Question

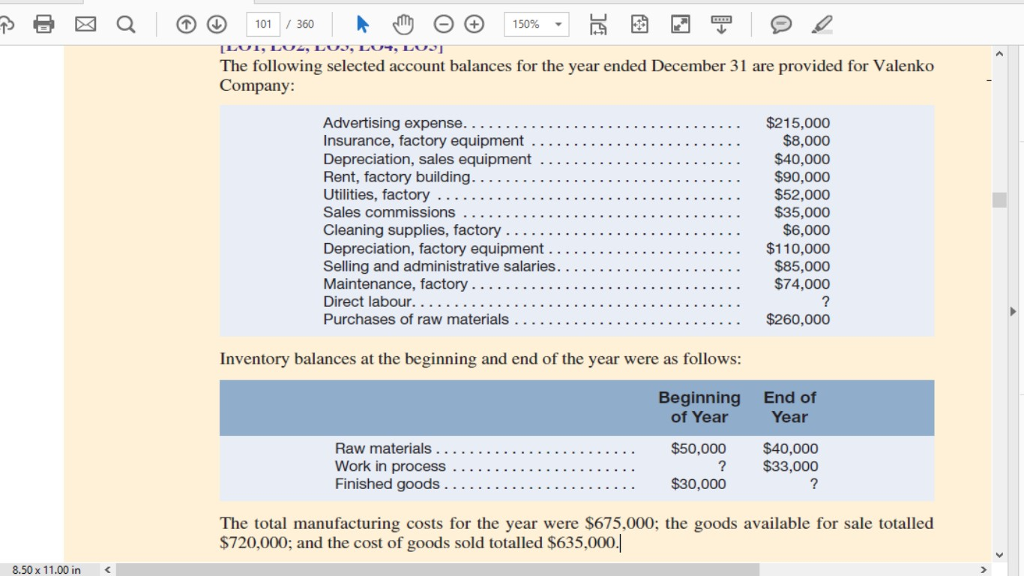

1. Prepare a schedule of cost of goods manufactured and the cost of goods sold section of the companys income statement for the year. 2.

1. Prepare a schedule of cost of goods manufactured and the cost of goods sold section of the companys income statement for the year. 2. Assume that the dollar amounts given above are for the equivalent of 30,000 units produced during the year. Compute the average cost per unit for direct materials used, and compute the average cost per unit for rent on the factory building. 3. Assume that In the following year, the company expects to produce 50,000 units. What average cost per unit and total cost would you expect to be incurred for direct materials? For rent on the factory building? (Assume that the direct materials is a variable cost and that the rent is a fixed cost.) 4. As the manager in charge of production costs, explain to the president the reason for any difference in the average costs per unit between (2) and (3) above.

1. Prepare a schedule of cost of goods manufactured and the cost of goods sold section of the companys income statement for the year. 2. Assume that the dollar amounts given above are for the equivalent of 30,000 units produced during the year. Compute the average cost per unit for direct materials used, and compute the average cost per unit for rent on the factory building. 3. Assume that In the following year, the company expects to produce 50,000 units. What average cost per unit and total cost would you expect to be incurred for direct materials? For rent on the factory building? (Assume that the direct materials is a variable cost and that the rent is a fixed cost.) 4. As the manager in charge of production costs, explain to the president the reason for any difference in the average costs per unit between (2) and (3) above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started