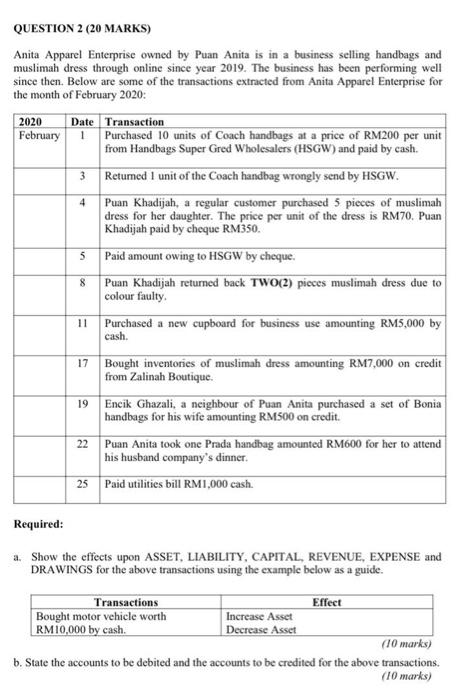

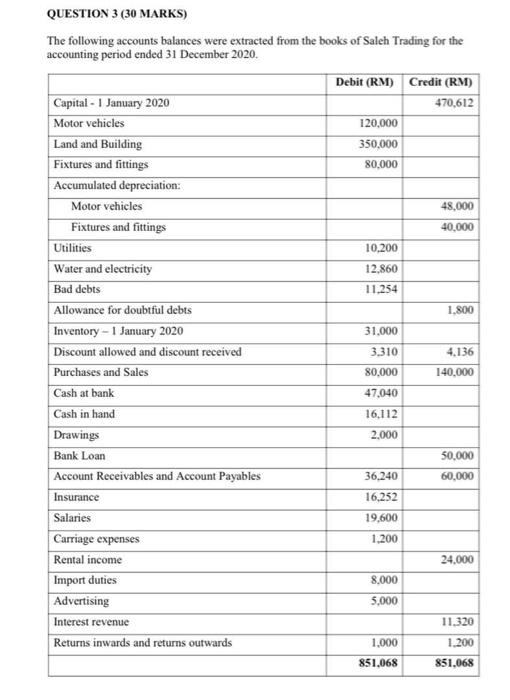

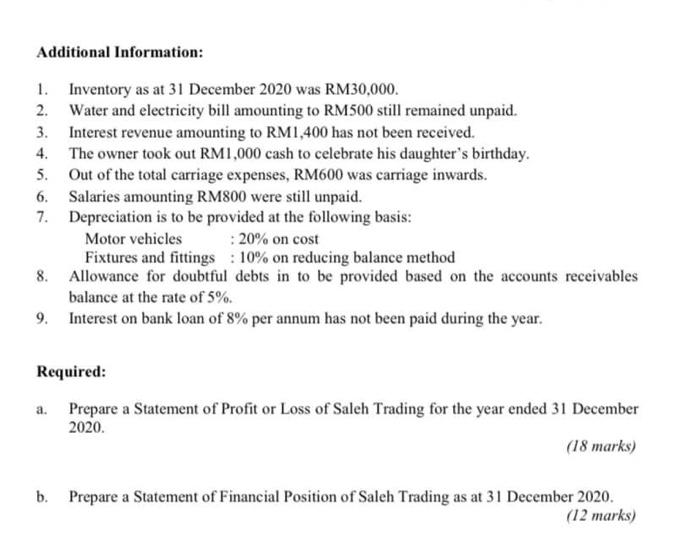

1 QUESTION 2 (20 MARKS) Anita Apparel Enterprise owned by Puan Anita is in a business selling handbags and muslimah dress through online since year 2019. The business has been performing well since then. Below are some of the transactions extracted from Anita Apparel Enterprise for the month of February 2020: 2020 Date Transaction February Purchased 10 units of Coach handbags at a price of RM200 per unit from Handbags Super Gred Wholesalers (HSGW) and paid by cash. 3 Returned 1 unit of the Coach handbag wrongly send by HSGW. Puan Khadijah, a regular customer purchased 5 pieces of muslimah dress for her daughter. The price per unit of the dress is RM70. Puan Khadijah paid by cheque RM350. 5 Paid amount owing to HSGW by cheque Puan Khadijah returned back TWO(2) pieces muslimah dress due to colour faulty Purchased a new cupboard for business use amounting RM5,000 by cash 4 8 11 17 Bought inventories of muslimah dress amounting RM7,000 on credit from Zalinah Boutique 19 Encik Ghazali, a neighbour of Puan Anita purchased a set of Bonia handbags for his wife amounting RM500 on credit. 22 Puan Anita took one Prada handbag amounted RM600 for her to attend his husband company's dinner. 25 Paid utilities bill RM 1,000 cash. Required: a. Show the effects upon ASSET, LIABILITY, CAPITAL, REVENUE, EXPENSE and DRAWINGS for the above transactions using the example below as a guide. Transactions Effect Bought motor vehicle worth Increase Asset RM10,000 by cash. Decrease Asset (10 marks) b. State the accounts to be debited and the accounts to be credited for the above transactions. (10 marks) QUESTION 3 (30 MARKS) The following accounts balances were extracted from the books of Saleh Trading for the accounting period ended 31 December 2020. Debit (RM) Credit (RM) Capital - 1 January 2020 470,612 Motor vehicles 120,000 Land and Building 350,000 Fixtures and fittings 80,000 Accumulated depreciation: Motor vehicles 48.000 Fixtures and fittings 40,000 Utilities 10.200 Water and electricity 12.860 Bad debts 11.254 Allowance for doubtful debts 1.800 Inventory - 1 January 2020 31.000 Discount allowed and discount received 3,310 4.136 Purchases and Sales 80.000 140,000 Cash at bank 47,040 Cash in hand 16,112 Drawings 2.000 Bank Loan 50.000 Account Receivables and Account Payables 36.240 60,000 Insurance 16.252 Salaries 19,600 Carriage expenses 1.200 Rental income 24.000 Import duties 8,000 Advertising 5.000 Interest revenue 11.320 Returns inwards and returns outwards 1,000 1.200 851,068 851,068 Additional Information: 1. Inventory as at 31 December 2020 was RM30,000. 2. Water and electricity bill amounting to RM500 still remained unpaid. 3. Interest revenue amounting to RM1,400 has not been received. 4. The owner took out RM1,000 cash to celebrate his daughter's birthday. 5. Out of the total carriage expenses, RM600 was carriage inwards. 6. Salaries amounting RM800 were still unpaid. 7. Depreciation is to be provided at the following basis: Motor vehicles : 20% on cost Fixtures and fittings : 10% on reducing balance method 8. Allowance for doubtful debts in to be provided based on the accounts receivables balance at the rate of 5%. 9. Interest on bank loan of 8% per annum has not been paid during the year. Required: a. Prepare a Statement of Profit or Loss of Saleh Trading for the year ended 31 December 2020. (18 marks) b. Prepare a Statement of Financial Position of Saleh Trading as at 31 December 2020. (12 marks)