inventory Valuation table to reflect purchase. The invoice term 3/10, net 30, FOB shipping point. Note: Update Inventory Valuation table Received $7,120 from Vachon Inc. for a sale on account last month. The remaining balance or the petty cash account was $249. Total expenses incurred using the petty cash fund this month amounting to $230. In this amount, it includes the shipping cost incurred on August 7 in the amount of $166 and the other costs are for the office supplies expense. Prepare the entry to replenish the nattu cash fund with Cha #7113 Made monthly bank loan payment of $2,209 which includes $1,880 principal and $329 interest. Prepared the payroll for the second half of August to be paid on September 5. Gross pay is $19,000, CPP is $969, El is $357 and income tax is $3,800. The cheque will be prepared later. Use the general journal to record this. Record the employer's share of CPP (100%) and El (140%) of what was deducted from employees.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started