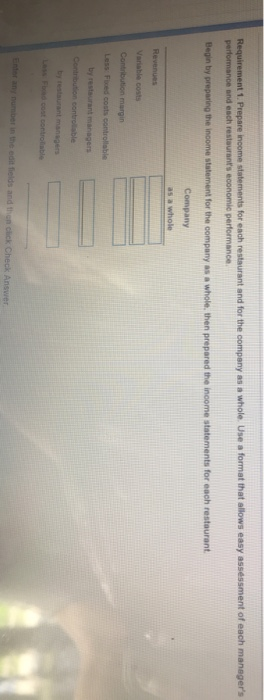

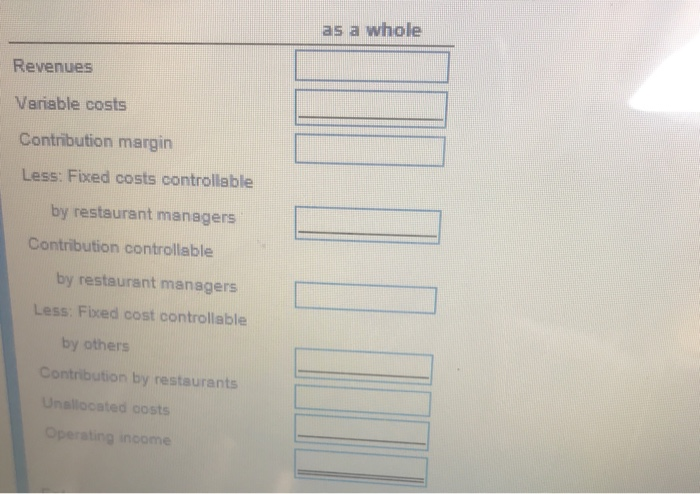

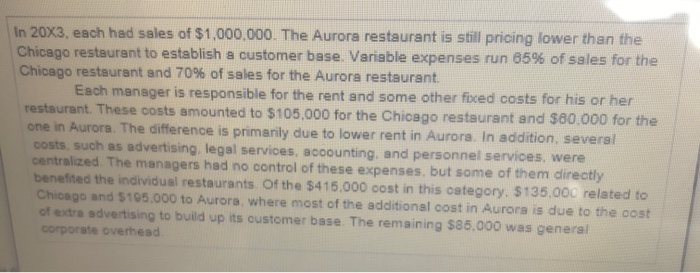

1. Prepare income statements for each restaurant and for the company as a whole. Use a format that allows easy assessment of each manager's performance and each restaurant's economic performance 2. Using only the information given in this exercise do the following: Evaluate each restaurant as an economic investment. b. Evaluate each manager Requirement 1. Prepare income statements for each restaurant and for the company as a whole. Use a format that allows easy assessment of each manager's performance and each restaurant's economic performance Begin by preparing the income statement for the company as a whole, then prepared the income statements for each restaurant Company as a whole Revenues Variable costs Contribution margir Less Fed costs controllable by restaurant managers Centribution controle Farbe in the edities and then click Check Answer as a whole Revenues Variable costs Contribution margin Less: Fixed costs controllable by restaurant managers Contribution controllable by restaurant managers Less: Fixed cost controllable by others Contribution by restaurants Unallocated costs Operating income LIT In 20X3, each had sales of $1,000,000. The Aurora restaurant is still pricing lower than the Chicago restaurant to establish a customer base. Variable expenses run 85% of sales for the Chicago restaurant and 70% of sales for the Aurora restaurant. Each manager is responsible for the rent and some other fixed costs for his or her restaurant. These costs amounted to $105,000 for the Chicago restaurant and $80,000 for the one in Aurora. The difference is primarily due to lower rent in Aurora. In addition, several costs, such as advertising, legal services, accounting, and personnel services, were centralized. The managers had no control of these expenses, but some of them directly benefited the individual restaurants. Of the $415.000 oost in this category. $135,000 related to Chicago and $105,000 to Aurora, where most of the additional cost in Aurora is due to the cost of extra advertising to build up its customer base. The remaining $85.000 was general corporate overhead