Question

1. PunchTab has 1,000,000 shares of common stock in a seed round. They raise $750,000 in a convertible note from an angel investor in the

1. PunchTab has 1,000,000 shares of common stock in a seed round. They raise $750,000 in a convertible note from an angel investor in the seed round. Conversion is triggered if there is a priced equity financing round with 20% price discount or capped value of PunchTab's interest at $6,000,000.

Suppose the Series A investor invests $3,000,000 for 20% of shares. Under $6,000,000 cap, what's the implied cap value of seed shares?

- $6

- $7

- $5

- $4

2. PunchTab has 1,000,000 shares of common stock in a seed round. They raise $750,000 in a convertible note from an angel investor in the seed round. Conversion is triggered if there is a priced equity financing round with 20% price discount or capped value of PunchTab's interest at $6,000,000.

Suppose the Series A investor invests $3,000,000 for 20% of shares. Under $6,000,000 cap, what's the implied share price?

- $17.78

- $7.11

- $10.67

- $14.22

3. PunchTab has 1,000,000 shares of common stock in a seed round. They raise $750,000 in a convertible note from an angel investor in the seed round. Conversion is triggered if there is a priced equity financing round with 20% price discount or capped value of PunchTab's interest at $6,000,000.

Suppose the Series A investor invests $3,000,000 for 20% of shares. Under $6,000,000 cap, what's the angel investor's percentage of ownership?

- 6.25%

- 8.89%

- 15.00%

- 9.38%

4. PunchTab has 1,000,000 shares of common stock in a seed round. They raise $750,000 in a convertible note from an angel investor in the seed round. Conversion is triggered if there is a priced equity financing round with 20% price discount or capped value of PunchTab's interest at $6,000,000.

Suppose the Series A investor invests $3,000,000 for 20% of shares. Under 20% price discount, what's the implied share price?

- $3.58

- $27.06

- $11.06

- $15.06

5. PunchTab has 1,000,000 shares of common stock in a seed round. They raise $750,000 in a convertible note from an angel investor in the seed round. Conversion is triggered if there is a priced equity financing round with 20% price discount or capped value of PunchTab's interest at $6,000,000.

Suppose the Series A investor invests $3,000,000 for 20% of shares. Under 20% price discount, what's the total shares?

- 1,355,932

- 1,311,475

- 1,395,349

- 1,327,801

6. PunchTab has 1,000,000 shares of common stock in a seed round. They raise $750,000 in a convertible note from an angel investor in the seed round. Conversion is triggered if there is a priced equity financing round with 20% price discount or capped value of PunchTab's interest at $6,000,000.

Suppose the Series A investor invests $3,000,000 for 20% of shares. Under 20% price discount, what's the angel investor's percentage of ownership?

- 3.75%

- 6.25%

- 4.69%

- 9.38%

7.

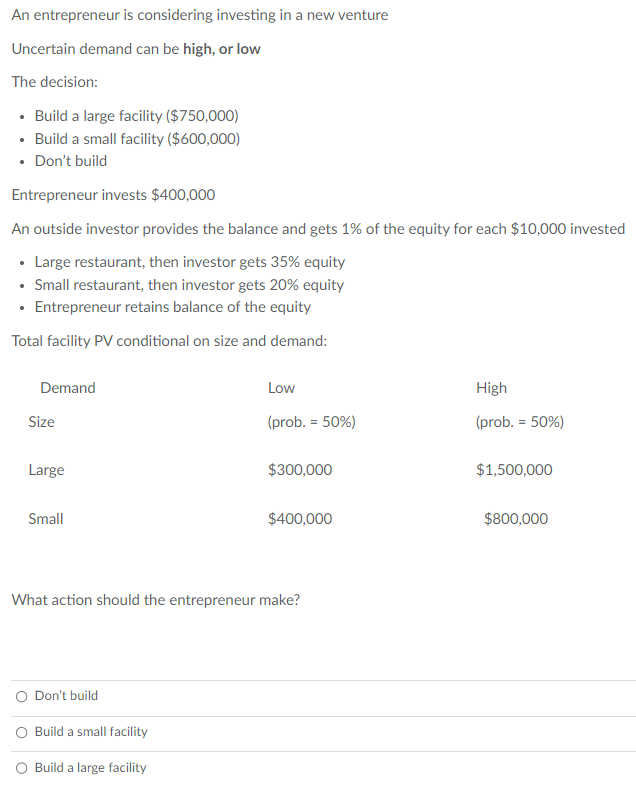

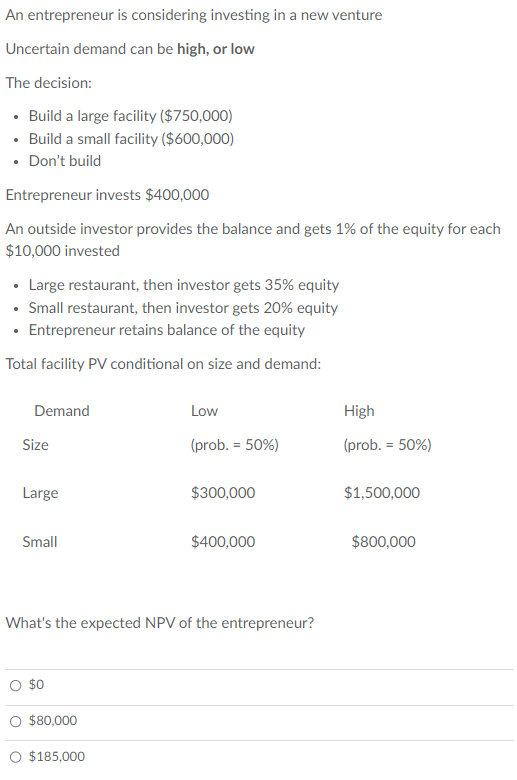

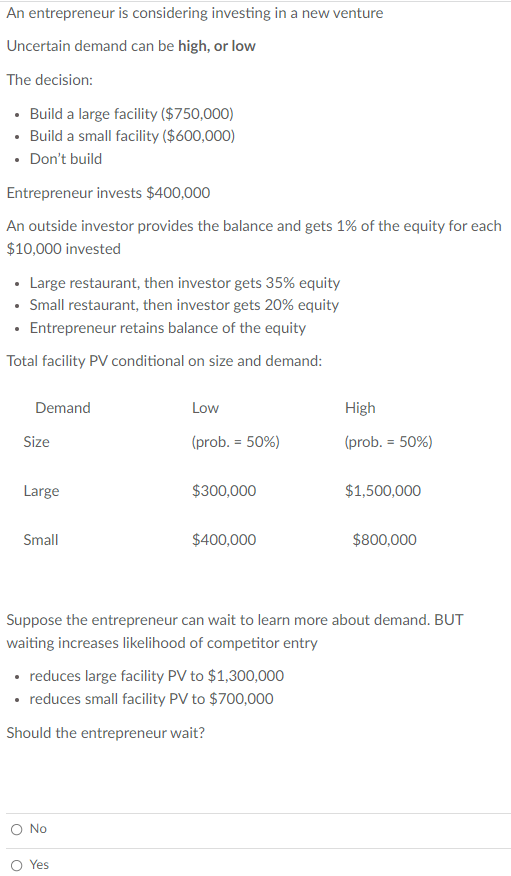

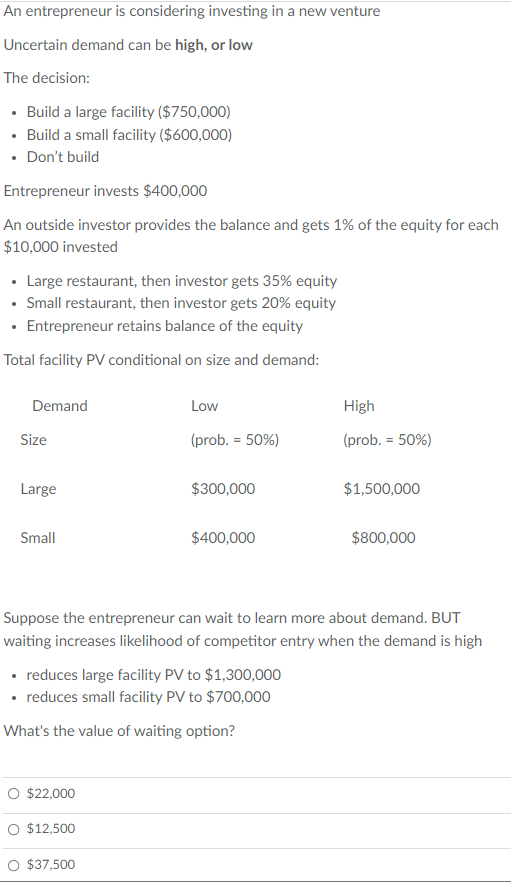

An entrepreneur is considering investing in a new venture Uncertain demand can be high, or low The decision: Build a large facility ($750,000) Build a small facility ($600,000) Don't build Entrepreneur invests $400,000 An outside investor provides the balance and gets 1% of the equity for each $10,000 invested Large restaurant, then investor gets 35% equity Small restaurant, then investor gets 20% equity . Entrepreneur retains balance of the equity Total facility PV conditional on size and demand: Demand Size Large Small O Don't build Low (prob. = 50%) O Build a small facility O Build a large facility $300,000 What action should the entrepreneur make? $400,000 High (prob. = 50%) $1,500,000 $800,000

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets go through each question and calculate the answers 1a To determine in which whorl turn of the shell the predation drill hole is located we need m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started