Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Provided below is the disclosure note from the financial statements of a publicly traded Company. Use the information in the disclosure note to

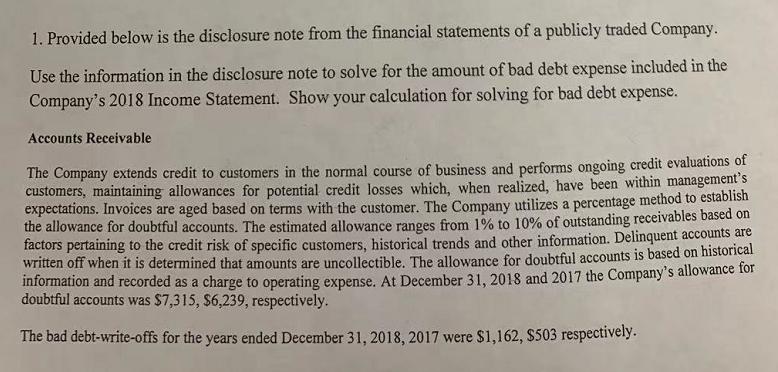

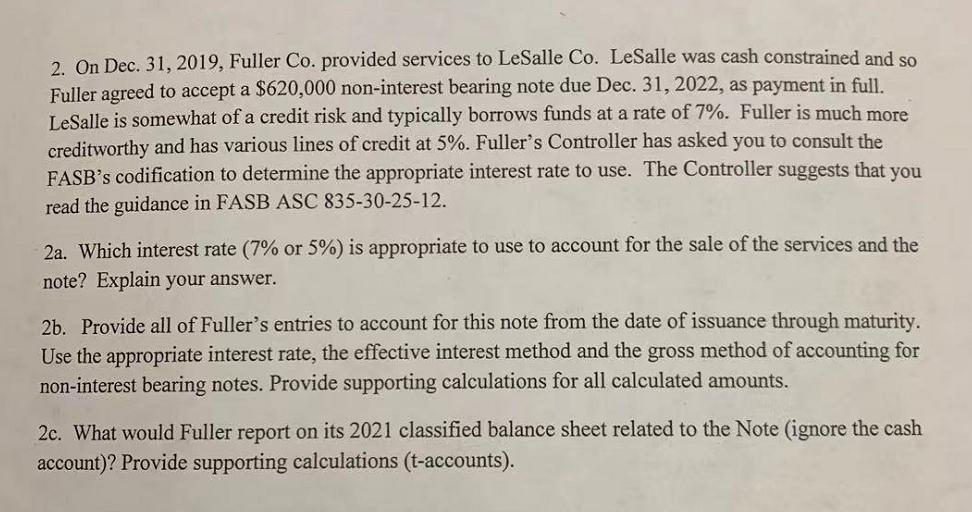

1. Provided below is the disclosure note from the financial statements of a publicly traded Company. Use the information in the disclosure note to solve for the amount of bad debt expense included in the Company's 2018 Income Statement. Show your calculation for solving for bad debt expense. Accounts Receivable The Company extends credit to customers in the normal course of business and performs ongoing credit evaluations of customers, maintaining allowances for potential credit losses which, when realized, have been within management's expectations. Invoices are aged based on terms with the customer. The Company utilizes a percentage method to establish the allowance for doubtful accounts. The estimated allowance ranges from 1% to 10% of outstanding receivables based on factors pertaining to the credit risk of specific customers, historical trends and other information. Delinquent accounts are written off when it is determined that amounts are uncollectible. The allowance for doubtful accounts is based on historical information and recorded as a charge to operating expense. At December 31, 2018 and 2017 the Company's allowance for doubtful accounts was $7,315, $6,239, respectively. The bad debt-write-offs for the years ended December 31, 2018, 2017 were $1,162, $503 respectively. 2. On Dec. 31, 2019, Fuller Co. provided services to LeSalle Co. LeSalle was cash constrained and so Fuller agreed to accept a $620,000 non-interest bearing note due Dec. 31, 2022, as payment in full. LeSalle is somewhat of a credit risk and typically borrows funds at a rate of 7%. Fuller is much more creditworthy and has various lines of credit at 5%. Fuller's Controller has asked you to consult the FASB's codification to determine the appropriate interest rate to use. The Controller suggests that you read the guidance in FASB ASC 835-30-25-12. 2a. Which interest rate (7% or 5%) is appropriate to use to account for the sale of the services and the note? Explain your answer. 2b. Provide all of Fuller's entries to account for this note from the date of issuance through maturity. Use the appropriate interest rate, the effective interest method and the gross method of accounting for non-interest bearing notes. Provide supporting calculations for all calculated amounts. 2c. What would Fuller report on its 2021 classified balance sheet related to the Note (ignore the cash account)? Provide supporting calculations (t-accounts).

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Bad debt expense included in the Companys 2018 Income Statement 1162 Bad debt expense Percentage o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started