Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Prepare Company 1's COMPLETE CASH FLOW STATEMENT for 2016 (that includes CFO, CFI, CFF) using INDIRECT approach for CFO part. 2. Explain how

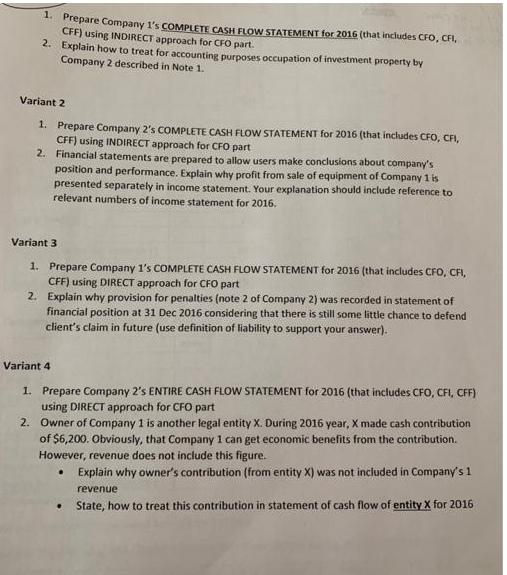

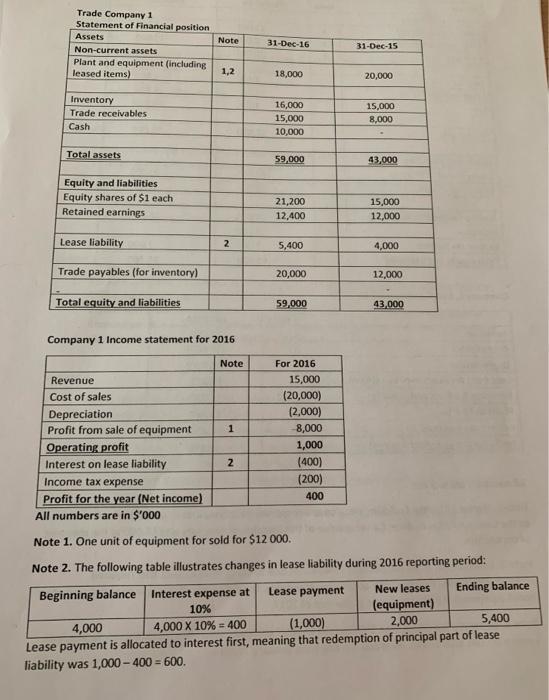

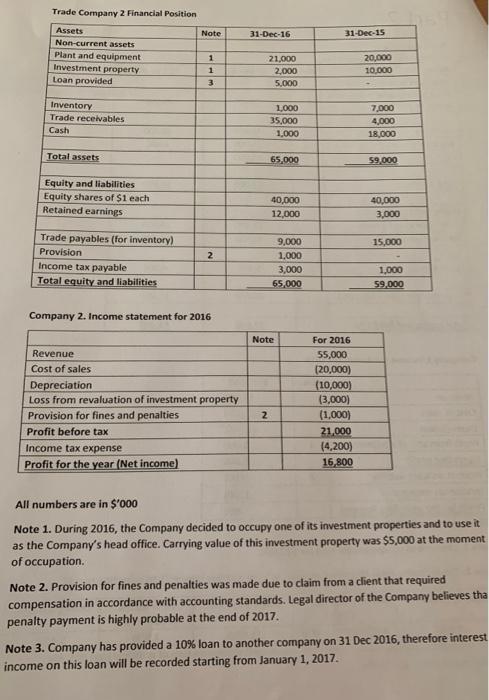

1. Prepare Company 1's COMPLETE CASH FLOW STATEMENT for 2016 (that includes CFO, CFI, CFF) using INDIRECT approach for CFO part. 2. Explain how to treat for accounting purposes occupation of investment property by Company 2 described in Note 1. Variant 2 1. 2. Prepare Company 2's COMPLETE CASH FLOW STATEMENT for 2016 (that includes CFO, CFI, CFF) using INDIRECT approach for CFO part Financial statements are prepared to allow users make conclusions about company's position and performance. Explain why profit from sale of equipment of Company 1 is presented separately in income statement. Your explanation should include reference to relevant numbers of income statement for 2016. Variant 3 1. Prepare Company 1's COMPLETE CASH FLOW STATEMENT for 2016 (that includes CFO, CFI, CFF) using DIRECT approach for CFO part 2. Explain why provision for penalties (note 2 of Company 2) was recorded in statement of financial position at 31 Dec 2016 considering that there is still some little chance to defend client's claim in future (use definition of liability to support your answer). Variant 4 1. Prepare Company 2's ENTIRE CASH FLOW STATEMENT for 2016 (that includes CFO, CFI, CFF) using DIRECT approach for CFO part 2. Owner of Company 1 is another legal entity X. During 2016 year, X made cash contribution of $6,200. Obviously, that Company 1 can get economic benefits from the contribution. However, revenue does not include this figure. . Explain why owner's contribution (from entity X) was not included in Company's 1 revenue State, how to treat this contribution in statement of cash flow of entity X for 2016 . Trade Company 1 Statement of Financial position Assets Non-current assets Plant and equipment (including leased items) Inventory Trade receivables Cash Total assets Equity and liabilities. Equity shares of $1 each Retained earnings Lease liability Trade payables (for inventory) Total equity and liabilities Revenue Cost of sales Note 1,2 Company 1 Income statement for 2016 2 4,000 Lease payment is allocated liability was 1,000-400 = 600. Note 1 31-Dec-16 2 18,000 16,000 15,000 10,000 59,000 21,200 12,400 5,400 20,000 59,000 For 2016 15,000 (20,000) (2,000) 8,000 1,000 (400) (200) 31-Dec-15 400 20,000 15,000 8,000 Depreciation Profit from sale of equipment Operating profit Interest on lease liability Income tax expense Profit for the year (Net income) All numbers are in $'000 Note 1. One unit of equipment for sold for $12 000. Note 2. The following table illustrates changes in lease liability during 2016 reporting period: Beginning balance Lease payment Ending balance 43,000 15,000 12,000 4,000 12,000 43,000 New leases (equipment) Interest expense at 10% 4,000 X 10% = 400 interest first, meaning that redemption of principal part of lease (1,000) 2,000 5,400 Trade Company 2 Financial Position Assets Non-current assets Plant and equipment Investment property Loan provided Inventory Trade receivables Cash Total assets Equity and liabilities Equity shares of $1 each Retained earnings Trade payables (for inventory) Provision Income tax payable Total equity and liabilities Note 1 1 3 2 Company 2. Income statement for 2016 Revenue Cost of sales Depreciation Loss from revaluation of investment property Provision for fines and penalties Profit before tax Income tax expense Profit for the year (Net income) 31-Dec-16 21,000 2 2,000 5,000 1,000 35,000 1,000 65,000 40,000 12,000 9,000 1,000 3,000 65,000 Note 31-Dec-15 For 2016 55,000 (20,000) (10,000) (3,000) (1,000) 21,000 (4,200) 16,800 20,000 10,000 7,000 4,000 18,000 $9,000 40,000 3,000 15,000 1,000 $9,000 All numbers are in $'000 Note 1. During 2016, the Company decided to occupy one of its investment properties and to use it as the Company's head office. Carrying value of this investment property was $5,000 at the moment of occupation. Note 2. Provision for fines and penalties was made due to claim from a client that required compensation in accordance with accounting standards. Legal director of the Company believes tha penalty payment is highly probable at the end of 2017. Note 3. Company has provided a 10% loan to another company on 31 Dec 2016, therefore interest income on this loan will be recorded starting from January 1, 2017.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

2 The investment property that was used for business purposes at the time of occupation would be transferred from the investment account to the property and plant account at the propertys carrying val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started