1. Record receipt of cash by borrowing $21,000 from the bank by signing a note.

2. Record payment of rent for the current month, $1,500.

3. Record services provided to customers, $4,400 for cash and $2,700 on account.

4. Record purchase of cages and equipment necessary to maintain the animals, $7,600 cash.

5. Record payment of employees' salaries for the first half of the month, $5,700.

6. Record payment of dividends to stockholders, $1,350.

7. Record receipt of cash in advance from a customer who wants to house his two dogs (Chance and Shadow) and cat (Sassy) while he goes on vacation the month of July, $1,700.

8. Record payment of utilities for the month, $2,500.

9. Record salaries earned by employees for the second half of the month, $5,700. Payment will be made on July 2.

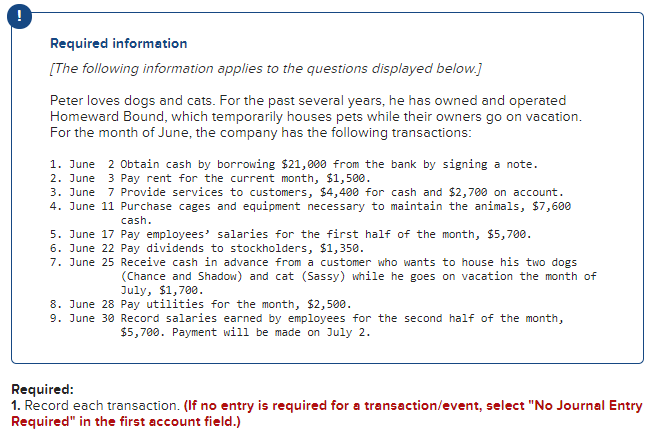

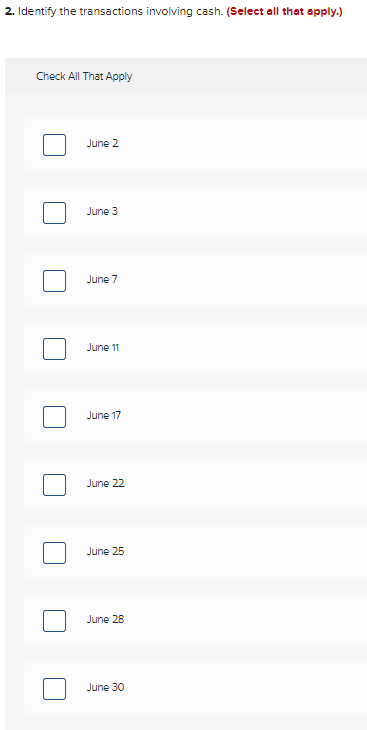

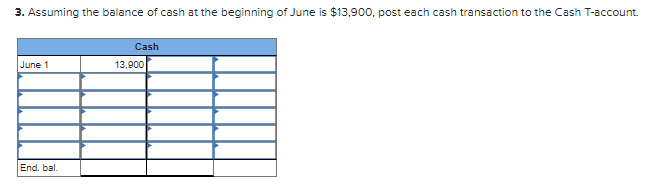

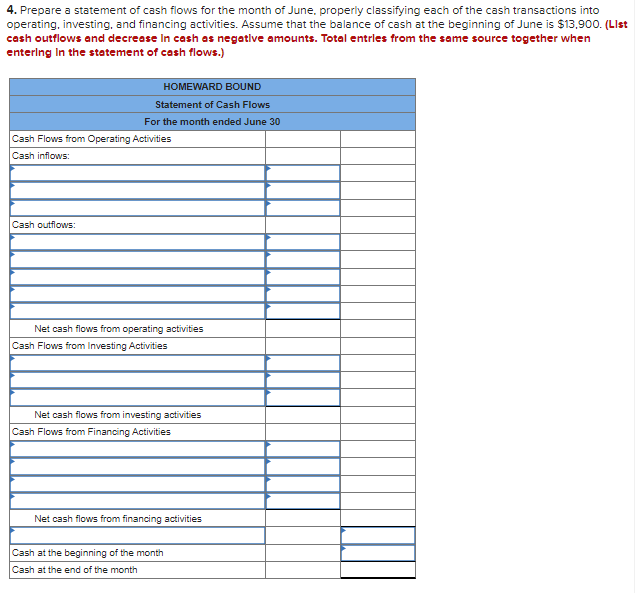

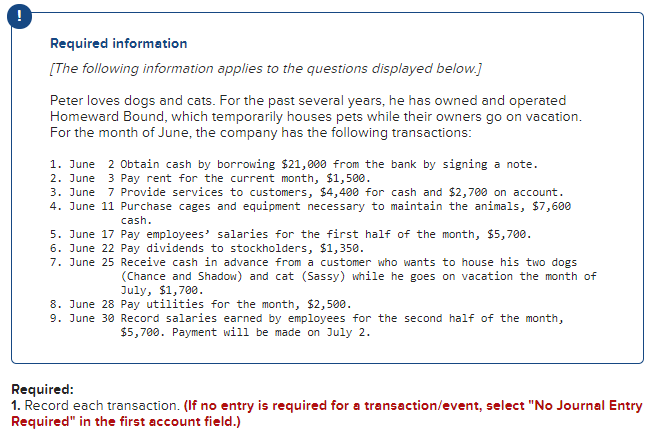

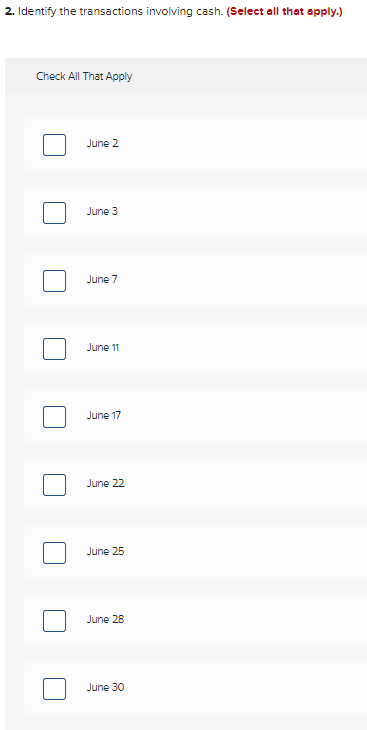

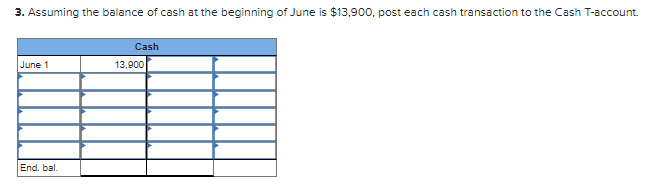

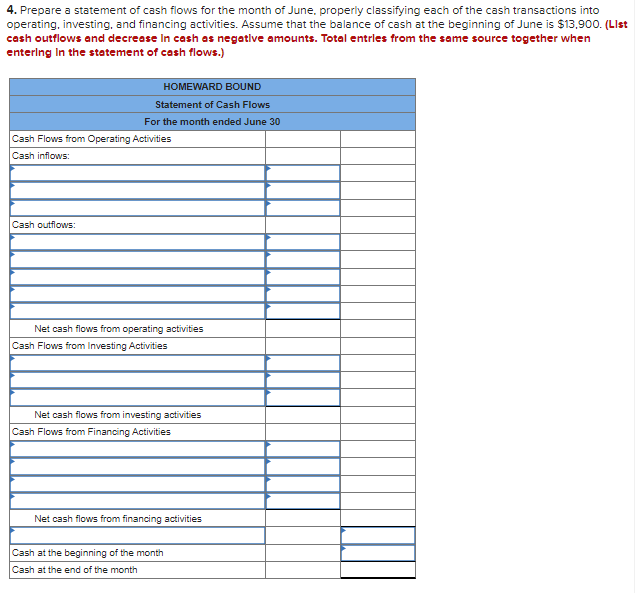

Required information [The following information applies to the questions displayed below.] Peter loves dogs and cats. For the past several years, he has owned and operated Homeward Bound, which temporarily houses pets while their owners go on vacation. For the month of June, the company has the following transactions: 1. June 2 Obtain cash by borrowing $21,800 from the bank by signing a note. 2. June 3 Pay rent for the current month, $1,500. 3. June 7 Provide services to customers, $4,400 for cash and $2,700 on account. 4. June 11 Purchase cages and equipment necessary to maintain the animals, $7,600 cash. 5. June 17 Pay employees' salaries for the first half of the month, $5,700. 6. June 22 Pay dividends to stockholders, $1,350. 7. June 25 Receive cash in advance from a customer who wants to house his two dogs (Chance and Shadow) and cat (Sassy) while he goes on vacation the month of July, $1,700 8. June 28 Pay utilities for the month, $2,500. 9. June 30 Record salaries earned by employees for the second half of the month, $5,700. Payment will be made on July 2. Required: 1. Record each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 2. Identify the transactions involving cash. (Select all that apply.) Check All That Apply June 2 June 3 June 7 June 11 June 17 June 22 June 25 June 2B June 30 3. Assuming the balance of cash at the beginning of June is $13.900. post each cash transaction to the Cash T-account. Cash 13.900 June 1 End, bal 4. Prepare a statement of cash flows for the month of June, properly classifying each of the cash transactions into operating, investing, and financing activities. Assume that the balance of cash at the beginning of June is $13,900. (List cash outflows and decrease in cash as negative amounts. Total entries from the same source together when entering in the statement of cash flows.) HOMEWARD BOUND Statement of Cash Flows For the month ended June 30 Cash Flows from Operating Activities Cash inflows: Cash outflows: Net cash flows from operating activities Cash Flows from Investing Activities Net cash flows from investing activities Cash Flows from Financing Activities Net cash flows from financing activities Cash at the beginning of the month Cash at the end of the month