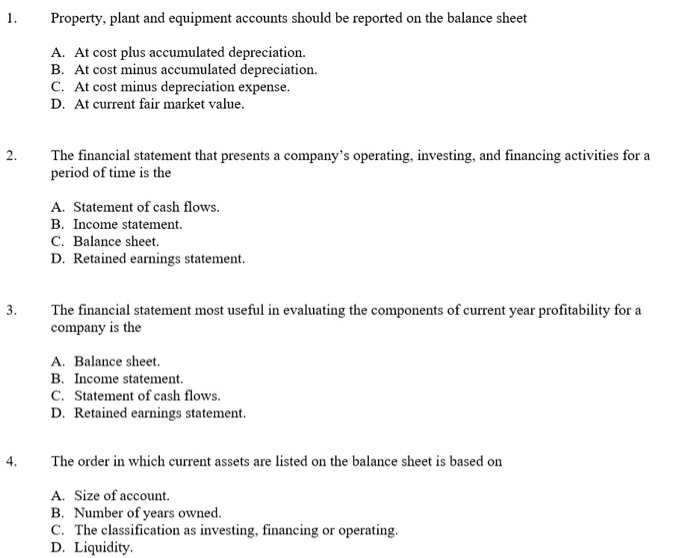

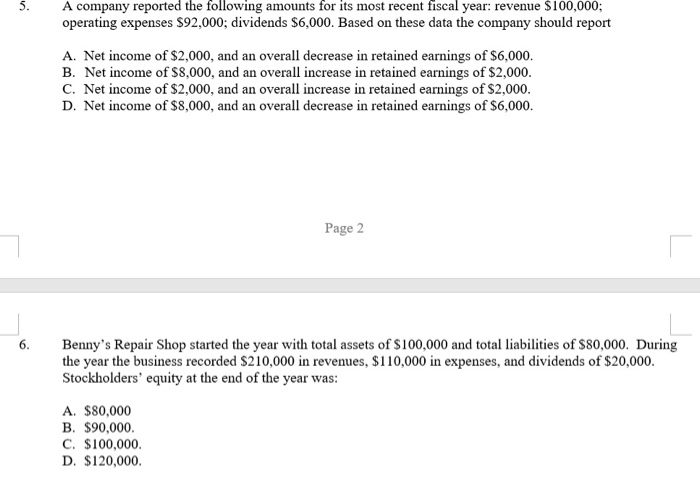

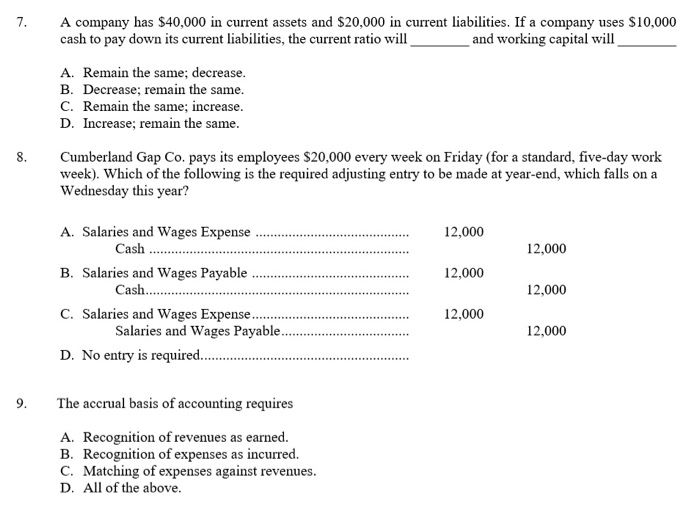

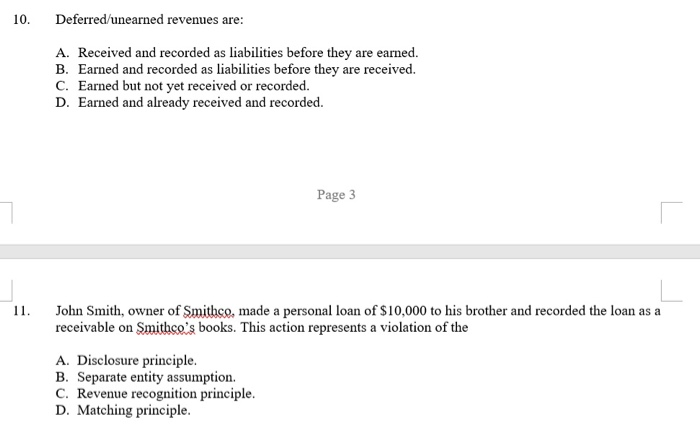

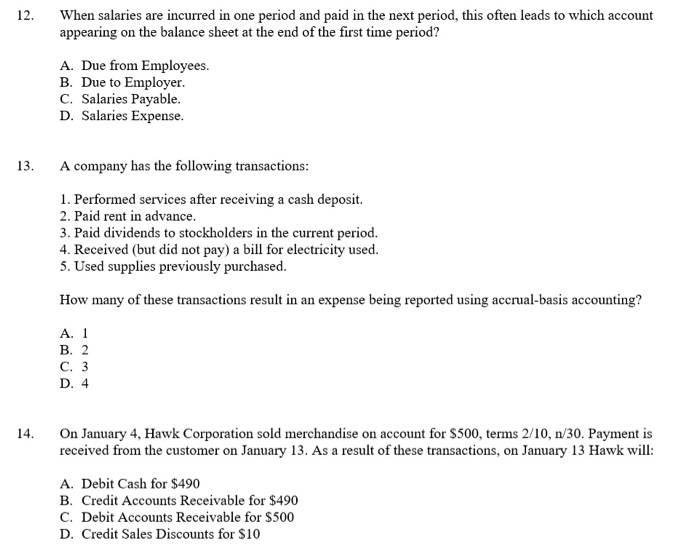

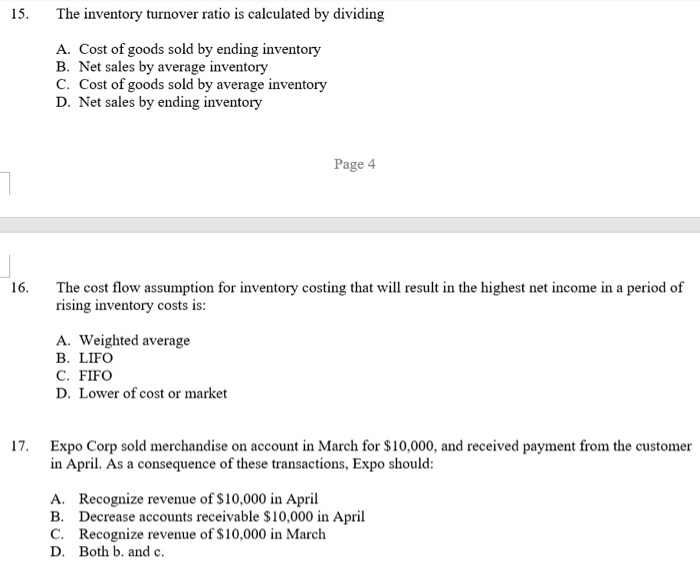

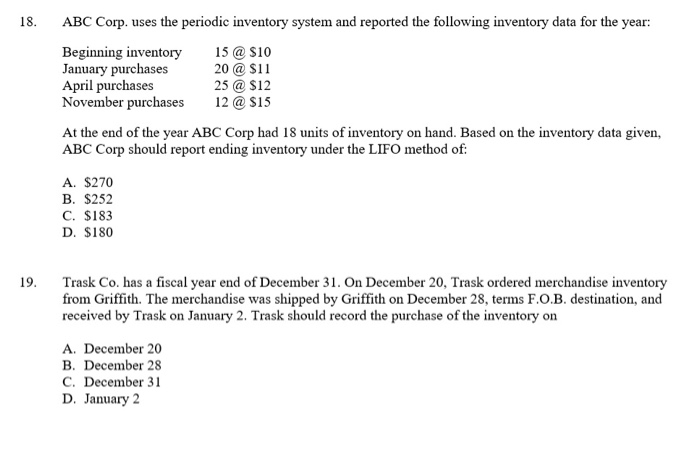

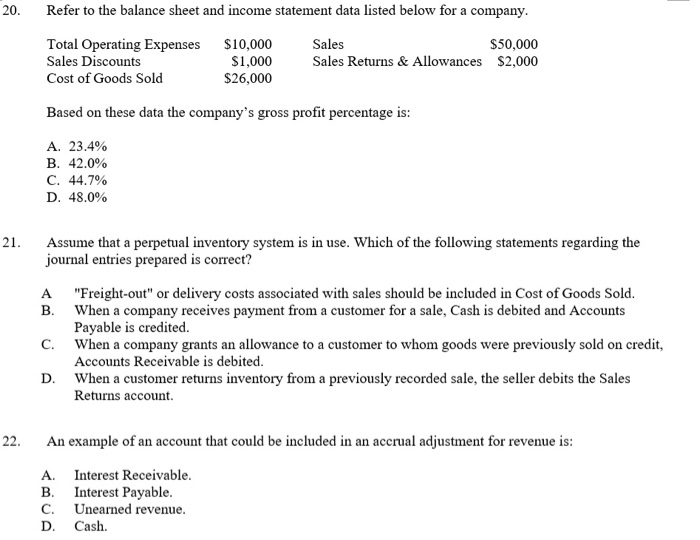

1. Property, plant and equipment accounts should be reported on the balance sheet A. At cost plus accumulated depreciation. B. At cost minus accumulated depreciation. C. At cost minus depreciation expense. D. At current fair market value. 2. The financial statement that presents a company's operating, investing, and financing activities for a period of time is the A. Statement of cash flows. B. Income statement. C. Balance sheet. D. Retained earnings statement. 3. The financial statement most useful in evaluating the components of current year profitability for a company is the A. Balance sheet. B. Income statement. C. Statement of cash flows. D. Retained earnings statement. The order in which current assets are listed on the balance sheet is based on A. Size of account. B. Number of years owned. C. The classification as investing, financing or operating, D. Liquidity 7. A company has $40,000 in current assets and $20,000 in current liabilities. If a company uses $10,000 cash to pay down its current liabilities, the current ratio will and working capital will A. Remain the same; decrease. B. Decrease; remain the same. C. Remain the same; increase. D. Increase; remain the same. 8. Cumberland Gap Co. pays its employees $20,000 every week on Friday (for a standard, five-day work week). Which of the following is the required adjusting entry to be made at year-end, which falls on a Wednesday this year? A. Salaries and Wages Expense ......... 12,000 Cash ........ 12,000 12,000 12,000 B. Salaries and Wages Payable Cash.. C. Salaries and Wages Expense.......... Salaries and Wages Payable.... D. No entry is required.. 12.000 12,000 9. The accrual basis of accounting requires A. Recognition of revenues as earned. B. Recognition of expenses as incurred. C. Matching of expenses against revenues. D. All of the above. 10. Deferred/unearned revenues are: A. Received and recorded as liabilities before they are earned. B. Earned and recorded as liabilities before they are received. C. Earned but not yet received or recorded. D. Earned and already received and recorded. Page 3 11. John Smith, owner of Smithco, made a personal loan of $10,000 to his brother and recorded the loan as a receivable on Smithco's books. This action represents a violation of the A. Disclosure principle. B. Separate entity assumption. C. Revenue recognition principle. D. Matching principle. 12. When salaries are incurred in one period and paid in the next period, this often leads to which account appearing on the balance sheet at the end of the first time period? A. Due from Employees. B. Due to Employer. C. Salaries Payable. D. Salaries Expense. 13. A company has the following transactions: 1. Performed services after receiving a cash deposit. 2. Paid rent in advance. 3. Paid dividends to stockholders in the current period. 4. Received (but did not pay) a bill for electricity used. 5. Used supplies previously purchased. How many of these transactions result in an expense being reported using accrual-basis accounting? A. 1 MU 14. On January 4, Hawk Corporation sold merchandise on account for $500, terms 2/10, n/30. Payment is received from the customer on January 13. As a result of these transactions, on January 13 Hawk will: A. Debit Cash for $490 B. Credit Accounts Receivable for $490 C. Debit Accounts Receivable for $500 D. Credit Sales Discounts for $10 15. The inventory turnover ratio is calculated by dividing A. Cost of goods sold by ending inventory B. Net sales by average inventory C. Cost of goods sold by average inventory D. Net sales by ending inventory Page 4 16. The cost flow assumption for inventory costing that will result in the highest net income in a period of rising inventory costs is: A. Weighted average B. LIFO C. FIFO D. Lower of cost or market 17. Expo Corp sold merchandise on account in March for $10,000, and received payment from the customer in April. As a consequence of these transactions, Expo should: A. Recognize revenue of $10,000 in April B. Decrease accounts receivable $10,000 in April c. Recognize revenue of $10,000 in March D. Both b. and c. 18. ABC Corp. uses the periodic inventory system and reported the following inventory data for the year: Beginning inventory January purchases April purchases November purchases 15 @ $10 20 @ $11 25 @ $12 12 @ $15 At the end of the year ABC Corp had 18 units of inventory on hand. Based on the inventory data given, ABC Corp should report ending inventory under the LIFO method of: A. $270 B. $252 C. $183 D. $180 19. Trask Co. has a fiscal year end of December 31. On December 20, Trask ordered merchandise inventory from Griffith. The merchandise was shipped by Griffith on December 28, terms F.O.B. destination, and received by Trask on January 2. Trask should record the purchase of the inventory on A. December 20 B. December 28 C. December 31 D. January 2