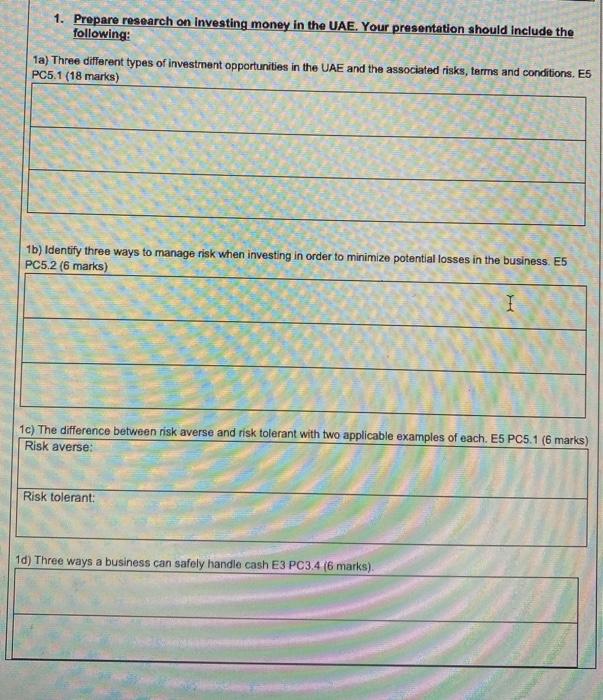

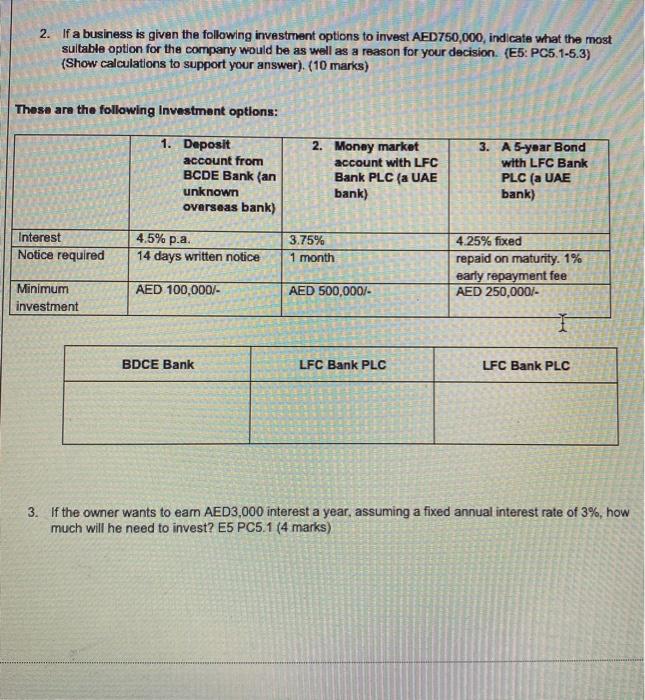

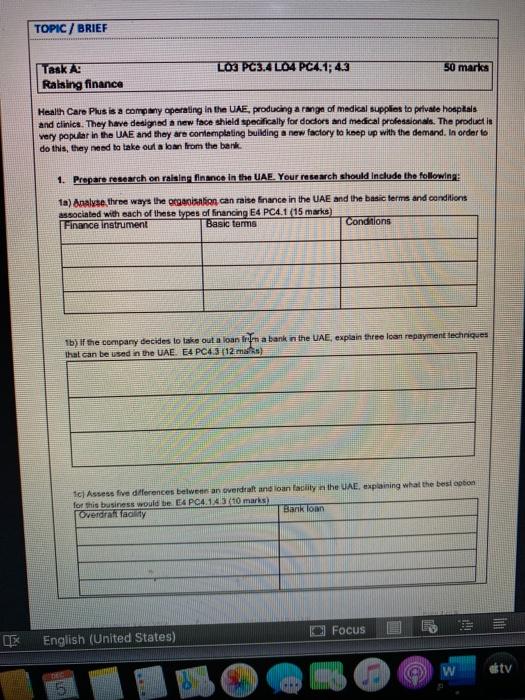

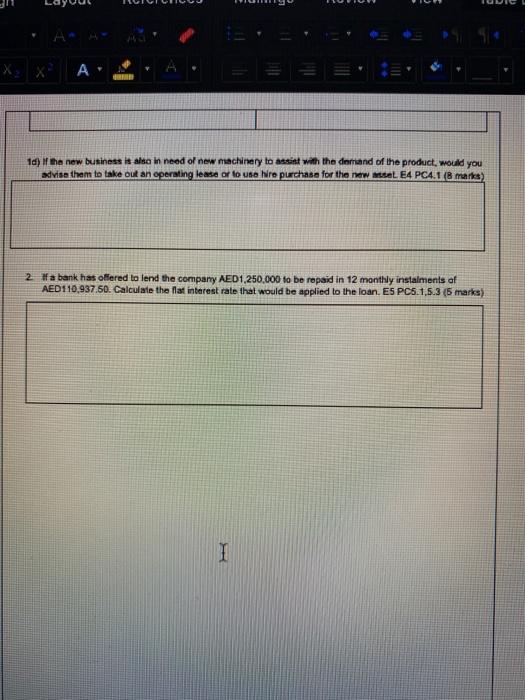

1. Prepare research on Investing money in the UAE. Your presentation should include the following: 1a) Three different types of investment opportunities in the UAE and the associated risks, terms and conditions. Es PC5.1 (18 marks) 1b) Identify three ways to manage risk when investing in order to minimize potential losses in the business. E5 PC5.2 (6 marks) I 1c) The difference between risk averse and risk tolerant with two applicable examples of each. E5 PC5.1 (6 marks) Risk averse: Risk tolerant: 1d) Three ways a business can safely handle cash E3 PC3.4 (6 marks). 2. If a business is given the following investment options to invest AED750,000, indicate what the most suitable option for the company would be as well as a reason for your decision (E5: PC5.1-5.3) (Show calculations to support your answer). (10 marks) These are the following Investment options: 1. Deposit account from BCDE Bank (an unknown overseas bank) 2. Money market account with LFC Bank PLC (a UAE bank) 3. A 5-year Bond with LFC Bank PLC (a UAE bank) 4.5% p.a. Interest Notice required 3.75% 1 month 14 days written notice 4.25% fixed repaid on maturity. 1% early repayment fee AED 250,000/- Minimum investment AED 100,000/- AED 500,000/- 1 BDCE Bank LFC Bank PLC LFC Bank PLC 3. If the owner wants to earn AED3,000 interest a year, assuming a fixed annual interest rate of 3%, how much will he need to invest? E5 PC5.1 (4 marks) TOPIC / BRIEF LOS PC3.4 L04 PC451; 4.3 50 marks Task Raising finance Health Care Plus is a company operating in the UAE. producing a range of medical supplies to private hospitals and clinics. They have designed a new face shield specifically for doctors and medical professionals. The product is very popular in the UAE and they are contemplating building a new factory to keep up with the demand. In order to do this, they need to take out a loan from the bank 1. Prepare research on raising finance in the UAE. Your research should include the following: 1a) Analyse three ways the organisation can raise finance in the UAE and the basic terms and conditions associated with each of these types of financing E4 PC4.1 (15 marks) Finance instrument Basic terms Conditions 1b) if the company decides to take out a loan from a bank in the UAE, explain three loan repayment techniques that can be used in the UAE. E4 PC43 (12 mahs) 1c) Assess five differences between an overdraft and loan facility in the UAE, explaining what the best option for this business would be E4 PC4145710 marks Overdrafia Bank loan FOCUS X English (United States) atv 5 1d) If the new business is also in need of new machinery to assist with the demand of the product, would you advise them to take out an operating lease or to use hire purchase for the new mitat. E4 PC4.1(B marks) 2. If a bank has offered to lend the company AED1,250,000 to be repaid in 12 monthly instalments of AED110,937.50. Calculate the flat interest rate that would be applied to the loan. E5 PC5.1.5.3 (5 marks) I 1. Prepare research on Investing money in the UAE. Your presentation should include the following: 1a) Three different types of investment opportunities in the UAE and the associated risks, terms and conditions. Es PC5.1 (18 marks) 1b) Identify three ways to manage risk when investing in order to minimize potential losses in the business. E5 PC5.2 (6 marks) I 1c) The difference between risk averse and risk tolerant with two applicable examples of each. E5 PC5.1 (6 marks) Risk averse: Risk tolerant: 1d) Three ways a business can safely handle cash E3 PC3.4 (6 marks). 2. If a business is given the following investment options to invest AED750,000, indicate what the most suitable option for the company would be as well as a reason for your decision (E5: PC5.1-5.3) (Show calculations to support your answer). (10 marks) These are the following Investment options: 1. Deposit account from BCDE Bank (an unknown overseas bank) 2. Money market account with LFC Bank PLC (a UAE bank) 3. A 5-year Bond with LFC Bank PLC (a UAE bank) 4.5% p.a. Interest Notice required 3.75% 1 month 14 days written notice 4.25% fixed repaid on maturity. 1% early repayment fee AED 250,000/- Minimum investment AED 100,000/- AED 500,000/- 1 BDCE Bank LFC Bank PLC LFC Bank PLC 3. If the owner wants to earn AED3,000 interest a year, assuming a fixed annual interest rate of 3%, how much will he need to invest? E5 PC5.1 (4 marks) TOPIC / BRIEF LOS PC3.4 L04 PC451; 4.3 50 marks Task Raising finance Health Care Plus is a company operating in the UAE. producing a range of medical supplies to private hospitals and clinics. They have designed a new face shield specifically for doctors and medical professionals. The product is very popular in the UAE and they are contemplating building a new factory to keep up with the demand. In order to do this, they need to take out a loan from the bank 1. Prepare research on raising finance in the UAE. Your research should include the following: 1a) Analyse three ways the organisation can raise finance in the UAE and the basic terms and conditions associated with each of these types of financing E4 PC4.1 (15 marks) Finance instrument Basic terms Conditions 1b) if the company decides to take out a loan from a bank in the UAE, explain three loan repayment techniques that can be used in the UAE. E4 PC43 (12 mahs) 1c) Assess five differences between an overdraft and loan facility in the UAE, explaining what the best option for this business would be E4 PC4145710 marks Overdrafia Bank loan FOCUS X English (United States) atv 5 1d) If the new business is also in need of new machinery to assist with the demand of the product, would you advise them to take out an operating lease or to use hire purchase for the new mitat. E4 PC4.1(B marks) 2. If a bank has offered to lend the company AED1,250,000 to be repaid in 12 monthly instalments of AED110,937.50. Calculate the flat interest rate that would be applied to the loan. E5 PC5.1.5.3