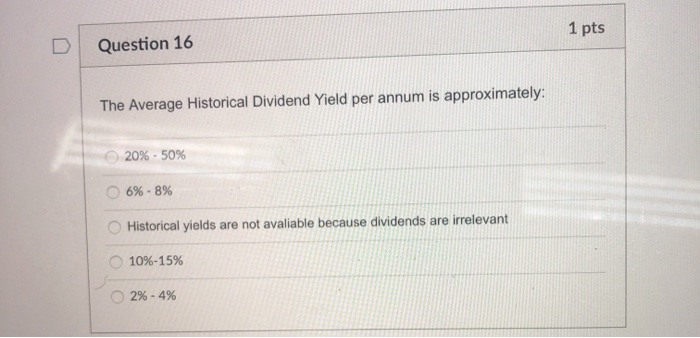

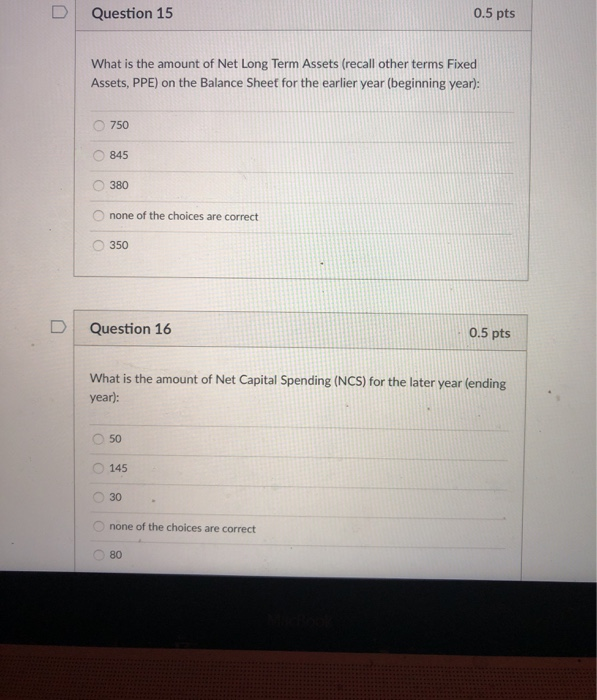

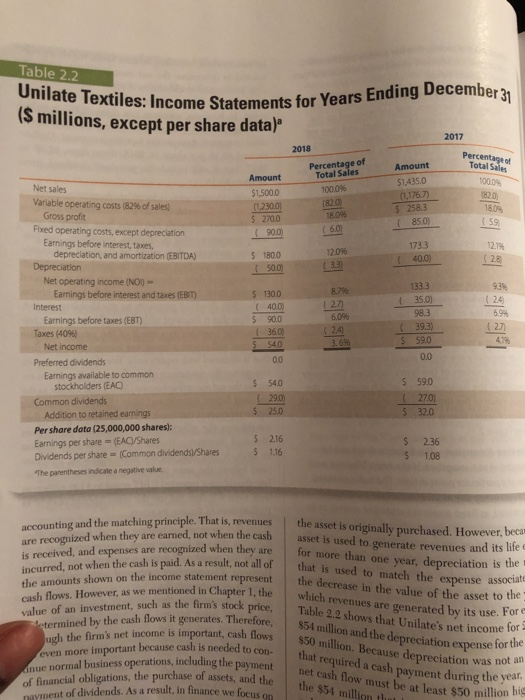

1 pts Question 16 The Average Historical Dividend Yield per annum is approximately: 20% - 50% 6% -8% Historical yields are not avaliable because dividends are irrelevant 10%-15% 2% -4% Question 15 0.5 pts What is the amount of Net Long Term Assets (recall other terms Fixed Assets, PPE) on the Balance Sheet for the earlier year (beginning year): 750 845 380 none of the choices are correct 350 Question 16 0.5 pts What is the amount of Net Capital Spending (NCS) for the later year (ending year): 50 145 30 none of the choices are correct 80 Table 2.2 Percentage of Total Sales 100.0% Percentage of Total Sales 000 (59 Unilate Textiles: Income Statements for Years Ending December 31 Table 2.2 shows that Unilate's net income for anue normal business operations, including the payment that required a cash payment during the year. net cash flow must be at least $50 million hi ($ millions, except per share data) 2017 2018 Amount Amount Net sales 51.435.0 $1.500.0 Variable operating costs (82% of sales (1,176.7) (1.230.0 Gross profit 52583 $ 270.0 18.09 Fixed operating costs, except depreciation 850) (900) (60) Earnings before Interest, taxes, depreciation and amortization (EBITDA) 1733 12.096 12.11 $ 180.0 Depreciation 3.3 140,0) (28 (500 Net operating income (NOI) - Earnings before interest and taxes (EBIT) 1333 93% $ 1300 Interest (400) (27) 35.0) ( 24 Earnings before taxes (EBT) $ 90.0 6.096 98.3 6.9% Taxes (4096 360) (39.3) (27) Net income $ 540 3.676 $59.0 419 Preferred dividends 0.0 0.0 Earnings available to common stockholders (EAC) S 54.0 $59.0 Common dividends 29.0) 27.01 Addition to retained earnings $ 25.0 $320 Per share data (25,000,000 shares): Earnings per share= (EAC/Shares $ 2.16 $ 2.36 Dividends per share (Common dividends/Shares $ 1.16 $ 1.08 The parentheses indicate a negative value accounting and the matching principle. That is, revenues are recognized when they are eamed, not when the cash is received, and expenses are recognized when they are incurred, not when the cash is paid. As a result, not all of the amounts shown on the income statement represent cash flows. However, as we mentioned in Chapter 1, the expense associate value of an investment, such as the firm's stock price, determined by the cash flows it generates. Therefore, ugh the firm's net income is important, cash flows even more important because cash is needed to con for the was not an of financial obligations, the purchase of assets, and the payment of dividends. As a result, in finance we focus on the asset is originally purchased. However, becam asset is used to generate revenues and its life for more than one year, depreciation is the that is used to match the the decrease in the value of the asset to the which revenues are generated by its use. For $54 million and the depreciation expense 850 million. Because depreciation the $54 million the 1 pts Question 16 The Average Historical Dividend Yield per annum is approximately: 20% - 50% 6% -8% Historical yields are not avaliable because dividends are irrelevant 10%-15% 2% -4% Question 15 0.5 pts What is the amount of Net Long Term Assets (recall other terms Fixed Assets, PPE) on the Balance Sheet for the earlier year (beginning year): 750 845 380 none of the choices are correct 350 Question 16 0.5 pts What is the amount of Net Capital Spending (NCS) for the later year (ending year): 50 145 30 none of the choices are correct 80 Table 2.2 Percentage of Total Sales 100.0% Percentage of Total Sales 000 (59 Unilate Textiles: Income Statements for Years Ending December 31 Table 2.2 shows that Unilate's net income for anue normal business operations, including the payment that required a cash payment during the year. net cash flow must be at least $50 million hi ($ millions, except per share data) 2017 2018 Amount Amount Net sales 51.435.0 $1.500.0 Variable operating costs (82% of sales (1,176.7) (1.230.0 Gross profit 52583 $ 270.0 18.09 Fixed operating costs, except depreciation 850) (900) (60) Earnings before Interest, taxes, depreciation and amortization (EBITDA) 1733 12.096 12.11 $ 180.0 Depreciation 3.3 140,0) (28 (500 Net operating income (NOI) - Earnings before interest and taxes (EBIT) 1333 93% $ 1300 Interest (400) (27) 35.0) ( 24 Earnings before taxes (EBT) $ 90.0 6.096 98.3 6.9% Taxes (4096 360) (39.3) (27) Net income $ 540 3.676 $59.0 419 Preferred dividends 0.0 0.0 Earnings available to common stockholders (EAC) S 54.0 $59.0 Common dividends 29.0) 27.01 Addition to retained earnings $ 25.0 $320 Per share data (25,000,000 shares): Earnings per share= (EAC/Shares $ 2.16 $ 2.36 Dividends per share (Common dividends/Shares $ 1.16 $ 1.08 The parentheses indicate a negative value accounting and the matching principle. That is, revenues are recognized when they are eamed, not when the cash is received, and expenses are recognized when they are incurred, not when the cash is paid. As a result, not all of the amounts shown on the income statement represent cash flows. However, as we mentioned in Chapter 1, the expense associate value of an investment, such as the firm's stock price, determined by the cash flows it generates. Therefore, ugh the firm's net income is important, cash flows even more important because cash is needed to con for the was not an of financial obligations, the purchase of assets, and the payment of dividends. As a result, in finance we focus on the asset is originally purchased. However, becam asset is used to generate revenues and its life for more than one year, depreciation is the that is used to match the the decrease in the value of the asset to the which revenues are generated by its use. For $54 million and the depreciation expense 850 million. Because depreciation the $54 million the