Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1- Prepare the firms proforma Balance sheet for 2019 using Sales Forecasting Method. Board Policies: 1- Gross Plant & Equipment Depreciation ratio is accepted as

1- Prepare the firm’s proforma Balance sheet for 2019 using Sales Forecasting Method.

| Board Policies: |

| 1- Gross Plant & Equipment Depreciation ratio is accepted as %20. |

| 2- All assets in the balance sheet will increase at the same rate as sales increase. |

| 3- All Current Liabilities in the balance sheet will increase at the same rate as sales. |

| 4- 100.000 additional Long Term Bonds will take place in 2019. |

| 5- For long term capital: |

| a- 50.000 new preferred stocks will be issued |

| b- A long term loan will be activated as 150.000 USD |

| b- Additional New stocks will be issued at 200.000 USD |

| 6- Net Profitability is %20 of total sales. |

| 7- %30 of Net Profit will be distributed as dividends |

| 8- Remaining %70 of Net Profit will be retained in the company |

Based on 2019’s projected sales; |

a- Calculate the forecast basis for assets and current liabilities

b- Calculate the amount of Financing Required ( capital deficit)

c- Prepare the Pro-Forma Balance Sheet.

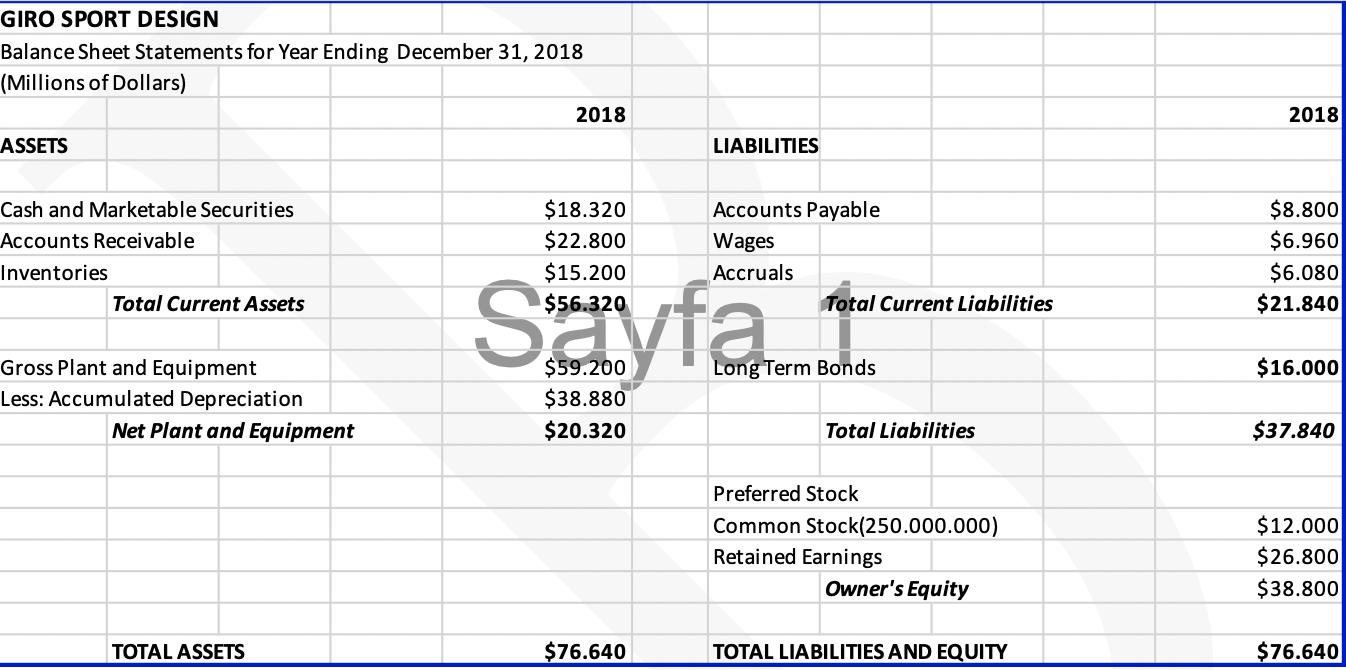

GIRO SPORT DESIGN Balance Sheet Statements for Year Ending December 31, 2018 (Millions of Dollars) 2018 2018 ASSETS LIABILITIES $18.320 $22.800 Accounts Payable $8.800 $6.960 Cash and Marketable Securities Accounts Receivable Wages $15.200 $56.320 $6.080 $21.840 Inventories Accruals Sayfa Total Current Assets Total Current Liabilities $59.200 $38.880 Gross Plant and Equipment Long Term Bonds $16.000 Less: Accumulated Depreciation Net Plant and Equipment $20.320 Total Liabilities $37.840 Preferred Stock Common Stock(250.000.000) $12.000 $26.800 Retained Earnings Owner's Equity $38.800 TOTAL ASSETS $76.640 TOTAL LIABILITIES AND EQUITY $76.640

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Assumptions Sales in 2018 was 100000 and 150000 in 2019 This results in to a 50 in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60d5e1d22491f_223820.pdf

180 KBs PDF File

60d5e1d22491f_223820.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started