Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 Question 1 (34 marks) - Company Valuation Ringo plc is planning to take over a smaller private limited company, Stellar Lid, and needs to

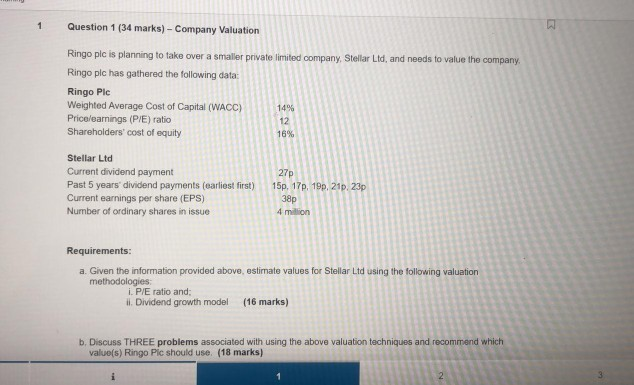

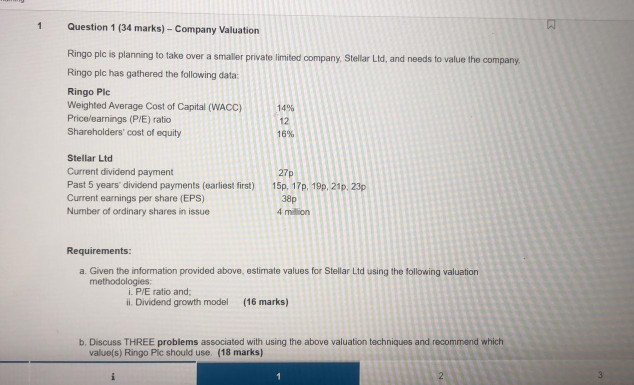

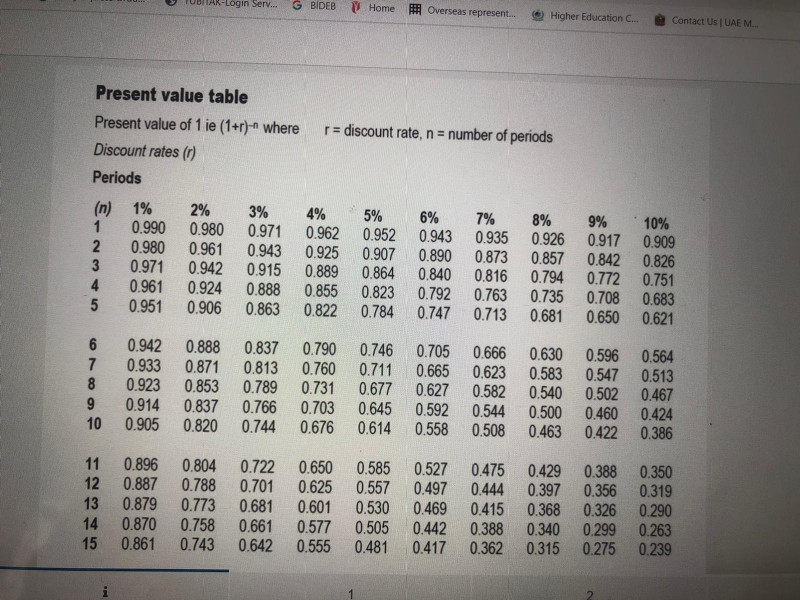

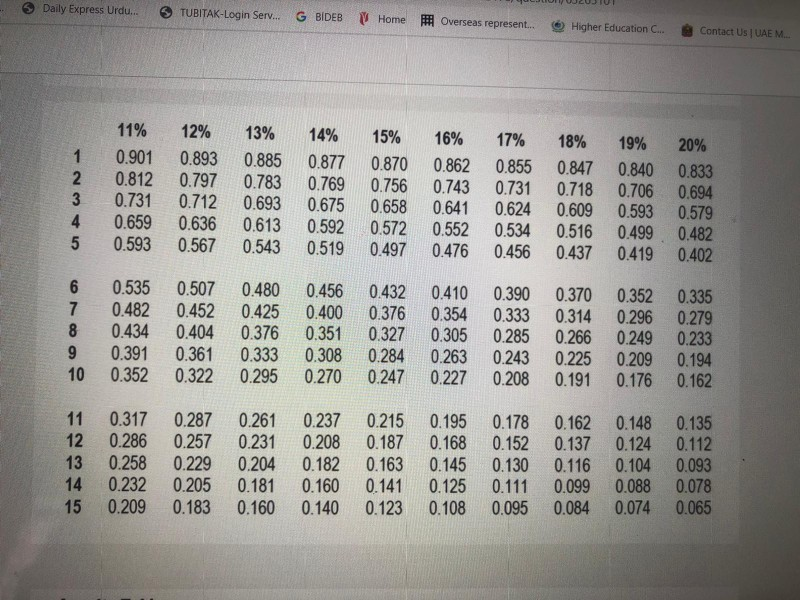

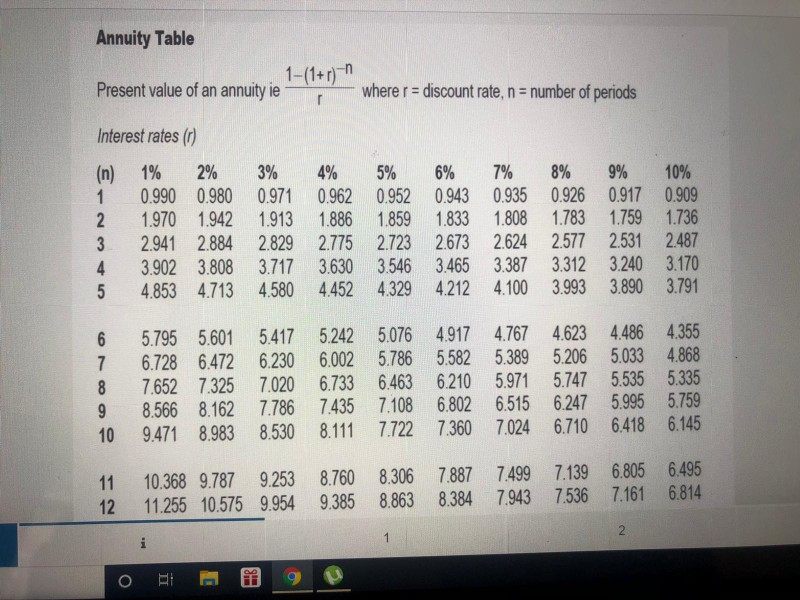

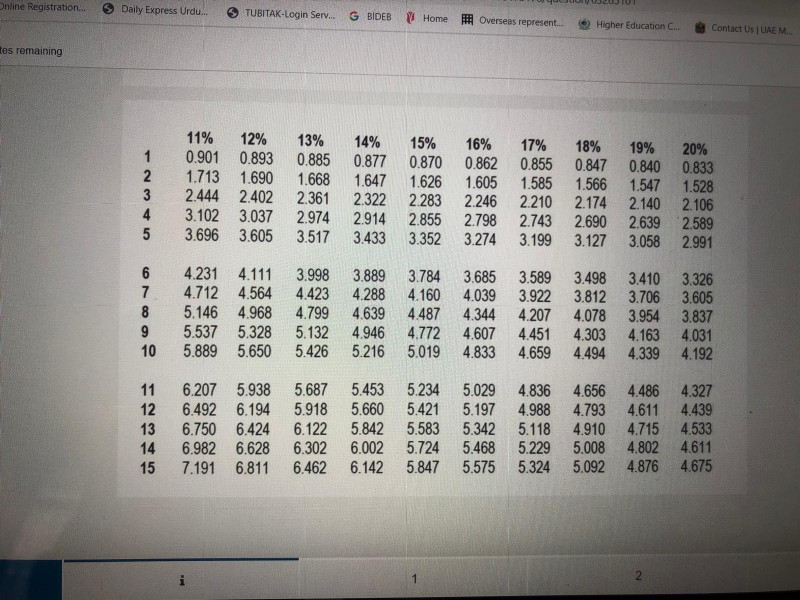

1 Question 1 (34 marks) - Company Valuation Ringo plc is planning to take over a smaller private limited company, Stellar Lid, and needs to value the company Ringo plc has gathered the following data: Ringo Plc Weighted Average Cost of Capital (WACC) 14% Price/earnings (P/E) ratio 12 Shareholders' cost of equity 16% Stellar Ltd Current dividend payment Past 5 years' dividend payments (earliest first) Current earnings per share (EPS) Number of ordinary shares in issue 27p 15p, 17p, 190, 210, 23p 38p 4 million Requirements: a. Given the information provided above, estimate values for Stellar Ltd using the following valuation methodologies i. P/E ratio and Dividend growth model (16 marks) b. Discuss THREE problems associated with using the above valuation techniques and recommend which value(s) Ringo Pic should use (18 marks) 2 AR-Login Serv... G BIDEB Home #Overseas represent... Higher Education C... Contact Us UAEM Present value table Present value of 1 ie (1+r)- where Discount rates (0) Periods r = discount rate, n = number of periods (n) 1% 2% 1 0.990 0.980 0.980 0.961 3 0.971 0.942 4 0.961 0.924 5 0.951 0.906 3% 4% 5% 6% 0.971 0.962 0.952 0.943 0.943 0.925 0.907 0.890 0.915 0.889 0.864 0.840 0.888 0.855 0.823 0.792 0.863 0.822 0.784 0.747 7% 8% 9% 10% 0.935 0.926 0.917 0.909 0.873 0.857 0.842 0.826 0.816 0.794 0.772 0.751 0.763 0.735 0.708 0.683 0.713 0.681 0.650 0.621 6 7 8 9 10 0.942 0.888 0.837 0.933 0.871 0.813 0.923 0.853 0.789 0.914 0.837 0.766 0.905 0.820 0.744 0.790 0.746 0.705 0.760 0.711 0.665 0.731 0.677 0.627 0.703 0.645 0.592 0.676 0.614 0.558 0.666 0.630 0.596 0.623 0.583 0.547 0.582 0.540 0.502 0.544 0.500 0.460 0.508 0.463 0.422 0.564 0.513 0.467 0.424 0.386 11 12 13 14 15 0.896 0.804 0.887 0.788 0.879 0.773 0.870 0.758 0.861 0.743 0.722 0.650 0.701 0.625 0.681 0.601 0.661 0.577 0.642 0.555 0.585 0.557 0.530 0.505 0.481 0.527 0.475 0.429 0.497 0.444 0.397 0.469 0.415 0.368 0.442 0.388 0.340 0.417 0.362 0.315 0.388 0.356 0.326 0.299 0.275 0.350 0.319 0.290 0.263 0.239 Daily Express Urdu... TUBITAK-Login Serv. G BIDEB Home Overseas represent. Higher Education C... Contact Us UAEM 1 2 3 4 5 11% 12% 13% 0.901 0.893 0.885 0.812 0.797 0.783 0.731 0.712 0.693 0.659 0.636 0.613 0.593 0.567 0.543 14% 0.877 0.769 0.675 0.592 0.519 15% 16% 17% 18% 19% 20% 0.870 0.862 0.855 0.847 0.840 0.833 0.756 0.743 0.731 0.718 0.706 0.694 0.658 0.641 0.624 0.609 0.593 0.579 0.572 0.552 0.534 0.516 0.499 0.482 0.497 0.476 0.456 0.437 0.419 0.402 6 7 8 9 10 0.535 0.482 0.434 0.391 0.352 0.507 0.480 0.452 0.425 0.404 0.376 0.361 0.333 0.322 0.295 0.456 0.400 0.351 0.308 0.270 0.432 0.376 0.327 0.284 0.247 0.410 0.354 0.305 0.263 0.227 0.390 0.370 0.333 0.314 0.285 0.266 0.243 0.225 0.208 0.191 0.352 0.335 0.296 0.279 0.249 0.233 0.209 0.194 0.176 0.162 11 0.317 0.287 12 0.286 0.257 13 0.258 0.229 0.232 0.205 15 0.209 0.183 0.261 0.231 0.204 0.181 0.160 0.237 0.208 0.182 0.160 0.140 0.215 0.187 0.163 0.141 0.123 0.195 0.168 0.145 0.125 0.108 0.178 0.162 0.148 0.135 0.152 0.137 0.124 0.112 0.130 0.116 0.104 0.093 0.111 0.099 0.088 0.078 0.095 0.084 0.074 0.065 14 Annuity Table 1-(1+r)" Present value of an annuity ie n where r = discount rate, n = number of periods Interest rates (0) 4% (n) 1% 2% 3% 5% 6% 7% 8% 9% 10% 1 0.990 0.980 0.971 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 5 4.853 4.713 4.580 4.452 4.329 4.212 4.212 4.100 3.993 3.890 3.791 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 11 12 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 2 i b Online Registration... Daily Express Urdu... TUBITAK-Login Serv... G BIDEB Home Overseas represent... Higher Education C... Contact Us UAEM tes remaining 1 2 3 4 5 11% 12% 0.901 0.893 1.713 1.690 2.444 2.402 3.102 3.037 3.696 3.605 13% 0.885 1.668 2.361 2.974 3.517 14% 0.877 1.647 2.322 2.914 3.433 15% 0.870 1.626 2.283 2.855 3.352 16% 17% 18% 19% 0.862 0.855 0.847 0.840 1.605 1.585 1.566 1.547 2.246 2.210 2.174 2.140 2.798 2.743 2.690 2.639 3.274 3.1993.127 3.058 20% 0.833 1.528 2.106 2.589 2.991 6 7 8 9 10 4.231 4.111 4.712 4.564 5.146 4.968 5.537 5.328 5.889 5.650 3.998 4.423 4.799 5.132 5.426 3.889 4.288 4.639 4.946 5.216 3.784 4.160 4.487 4.772 5.019 3.685 4.039 4.344 4.607 4.833 3.589 3.922 4.207 4.451 4.659 3.498 3.410 3.326 3.812 3.706 3.605 4.078 3.954 3.837 4.303 4.163 4.031 4.494 4.339 4.192 11 12 13 14 15 6.207 5.938 6.492 6.194 6.750 6.424 6.982 6.628 7.191 6.811 5.687 5.453 5.234 5.918 5.660 5.421 6.122 5.842 5.583 6.302 6.002 5.724 6.462 6.142 5.847 5.029 5.197 5.342 5.468 5.575 4.836 4.988 5.118 5.229 5.324 4.656 4.486 4.327 4.793 4.611 4.439 4.910 4.715 4.533 5.008 4.802 4.611 5.092 4.876 4.675 2 1 Question 1 (34 marks) - Company Valuation Ringo plc is planning to take over a smaller private limited company, Stellar Lid, and needs to value the company Ringo plc has gathered the following data: Ringo Plc Weighted Average Cost of Capital (WACC) 14% Price/earnings (P/E) ratio 12 Shareholders' cost of equity 16% Stellar Ltd Current dividend payment Past 5 years' dividend payments (earliest first) Current earnings per share (EPS) Number of ordinary shares in issue 27p 15p, 17p, 190, 210, 23p 38p 4 million Requirements: a. Given the information provided above, estimate values for Stellar Ltd using the following valuation methodologies i. P/E ratio and Dividend growth model (16 marks) b. Discuss THREE problems associated with using the above valuation techniques and recommend which value(s) Ringo Pic should use (18 marks) 2 AR-Login Serv... G BIDEB Home #Overseas represent... Higher Education C... Contact Us UAEM Present value table Present value of 1 ie (1+r)- where Discount rates (0) Periods r = discount rate, n = number of periods (n) 1% 2% 1 0.990 0.980 0.980 0.961 3 0.971 0.942 4 0.961 0.924 5 0.951 0.906 3% 4% 5% 6% 0.971 0.962 0.952 0.943 0.943 0.925 0.907 0.890 0.915 0.889 0.864 0.840 0.888 0.855 0.823 0.792 0.863 0.822 0.784 0.747 7% 8% 9% 10% 0.935 0.926 0.917 0.909 0.873 0.857 0.842 0.826 0.816 0.794 0.772 0.751 0.763 0.735 0.708 0.683 0.713 0.681 0.650 0.621 6 7 8 9 10 0.942 0.888 0.837 0.933 0.871 0.813 0.923 0.853 0.789 0.914 0.837 0.766 0.905 0.820 0.744 0.790 0.746 0.705 0.760 0.711 0.665 0.731 0.677 0.627 0.703 0.645 0.592 0.676 0.614 0.558 0.666 0.630 0.596 0.623 0.583 0.547 0.582 0.540 0.502 0.544 0.500 0.460 0.508 0.463 0.422 0.564 0.513 0.467 0.424 0.386 11 12 13 14 15 0.896 0.804 0.887 0.788 0.879 0.773 0.870 0.758 0.861 0.743 0.722 0.650 0.701 0.625 0.681 0.601 0.661 0.577 0.642 0.555 0.585 0.557 0.530 0.505 0.481 0.527 0.475 0.429 0.497 0.444 0.397 0.469 0.415 0.368 0.442 0.388 0.340 0.417 0.362 0.315 0.388 0.356 0.326 0.299 0.275 0.350 0.319 0.290 0.263 0.239 Daily Express Urdu... TUBITAK-Login Serv. G BIDEB Home Overseas represent. Higher Education C... Contact Us UAEM 1 2 3 4 5 11% 12% 13% 0.901 0.893 0.885 0.812 0.797 0.783 0.731 0.712 0.693 0.659 0.636 0.613 0.593 0.567 0.543 14% 0.877 0.769 0.675 0.592 0.519 15% 16% 17% 18% 19% 20% 0.870 0.862 0.855 0.847 0.840 0.833 0.756 0.743 0.731 0.718 0.706 0.694 0.658 0.641 0.624 0.609 0.593 0.579 0.572 0.552 0.534 0.516 0.499 0.482 0.497 0.476 0.456 0.437 0.419 0.402 6 7 8 9 10 0.535 0.482 0.434 0.391 0.352 0.507 0.480 0.452 0.425 0.404 0.376 0.361 0.333 0.322 0.295 0.456 0.400 0.351 0.308 0.270 0.432 0.376 0.327 0.284 0.247 0.410 0.354 0.305 0.263 0.227 0.390 0.370 0.333 0.314 0.285 0.266 0.243 0.225 0.208 0.191 0.352 0.335 0.296 0.279 0.249 0.233 0.209 0.194 0.176 0.162 11 0.317 0.287 12 0.286 0.257 13 0.258 0.229 0.232 0.205 15 0.209 0.183 0.261 0.231 0.204 0.181 0.160 0.237 0.208 0.182 0.160 0.140 0.215 0.187 0.163 0.141 0.123 0.195 0.168 0.145 0.125 0.108 0.178 0.162 0.148 0.135 0.152 0.137 0.124 0.112 0.130 0.116 0.104 0.093 0.111 0.099 0.088 0.078 0.095 0.084 0.074 0.065 14 Annuity Table 1-(1+r)" Present value of an annuity ie n where r = discount rate, n = number of periods Interest rates (0) 4% (n) 1% 2% 3% 5% 6% 7% 8% 9% 10% 1 0.990 0.980 0.971 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 5 4.853 4.713 4.580 4.452 4.329 4.212 4.212 4.100 3.993 3.890 3.791 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 11 12 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 2 i b Online Registration... Daily Express Urdu... TUBITAK-Login Serv... G BIDEB Home Overseas represent... Higher Education C... Contact Us UAEM tes remaining 1 2 3 4 5 11% 12% 0.901 0.893 1.713 1.690 2.444 2.402 3.102 3.037 3.696 3.605 13% 0.885 1.668 2.361 2.974 3.517 14% 0.877 1.647 2.322 2.914 3.433 15% 0.870 1.626 2.283 2.855 3.352 16% 17% 18% 19% 0.862 0.855 0.847 0.840 1.605 1.585 1.566 1.547 2.246 2.210 2.174 2.140 2.798 2.743 2.690 2.639 3.274 3.1993.127 3.058 20% 0.833 1.528 2.106 2.589 2.991 6 7 8 9 10 4.231 4.111 4.712 4.564 5.146 4.968 5.537 5.328 5.889 5.650 3.998 4.423 4.799 5.132 5.426 3.889 4.288 4.639 4.946 5.216 3.784 4.160 4.487 4.772 5.019 3.685 4.039 4.344 4.607 4.833 3.589 3.922 4.207 4.451 4.659 3.498 3.410 3.326 3.812 3.706 3.605 4.078 3.954 3.837 4.303 4.163 4.031 4.494 4.339 4.192 11 12 13 14 15 6.207 5.938 6.492 6.194 6.750 6.424 6.982 6.628 7.191 6.811 5.687 5.453 5.234 5.918 5.660 5.421 6.122 5.842 5.583 6.302 6.002 5.724 6.462 6.142 5.847 5.029 5.197 5.342 5.468 5.575 4.836 4.988 5.118 5.229 5.324 4.656 4.486 4.327 4.793 4.611 4.439 4.910 4.715 4.533 5.008 4.802 4.611 5.092 4.876 4.675 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started