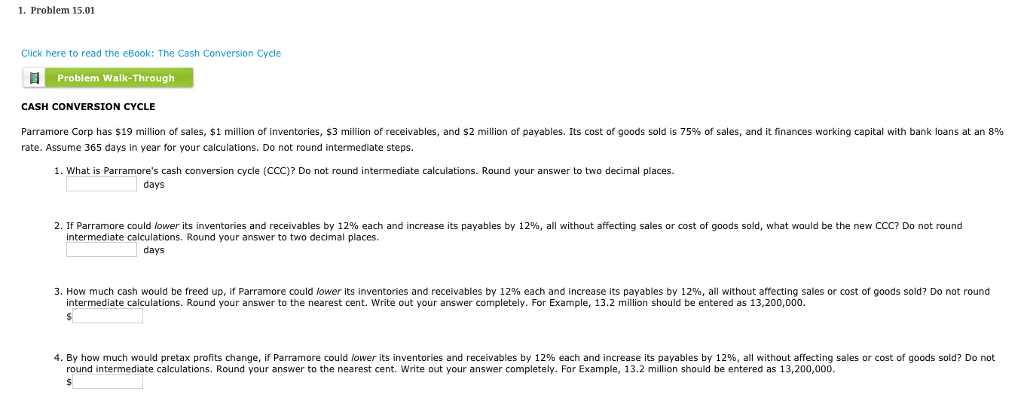

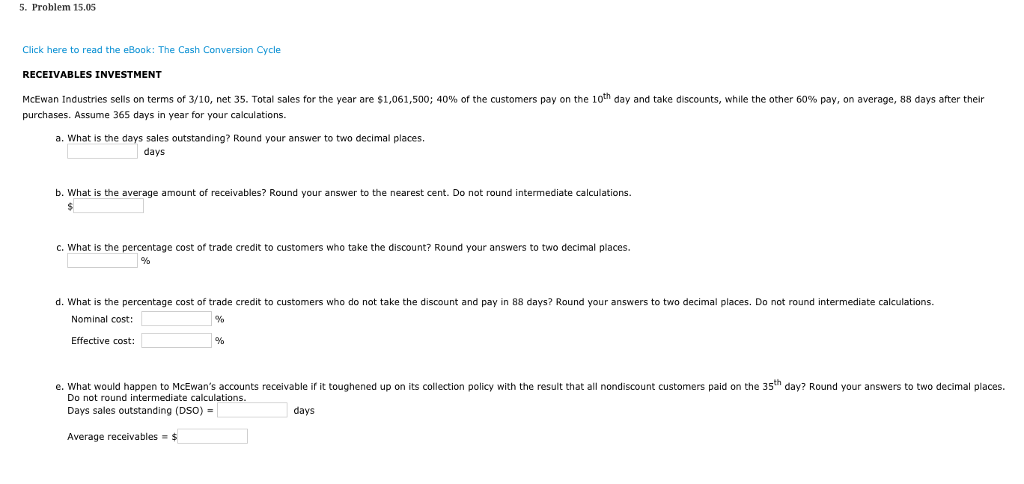

1. Problem 15.01 Click here to read the eBook: The Cash Conversion Cycle Problem Walk-Through CASH CONVERSION CYCLE Pa amore Corp has s 19 million of sales, $1 million of inventories S3 million of receivables, and $2 million of payables. Its cost of goods sold s 75% o sales and tinances working capital rate. Assume 365 days in year for your calculations. Do not round intermediate steps. baik ansat a 1. What is Parramore's cash conversion cycle (CCC)? Do not round intermediate calculations. Round your answer to two decimal places. days 2 If Parramore could lo er its inventor es and receivables by 12% each and increase its payables by 12% intermediate calculations. Round your answer to two decimal places al without affecting sales or cost of goods sold what wou d the new Do not rund days 3. How much cash would be rreed up Parra ore could ver s inventories and receivables by 12% each and increase its payables b. 1 %, all it ou a ecting sa s or cos or goods sold? no round intermediate calculations. Round your answer to the nearest cent. Write out your answer completely. For Example, 13.2 million should be entered as 13,200,000. 4. By how much would pretax profits change, if Parramore could lower its inventores and receivables by 1 % each and increase its payables by 12 6 all without affecting sales or cost ofgoods sold on round intermediate calculations. Round your answer to the nearest cent. Write out your answer completely. For Example, 13.2 million should be entered as 13,200,000 5. Problem 15.05 Click here to re ad the eBook: The Cash Conversion Cycle RECEIVABLES INVESTMENT McEwan Industries sells on terms of 3 10 net 35. Total sales for the year are S1 061,500; 40% of the customers pay on the 10th day and take discounts, while the other 60% pay, on average, 88 days after their purchases. Assume 365 days in year for your calculations. a. What is the days sales outstanding? Round your answer to two decimal places. days b. What is the average amount of receivables? Round your answer to the nearest cent. Do not round intermediate calculations. c. What is the percentage cost of trade credit to customers who take the disoount? Round your answers to two decimal places. d. What is the percentage cost of trade credit to customers who do not take the discount and pay in 88 days? Round your answers to two decimal places. Do not round intermediate calculations Nominal cost: Effective cost: e. What would happen to McEwan's accounts receivable if it toughened up on its collection policy with the result that all nondiscount customers paid on the 35th day? Round your answers to two decimal places. Do not round intermediate calculations. Days sales outstanding (DSO) days Average receivables