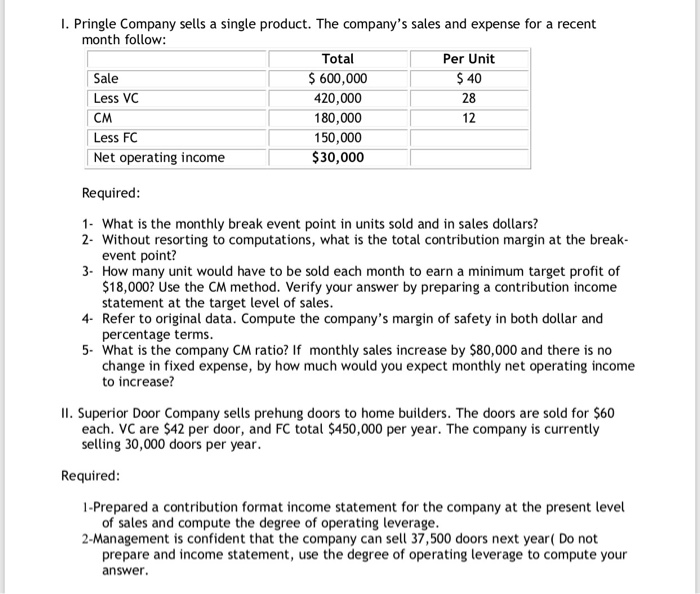

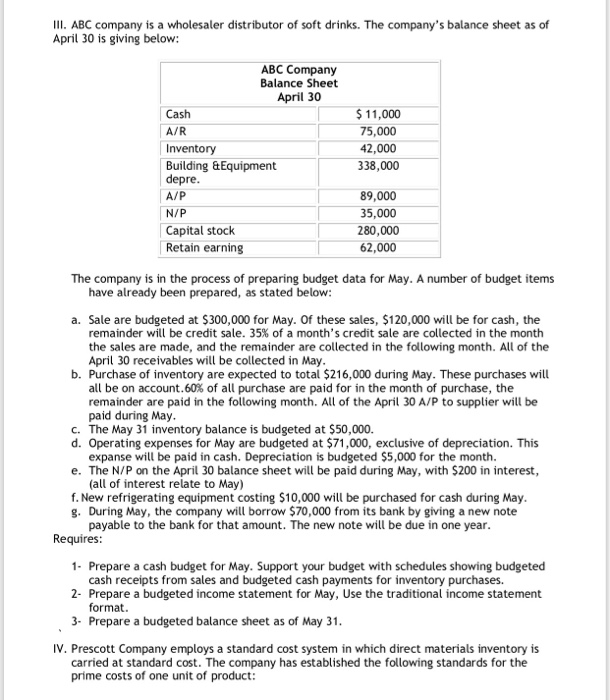

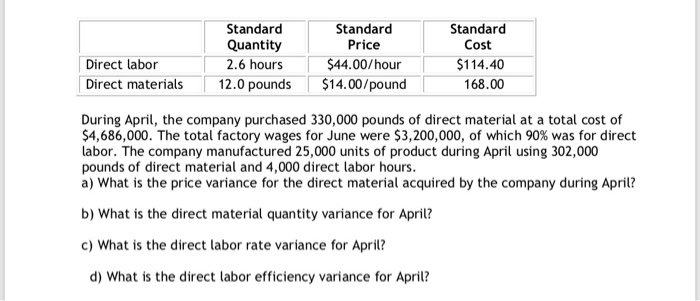

1. Pringle Company sells a single product. The company's sales and expense for a recent month follow: Total Per Unit Sale $ 600,000 $ 40 Less VC 420,000 28 CM 180,000 12 Less FC 150,000 Net operating income $30,000 Required: 1. What is the monthly break event point in units sold and in sales dollars? 2- Without resorting to computations, what is the total contribution margin at the break- event point? 3. How many unit would have to be sold each month to earn a minimum target profit of $18,000? Use the CM method. Verify your answer by preparing a contribution income statement at the target level of sales. 4. Refer to original data. Compute the company's margin of safety in both dollar and percentage terms. 5. What is the company CM ratio? If monthly sales increase by $80,000 and there is no change in fixed expense, by how much would you expect monthly net operating income to increase? II. Superior Door Company sells prehung doors to home builders. The doors are sold for $60 each. VC are $42 per door, and FC total $450,000 per year. The company is currently selling 30,000 doors per year. Required: 1-Prepared a contribution format income statement for the company at the present level of sales and compute the degree of operating leverage. 2-Management is confident that the company can sell 37,500 doors next year ( Do not prepare and income statement, use the degree of operating leverage to compute your answer. III. ABC company is a wholesaler distributor of soft drinks. The company's balance sheet as of April 30 is giving below: ABC Company Balance Sheet April 30 Cash A/R Inventory Building & Equipment depre. A/P N/P Capital stock Retain earning $11,000 75,000 42,000 338,000 89,000 35,000 280,000 62,000 The company is in the process of preparing budget data for May. A number of budget items have already been prepared, as stated below: a. Sale are budgeted at $300,000 for May. Of these sales, $120,000 will be for cash, the remainder will be credit sale. 35% of a month's credit sale are collected in the month the sales are made, and the remainder are collected in the following month. All of the April 30 receivables will be collected in May. b. Purchase of inventory are expected to total $216.000 during May. These purchases will all be on account.60% of all purchase are paid for in the month of purchase, the remainder are paid in the following month. All of the April 30 A/P to supplier will be paid during May. C. The May 31 inventory balance is budgeted at $50,000. d. Operating expenses for May are budgeted at $71,000, exclusive of depreciation. This expanse will be paid in cash. Depreciation is budgeted $5,000 for the month. e. The N/P on the April 30 balance sheet will be paid during May, with $200 in interest, (all of interest relate to May) f. New refrigerating equipment costing $10,000 will be purchased for cash during May. g. During May, the company will borrow $70,000 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year. Requires: 1. Prepare a cash budget for May. Support your budget with schedules showing budgeted h receipts from sales and budgeted cash payments for inventory purchases. 2- Prepare a budgeted income statement for May, Use the traditional income statement format. 3- Prepare a budgeted balance sheet as of May 31. IV. Prescott Company employs a standard cost system in which direct materials inventory is carried at standard cost. The company has established the following standards for the prime costs of one unit of product: Standard Quantity 2.6 hours 12.0 pounds Standard Price $44.00/hour $14.00/pound Standard Cost $114.40 168.00 Direct labor Direct materials During April, the company purchased 330,000 pounds of direct material at a total cost of $4,686,000. The total factory wages for June were $3,200,000, of which 90% was for direct labor. The company manufactured 25,000 units of product during April using 302,000 pounds of direct material and 4,000 direct labor hours. a) What is the price variance for the direct material acquired by the company during April? b) What is the direct material quantity variance for April? c) What is the direct labor rate variance for April? d) What is the direct labor efficiency variance for April