Answered step by step

Verified Expert Solution

Question

1 Approved Answer

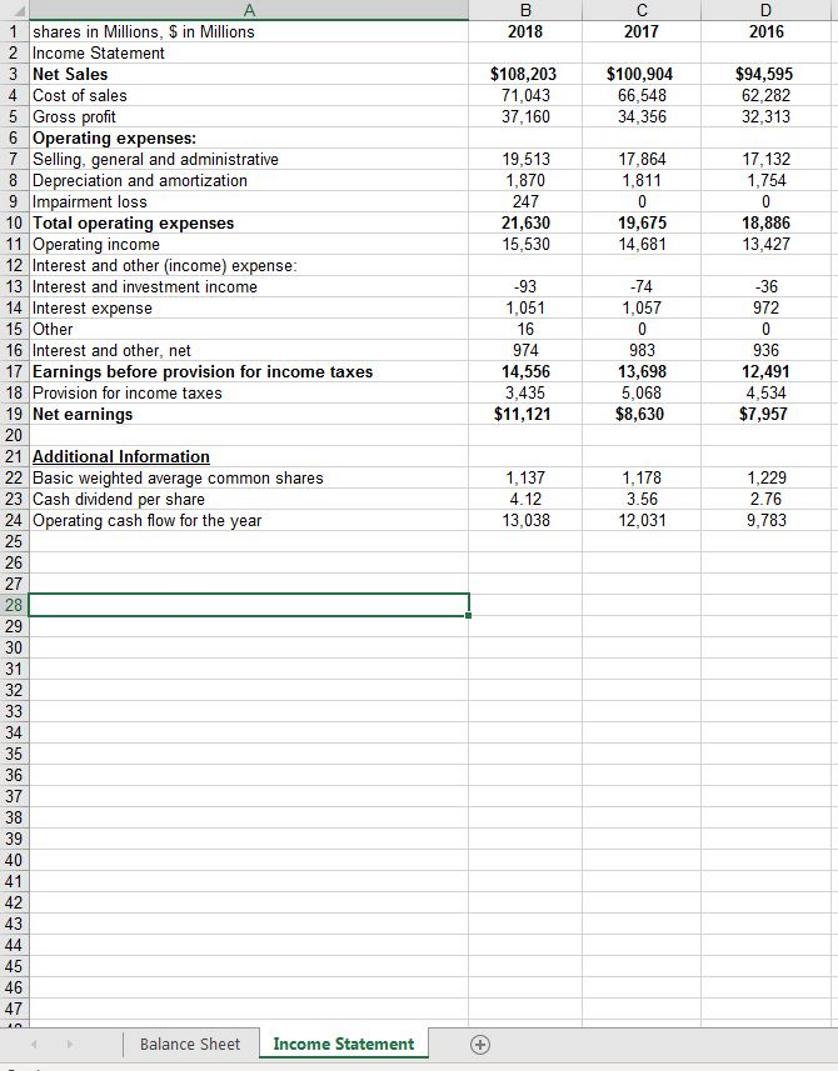

1. Prepare vertical common-size income statements and balance sheets for both companies 2. Prepare horizontal analysis on income statements and balance sheets for both companies

1. Prepare vertical common-size income statements and balance sheets for both companies 2. Prepare horizontal analysis on income statements and balance sheets for both companies 3. Ratio analyses 4. Comment on the analytical results of the two companies based on your work in excel5. Conclusive summary on the firms

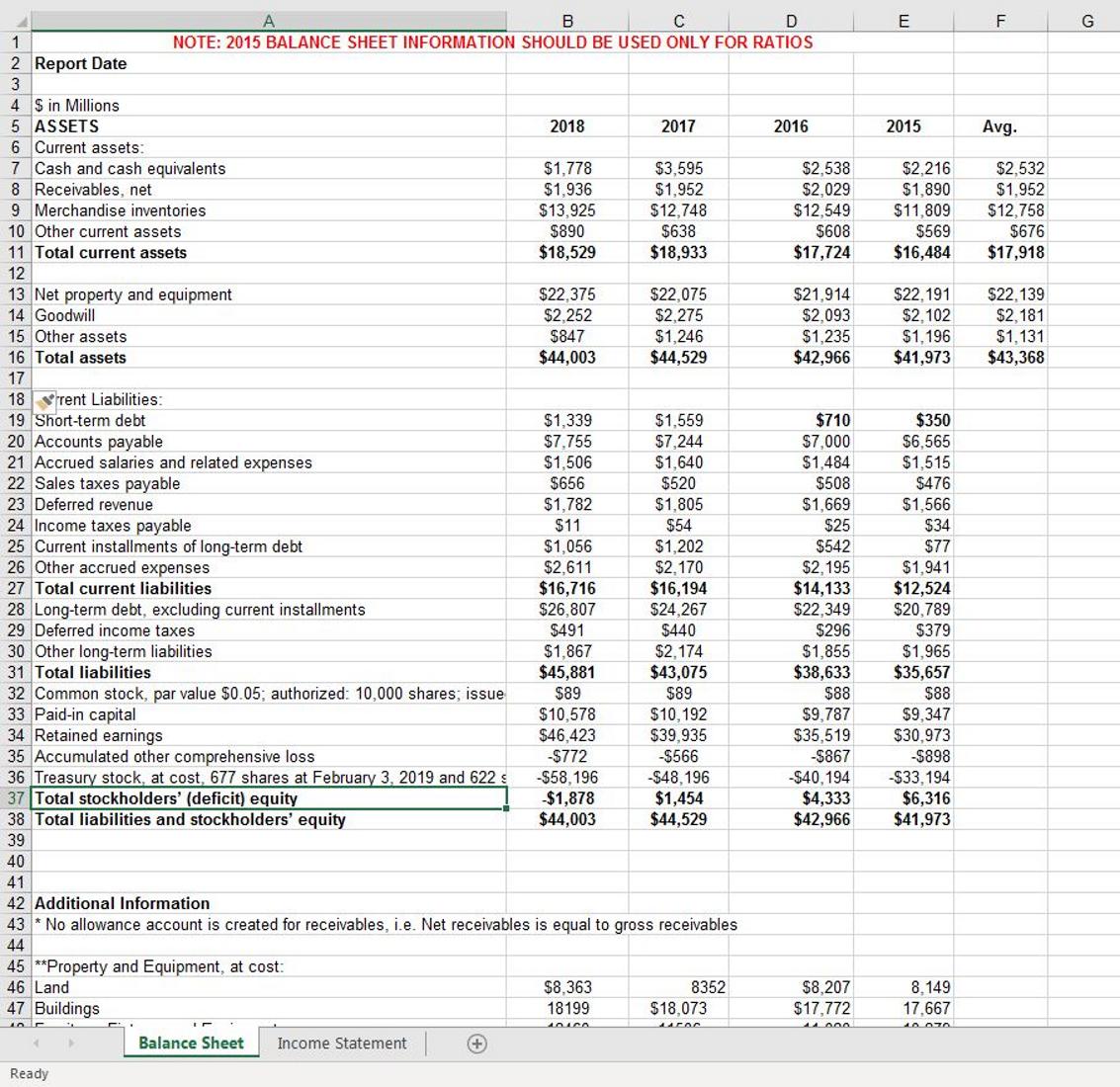

HOME DEPOT

LOWE

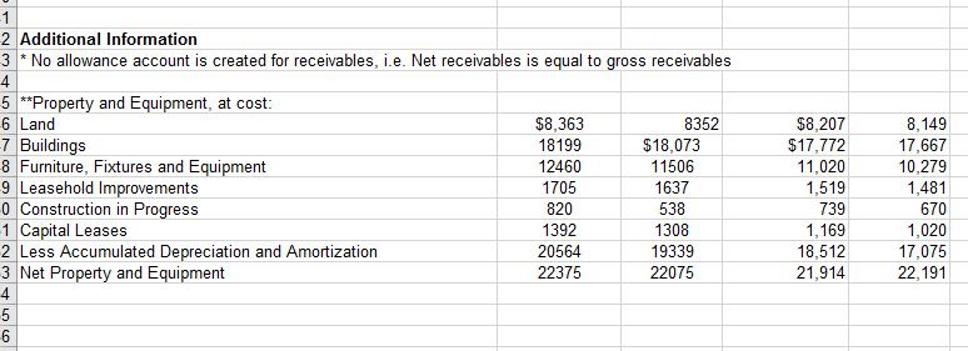

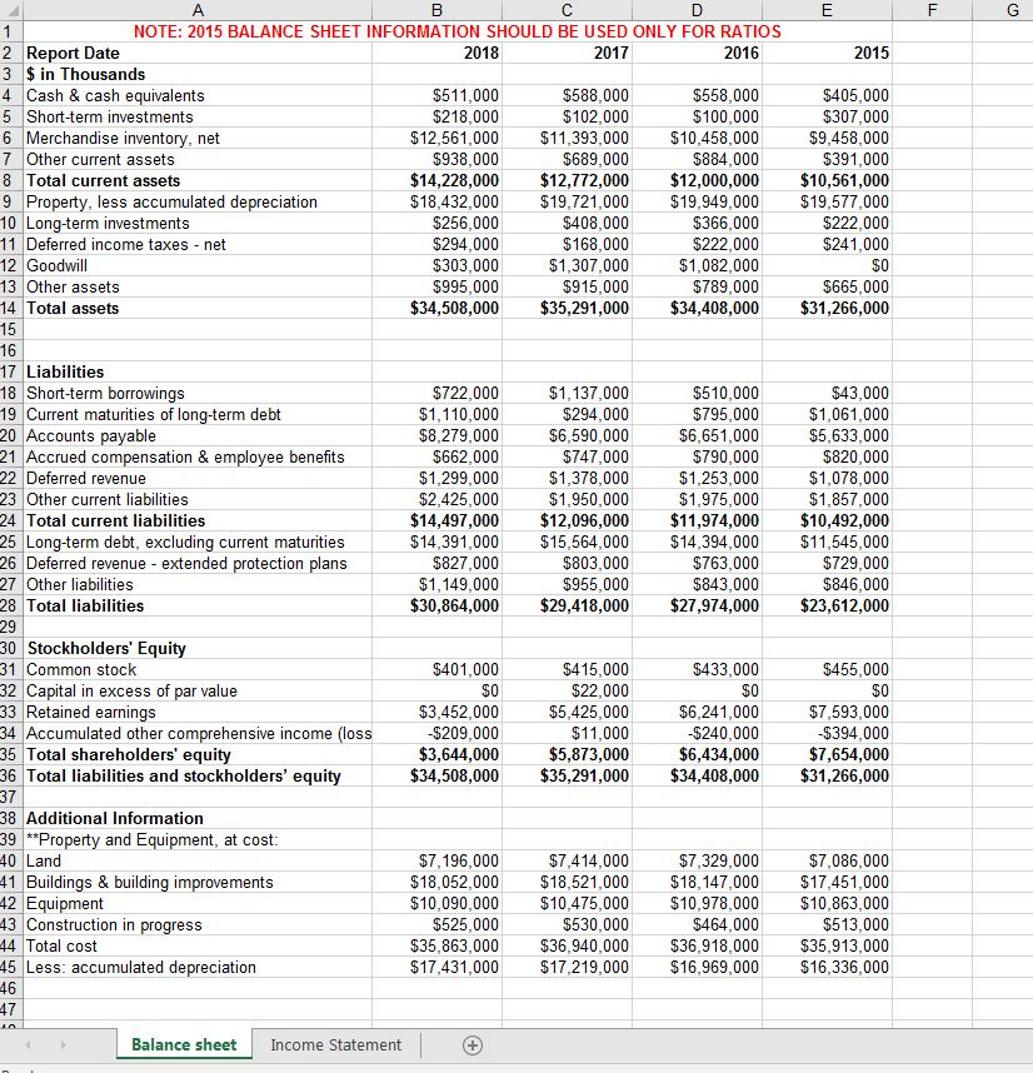

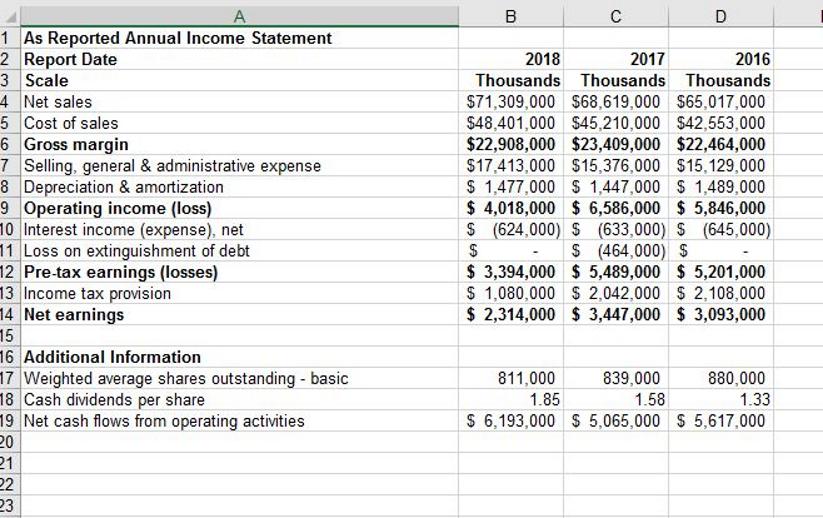

1 2 Report Date 3 4 Sin Millions 5 ASSETS 6 Current assets: 7 Cash and cash equivalents 8 Receivables, net. 9 Merchandise inventories 10 Other current assets 11 Total current assets 12 13 Net property and equipment 14 Goodwill 15 Other assets 16 Total assets 17 18 rent Liabilities: 19 Short-term debt A B C D NOTE: 2015 BALANCE SHEET INFORMATION SHOULD BE USED ONLY FOR RATIOS 20 Accounts payable 21 Accrued salaries and related expenses 22 Sales taxes payable 23 Deferred revenue 24 Income taxes payable 25 Current installments of long-term debt 26 Other accrued expenses 27 Total current liabilities 28 Long-term debt, excluding current installments 29 Deferred income taxes 30 Other long-term liabilities 31 Total liabilities 32 Common stock, par value $0.05; authorized: 10,000 shares; issue 33 Paid-in capital 34 Retained earnings 35 Accumulated other comprehensive loss 36 Treasury stock, at cost, 677 shares at February 3, 2019 and 622 37 Total stockholders' (deficit) equity 38 Total liabilities and stockholders' equity 39 40 41 45 **Property and Equipment, at cost: 46 Land 47 Buildings Ready 2018 Balance Sheet Income Statement $1,778 $1,936 $13,925 $890 $18,529 $22,375 $2,252 $847 $44,003 $1,339 $7,755 $1,506 $656 $1,782 $11 $1,056 $2,611 $16,716 $26,807 $491 $1,867 $45,881 $89 $10,578 $46,423 -$772 -$58,196 -$1,878 $44,003 2017 $8,363 18199 10100 $3,595 $1,952 $12,748 $638 $18,933 $22,075 $2,275 $1,246 $44,529 $1,559 $7,244 $1,640 $520 42 Additional Information 43 * No allowance account is created for receivables, i.e. Net receivables is equal to gross receivables 44 $1,805 $54 $1,202 $2,170 $16,194 $24,267 $440 $2,174 $43,075 $89 $10,192 $39,935 -$566 -$48,196 $1,454 $44,529 8352 $18,073 Ascoc 2016 $2,538 $2,029 $12,549 $608 $17,724 $21,914 $2,093 $1,235 $42,966 $710 $7,000 $1,484 $508 $1,669 $25 $542 $2,195 $14,133 $22,349 $296 $1,855 $38,633 $88 $9,787 $35,519 -$867 -$40,194 $4,333 $42,966 $8,207 $17,772 E 2015 $2,216 $1,890 $11,809 $569 $16,484 $22,191 $2,102 $1,196 $41,973 $350 $6,565 $1,515 $476 $1,566 $34 $77 $1,941 $12,524 $20,789 $379 $1,965 $35,657 $88 $9,347 $30,973 -$898 -$33,194 $6,316 $41,973 8,149 17,667 10.070 F Avg. $2,532 $1,952 $12,758 $676 $17,918 $22,139 $2,181 $1,131 $43,368 G

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started