Answered step by step

Verified Expert Solution

Question

1 Approved Answer

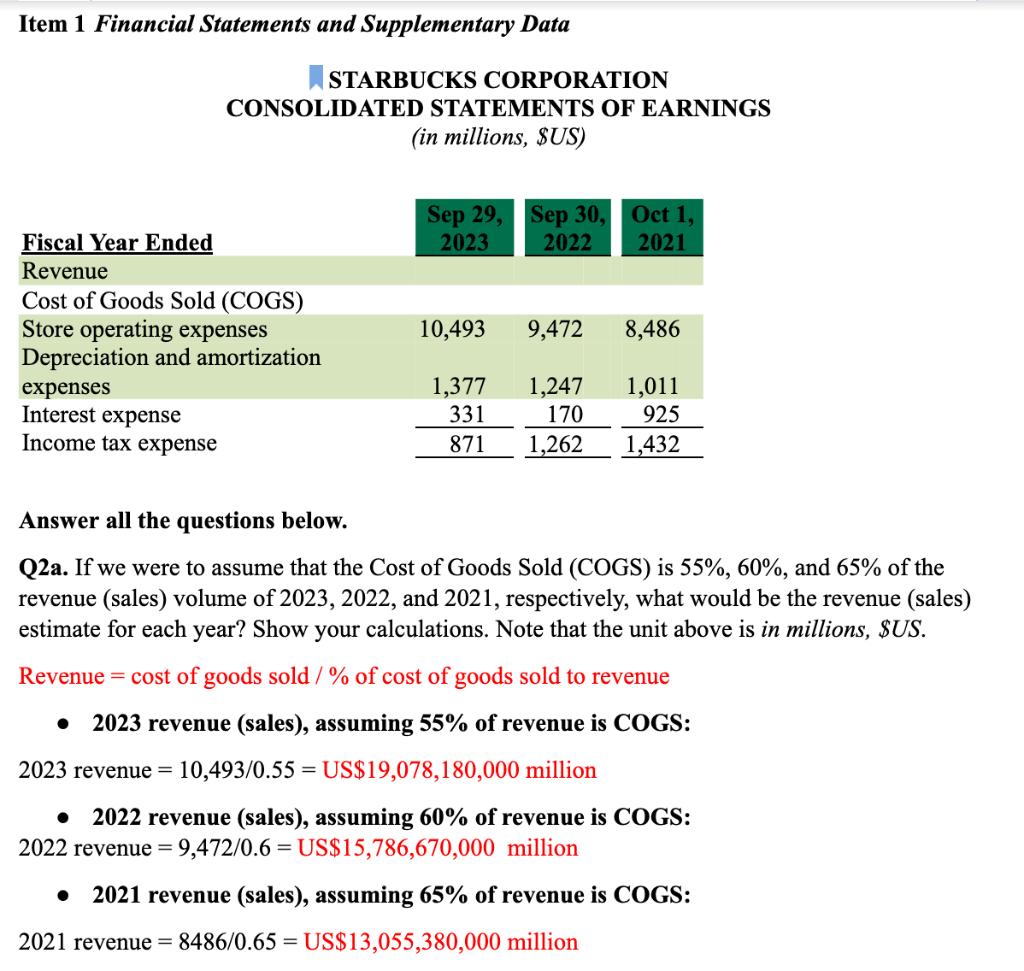

Item 1 Financial Statements and Supplementary Data Fiscal Year Ended Revenue STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (in millions, $US) Cost of Goods Sold

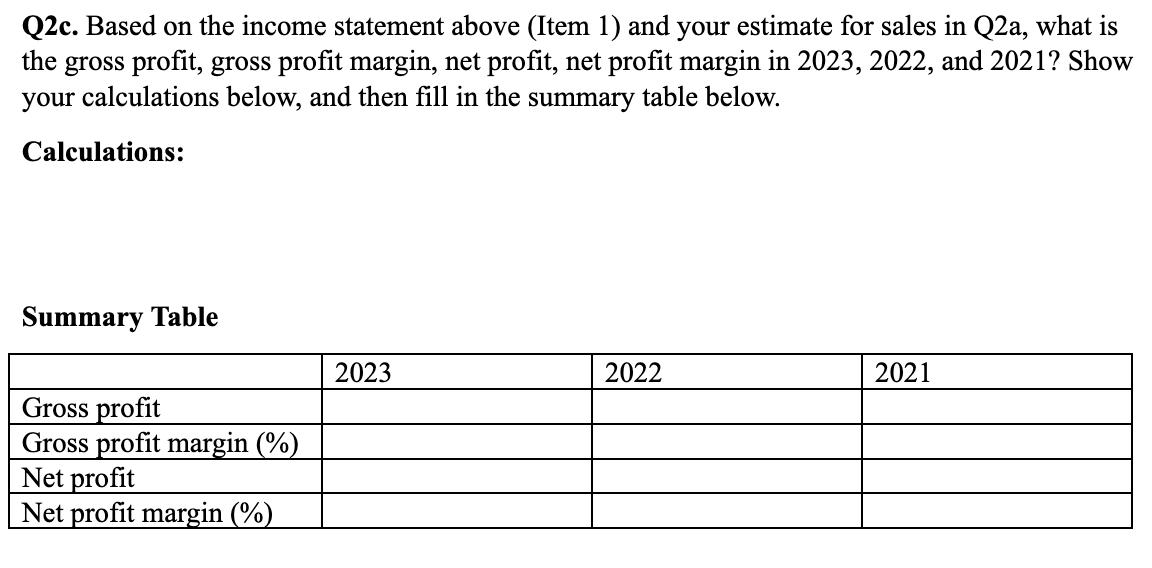

Item 1 Financial Statements and Supplementary Data Fiscal Year Ended Revenue STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (in millions, $US) Cost of Goods Sold (COGS) Store operating expenses Depreciation and amortization expenses Interest expense Income tax expense Sep 29, 2023 10,493 1,377 331 871 Sep 30, 2022 9,472 1,247 170 Oct 1, 2021 8,486 1,011 925 1,262 1,432 Answer all the questions below. Q2a. If we were to assume that the Cost of Goods Sold (COGS) is 55%, 60%, and 65% of the revenue (sales) volume of 2023, 2022, and 2021, respectively, what would be the revenue (sales) estimate for each year? Show your calculations. Note that the unit above is in millions, $US. Revenue = cost of goods sold / % of cost of goods sold to revenue 2023 revenue (sales), assuming 55% of revenue is COGS: 2023 revenue = 10,493/0.55 = US$19,078,180,000 million 2022 revenue (sales), assuming 60% of revenue is COGS: 2022 revenue = 9,472/0.6 = US$15,786,670,000 million 2021 revenue (sales), assuming 65% of revenue is COGS: 2021 revenue = 8486/0.65 US$13,055,380,000 million Q2c. Based on the income statement above (Item 1) and your estimate for sales in Q2a, what is the gross profit, gross profit margin, net profit, net profit margin in 2023, 2022, and 2021? Show your calculations below, and then fill in the summary table below. Calculations: Summary Table Gross profit Gross profit margin (%) Net profit Net profit margin (%) 2023 2022 2021

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

2023 2022 2021 G ross profit US 19 07 8 180 000 US 15 786 670 000 US 14 371 000 000 G ross ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started