Answered step by step

Verified Expert Solution

Question

1 Approved Answer

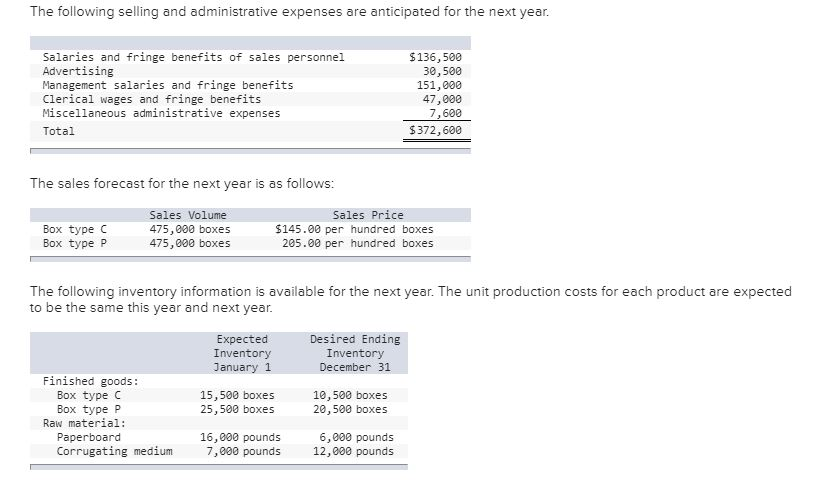

1. Prepare the production-overhead budget for the next year. 2. Prepare the selling and administrative expense budget for the next year. 3. Prepare the budgeted

1. Prepare the production-overhead budget for the next year.

2. Prepare the selling and administrative expense budget for the next year.

3. Prepare the budgeted income statement for the next year.

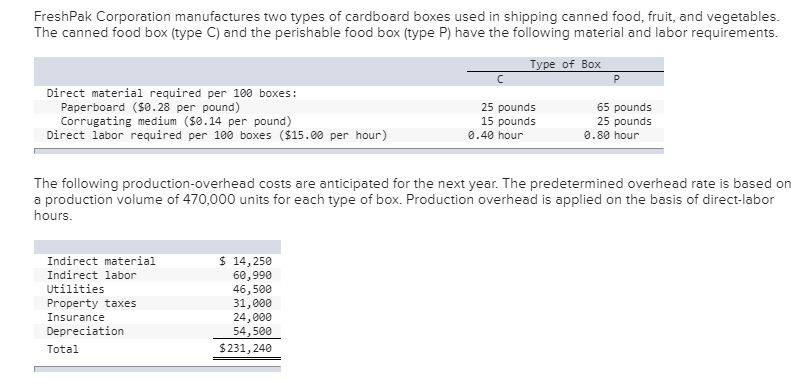

FreshPak Corporation manufactures two types of cardboard boxes used in shipping canned food, fruit, and vegetables The canned food box (type C) and the perishable food box (type P) have the following material and labor requirements. Type of Box Direct material required per 100 boxes: Paperboard ($0.28 per pound) Corrugating medium ($0.14 per pound) 25 pounds 15 pounds 65 pounds 25 pounds Direct labor required per 100 boxes ($15.00 per hour) 0.40 hour 0.80 hour The following production-overhead costs are anticipated for the next year. The predetermined overhead rate is based on a production volume of 470,000 units for each type of box. Production overhead is applied on the basis of direct-labor hours Indirect material Indirect labor Utilities Property taxes Insurance Depreciation Total $ 14,250 60,990 46,500 31,000 24,000 54,500 $231,240 FreshPak Corporation manufactures two types of cardboard boxes used in shipping canned food, fruit, and vegetables The canned food box (type C) and the perishable food box (type P) have the following material and labor requirements. Type of Box Direct material required per 100 boxes: Paperboard ($0.28 per pound) Corrugating medium ($0.14 per pound) 25 pounds 15 pounds 65 pounds 25 pounds Direct labor required per 100 boxes ($15.00 per hour) 0.40 hour 0.80 hour The following production-overhead costs are anticipated for the next year. The predetermined overhead rate is based on a production volume of 470,000 units for each type of box. Production overhead is applied on the basis of direct-labor hours Indirect material Indirect labor Utilities Property taxes Insurance Depreciation Total $ 14,250 60,990 46,500 31,000 24,000 54,500 $231,240Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started