Question

1. (Pricing of derivatives in a Binomial tree, risk-neutral probability) Consider a binomial model with 3 periods, in which r = 1%, u =

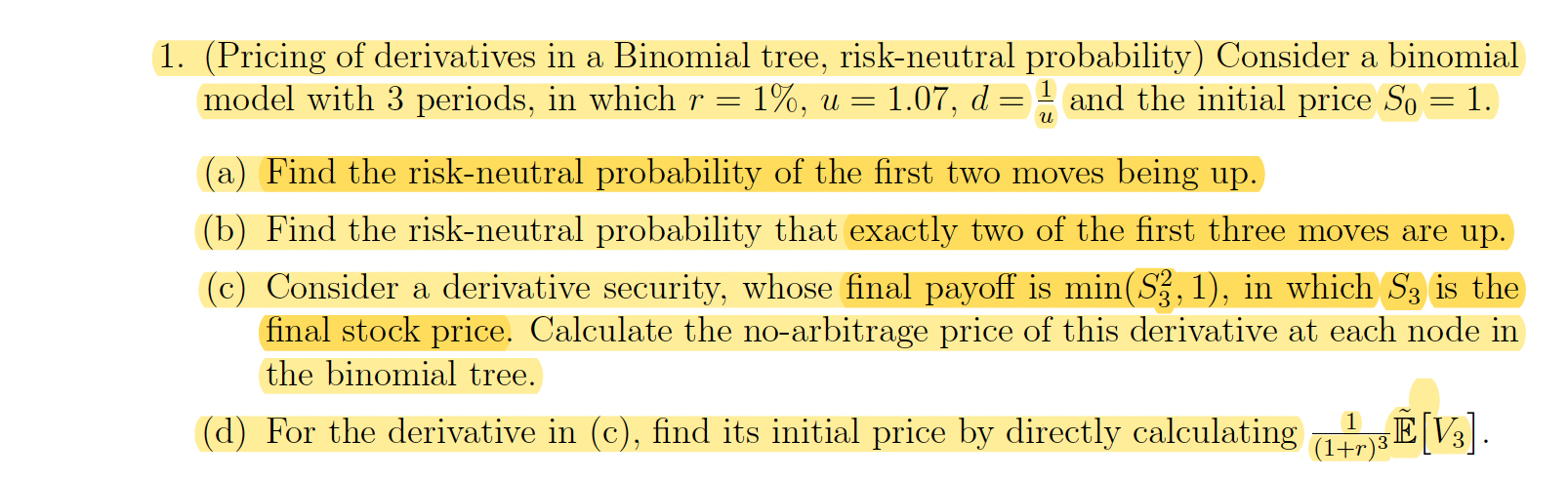

1. (Pricing of derivatives in a Binomial tree, risk-neutral probability) Consider a binomial model with 3 periods, in which r = 1%, u = 1.07, d = and the initial price So = 1. (a) Find the risk-neutral probability of the first two moves being up. (b) Find the risk-neutral probability that exactly two of the first three moves are up. (c) Consider a derivative security, whose final payoff is min(S, 1), in which S3 is the final stock price. Calculate the no-arbitrage price of this derivative at each node in the binomial tree. (d) For the derivative in (c), find its initial price by directly calculating (1+)3E [V3]. (1+r)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Marketing Mistakes And Successes

Authors: James F. Dartley

11th Edition

978-0470169810, 0470169818

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App