Answered step by step

Verified Expert Solution

Question

1 Approved Answer

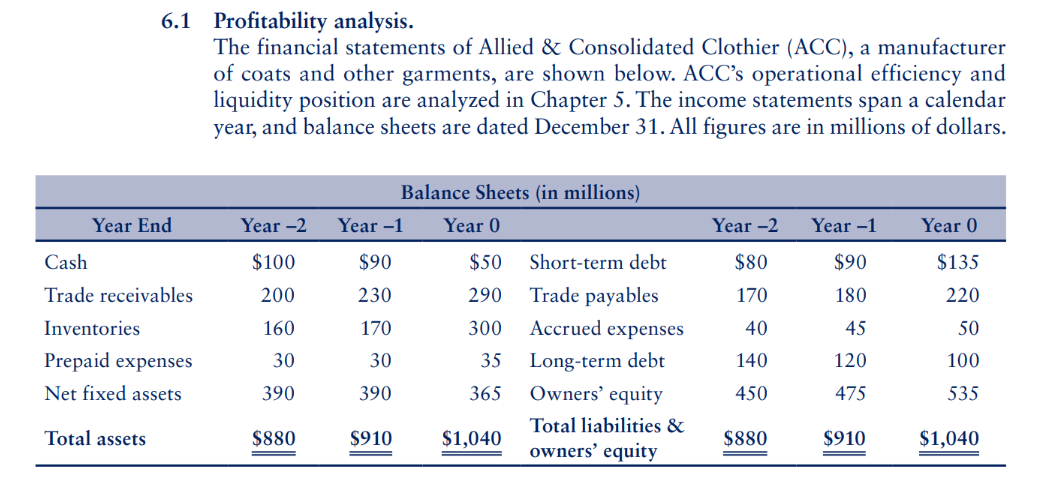

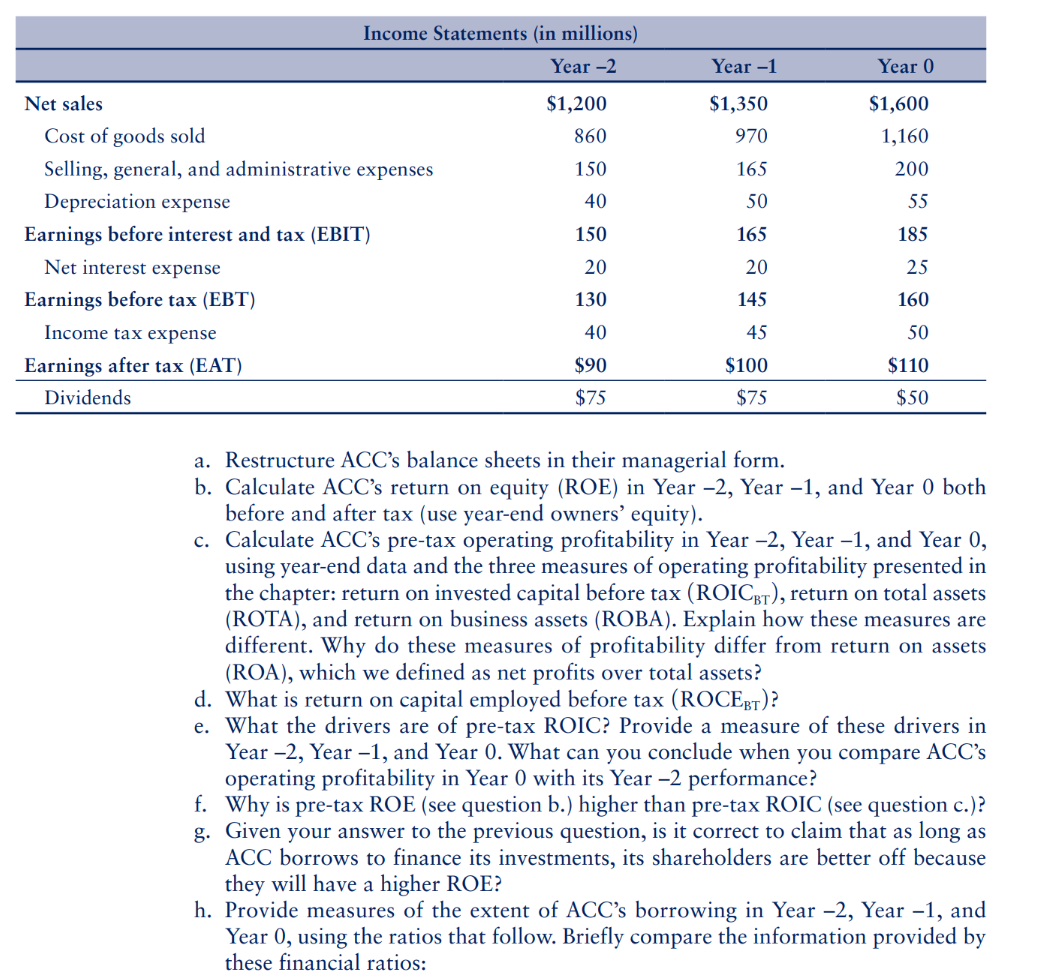

1 Profitability analysis. The financial statements of Allied & Consolidated Clothier (ACC), a manufacturer of coats and other garments, are shown below. ACC's operational efficiency

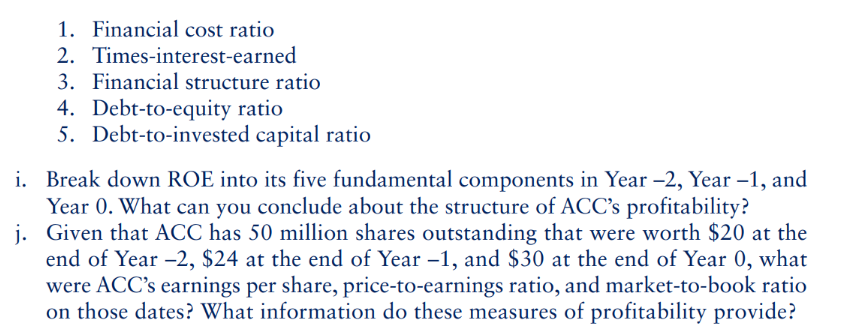

1 Profitability analysis. The financial statements of Allied \& Consolidated Clothier (ACC), a manufacturer of coats and other garments, are shown below. ACC's operational efficiency and liquidity position are analyzed in Chapter 5 . The income statements span a calendar year, and balance sheets are dated December 31. All figures are in millions of dollars. 1. Financial cost ratio 2. Times-interest-earned 3. Financial structure ratio 4. Debt-to-equity ratio 5. Debt-to-invested capital ratio i. Break down ROE into its five fundamental components in Year -2 , Year -1 , and Year 0 . What can you conclude about the structure of ACC's profitability? j. Given that ACC has 50 million shares outstanding that were worth $20 at the end of Year 2,$24 at the end of Year -1 , and $30 at the end of Year 0 , what were ACC's earnings per share, price-to-earnings ratio, and market-to-book ratio on those dates? What information do these measures of profitability provide? a. Restructure ACC's balance sheets in their managerial form. b. Calculate ACC's return on equity (ROE) in Year -2 , Year -1 , and Year 0 both before and after tax (use year-end owners' equity). c. Calculate ACC's pre-tax operating profitability in Year -2, Year -1 , and Year 0, using year-end data and the three measures of operating profitability presented in the chapter: return on invested capital before tax (ROICBT), return on total assets (ROTA), and return on business assets (ROBA). Explain how these measures are different. Why do these measures of profitability differ from return on assets (ROA), which we defined as net profits over total assets? d. What is return on capital employed before tax (ROCEBT) ? e. What the drivers are of pre-tax ROIC? Provide a measure of these drivers in Year -2, Year -1, and Year 0. What can you conclude when you compare ACC's operating profitability in Year 0 with its Year -2 performance? f. Why is pre-tax ROE (see question b.) higher than pre-tax ROIC (see question c.)? g. Given your answer to the previous question, is it correct to claim that as long as ACC borrows to finance its investments, its shareholders are better off because they will have a higher ROE? h. Provide measures of the extent of ACC's borrowing in Year -2, Year -1, and Year 0, using the ratios that follow. Briefly compare the information provided by these financial ratios: 1 Profitability analysis. The financial statements of Allied \& Consolidated Clothier (ACC), a manufacturer of coats and other garments, are shown below. ACC's operational efficiency and liquidity position are analyzed in Chapter 5 . The income statements span a calendar year, and balance sheets are dated December 31. All figures are in millions of dollars. 1. Financial cost ratio 2. Times-interest-earned 3. Financial structure ratio 4. Debt-to-equity ratio 5. Debt-to-invested capital ratio i. Break down ROE into its five fundamental components in Year -2 , Year -1 , and Year 0 . What can you conclude about the structure of ACC's profitability? j. Given that ACC has 50 million shares outstanding that were worth $20 at the end of Year 2,$24 at the end of Year -1 , and $30 at the end of Year 0 , what were ACC's earnings per share, price-to-earnings ratio, and market-to-book ratio on those dates? What information do these measures of profitability provide? a. Restructure ACC's balance sheets in their managerial form. b. Calculate ACC's return on equity (ROE) in Year -2 , Year -1 , and Year 0 both before and after tax (use year-end owners' equity). c. Calculate ACC's pre-tax operating profitability in Year -2, Year -1 , and Year 0, using year-end data and the three measures of operating profitability presented in the chapter: return on invested capital before tax (ROICBT), return on total assets (ROTA), and return on business assets (ROBA). Explain how these measures are different. Why do these measures of profitability differ from return on assets (ROA), which we defined as net profits over total assets? d. What is return on capital employed before tax (ROCEBT) ? e. What the drivers are of pre-tax ROIC? Provide a measure of these drivers in Year -2, Year -1, and Year 0. What can you conclude when you compare ACC's operating profitability in Year 0 with its Year -2 performance? f. Why is pre-tax ROE (see question b.) higher than pre-tax ROIC (see question c.)? g. Given your answer to the previous question, is it correct to claim that as long as ACC borrows to finance its investments, its shareholders are better off because they will have a higher ROE? h. Provide measures of the extent of ACC's borrowing in Year -2, Year -1, and Year 0, using the ratios that follow. Briefly compare the information provided by these financial ratios

1 Profitability analysis. The financial statements of Allied \& Consolidated Clothier (ACC), a manufacturer of coats and other garments, are shown below. ACC's operational efficiency and liquidity position are analyzed in Chapter 5 . The income statements span a calendar year, and balance sheets are dated December 31. All figures are in millions of dollars. 1. Financial cost ratio 2. Times-interest-earned 3. Financial structure ratio 4. Debt-to-equity ratio 5. Debt-to-invested capital ratio i. Break down ROE into its five fundamental components in Year -2 , Year -1 , and Year 0 . What can you conclude about the structure of ACC's profitability? j. Given that ACC has 50 million shares outstanding that were worth $20 at the end of Year 2,$24 at the end of Year -1 , and $30 at the end of Year 0 , what were ACC's earnings per share, price-to-earnings ratio, and market-to-book ratio on those dates? What information do these measures of profitability provide? a. Restructure ACC's balance sheets in their managerial form. b. Calculate ACC's return on equity (ROE) in Year -2 , Year -1 , and Year 0 both before and after tax (use year-end owners' equity). c. Calculate ACC's pre-tax operating profitability in Year -2, Year -1 , and Year 0, using year-end data and the three measures of operating profitability presented in the chapter: return on invested capital before tax (ROICBT), return on total assets (ROTA), and return on business assets (ROBA). Explain how these measures are different. Why do these measures of profitability differ from return on assets (ROA), which we defined as net profits over total assets? d. What is return on capital employed before tax (ROCEBT) ? e. What the drivers are of pre-tax ROIC? Provide a measure of these drivers in Year -2, Year -1, and Year 0. What can you conclude when you compare ACC's operating profitability in Year 0 with its Year -2 performance? f. Why is pre-tax ROE (see question b.) higher than pre-tax ROIC (see question c.)? g. Given your answer to the previous question, is it correct to claim that as long as ACC borrows to finance its investments, its shareholders are better off because they will have a higher ROE? h. Provide measures of the extent of ACC's borrowing in Year -2, Year -1, and Year 0, using the ratios that follow. Briefly compare the information provided by these financial ratios: 1 Profitability analysis. The financial statements of Allied \& Consolidated Clothier (ACC), a manufacturer of coats and other garments, are shown below. ACC's operational efficiency and liquidity position are analyzed in Chapter 5 . The income statements span a calendar year, and balance sheets are dated December 31. All figures are in millions of dollars. 1. Financial cost ratio 2. Times-interest-earned 3. Financial structure ratio 4. Debt-to-equity ratio 5. Debt-to-invested capital ratio i. Break down ROE into its five fundamental components in Year -2 , Year -1 , and Year 0 . What can you conclude about the structure of ACC's profitability? j. Given that ACC has 50 million shares outstanding that were worth $20 at the end of Year 2,$24 at the end of Year -1 , and $30 at the end of Year 0 , what were ACC's earnings per share, price-to-earnings ratio, and market-to-book ratio on those dates? What information do these measures of profitability provide? a. Restructure ACC's balance sheets in their managerial form. b. Calculate ACC's return on equity (ROE) in Year -2 , Year -1 , and Year 0 both before and after tax (use year-end owners' equity). c. Calculate ACC's pre-tax operating profitability in Year -2, Year -1 , and Year 0, using year-end data and the three measures of operating profitability presented in the chapter: return on invested capital before tax (ROICBT), return on total assets (ROTA), and return on business assets (ROBA). Explain how these measures are different. Why do these measures of profitability differ from return on assets (ROA), which we defined as net profits over total assets? d. What is return on capital employed before tax (ROCEBT) ? e. What the drivers are of pre-tax ROIC? Provide a measure of these drivers in Year -2, Year -1, and Year 0. What can you conclude when you compare ACC's operating profitability in Year 0 with its Year -2 performance? f. Why is pre-tax ROE (see question b.) higher than pre-tax ROIC (see question c.)? g. Given your answer to the previous question, is it correct to claim that as long as ACC borrows to finance its investments, its shareholders are better off because they will have a higher ROE? h. Provide measures of the extent of ACC's borrowing in Year -2, Year -1, and Year 0, using the ratios that follow. Briefly compare the information provided by these financial ratios Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started