Question

1 Prepare the required adjusting entry for each situation as of December 31, 2018 for (SBAD) Company. (a) Suppose company had received a $1,800 shipment

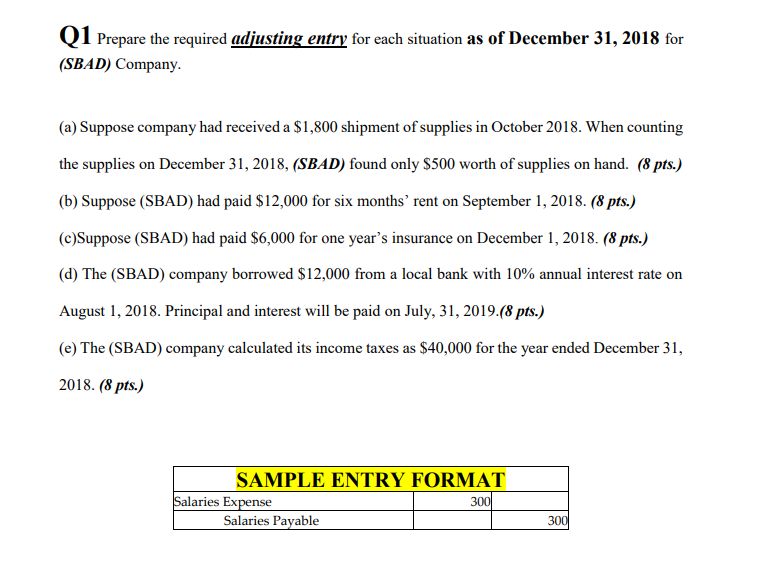

1 Prepare the required adjusting entry for each situation as of December 31, 2018 for (SBAD) Company. (a) Suppose company had received a $1,800 shipment of supplies in October 2018. When counting the supplies on December 31, 2018, (SBAD) found only $500 worth of supplies on hand. (8 pts.) (b) Suppose (SBAD) had paid $12,000 for six months' rent on September 1, 2018. (8 pts.) (c)Suppose (SBAD) had paid $6,000 for one year's insurance on December 1, 2018. (8 pts.) (d) The (SBAD) company borrowed $12,000 from a local bank with 10% annual interest rate on August 1, 2018. Principal and interest will be paid on July, 31, 2019.(8 pts.) (e) The (SBAD) company calculated its income taxes as $40,000 for the year ended December 31, 2018. (8 pts.) SAMPLE ENTRY FORMAT Salaries Expense Salaries Payable 300 300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started