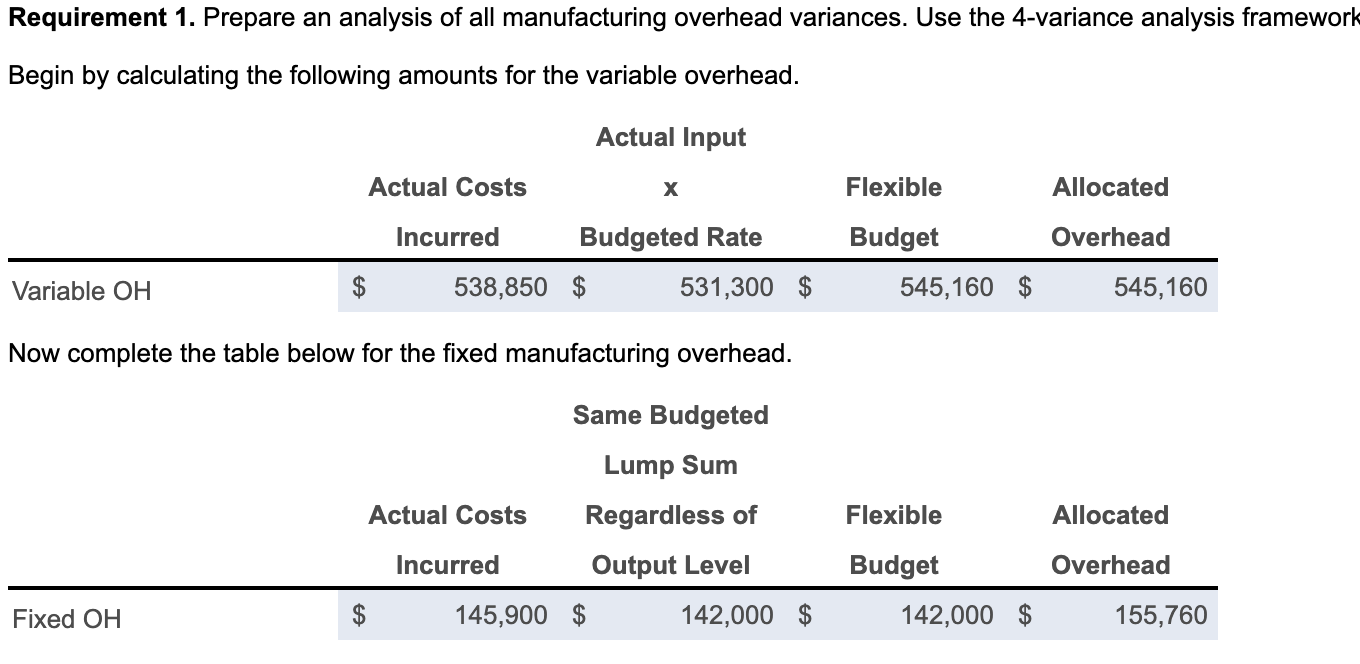

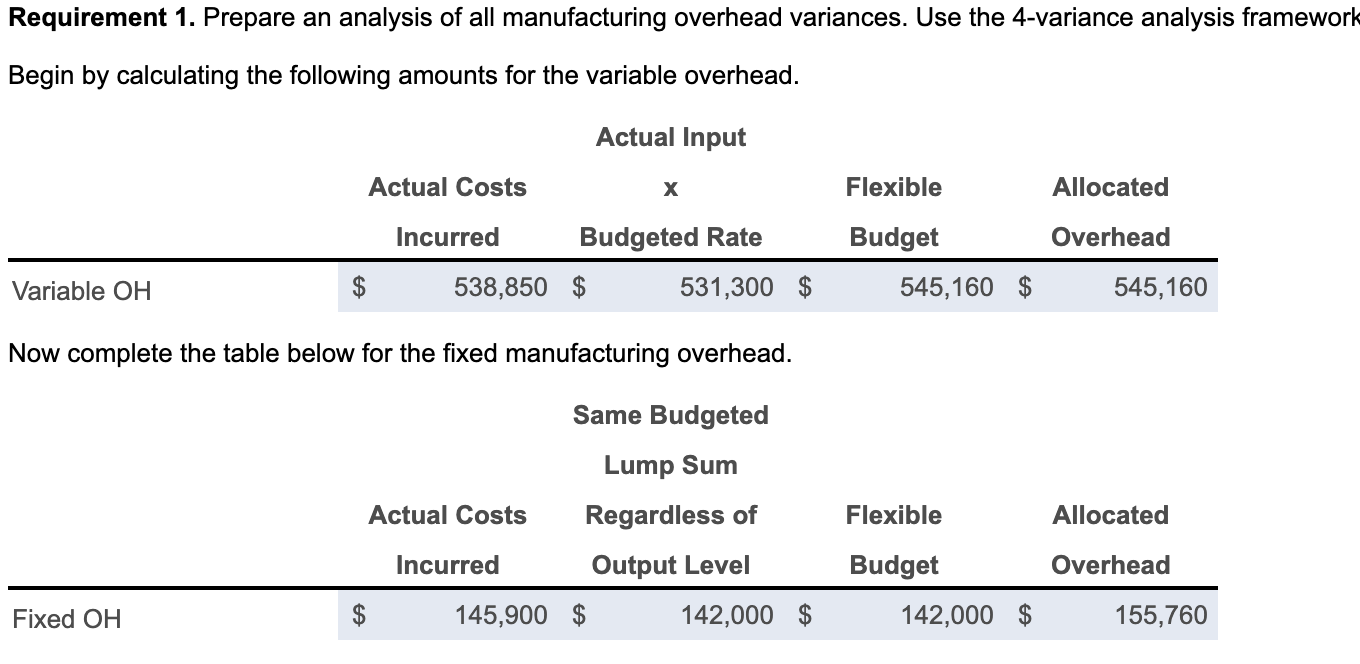

| 1. | Prepare an analysis of all manufacturing overhead variances. Use the 4-variance analysis framework. |

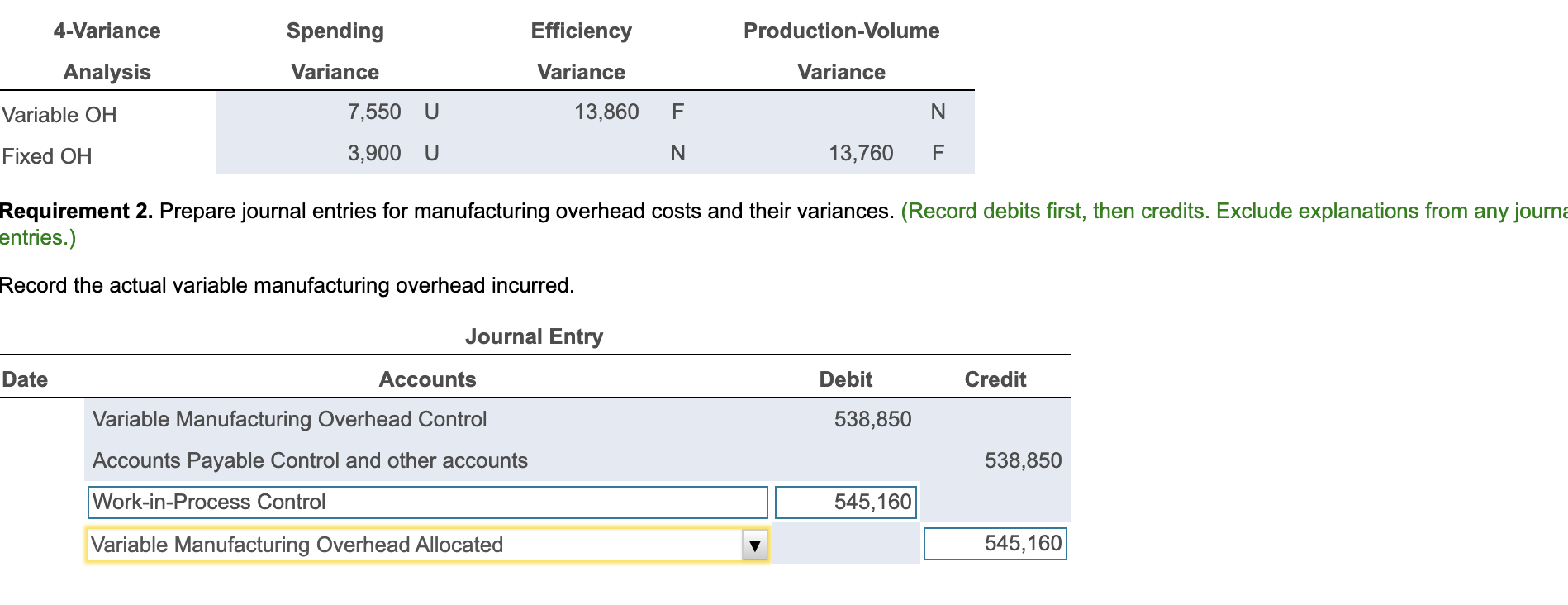

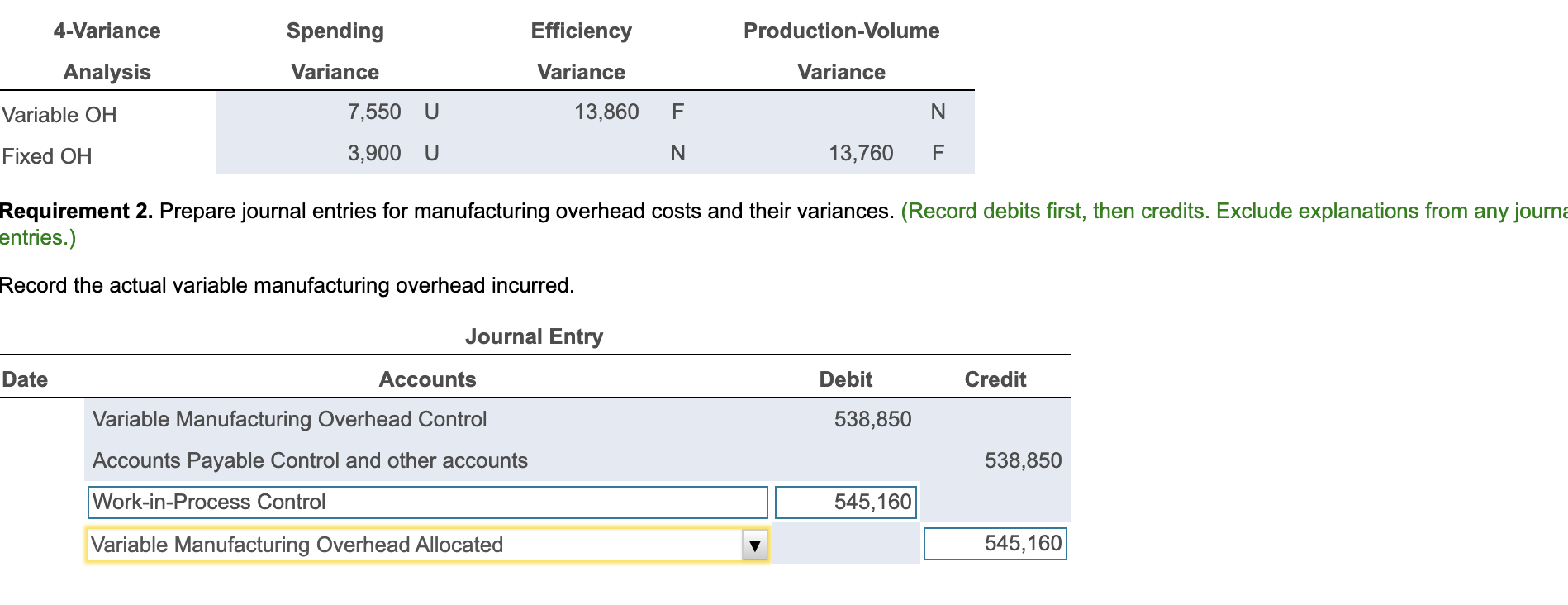

| 2. | Prepare journal entries for manufacturing overhead costs and their variances. |

| 3. | Describe how individual variable manufacturing overhead items are controlled from day today. |

| 4. | Discuss possible causes of the variable manufacturing overhead variances. |

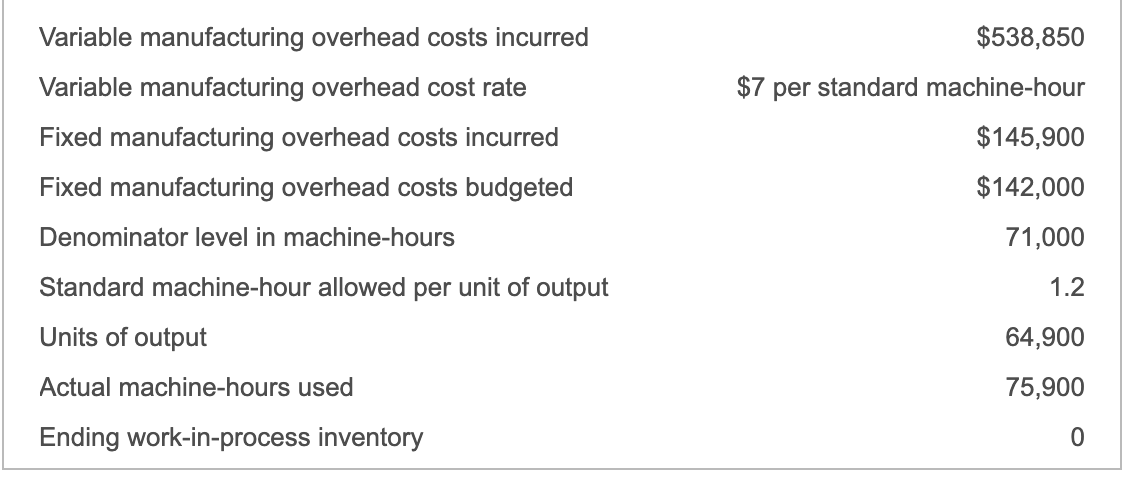

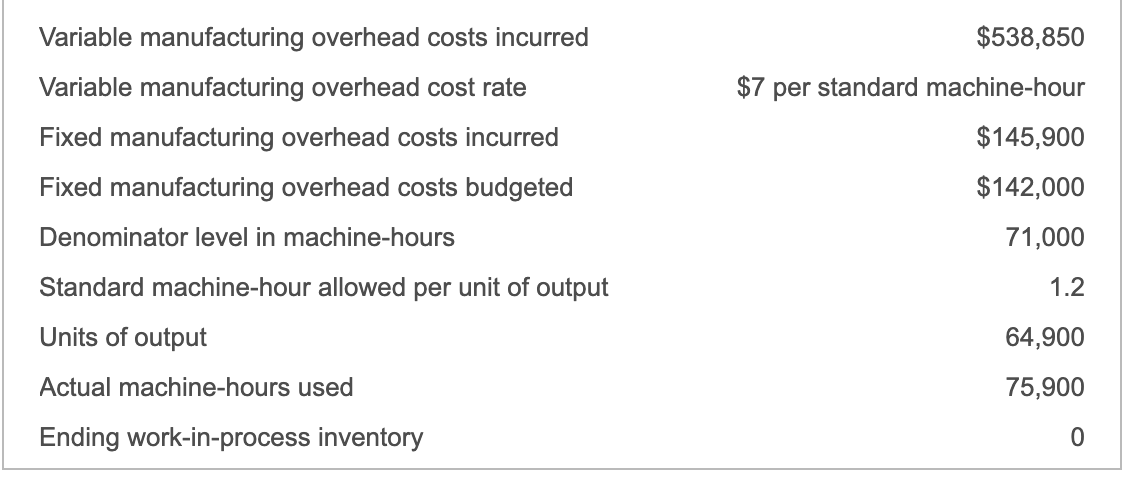

$538,850 Variable manufacturing overhead costs incurred Variable manufacturing overhead cost rate Fixed manufacturing overhead costs incurred Fixed manufacturing overhead costs budgeted Denominator level in machine-hours $7 per standard machine-hour $145,900 $142,000 71,000 1.2 64,900 75,900 Standard machine-hour allowed per unit of output Units of output Actual machine-hours used Ending work-in-process inventory Requirement 1. Prepare an analysis of all manufacturing overhead variances. Use the 4-variance analysis framework Begin by calculating the following amounts for the variable overhead. Actual Input Actual Costs Flexible Allocated Overhead Incurred Budgeted Rate 538,850 $ 531,300 $ Budget 545,160 $ Variable OH $ 545,160 Now complete the table below for the fixed manufacturing overhead. Same Budgeted Lump Sum Actual Costs Regardless of Flexible Allocated Budget Incurred Output Level 145,900 $ 142,000 $ Overhead 155,760 Fixed OH $ 142,000 $ 4-Variance Spending Efficiency Production-Volume Analysis Variance Variance Variance 13,860 Variable OH Fixed OH 7,550 3,900 U U F N N 13,760 F Requirement 2. Prepare journal entries for manufacturing overhead costs and their variances. (Record debits first, then credits. Exclude explanations from any journa entries.) Record the actual variable manufacturing overhead incurred. Journal Entry Date Accounts Debit Credit 538,850 Variable Manufacturing Overhead Control Accounts Payable Control and other accounts Work-in-Process Control 538,850 545,160 Variable Manufacturing Overhead Allocated 545,160 $538,850 Variable manufacturing overhead costs incurred Variable manufacturing overhead cost rate Fixed manufacturing overhead costs incurred Fixed manufacturing overhead costs budgeted Denominator level in machine-hours $7 per standard machine-hour $145,900 $142,000 71,000 1.2 64,900 75,900 Standard machine-hour allowed per unit of output Units of output Actual machine-hours used Ending work-in-process inventory Requirement 1. Prepare an analysis of all manufacturing overhead variances. Use the 4-variance analysis framework Begin by calculating the following amounts for the variable overhead. Actual Input Actual Costs Flexible Allocated Overhead Incurred Budgeted Rate 538,850 $ 531,300 $ Budget 545,160 $ Variable OH $ 545,160 Now complete the table below for the fixed manufacturing overhead. Same Budgeted Lump Sum Actual Costs Regardless of Flexible Allocated Budget Incurred Output Level 145,900 $ 142,000 $ Overhead 155,760 Fixed OH $ 142,000 $ 4-Variance Spending Efficiency Production-Volume Analysis Variance Variance Variance 13,860 Variable OH Fixed OH 7,550 3,900 U U F N N 13,760 F Requirement 2. Prepare journal entries for manufacturing overhead costs and their variances. (Record debits first, then credits. Exclude explanations from any journa entries.) Record the actual variable manufacturing overhead incurred. Journal Entry Date Accounts Debit Credit 538,850 Variable Manufacturing Overhead Control Accounts Payable Control and other accounts Work-in-Process Control 538,850 545,160 Variable Manufacturing Overhead Allocated 545,160