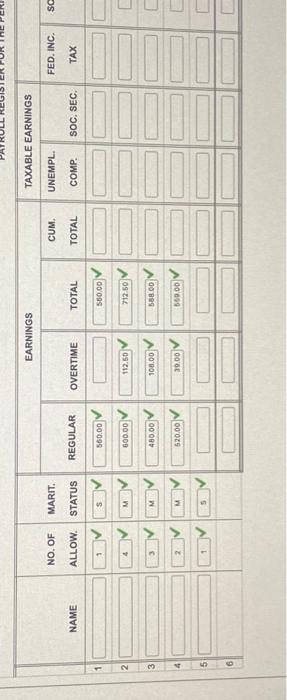

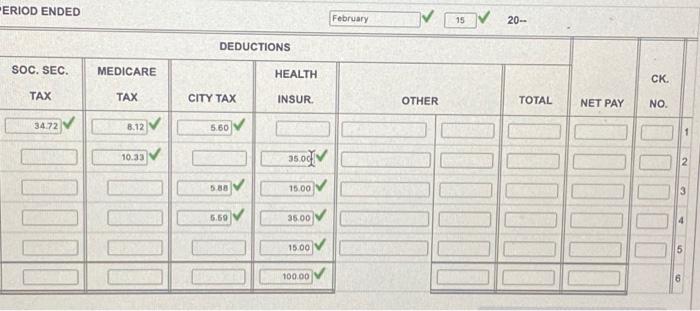

1. prepare a payroll register for karens cupcakes ( in taxable earning// unempolyment compensatation column, enter same amounts as soical security column) total the amounts columns to verify

2.prepare a jounal entry for the payment of this payroll

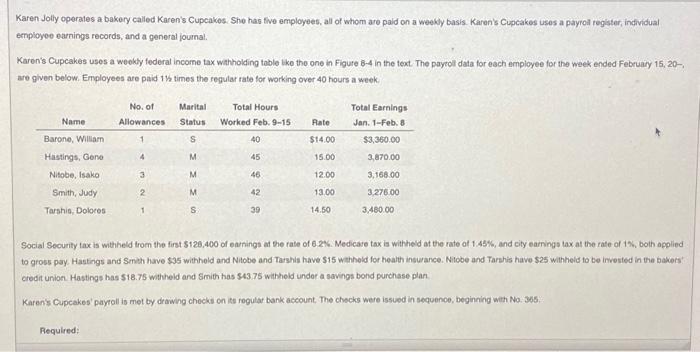

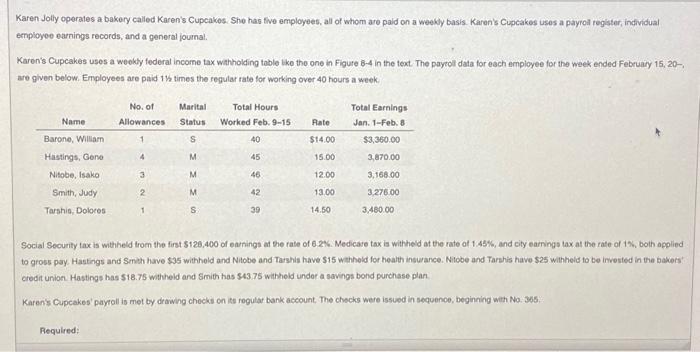

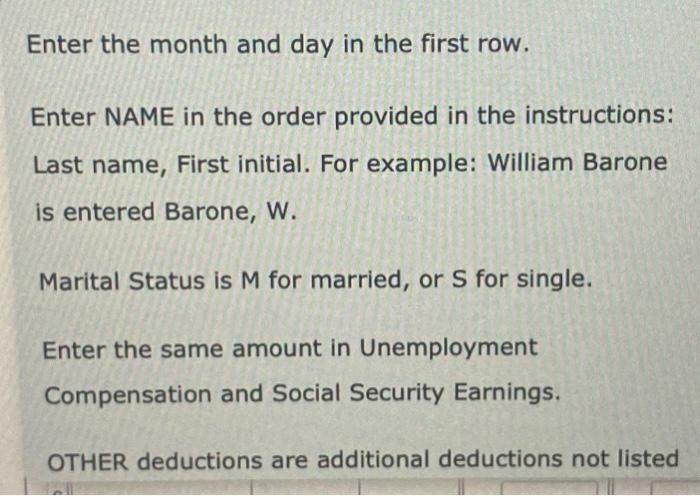

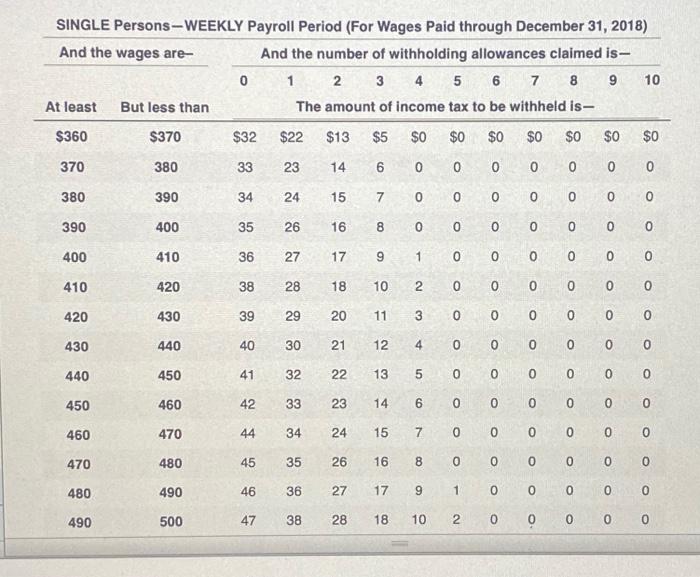

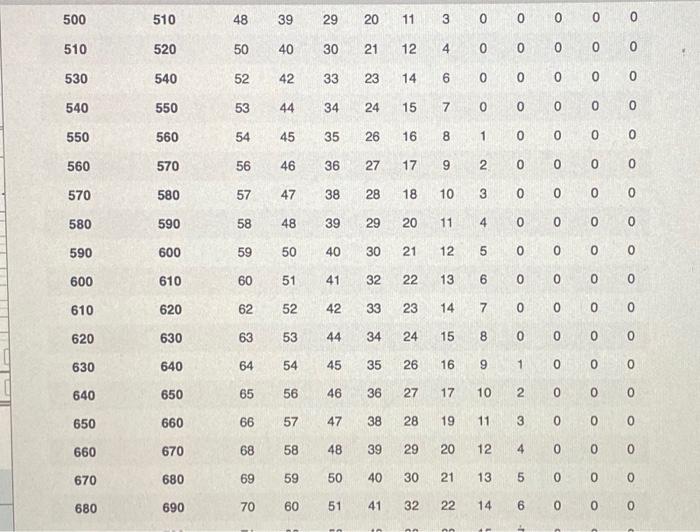

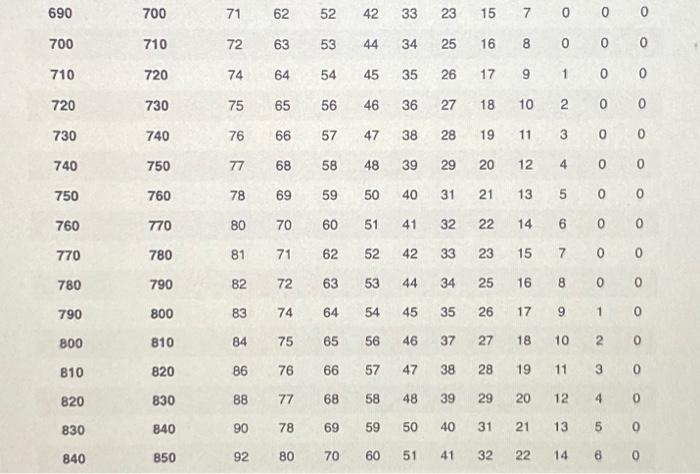

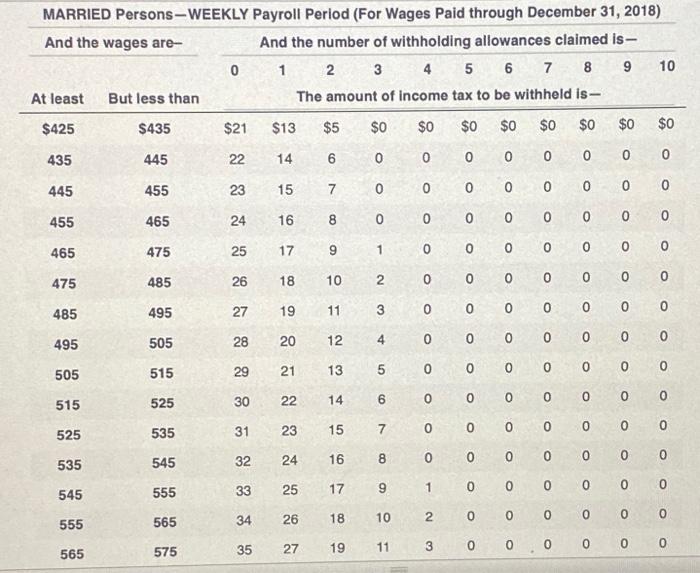

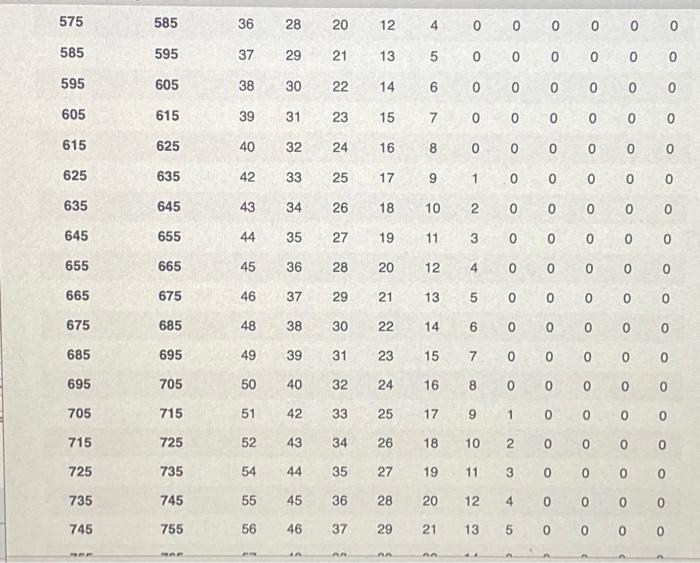

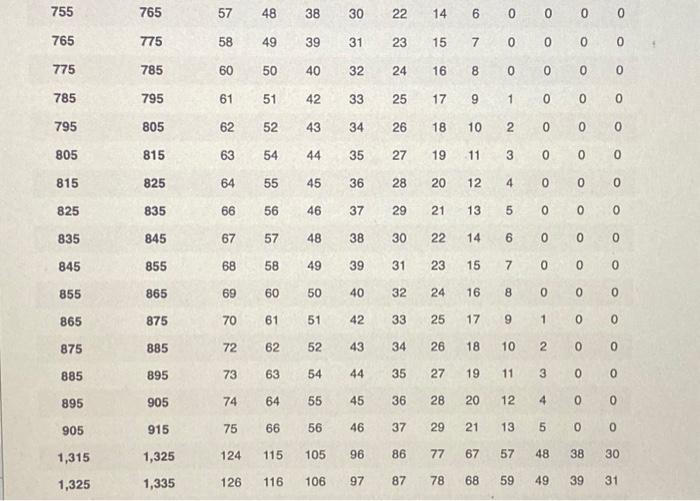

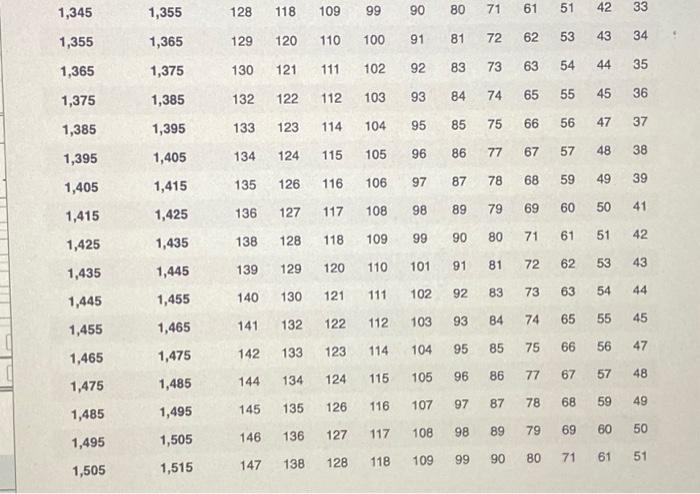

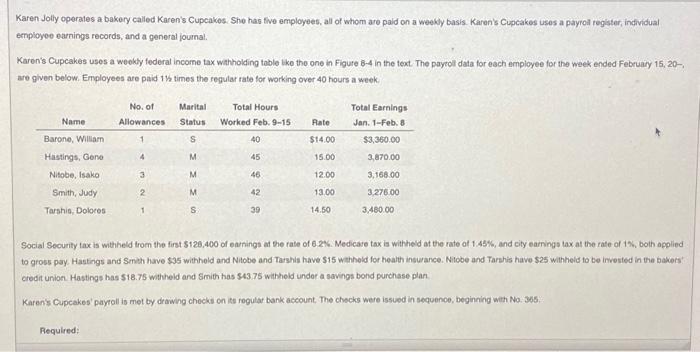

ERIOD ENDED February DEDUCTIONS 690700710720730740750760770780790800810820830840700710720730740750760770780790800810820830840850717274757677788081828384868890926263646566686970717274757677788052535456575859606263646566686970424445464748505152535456575859603334353638394041424445464748505123252627282931323334353738394041151617181920212223252627282931327891011121314151617181920212200123456789101112131400000000001234560000000000000000 Enter the month and day in the first row. Enter NAME in the order provided in the instructions: Last name, First initial. For example: William Barone is entered Barone, W. Marital Status is M for married, or S for single. Enter the same amount in Unemployment Compensation and Social Security Earnings. OTHER deductions are additional deductions not listed 1,3451,3551,3651,3751,3851,3951,4051,4151,4251,4351,4451,4551,4651,4751,4851,4951,5051,3551,3651,3751,3851,3951,4051,4151,4251,4351,4451,4551,4651,4751,4851,4951,5051,51512812913013213313413513613813914014114214414514614711812012112212312412612712812913013213313413513613810911011111211411511611711812012112212312412612712899100102103104105106108109110111112114115116117118909192939596979899101102103104105107108109808183848586878990919293959697989971727374757778798081838485868789906162636566676869717273747577787980515354555657596061626365666768697142434445474849505153545556575960613334353637383941424344454748495051 MARRIED Persons - WEEKLY Payroll Period (For Wages Paid through December 31, 2018) And the wages areAnd the number of withholding allowances claimed is - 012345678910 \begin{tabular}{lllllllllllll} At least & But less than & \multicolumn{10}{c}{ The amount of income tax to be withheld is- } \\ \hline$425 & $435 & $21 & $13 & $5 & $0 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ 435 & 445 & 22 & 14 & 6 & 0 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 445 & 455 & 23 & 15 & 7 & 0 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 455 & 465 & 24 & 16 & 8 & 0 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 465 & 475 & 25 & 17 & 9 & 1 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 475 & 485 & 26 & 18 & 10 & 2 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 485 & 495 & 27 & 19 & 11 & 3 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 495 & 505 & 28 & 20 & 12 & 4 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 505 & 515 & 29 & 21 & 13 & 5 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 515 & 525 & 30 & 22 & 14 & 6 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 525 & 535 & 31 & 23 & 15 & 7 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 535 & 545 & 32 & 24 & 16 & 8 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 545 & 555 & 33 & 25 & 17 & 9 & 1 & 0 & 0 & 0 & 0 & 0 & 0 \\ 555 & 565 & 34 & 26 & 18 & 10 & 2 & 0 & 0 & 0 & 0 & 0 & 0 \\ 565 & 575 & 35 & 27 & 19 & 11 & 3 & 0 & 0 & 0 & 0 & 0 & 0 \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline 755 & 765 & 57 & 48 & 38 & 30 & 22 & 14 & 6 & 0 & 0 & 0 \\ \hline 765 & 775 & 58 & 49 & 39 & 31 & 23 & 15 & 7 & 0 & 0 & 0 \\ \hline 775 & 785 & 60 & 50 & 40 & 32 & 24 & 16 & 8 & 0 & 0 & 0 \\ \hline 785 & 795 & 61 & 51 & 42 & 33 & 25 & 17 & 9 & 1 & 0 & 0 \\ \hline 795 & 805 & 62 & 52 & 43 & 34 & 26 & 18 & 10 & 2 & 0 & 0 \\ \hline 805 & 815 & 63 & 54 & 44 & 35 & 27 & 19 & 11 & 3 & 0 & 0 \\ \hline 815 & 825 & 64 & 55 & 45 & 36 & 28 & 20 & 12 & 4 & 0 & 0 \\ \hline 825 & 835 & 66 & 56 & 46 & 37 & 29 & 21 & 13 & 5 & 0 & 0 \\ \hline 835 & 845 & 67 & 57 & 48 & 38 & 30 & 22 & 14 & 6 & 0 & 0 \\ \hline 845 & 855 & 68 & 58 & 49 & 39 & 31 & 23 & 15 & 7 & 0 & 0 \\ \hline 855 & 865 & 69 & 60 & 50 & 40 & 32 & 24 & 16 & 8 & 0 & 0 \\ \hline 865 & 875 & 70 & 61 & 51 & 42 & 33 & 25 & 17 & 9 & 1 & 0 \\ \hline 875 & 885 & 72 & 62 & 52 & 43 & 34 & 26 & 18 & 10 & 2 & 0 \\ \hline 885 & 895 & 73 & 63 & 54 & 44 & 35 & 27 & 19 & 11 & 3 & 0 \\ \hline 895 & 905 & 74 & 64 & 55 & 45 & 36 & 28 & 20 & 12 & 4 & 0 \\ \hline 905 & 915 & 75 & 66 & 56 & 46 & 37 & 29 & 21 & 13 & 5 & 0 \\ \hline 1,315 & 1,325 & 124 & 115 & 105 & 96 & 86 & 77 & 67 & 57 & 48 & 38 \\ \hline 1,325 & 1,335 & 126 & 116 & 106 & 97 & 87 & 78 & 68 & 59 & 49 & 39 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline 575 & 585 & 36 & 28 & 20 & 12 & 4 & 0 & 0 & 0 & 0 & 0 & 0 \\ \hline 585 & 595 & 37 & 29 & 21 & 13 & 5 & 0 & 0 & 0 & 0 & 0 & 0 \\ \hline 595 & 605 & 38 & 30 & 22 & 14 & 6 & 0 & 0 & 0 & 0 & 0 & 0 \\ \hline 605 & 615 & 39 & 31 & 23 & 15 & 7 & 0 & 0 & 0 & 0 & 0 & 0 \\ \hline 615 & 625 & 40 & 32 & 24 & 16 & 8 & 0 & 0 & 0 & 0 & 0 & 0 \\ \hline 625 & 635 & 42 & 33 & 25 & 17 & 9 & 1 & 0 & 0 & 0 & 0 & 0 \\ \hline 635 & 645 & 43 & 34 & 26 & 18 & 10 & 2 & 0 & 0 & 0 & 0 & 0 \\ \hline 645 & 655 & 44 & 35 & 27 & 19 & 11 & 3 & 0 & 0 & 0 & 0 & 0 \\ \hline 655 & 665 & 45 & 36 & 28 & 20 & 12 & 4 & 0 & 0 & 0 & 0 & 0 \\ \hline 665 & 675 & 46 & 37 & 29 & 21 & 13 & 5 & 0 & 0 & 0 & 0 & 0 \\ \hline 675 & 685 & 48 & 38 & 30 & 22 & 14 & 6 & 0 & 0 & 0 & 0 & 0 \\ \hline 685 & 695 & 49 & 39 & 31 & 23 & 15 & 7 & 0 & 0 & 0 & 0 & 0 \\ \hline 695 & 705 & 50 & 40 & 32 & 24 & 16 & 8 & 0 & 0 & 0 & 0 & 0 \\ \hline 705 & 715 & 51 & 42 & 33 & 25 & 17 & 9 & 1 & 0 & 0 & 0 & 0 \\ \hline 715 & 725 & 52 & 43 & 34 & 26 & 18 & 10 & 2 & 0 & 0 & 0 & 0 \\ \hline 725 & 735 & 54 & 44 & 35 & 27 & 19 & 11 & 3 & 0 & 0 & 0 & 0 \\ \hline 735 & 745 & 55 & 45 & 36 & 28 & 20 & 12 & 4 & 0 & 0 & 0 & 0 \\ \hline 745 & 755 & 56 & 46 & 37 & 29 & 21 & 13 & 5 & 0 & 0 & 0 & 0 \\ \hline mem & & m & in & & n & nn & 1 & . & a & ? & & \\ \hline \end{tabular} SINGLE Persons - WEEKLY Payroll Period (For Wages Paid through December 31, 2018) And the wages are- And the number of withholding allowances claimed is- 012345678910 The amount of income tax to be withheld is- \begin{tabular}{lllllllllllll} At least & But less than & \multicolumn{8}{c}{ The amount of income tax to be withheld is- } \\ \hline$360 & $370 & $32 & $22 & $13 & $5 & $0 & $0 & $0 & $0 & $0 & $0 & $0 \\ 370 & 380 & 33 & 23 & 14 & 6 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 380 & 390 & 34 & 24 & 15 & 7 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 390 & 400 & 35 & 26 & 16 & 8 & 0 & 0 & 0 & 0 & 0 & 0 & 0 \\ 400 & 410 & 36 & 27 & 17 & 9 & 1 & 0 & 0 & 0 & 0 & 0 & 0 \\ 410 & 420 & 38 & 28 & 18 & 10 & 2 & 0 & 0 & 0 & 0 & 0 & 0 \\ 420 & 430 & 39 & 29 & 20 & 11 & 3 & 0 & 0 & 0 & 0 & 0 & 0 \\ 430 & 440 & 40 & 30 & 21 & 12 & 4 & 0 & 0 & 0 & 0 & 0 & 0 \\ 440 & 450 & 41 & 32 & 22 & 13 & 5 & 0 & 0 & 0 & 0 & 0 & 0 \\ 450 & 460 & 42 & 33 & 23 & 14 & 6 & 0 & 0 & 0 & 0 & 0 & 0 \\ 460 & 470 & 44 & 34 & 24 & 15 & 7 & 0 & 0 & 0 & 0 & 0 & 0 \\ 470 & 480 & 45 & 35 & 26 & 16 & 8 & 0 & 0 & 0 & 0 & 0 & 0 \\ 480 & 490 & 46 & 36 & 27 & 17 & 9 & 1 & 0 & 0 & 0 & 0 & 0 \\ 490 & 500 & 47 & 38 & 28 & 18 & 10 & 2 & 0 & 0 & 0 & 0 & 0 \end{tabular} Karen Jolly operates a bakery called Karen's Cupcakes. She has five employees, all of whom are paid on a weekby basis. Karen's Cupcakes uses a payroa register, individual employee earnings records, and a general journal. Karen's Cupcakes uses a weokby federal income tax witholding table tho the one in Figure 8-4 in the text. The paycolt data for each employee for the week ended February 15,20 -, are given below. Employees are paid ith times the regular rate for working over 40 hours a week. Social Security tax is withiheld trom the first $128,400 of eavnings of the rate of 62%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied credit union. Hastings has $18.75 witheid and Smith has $43.75 witheld under a savings bond purchase plan. Karens Cupcakes' paytoll is met by drawing checks on its regular bank account, The checks were issued in sequence, beginning with Na. 305. \begin{tabular}{|lllllllllllll} 500 & 510 & 48 & 39 & 29 & 20 & 11 & 3 & 0 & 0 & 0 & 0 & 0 \\ 510 & 520 & 50 & 40 & 30 & 21 & 12 & 4 & 0 & 0 & 0 & 0 & 0 \\ 530 & 540 & 52 & 42 & 33 & 23 & 14 & 6 & 0 & 0 & 0 & 0 & 0 \\ 540 & 550 & 53 & 44 & 34 & 24 & 15 & 7 & 0 & 0 & 0 & 0 & 0 \\ 550 & 560 & 54 & 45 & 35 & 26 & 16 & 8 & 1 & 0 & 0 & 0 & 0 \\ 560 & 570 & 56 & 46 & 36 & 27 & 17 & 9 & 2 & 0 & 0 & 0 & 0 \\ 570 & 580 & 57 & 47 & 38 & 28 & 18 & 10 & 3 & 0 & 0 & 0 & 0 \\ 580 & 590 & 58 & 48 & 39 & 29 & 20 & 11 & 4 & 0 & 0 & 0 & 0 \\ 590 & 600 & 59 & 50 & 40 & 30 & 21 & 12 & 5 & 0 & 0 & 0 & 0 \\ 600 & 610 & 60 & 51 & 41 & 32 & 22 & 13 & 6 & 0 & 0 & 0 & 0 \\ 610 & 620 & 62 & 52 & 42 & 33 & 23 & 14 & 7 & 0 & 0 & 0 & 0 \\ 620 & 630 & 63 & 53 & 44 & 34 & 24 & 15 & 8 & 0 & 0 & 0 & 0 \\ 630 & 640 & 64 & 54 & 45 & 35 & 26 & 16 & 9 & 1 & 0 & 0 & 0 \\ 640 & 650 & 65 & 56 & 46 & 36 & 27 & 17 & 10 & 2 & 0 & 0 & 0 \\ 650 & 660 & 66 & 57 & 47 & 38 & 28 & 19 & 11 & 3 & 0 & 0 & 0 \\ 660 & 670 & 68 & 58 & 48 & 39 & 29 & 20 & 12 & 4 & 0 & 0 & 0 \\ 670 & 680 & 69 & 59 & 50 & 40 & 30 & 21 & 13 & 5 & 0 & 0 & 0 \\ 680 & 690 & 70 & 60 & 51 & 41 & 32 & 22 & 14 & 6 & 0 & 0 & 0 \end{tabular}