Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Q. Susan is a university student who was gifted a $3000 check upon graduating high school in June 2018. In January 2019, she

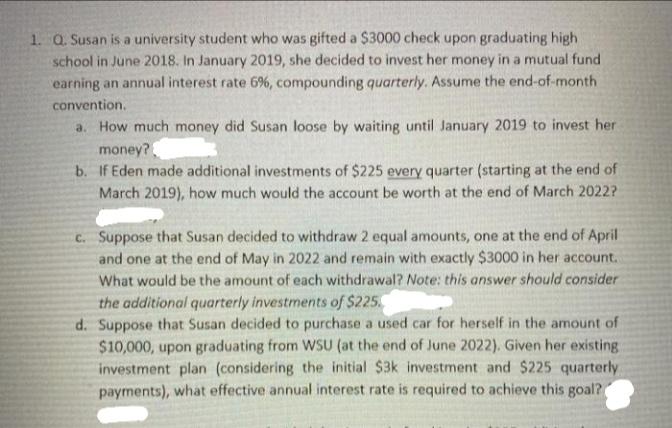

1. Q. Susan is a university student who was gifted a $3000 check upon graduating high school in June 2018. In January 2019, she decided to invest her money in a mutual fund earning an annual interest rate 6%, compounding quarterly. Assume the end-of-month convention. a. How much money did Susan loose by waiting until January 2019 to invest her money? b. If Eden made additional investments of $225 every quarter (starting at the end of March 2019), how much would the account be worth at the end of March 2022? C. Suppose that Susan decided to withdraw 2 equal amounts, one at the end of April and one at the end of May in 2022 and remain with exactly $3000 in her account. What would be the amount of each withdrawal? Note: this answer should consider the additional quarterly investments of $225. d. Suppose that Susan decided to purchase a used car for herself in the amount of $10,000, upon graduating from WSU (at the end of June 2022). Given her existing investment plan (considering the initial $3k investment and $225 quarterly payments), what effective annual interest rate is required to achieve this goal?

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started