Question

Shook Builders borrowed $15,000 on April 1, 20X1. The loan has anannual*interest rate of 14%. Shook Builders repaid the loan in full (principal and

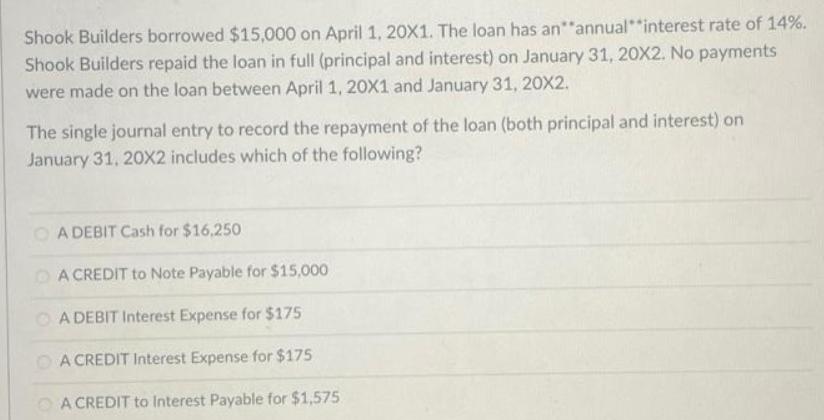

Shook Builders borrowed $15,000 on April 1, 20X1. The loan has an"annual*interest rate of 14%. Shook Builders repaid the loan in full (principal and interest) on January 31, 2OX2. No payments were made on the loan between April 1, 20X1 and January 31, 20X2. The single journal entry to record the repayment of the loan (both principal and interest) on January 31, 20X2 includes which of the following? O A DEBIT Cash for $16,250 OA CREDIT to Note Payable for $15,000 O A DEBIT Interest Expense for $175 A CREDIT Interest Expense for $175 A CREDIT to Interest Payable for $1,575

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Loan Amount 15000 Interest rate 14 Period April 1 to Jan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

7th edition

978-0077614041, 9780077446475, 77614046, 007744647X, 77647092, 978-0077647094

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App