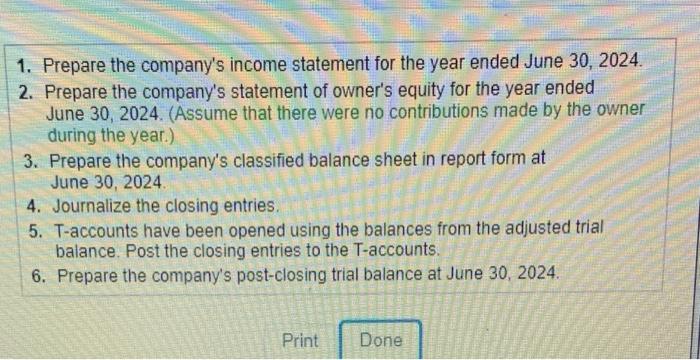

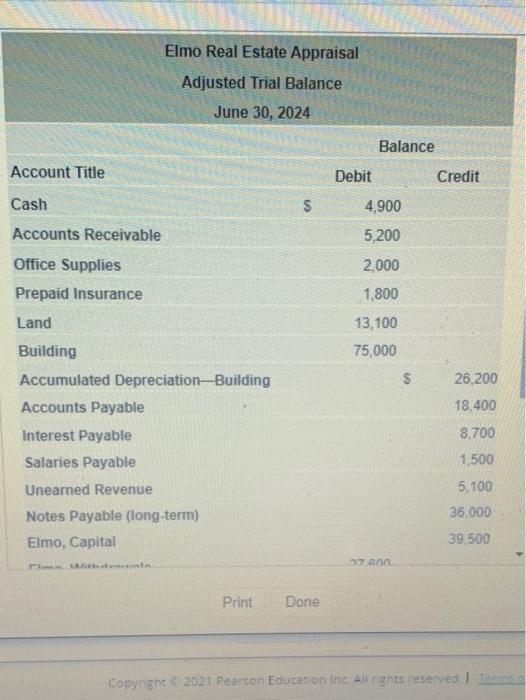

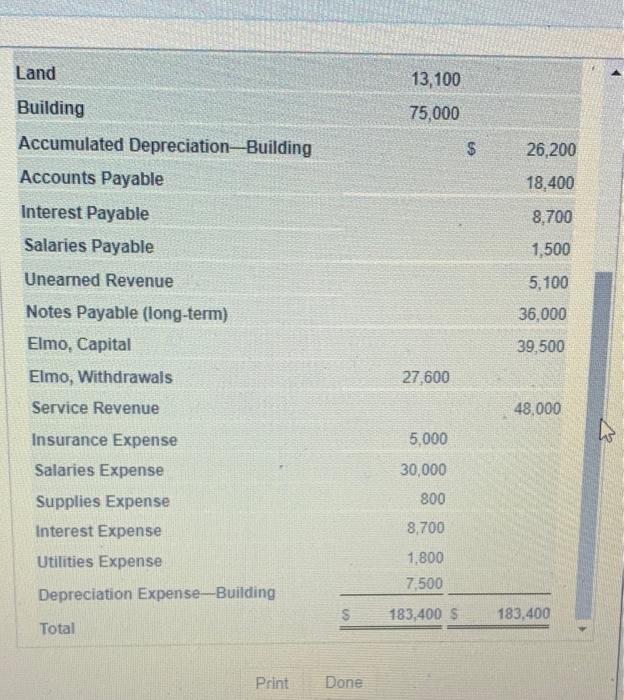

1. Prepare the company's income statement for the year ended June 30, 2024. 2. Prepare the company's statement of owner's equity for the year ended June 30, 2024. (Assume that there were no contributions made by the owner during the year.) 3. Prepare the company's classified balance sheet in report form at June 30, 2024 4. Journalize the closing entries. 5. T-accounts have been opened using the balances from the adjusted trial balance. Post the closing entries to the T-accounts. 6. Prepare the company's post-closing trial balance at June 30, 2024. Print Done Elmo Real Estate Appraisal Adjusted Trial Balance June 30, 2024 Balance Account Title Debit Credit Cash $ 4,900 Accounts Receivable 5,200 Office Supplies Prepaid Insurance 2,000 1,800 Land 13,100 75,000 $ 26,200 Building Accumulated Depreciation-Building Accounts Payable Interest Payable Salaries Payable 18.400 8.700 1,500 Unearned Revenue 5.100 36.000 Notes Payable (long-term) Elmo, Capital 39,500 17 Print Done Copyright 2021 Pearson Education Inc. All rights reserved Land 13,100 75,000 $ Building Accumulated Depreciation Building Accounts Payable Interest Payable Salaries Payable 26,200 18,400 8,700 1,500 5.100 Unearned Revenue 36,000 Notes Payable (long-term) Elmo, Capital 39,500 27,600 Elmo, Withdrawals Service Revenue 48,000 5,000 30,000 Insurance Expense Salaries Expense Supplies Expense Interest Expense Utilities Expense 800 8,700 1,800 7,500 Depreciation Expense Building S 183,400 $ 183,400 Total Print Done Elmo Real Estate Appraisal Income Statement Year Ended June 30, 2024 Net Income (Loss) fialdean In be 1. Prepare the company's income statement for the year ended June 30, 2024. 2. Prepare the company's statement of owner's equity for the year ended June 30, 2024. (Assume that there were no contributions made by the owner during the year.) 3. Prepare the company's classified balance sheet in report form at June 30, 2024 4. Journalize the closing entries. 5. T-accounts have been opened using the balances from the adjusted trial balance. Post the closing entries to the T-accounts. 6. Prepare the company's post-closing trial balance at June 30, 2024. Print Done Elmo Real Estate Appraisal Adjusted Trial Balance June 30, 2024 Balance Account Title Debit Credit Cash $ 4,900 Accounts Receivable 5,200 Office Supplies Prepaid Insurance 2,000 1,800 Land 13,100 75,000 $ 26,200 Building Accumulated Depreciation-Building Accounts Payable Interest Payable Salaries Payable 18.400 8.700 1,500 Unearned Revenue 5.100 36.000 Notes Payable (long-term) Elmo, Capital 39,500 17 Print Done Copyright 2021 Pearson Education Inc. All rights reserved Land 13,100 75,000 $ Building Accumulated Depreciation Building Accounts Payable Interest Payable Salaries Payable 26,200 18,400 8,700 1,500 5.100 Unearned Revenue 36,000 Notes Payable (long-term) Elmo, Capital 39,500 27,600 Elmo, Withdrawals Service Revenue 48,000 5,000 30,000 Insurance Expense Salaries Expense Supplies Expense Interest Expense Utilities Expense 800 8,700 1,800 7,500 Depreciation Expense Building S 183,400 $ 183,400 Total Print Done Elmo Real Estate Appraisal Income Statement Year Ended June 30, 2024 Net Income (Loss) fialdean In be