Question

1. Problem Statement: No more than a sentence or two that succinctly identifies your problem. 2. Situation Analysis: (typically 3-5 bullet points per C, focus

1. Problem Statement: No more than a sentence or two that succinctly identifies your problem.

2. Situation Analysis: (typically 3-5 bullet points per C, focus on those most relevant to your problem)

Company

- Information

- Information

- Etc.

Customers

- Information

- Information

- Etc.

Competitors

- Information

- Information

- Etc.

Context

- Information

- Information

- Etc.

Collaborators (if appropriate probably very little or nothing in this case)

3. Alternatives [just choose two use those in the case]

Alternative One: (Short title of this alternative)

Description: write a short paragraph that describes your alternative. In this case, it should be framed as a positioning statement using the template in your reading on positioning. When thinking of your pros and cons, consider the content in the case, your situation analysis, and (in this case) the criteria for Vetting the positioning statement in your reading.

Pros: (of alternative 1)

- Add as many as relevant. Be analytical not descriptive of your alternative. The bullets do not need to be complete sentences.

Cons: (of alternative 1)

- Add as many as relevant. Be analytical not descriptive of your alternative. The bullets do not need to be complete sentences.

Alternative Two: (Short title of this alternative)

Description: write a short paragraph that describes your alternative. In this case, it should be framed as a positioning statement using the template in your reading on positioning. When thinking of your pros and cons, consider the content in the case, your situation analysis, and (in this case) the criteria for Vetting the positioning statement in your reading.

Pros: (of alternative 2)

- Add as many as relevant. Be analytical not descriptive of your alternative. The bullets do not need to be complete sentences.

Cons: (of alternative 1)

- Add as many as relevant. Be analytical not descriptive of your alternative. The bullets do not need to be complete sentences.

4. Recommendation

Write a 1-2 paragraph explanation of why you chose one alternative over the other. What information was most important in making this recommendation? This might end up being somewhat repetitive of the pros/cons listed above but that is OK.

5. Implementation Plan (This is the marketing strategy you will recommend. Recall the key elements of the marketing strategy target market + 4 Ps. This section can go beyond the bounds of what is actually presented in the case. Use some creativity, but remember the pieces of a marketing strategy should be integrated and fit logically together. You might find it easiest to use headings and short descriptions for each element. For each element, explain your reasoning.)

Target market: (briefly describe your target market.)

Product: (which can include brand name for example, possibly packaging, others, the physical product does not change between the alternatives listed in the case.)

Place: (what channels of distribution retail outlets will your plan emphasize?)

Promotion: (how will you tell customers about your product, advertising, promotion, sales promotion, trade promotion, social media, sales force, etc. Think about the message you want to communicate about your product and how you might do that.)

Price: (given in case, though you could change if you think appropriate.)

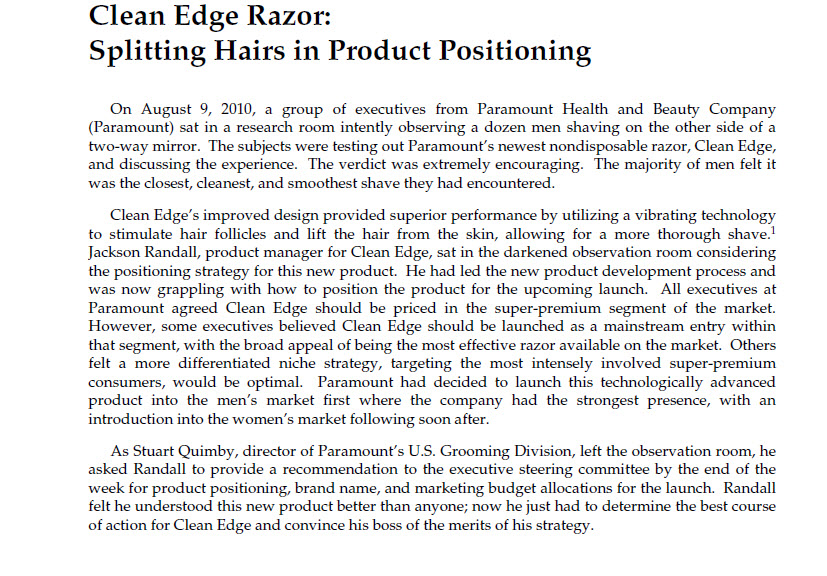

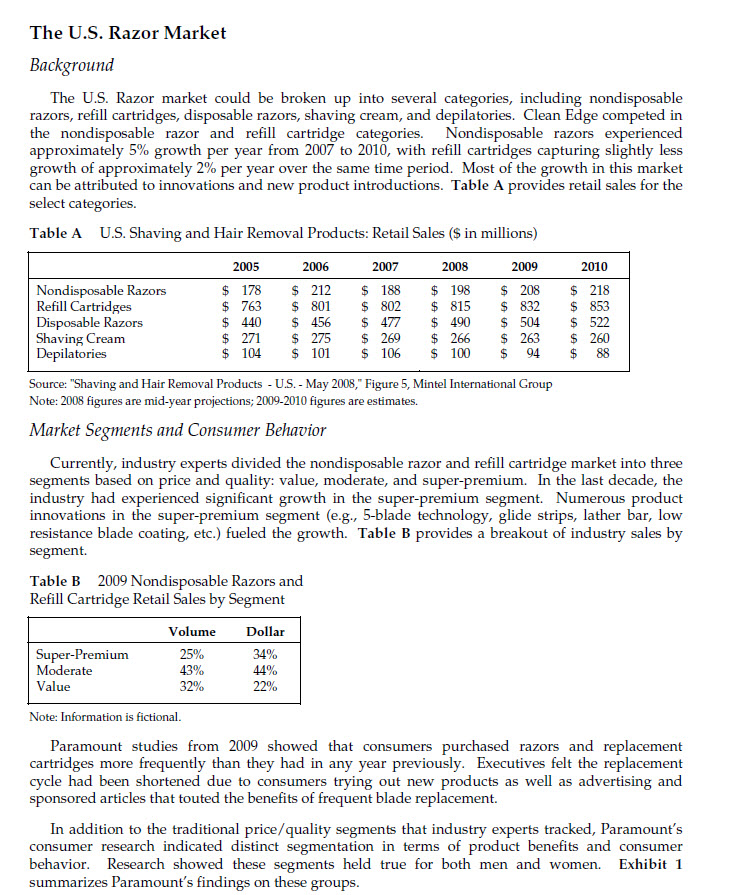

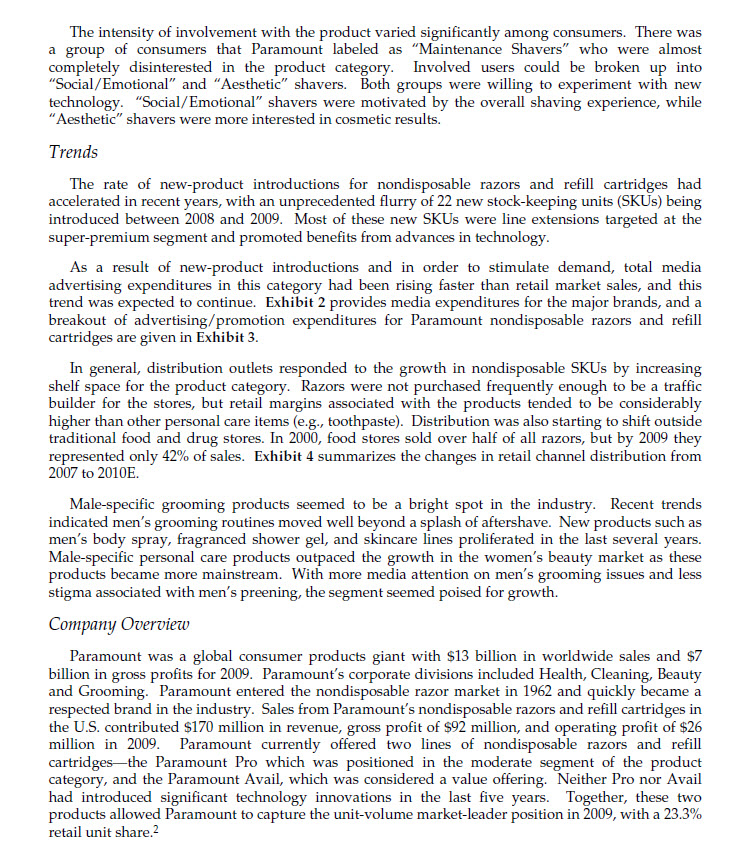

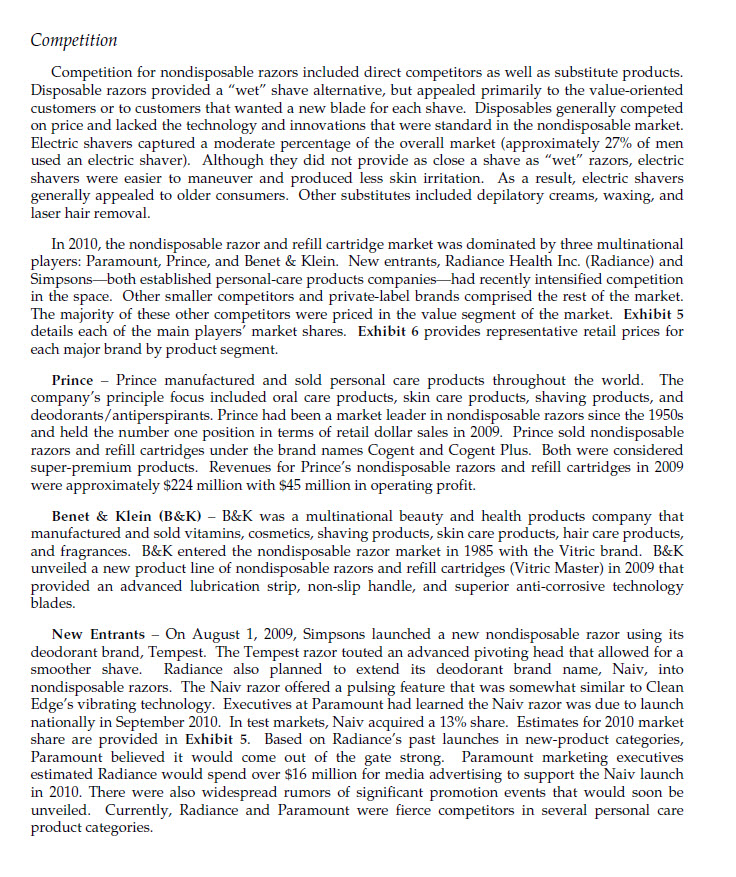

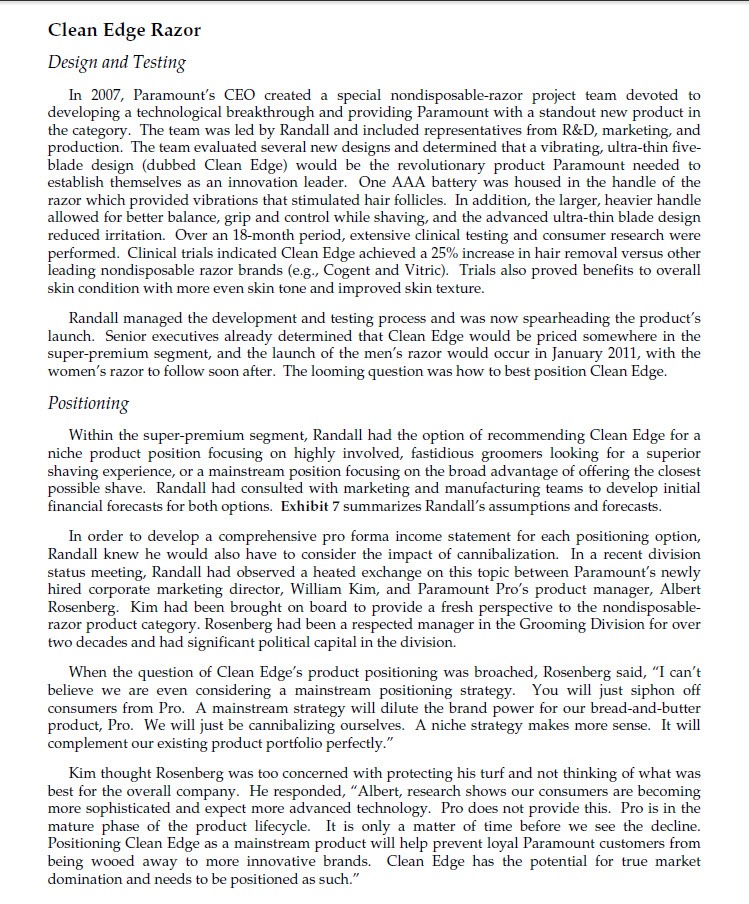

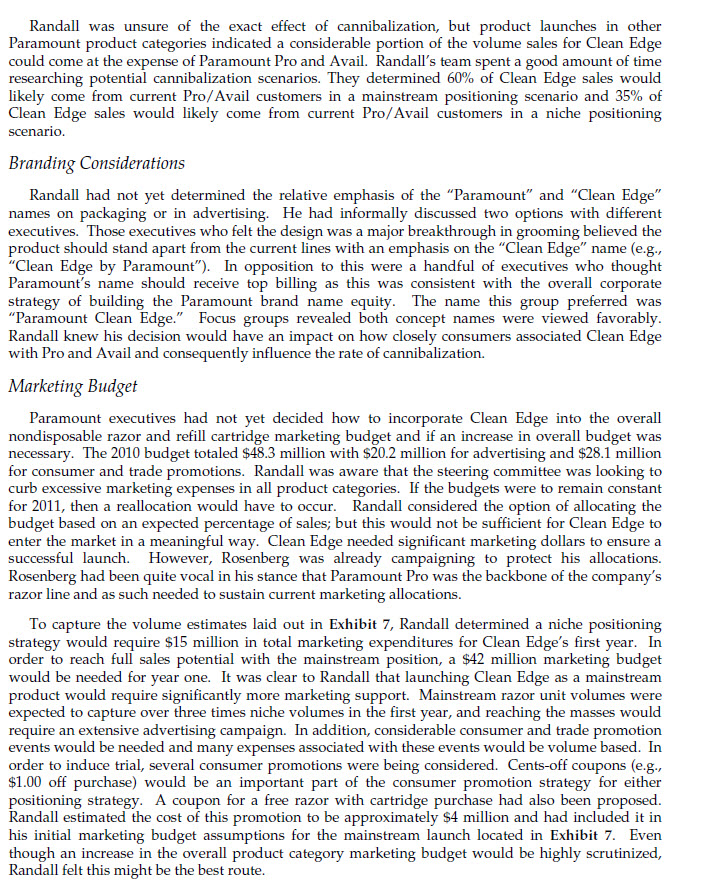

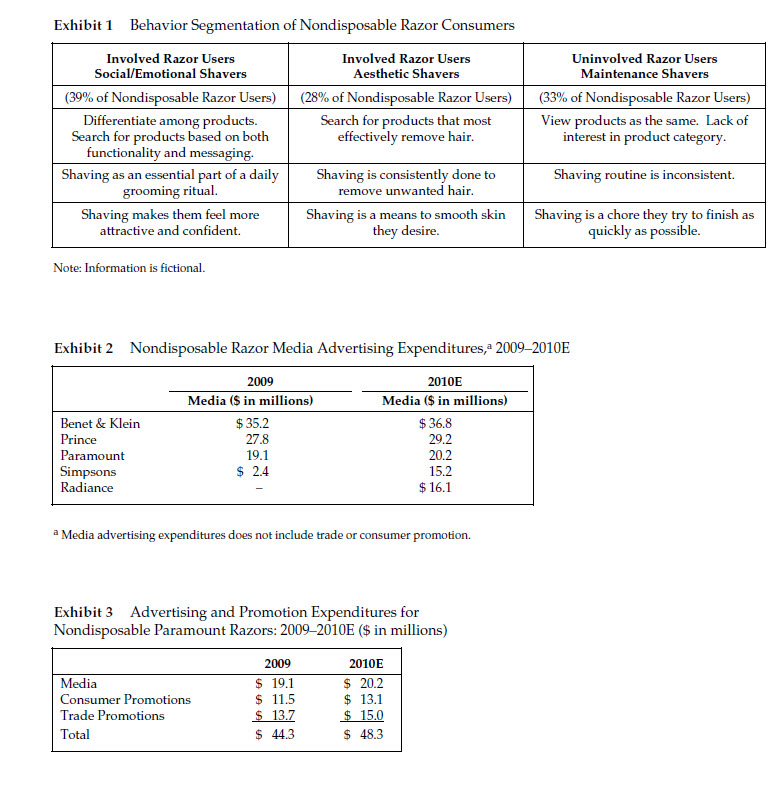

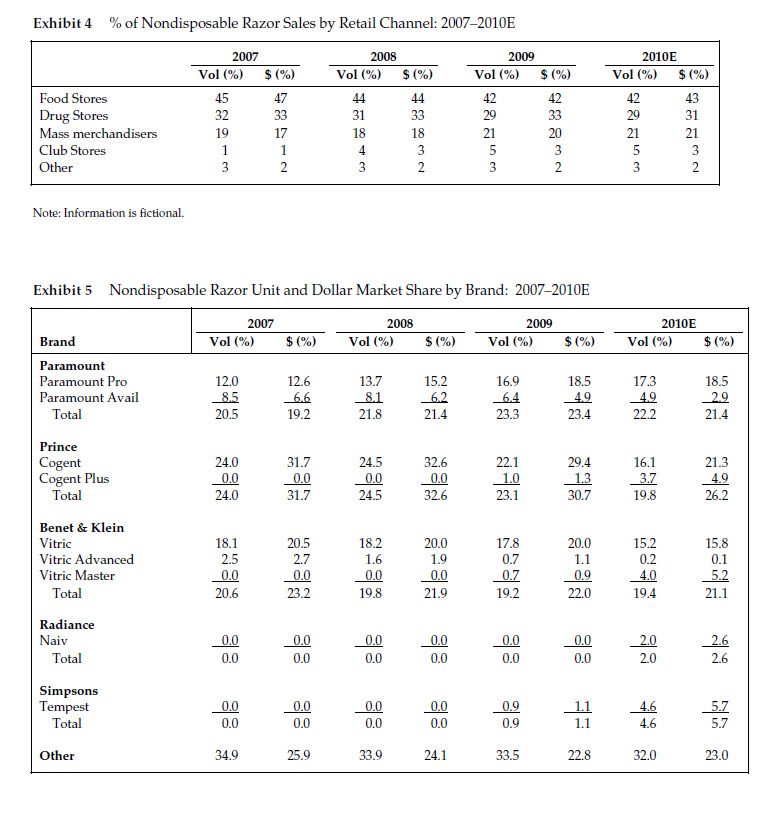

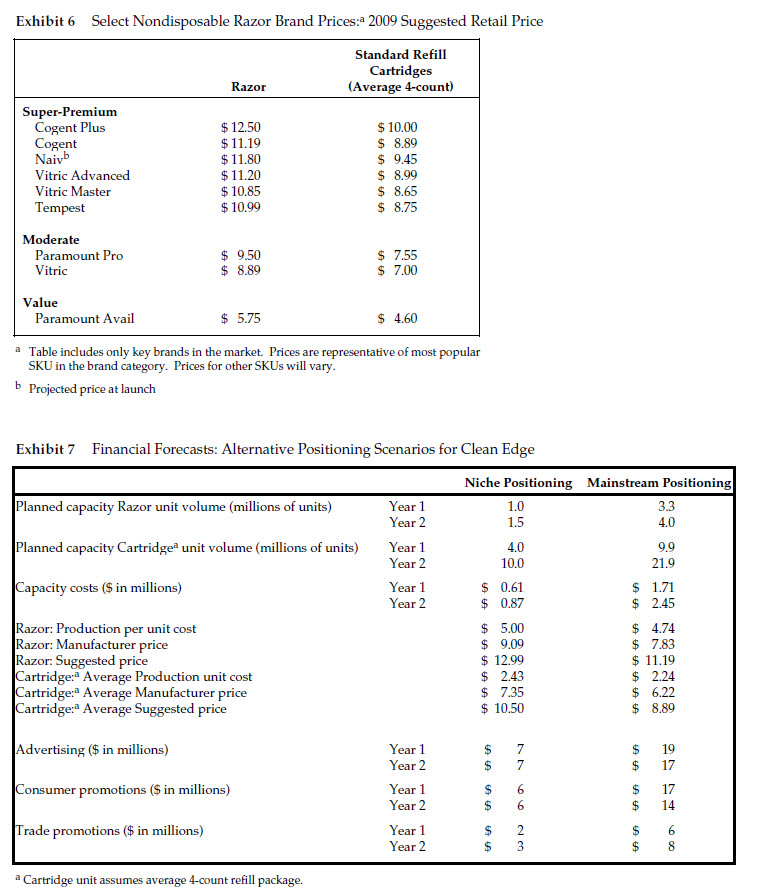

Clean Edge Razor: Splitting Hairs in Product Positioning On August 9, 2010, a group of executives from Paramount Health and Beauty Company (Paramount) sat in a research room intently observing a dozen men shaving on the other side of a two-way mirror. The subjects were testing out Paramount's newest nondisposable razor, Clean Edge, and discussing the experience. The verdict was extremely encouraging. The majority of men felt it was the closest, cleanest, and smoothest shave they had encountered. Clean Edge's improved design provided superior performance by utilizing a vibrating technology to stimulate hair follicles and lift the hair from the skin, allowing for a more thorough shave. Jackson Randall, product manager for Clean Edge, sat in the darkened observation room considering the positioning strategy for this new product. He had led the new product development process and was now grappling with how to position the product for the upcoming launch. All executives at Paramount agreed Clean Edge should be priced in the super-premium segment of the market. However, some executives believed Clean Edge should be launched as a mainstream entry within that segment, with the broad appeal of being the most effective razor available on the market. Others felt a more differentiated niche strategy, targeting the most intensely involved super-premium consumers, would be optimal. Paramount had decided to launch this technologically advanced product into the men's market first where the company had the strongest presence, with an introduction into the women's market following soon after. As Stuart Quimby, director of Paramount's U.S. Grooming Division, left the observation room, he asked Randall to provide a recommendation to the executive steering committee by the end of the week for product positioning, brand name, and marketing budget allocations for the launch. Randall felt he understood this new product better than anyone; now he just had to determine the best course of action for Clean Edge and convince his boss of the merits of his strategy. The U.S. Razor Market Background The U.S. Razor market could be broken up into several categories, including nondisposable razors, refill cartridges, disposable razors, shaving cream, and depilatories. Clean Edge competed in the nondisposable razor and refill cartridge categories. Nondisposable razors experienced approximately 5% growth per year from 2007 to 2010, with refill cartridges capturing slightly less growth of approximately 2% per year over the same time period. Most of the growth in this market can be attributed to innovations and new product introductions. Table A provides retail sales for the select categories. Table A U.S. Shaving and Hair Removal Products: Retail Sales ($ in millions) 2010 Nondisposable Razors Refill Cartridges Disposable Razors Shaving Cream Depilatories 2005 178 $ 763 $ 440 271 $ 104 $ $ 2006 $ 212 $ 801 $ 456 $ 275 $ 101 2007 $ 188 $ 802 $ 477 $ 269 $ 106 2008 $ 198 $ 815 $ 490 $ 266 $ 100 2009 $ 208 $ 832 $ 504 $ 263 $ 94 $ 218 $ 853 $ 522 $ 260 $ 88 Source: "Shaving and Hair Removal Products - U.S. - May 2008," Figure 5, Mintel International Group Note: 2008 figures are mid-year projections; 2009-2010 figures are estimates. Market Segments and Consumer Behavior Currently, industry experts divided the nondisposable razor and refill cartridge market into three segments based on price and quality: value, moderate, and super-premium. In the last decade, the industry had experienced significant growth in the super-premium segment. Numerous product innovations in the super-premium segment (e.g., 5-blade technology, glide strips, lather bar, low resistance blade coating, etc.) fueled the growth. Table B provides a breakout of industry sales by segment. Table B 2009 Nondisposable Razors and Refill Cartridge Retail Sales by Segment Super-Premium Moderate Value Volume 25% 43% 32% Dollar 34% 44% 22% Note: Information is fictional. Paramount studies from 2009 showed that consumers purchased razors and replacement cartridges more frequently than they had in any year previously. Executives felt the replacement cycle had been shortened due to consumers trying out new products as well as advertising and sponsored articles that touted the benefits of frequent blade replacement. In addition to the traditional price/quality segments that industry experts tracked, Paramount's consumer research indicated distinct segmentation in terms of product benefits and consumer behavior. Research showed these segments held true for both men and women. Exhibit 1 summarizes Paramount's findings on these groups. The intensity of involvement with the product varied significantly among consumers. There was a group of consumers that Paramount labeled as "Maintenance Shavers" who were almost completely disinterested in the product category. Involved users could be broken up into "Social/Emotional" and "Aesthetic" shavers. Both groups were willing to experiment with new technology. "Social/Emotional" shavers were motivated by the overall shaving experience, while "Aesthetic" shavers were more interested in cosmetic results. Trends The rate of new-product introductions for nondisposable razors and refill cartridges had accelerated in recent years, with an unprecedented flurry of 22 new stock-keeping units (SKUs) being introduced between 2008 and 2009. Most of these new SKUs were line extensions targeted at the super-premium segment and promoted benefits from advances in technology. As a result of new-product introductions and in order to stimulate demand, total media advertising expenditures in this category had been rising faster than retail market sales, and this trend was expected to continue. Exhibit 2 provides media expenditures for the major brands, and a breakout of advertising/promotion expenditures for Paramount nondisposable razors and refill cartridges are given in Exhibit 3. In general, distribution outlets responded to the growth in nondisposable SKUs by increasing shelf space for the product category. Razors were not purchased frequently enough to be a traffic builder for the stores, but retail margins associated with the products tended to be considerably higher than other personal care items (e.g., toothpaste). Distribution was also starting to shift outside traditional food and drug stores. In 2000, food stores sold over half of all razors, but by 2009 they represented only 42% of sales. Exhibit 4 summarizes the changes in retail channel distribution from 2007 to 2010E. Male-specific grooming products seemed to be a bright spot in the industry. Recent trends indicated men's grooming routines moved well beyond a splash of aftershave. New products such as men's body spray, fragranced shower gel, and skincare lines proliferated in the last several years. Male-specific personal care products outpaced the growth in the women's beauty market as these products became more mainstream. With more media attention on men's grooming issues and less stigma associated with men's preening, the segment seemed poised for growth. Company Overview Paramount was a global consumer products giant with $13 billion in worldwide sales and $7 billion in gross profits for 2009. Paramount's corporate divisions included Health, Cleaning, Beauty and Grooming. Paramount entered the nondisposable razor market in 1962 and quickly became a respected brand in the industry. Sales from Paramount's nondisposable razors and refill cartridges in the U.S. contributed $170 million in revenue, gross profit of $92 million, and operating profit of $26 million in 2009. Paramount currently offered two lines of nondisposable razors and refill cartridgesthe Paramount Pro which was positioned in the moderate segment of the product category, and the Paramount Avail, which was considered a value offering. Neither Pro nor Avail had introduced significant technology innovations in the last five years. Together, these two products allowed Paramount to capture the unit-volume market-leader position in 2009, with a 23.3% retail unit share.? Competition Competition for nondisposable razors included direct competitors as well as substitute products. Disposable razors provided a "wet" shave alternative, but appealed primarily to the value-oriented customers or to customers that wanted a new blade for each shave. Disposables generally competed on price and lacked the technology and innovations that were standard in the nondisposable market. Electric shavers captured a moderate percentage of the overall market (approximately 27% of men used an electric shaver). Although they did not provide as close a shave as "wet" razors, electric shavers were easier to maneuver and produced less skin irritation. As a result, electric shavers generally appealed to older consumers. Other substitutes included depilatory creams, waxing, and laser hair removal. In 2010, the nondisposable razor and refill cartridge market was dominated by three multinational players: Paramount, Prince, and Benet & Klein. New entrants, Radiance Health Inc. (Radiance) and Simpsonsboth established personal-care products companieshad recently intensified competition in the space. Other smaller competitors and private-label brands comprised the rest of the market. The majority of these other competitors were priced in the value segment of the market. Exhibit 5 details each of the main players' market shares. Exhibit 6 provides representative retail prices for each major brand by product segment. Prince - Prince manufactured and sold personal care products throughout the world. The company's principle focus included oral care products, skin care products, shaving products, and deodorants/antiperspirants. Prince had been a market leader in nondisposable razors since the 1950s and held the number one position in terms of retail dollar sales in 2009. Prince sold nondisposable razors and refill cartridges under the brand names Cogent and Cogent Plus. Both were considered super-premium products. Revenues for Prince's nondisposable razors and refill cartridges in 2009 were approximately $224 million with $45 million in operating profit. Benet & Klein (B&K) - B&K was a multinational beauty and health products company that manufactured and sold vitamins, cosmetics, shaving products, skin care products, hair care products, and fragrances. B&K entered the nondisposable razor market in 1985 with the Vitric brand. B&K unveiled a new product line of nondisposable razors and refill cartridges (Vitric Master) in 2009 that provided an advanced lubrication strip, non-slip handle, and superior anti-corrosive technology blades. New Entrants - On August 1, 2009, Simpsons launched a new nondisposable razor using its deodorant brand, Tempest. The Tempest razor touted an advanced pivoting head that allowed for a smoother shave. Radiance also planned to extend its deodorant brand name, Naiv, into nondisposable razors. The Naiv razor offered a pulsing feature that was somewhat similar to Clean Edge's vibrating technology. Executives at Paramount had learned the Naiv razor was due to launch nationally in September 2010. In test markets, Naiv acquired a 13% share. Estimates for 2010 market share are provided in Exhibit 5. Based on Radiance's past launches in new-product categories, Paramount believed it would come out of the gate strong. Paramount marketing executives estimated Radiance would spend over $16 million for media advertising to support the Naiv launch in 2010. There were also widespread rumors of significant promotion events that would soon be unveiled. Currently, Radiance and Paramount were fierce competitors in several personal care product categories. Clean Edge Razor Design and Testing In 2007, Paramount's CEO created a special nondisposable-razor project team devoted to developing a technological breakthrough and providing Paramount with a standout new product in the category. The team was led by Randall and included representatives from R&D, marketing, and production. The team evaluated several new designs and determined that a vibrating, ultra-thin five- blade design (dubbed Clean Edge) would be the revolutionary product Paramount needed to establish themselves as an innovation leader. One AAA battery was housed in the handle of the razor which provided vibrations that stimulated hair follicles. In addition, the larger, heavier handle allowed for better balance, grip and control while shaving, and the advanced ultra-thin blade design reduced irritation. Over an 18-month period, extensive clinical testing and consumer research were performed. Clinical trials indicated Clean Edge achieved a 25% increase in hair removal versus other leading nondisposable razor brands (e.g., Cogent and Vitric). Trials also proved benefits to overall skin condition with more even skin tone and improved skin texture. Randall managed the development and testing process and was now spearheading the product's launch. Senior executives already determined that Clean Edge would be priced somewhere in the super-premium segment, and the launch of the men's razor would occur in January 2011, with the women's razor to follow soon after. The looming question was how to best position Clean Edge. Positioning Within the super-premium segment, Randall had the option of recommending Clean Edge for a niche product position focusing on highly involved, fastidious groomers looking for a superior shaving experience, or a mainstream position focusing on the broad advantage of offering the closest possible shave. Randall had consulted with marketing and manufacturing teams to develop initial financial forecasts for both options. Exhibit 7 summarizes Randall's assumptions and forecasts In order to develop a comprehensive pro forma income statement for each positioning option, Randall knew he would also have to consider the impact of cannibalization. In a recent division status meeting, Randall had observed a heated exchange on this topic between Paramount's newly hired corporate marketing director, William Kim, and Paramount Pro's product manager, Albert Rosenberg. Kim had been brought on board to provide a fresh perspective to the nondisposable- razor product category. Rosenberg had been a respected manager in the Grooming Division for over two decades and had significant political capital in the division. When the question of Clean Edge's product positioning was broached, Rosenberg said, "I can't believe we are even considering a mainstream positioning strategy. You will just siphon off consumers from Pro. A mainstream strategy will dilute the brand power for our bread-and-butter product, Pro. We will just be cannibalizing ourselves. A niche strategy makes more sense. It will complement our existing product portfolio perfectly." Kim thought Rosenberg was too concerned with protecting his turf and not thinking of what was best for the overall company. He responded, "Albert, research shows our consumers are becoming more sophisticated and expect more advanced technology. Pro does not provide this. Pro is in the mature phase of the product lifecycle. It is only a matter of time before we see the decline. Positioning Clean Edge as a mainstream product will help prevent loyal Paramount customers from being wooed away to more innovative brands. Clean Edge has the potential for true market domination and needs to be positioned as such." Randall was unsure of the exact effect of cannibalization, but product launches in other Paramount product categories indicated a considerable portion of the volume sales for Clean Edge could come at the expense of Paramount Pro and Avail. Randall's team spent a good amount of time researching potential cannibalization scenarios. They determined 60% of Clean Edge sales would likely come from current Pro/Avail customers in a mainstream positioning scenario and 35% of Clean Edge sales would likely come from current Pro/Avail customers in a niche positioning scenario. Branding Considerations Randall had not yet determined the relative emphasis of the "Paramount" and "Clean Edge" names on packaging or in advertising. He had informally discussed two options with different executives. Those executives who felt the design was a major breakthrough in grooming believed the product should stand apart from the current lines with an emphasis on the "Clean Edge" name (e.g., "Clean Edge by Paramount"). In opposition to this were a handful of executives who thought Paramount's name should receive top billing as this was consistent with the overall corporate strategy of building the Paramount brand name equity. The name this group preferred was "Paramount Clean Edge." Focus groups revealed both concept names were viewed favorably. Randall knew his decision would have an impact on how closely consumers associated Clean Edge with Pro and Avail and consequently influence the rate of cannibalization. Marketing Budget Paramount executives had not yet decided how to incorporate Clean Edge into the overall nondisposable razor and refill cartridge marketing budget and if an increase in overall budget was necessary. The 2010 budget totaled $48.3 million with $20.2 million for advertising and $28.1 million for consumer and trade promotions. Randall was aware that the steering committee was looking to curb excessive marketing expenses in all product categories. If the budgets were to remain constant for 2011, then a reallocation would have to occur. Randall considered the option of allocating the budget based on an expected percentage of sales; but this would not be sufficient for Clean Edge to enter the market in a meaningful way. Clean Edge needed significant marketing dollars to ensure a successful launch. However, Rosenberg was already campaigning to protect his allocations. Rosenberg had been quite vocal in his stance that Paramount Pro was the backbone of the company's razor line and as such needed to sustain current marketing allocations. To capture the volume estimates laid out in Exhibit 7, Randall determined a niche positioning strategy would require $15 million in total marketing expenditures for Clean Edge's first year. In order to reach full sales potential with the mainstream position, a $42 million marketing budget would be needed for year one. It was clear to Randall that launching Clean Edge as a mainstream product would require significantly more marketing support. Mainstream razor unit volumes were expected to capture over three times niche volumes in the first year, and reaching the masses would require an extensive advertising campaign. In addition, considerable consumer and trade promotion events would be needed and many expenses associated with these events would be volume based. In order to induce trial, several consumer promotions were being considered. Cents-off coupons (e.g., $1.00 off purchase) would be an important part of the consumer promotion strategy for either positioning strategy. A coupon for a free razor with cartridge purchase had also been proposed. Randall estimated the cost of this promotion to be approximately $4 million and had included it in his initial marketing budget assumptions for the mainstream launch located in Exhibit 7. Even though an increase in the overall product category marketing budget would be highly scrutinized, Randall felt this might be the best route. Conclusion Randall's gut told him Clean Edge had significant mainstream potential in the super-premium segment. He felt the vibrating, thin-blade razor would become the new standard in men's shaving and would quickly gain mass appeal. However, Randall had to consider the optimal positioning strategy in the context of the entire company. He knew Paramount Pro's product manager, Rosenberg, would vehemently oppose a mainstream launch, and he had to consider if launching as a niche product for a year or two might be a better move. Randall hoped that an economic analysis would help him find the right answer. He planned to build a simple profit-and-loss pro forma that took into account the effects of cannibalization on Paramount Pro and Avail. Randall also realized it would be important to develop contingency plans to address different scenarios. After this was complete, he could make a more informed decision about a positioning recommendation and then get started on brand name and budget recommendations. Exhibit 1 Behavior Segmentation of Nondisposable Razor Consumers Involved Razor Users Social/Emotional Shavers (39% of Nondisposable Razor Users) Differentiate among products. Search for products based on both functionality and messaging. Shaving as an essential part of a daily grooming ritual. Shaving makes them feel more attractive and confident. Involved Razor Users Aesthetic Shavers (28% of Nondisposable Razor Users) Search for products that most effectively remove hair. Uninvolved Razor Users Maintenance Shavers (33% of Nondisposable Razor Users) View products as the same. Lack of interest in product category. Shaving routine is inconsistent. Shaving is consistently done to remove unwanted hair. Shaving is a means to smooth skin they desire. Shaving is a chore they try to finish as quickly as possible. Note: Information is fictional. Exhibit 2 Nondisposable Razor Media Advertising Expenditures, a 20092010E Benet & Klein Prince Paramount Simpsons Radiance 2009 Media ($ in millions) $35.2 27.8 19.1 $ 2.4 2010E Media ($ in millions) $36.8 29.2 20.2 15.2 $ 16.1 a Media advertising expenditures does not include trade or consumer promotion. Exhibit 3 Advertising and Promotion Expenditures for Nondisposable Paramount Razors: 2009-2010E ($ in millions) Media Consumer Promotions Trade Promotions Total 2009 $ 19.1 $ 11.5 $ 13.7 $ 44.3 2010E $ 20.2 $ 13.1 $ 15.0 $ 48.3 Exhibit4 % of Nondisposable Razor Sales by Retail Channel: 2007-2010E 2007 vol (%) $ (%) 2008 Vol (%) $ (%) 2009 vol (%) $ (%) 2010E vol (%) $ (%) 4243 Food Stores Drug Stores Mass merchandisers Club Stores Other Note: Information is fictional. Exhibit 5 Nondisposable Razor Unit and Dollar Market Share by Brand: 2007-2010E 2007 Vol (%) 2008 Vol (%) $ (%) 2010E Vol (%) 2009 Vol (%) $ (%) $ (%) $ (%) Brand Paramount Paramount Pro Paramount Avail Total 12.0 12.6 16.9 18.5 85 6.6 13.7 8.1 21.8 6.4 4, 18.5 29 21.4 20.5 19.2 23.3 23.4 29.4 Prince Cogent Cogent Plus Total 24.0 0.0 24.0 31.7 0.0 245 0.0 245 221 1.0 23.1 21.3 4.9 26.2 31.7 30,7 Benet & Klein Vitric 18.1 205 17.8 Vitric Advanced Vitric Master Total 15.8 0.1 21.1 20.6 Radiance Naiv Total Simpsons Tempest Total 1146 00 0.0 0. 00. 00. 00. 00.9 000009009 0.9 34. 925. 933. 9241 33. 522. 832. 023.0 Other Exhibit 6 Select Nondisposable Razor Brand Prices:a 2009 Suggested Retail Price Standard Refill Cartridges (Average 4-count) Razor Super-Premium Cogent Plus Cogent $10.00 $ 8.89 $ 9.45 Naivb $ 12.50 $11.19 $11.80 $11.20 $10.85 $10.99 Vitric Advanced Vitric Master Tempest 8.99 8.65 8.75 Moderate Paramount Pro $ 9.50 $ 8.89 $ 7.55 $ 7.00 Vitric Value Paramount Avail $ 5.75 $ 4.60 a Table includes only key brands in the market. Prices are representative of most popular SKU in the brand category. Prices for other SKUs will vary. b Projected price at launch Exhibit 7 Financial Forecasts: Alternative Positioning Scenarios for Clean Edge Planned capacity Razor unit volume (millions of units) Niche Positioning Mainstream Positioning 3.3 1.5 4.0 1.0 Planned capacity Cartridge unit volume (millions of units) Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 Capacity costs ($ in millions) Razor: Production per unit cost Razor: Manufacturer price Razor: Suggested price Cartridge: Average Production unit cost Cartridge: Average Manufacturer price Cartridge: Average Suggested price 4.0 10.0 $ 0.61 $ 0.87 5.00 $ 9.09 $ 12.99 $ 2.43 $ 7.35 $ 10.50 9.9 21.9 $ 1.71 2.45 4.74 7.83 $11.19 2.24 6.22 8.89 Advertising ($ in millions) Year 1 $ 7 19 $ 7 Consumer promotions ($ in millions) A Year 2 Year 1 Year 2 Year 1 Year 2 $ 6 Trade promotions ($ in millions) A $ 3 a Cartridge unit assumes average 4-count refill package. Clean Edge Razor: Splitting Hairs in Product Positioning On August 9, 2010, a group of executives from Paramount Health and Beauty Company (Paramount) sat in a research room intently observing a dozen men shaving on the other side of a two-way mirror. The subjects were testing out Paramount's newest nondisposable razor, Clean Edge, and discussing the experience. The verdict was extremely encouraging. The majority of men felt it was the closest, cleanest, and smoothest shave they had encountered. Clean Edge's improved design provided superior performance by utilizing a vibrating technology to stimulate hair follicles and lift the hair from the skin, allowing for a more thorough shave. Jackson Randall, product manager for Clean Edge, sat in the darkened observation room considering the positioning strategy for this new product. He had led the new product development process and was now grappling with how to position the product for the upcoming launch. All executives at Paramount agreed Clean Edge should be priced in the super-premium segment of the market. However, some executives believed Clean Edge should be launched as a mainstream entry within that segment, with the broad appeal of being the most effective razor available on the market. Others felt a more differentiated niche strategy, targeting the most intensely involved super-premium consumers, would be optimal. Paramount had decided to launch this technologically advanced product into the men's market first where the company had the strongest presence, with an introduction into the women's market following soon after. As Stuart Quimby, director of Paramount's U.S. Grooming Division, left the observation room, he asked Randall to provide a recommendation to the executive steering committee by the end of the week for product positioning, brand name, and marketing budget allocations for the launch. Randall felt he understood this new product better than anyone; now he just had to determine the best course of action for Clean Edge and convince his boss of the merits of his strategy. The U.S. Razor Market Background The U.S. Razor market could be broken up into several categories, including nondisposable razors, refill cartridges, disposable razors, shaving cream, and depilatories. Clean Edge competed in the nondisposable razor and refill cartridge categories. Nondisposable razors experienced approximately 5% growth per year from 2007 to 2010, with refill cartridges capturing slightly less growth of approximately 2% per year over the same time period. Most of the growth in this market can be attributed to innovations and new product introductions. Table A provides retail sales for the select categories. Table A U.S. Shaving and Hair Removal Products: Retail Sales ($ in millions) 2010 Nondisposable Razors Refill Cartridges Disposable Razors Shaving Cream Depilatories 2005 178 $ 763 $ 440 271 $ 104 $ $ 2006 $ 212 $ 801 $ 456 $ 275 $ 101 2007 $ 188 $ 802 $ 477 $ 269 $ 106 2008 $ 198 $ 815 $ 490 $ 266 $ 100 2009 $ 208 $ 832 $ 504 $ 263 $ 94 $ 218 $ 853 $ 522 $ 260 $ 88 Source: "Shaving and Hair Removal Products - U.S. - May 2008," Figure 5, Mintel International Group Note: 2008 figures are mid-year projections; 2009-2010 figures are estimates. Market Segments and Consumer Behavior Currently, industry experts divided the nondisposable razor and refill cartridge market into three segments based on price and quality: value, moderate, and super-premium. In the last decade, the industry had experienced significant growth in the super-premium segment. Numerous product innovations in the super-premium segment (e.g., 5-blade technology, glide strips, lather bar, low resistance blade coating, etc.) fueled the growth. Table B provides a breakout of industry sales by segment. Table B 2009 Nondisposable Razors and Refill Cartridge Retail Sales by Segment Super-Premium Moderate Value Volume 25% 43% 32% Dollar 34% 44% 22% Note: Information is fictional. Paramount studies from 2009 showed that consumers purchased razors and replacement cartridges more frequently than they had in any year previously. Executives felt the replacement cycle had been shortened due to consumers trying out new products as well as advertising and sponsored articles that touted the benefits of frequent blade replacement. In addition to the traditional price/quality segments that industry experts tracked, Paramount's consumer research indicated distinct segmentation in terms of product benefits and consumer behavior. Research showed these segments held true for both men and women. Exhibit 1 summarizes Paramount's findings on these groups. The intensity of involvement with the product varied significantly among consumers. There was a group of consumers that Paramount labeled as "Maintenance Shavers" who were almost completely disinterested in the product category. Involved users could be broken up into "Social/Emotional" and "Aesthetic" shavers. Both groups were willing to experiment with new technology. "Social/Emotional" shavers were motivated by the overall shaving experience, while "Aesthetic" shavers were more interested in cosmetic results. Trends The rate of new-product introductions for nondisposable razors and refill cartridges had accelerated in recent years, with an unprecedented flurry of 22 new stock-keeping units (SKUs) being introduced between 2008 and 2009. Most of these new SKUs were line extensions targeted at the super-premium segment and promoted benefits from advances in technology. As a result of new-product introductions and in order to stimulate demand, total media advertising expenditures in this category had been rising faster than retail market sales, and this trend was expected to continue. Exhibit 2 provides media expenditures for the major brands, and a breakout of advertising/promotion expenditures for Paramount nondisposable razors and refill cartridges are given in Exhibit 3. In general, distribution outlets responded to the growth in nondisposable SKUs by increasing shelf space for the product category. Razors were not purchased frequently enough to be a traffic builder for the stores, but retail margins associated with the products tended to be considerably higher than other personal care items (e.g., toothpaste). Distribution was also starting to shift outside traditional food and drug stores. In 2000, food stores sold over half of all razors, but by 2009 they represented only 42% of sales. Exhibit 4 summarizes the changes in retail channel distribution from 2007 to 2010E. Male-specific grooming products seemed to be a bright spot in the industry. Recent trends indicated men's grooming routines moved well beyond a splash of aftershave. New products such as men's body spray, fragranced shower gel, and skincare lines proliferated in the last several years. Male-specific personal care products outpaced the growth in the women's beauty market as these products became more mainstream. With more media attention on men's grooming issues and less stigma associated with men's preening, the segment seemed poised for growth. Company Overview Paramount was a global consumer products giant with $13 billion in worldwide sales and $7 billion in gross profits for 2009. Paramount's corporate divisions included Health, Cleaning, Beauty and Grooming. Paramount entered the nondisposable razor market in 1962 and quickly became a respected brand in the industry. Sales from Paramount's nondisposable razors and refill cartridges in the U.S. contributed $170 million in revenue, gross profit of $92 million, and operating profit of $26 million in 2009. Paramount currently offered two lines of nondisposable razors and refill cartridgesthe Paramount Pro which was positioned in the moderate segment of the product category, and the Paramount Avail, which was considered a value offering. Neither Pro nor Avail had introduced significant technology innovations in the last five years. Together, these two products allowed Paramount to capture the unit-volume market-leader position in 2009, with a 23.3% retail unit share.? Competition Competition for nondisposable razors included direct competitors as well as substitute products. Disposable razors provided a "wet" shave alternative, but appealed primarily to the value-oriented customers or to customers that wanted a new blade for each shave. Disposables generally competed on price and lacked the technology and innovations that were standard in the nondisposable market. Electric shavers captured a moderate percentage of the overall market (approximately 27% of men used an electric shaver). Although they did not provide as close a shave as "wet" razors, electric shavers were easier to maneuver and produced less skin irritation. As a result, electric shavers generally appealed to older consumers. Other substitutes included depilatory creams, waxing, and laser hair removal. In 2010, the nondisposable razor and refill cartridge market was dominated by three multinational players: Paramount, Prince, and Benet & Klein. New entrants, Radiance Health Inc. (Radiance) and Simpsonsboth established personal-care products companieshad recently intensified competition in the space. Other smaller competitors and private-label brands comprised the rest of the market. The majority of these other competitors were priced in the value segment of the market. Exhibit 5 details each of the main players' market shares. Exhibit 6 provides representative retail prices for each major brand by product segment. Prince - Prince manufactured and sold personal care products throughout the world. The company's principle focus included oral care products, skin care products, shaving products, and deodorants/antiperspirants. Prince had been a market leader in nondisposable razors since the 1950s and held the number one position in terms of retail dollar sales in 2009. Prince sold nondisposable razors and refill cartridges under the brand names Cogent and Cogent Plus. Both were considered super-premium products. Revenues for Prince's nondisposable razors and refill cartridges in 2009 were approximately $224 million with $45 million in operating profit. Benet & Klein (B&K) - B&K was a multinational beauty and health products company that manufactured and sold vitamins, cosmetics, shaving products, skin care products, hair care products, and fragrances. B&K entered the nondisposable razor market in 1985 with the Vitric brand. B&K unveiled a new product line of nondisposable razors and refill cartridges (Vitric Master) in 2009 that provided an advanced lubrication strip, non-slip handle, and superior anti-corrosive technology blades. New Entrants - On August 1, 2009, Simpsons launched a new nondisposable razor using its deodorant brand, Tempest. The Tempest razor touted an advanced pivoting head that allowed for a smoother shave. Radiance also planned to extend its deodorant brand name, Naiv, into nondisposable razors. The Naiv razor offered a pulsing feature that was somewhat similar to Clean Edge's vibrating technology. Executives at Paramount had learned the Naiv razor was due to launch nationally in September 2010. In test markets, Naiv acquired a 13% share. Estimates for 2010 market share are provided in Exhibit 5. Based on Radiance's past launches in new-product categories, Paramount believed it would come out of the gate strong. Paramount marketing executives estimated Radiance would spend over $16 million for media advertising to support the Naiv launch in 2010. There were also widespread rumors of significant promotion events that would soon be unveiled. Currently, Radiance and Paramount were fierce competitors in several personal care product categories. Clean Edge Razor Design and Testing In 2007, Paramount's CEO created a special nondisposable-razor project team devoted to developing a technological breakthrough and providing Paramount with a standout new product in the category. The team was led by Randall and included representatives from R&D, marketing, and production. The team evaluated several new designs and determined that a vibrating, ultra-thin five- blade design (dubbed Clean Edge) would be the revolutionary product Paramount needed to establish themselves as an innovation leader. One AAA battery was housed in the handle of the razor which provided vibrations that stimulated hair follicles. In addition, the larger, heavier handle allowed for better balance, grip and control while shaving, and the advanced ultra-thin blade design reduced irritation. Over an 18-month period, extensive clinical testing and consumer research were performed. Clinical trials indicated Clean Edge achieved a 25% increase in hair removal versus other leading nondisposable razor brands (e.g., Cogent and Vitric). Trials also proved benefits to overall skin condition with more even skin tone and improved skin texture. Randall managed the development and testing process and was now spearheading the product's launch. Senior executives already determined that Clean Edge would be priced somewhere in the super-premium segment, and the launch of the men's razor would occur in January 2011, with the women's razor to follow soon after. The looming question was how to best position Clean Edge. Positioning Within the super-premium segment, Randall had the option of recommending Clean Edge for a niche product position focusing on highly involved, fastidious groomers looking for a superior shaving experience, or a mainstream position focusing on the broad advantage of offering the closest possible shave. Randall had consulted with marketing and manufacturing teams to develop initial financial forecasts for both options. Exhibit 7 summarizes Randall's assumptions and forecasts In order to develop a comprehensive pro forma income statement for each positioning option, Randall knew he would also have to consider the impact of cannibalization. In a recent division status meeting, Randall had observed a heated exchange on this topic between Paramount's newly hired corporate marketing director, William Kim, and Paramount Pro's product manager, Albert Rosenberg. Kim had been brought on board to provide a fresh perspective to the nondisposable- razor product category. Rosenberg had been a respected manager in the Grooming Division for over two decades and had significant political capital in the division. When the question of Clean Edge's product positioning was broached, Rosenberg said, "I can't believe we are even considering a mainstream positioning strategy. You will just siphon off consumers from Pro. A mainstream strategy will dilute the brand power for our bread-and-butter product, Pro. We will just be cannibalizing ourselves. A niche strategy makes more sense. It will complement our existing product portfolio perfectly." Kim thought Rosenberg was too concerned with protecting his turf and not thinking of what was best for the overall company. He responded, "Albert, research shows our consumers are becoming more sophisticated and expect more advanced technology. Pro does not provide this. Pro is in the mature phase of the product lifecycle. It is only a matter of time before we see the decline. Positioning Clean Edge as a mainstream product will help prevent loyal Paramount customers from being wooed away to more innovative brands. Clean Edge has the potential for true market domination and needs to be positioned as such." Randall was unsure of the exact effect of cannibalization, but product launches in other Paramount product categories indicated a considerable portion of the volume sales for Clean Edge could come at the expense of Paramount Pro and Avail. Randall's team spent a good amount of time researching potential cannibalization scenarios. They determined 60% of Clean Edge sales would likely come from current Pro/Avail customers in a mainstream positioning scenario and 35% of Clean Edge sales would likely come from current Pro/Avail customers in a niche positioning scenario. Branding Considerations Randall had not yet determined the relative emphasis of the "Paramount" and "Clean Edge" names on packaging or in advertising. He had informally discussed two options with different executives. Those executives who felt the design was a major breakthrough in grooming believed the product should stand apart from the current lines with an emphasis on the "Clean Edge" name (e.g., "Clean Edge by Paramount"). In opposition to this were a handful of executives who thought Paramount's name should receive top billing as this was consistent with the overall corporate strategy of building the Paramount brand name equity. The name this group preferred was "Paramount Clean Edge." Focus groups revealed both concept names were viewed favorably. Randall knew his decision would have an impact on how closely consumers associated Clean Edge with Pro and Avail and consequently influence the rate of cannibalization. Marketing Budget Paramount executives had not yet decided how to incorporate Clean Edge into the overall nondisposable razor and refill cartridge marketing budget and if an increase in overall budget was necessary. The 2010 budget totaled $48.3 million with $20.2 million for advertising and $28.1 million for consumer and trade promotions. Randall was aware that the steering committee was looking to curb excessive marketing expenses in all product categories. If the budgets were to remain constant for 2011, then a reallocation would have to occur. Randall considered the option of allocating the budget based on an expected percentage of sales; but this would not be sufficient for Clean Edge to enter the market in a meaningful way. Clean Edge needed significant marketing dollars to ensure a successful launch. However, Rosenberg was already campaigning to protect his allocations. Rosenberg had been quite vocal in his stance that Paramount Pro was the backbone of the company's razor line and as such needed to sustain current marketing allocations. To capture the volume estimates laid out in Exhibit 7, Randall determined a niche positioning strategy would require $15 million in total marketing expenditures for Clean Edge's first year. In order to reach full sales potential with the mainstream position, a $42 million marketing budget would be needed for year one. It was clear to Randall that launching Clean Edge as a mainstream product would require significantly more marketing support. Mainstream razor unit volumes were expected to capture over three times niche volumes in the first year, and reaching the masses would require an extensive advertising campaign. In addition, considerable consumer and trade promotion events would be needed and many expenses associated with these events would be volume based. In order to induce trial, several consumer promotions were being considered. Cents-off coupons (e.g., $1.00 off purchase) would be an important part of the consumer promotion strategy for either positioning strategy. A coupon for a free razor with cartridge purchase had also been proposed. Randall estimated the cost of this promotion to be approximately $4 million and had included it in his initial marketing budget assumptions for the mainstream launch located in Exhibit 7. Even though an increase in the overall product category marketing budget would be highly scrutinized, Randall felt this might be the best route. Conclusion Randall's gut told him Clean Edge had significant mainstream potential in the super-premium segment. He felt the vibrating, thin-blade razor would become the new standard in men's shaving and would quickly gain mass appeal. However, Randall had to consider the optimal positioning strategy in the context of the entire company. He knew Paramount Pro's product manager, Rosenberg, would vehemently oppose a mainstream launch, and he had to consider if launching as a niche product for a year or two might be a better move. Randall hoped that an economic analysis would help him find the right answer. He planned to build a simple profit-and-loss pro forma that took into account the effects of cannibalization on Paramount Pro and Avail. Randall also realized it would be important to develop contingency plans to address different scenarios. After this was complete, he could make a more informed decision about a positioning recommendation and then get started on brand name and budget recommendations. Exhibit 1 Behavior Segmentation of Nondisposable Razor Consumers Involved Razor Users Social/Emotional Shavers (39% of Nondisposable Razor Users) Differentiate among products. Search for products based on both functionality and messaging. Shaving as an essential part of a daily grooming ritual. Shaving makes them feel more attractive and confident. Involved Razor Users Aesthetic Shavers (28% of Nondisposable Razor Users) Search for products that most effectively remove hair. Uninvolved Razor Users Maintenance Shavers (33% of Nondisposable Razor Users) View products as the same. Lack of interest in product category. Shaving routine is inconsistent. Shaving is consistently done to remove unwanted hair. Shaving is a means to smooth skin they desire. Shaving is a chore they try to finish as quickly as possible. Note: Information is fictional. Exhibit 2 Nondisposable Razor Media Advertising Expenditures, a 20092010E Benet & Klein Prince Paramount Simpsons Radiance 2009 Media ($ in millions) $35.2 27.8 19.1 $ 2.4 2010E Media ($ in millions) $36.8 29.2 20.2 15.2 $ 16.1 a Media advertising expenditures does not include trade or consumer promotion. Exhibit 3 Advertising and Promotion Expenditures for Nondisposable Paramount Razors: 2009-2010E ($ in millions) Media Consumer Promotions Trade Promotions Total 2009 $ 19.1 $ 11.5 $ 13.7 $ 44.3 2010E $ 20.2 $ 13.1 $ 15.0 $ 48.3 Exhibit4 % of Nondisposable Razor Sales by Retail Channel: 2007-2010E 2007 vol (%) $ (%) 2008 Vol (%) $ (%) 2009 vol (%) $ (%) 2010E vol (%) $ (%) 4243 Food Stores Drug Stores Mass merchandisers Club Stores Other Note: Information is fictional. Exhibit 5 Nondisposable Razor Unit and Dollar Market Share by Brand: 2007-2010E 2007 Vol (%) 2008 Vol (%) $ (%) 2010E Vol (%) 2009 Vol (%) $ (%) $ (%) $ (%) Brand Paramount Paramount Pro Paramount Avail Total 12.0 12.6 16.9 18.5 85 6.6 13.7 8.1 21.8 6.4 4, 18.5 29 21.4 20.5 19.2 23.3 23.4 29.4 Prince Cogent Cogent Plus Total 24.0 0.0 24.0 31.7 0.0 245 0.0 245 221 1.0 23.1 21.3 4.9 26.2 31.7 30,7 Benet & Klein Vitric 18.1 205 17.8 Vitric Advanced Vitric Master Total 15.8 0.1 21.1 20.6 Radiance Naiv Total Simpsons Tempest Total 1146 00 0.0 0. 00. 00. 00. 00.9 000009009 0.9 34. 925. 933. 9241 33. 522. 832. 023.0 Other Exhibit 6 Select Nondisposable Razor Brand Prices:a 2009 Suggested Retail Price Standard Refill Cartridges (Average 4-count) Razor Super-Premium Cogent Plus Cogent $10.00 $ 8.89 $ 9.45 Naivb $ 12.50 $11.19 $11.80 $11.20 $10.85 $10.99 Vitric Advanced Vitric Master Tempest 8.99 8.65 8.75 Moderate Paramount Pro $ 9.50 $ 8.89 $ 7.55 $ 7.00 Vitric Value Paramount Avail $ 5.75 $ 4.60 a Table includes only key brands in the market. Prices are representative of most popular SKU in the brand category. Prices for other SKUs will vary. b Projected price at launch Exhibit 7 Financial Forecasts: Alternative Positioning Scenarios for Clean Edge Planned capacity Razor unit volume (millions of units) Niche Positioning Mainstream Positioning 3.3 1.5 4.0 1.0 Planned capacity Cartridge unit volume (millions of units) Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 Capacity costs ($ in millions) Razor: Production per unit cost Razor: Manufacturer price Razor: Suggested price Cartridge: Average Production unit cost Cartridge: Average Manufacturer price Cartridge: Average Suggested price 4.0 10.0 $ 0.61 $ 0.87 5.00 $ 9.09 $ 12.99 $ 2.43 $ 7.35 $ 10.50 9.9 21.9 $ 1.71 2.45 4.74 7.83 $11.19 2.24 6.22 8.89 Advertising ($ in millions) Year 1 $ 7 19 $ 7 Consumer promotions ($ in millions) A Year 2 Year 1 Year 2 Year 1 Year 2 $ 6 Trade promotions ($ in millions) A $ 3 a Cartridge unit assumes average 4-count refill packageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started