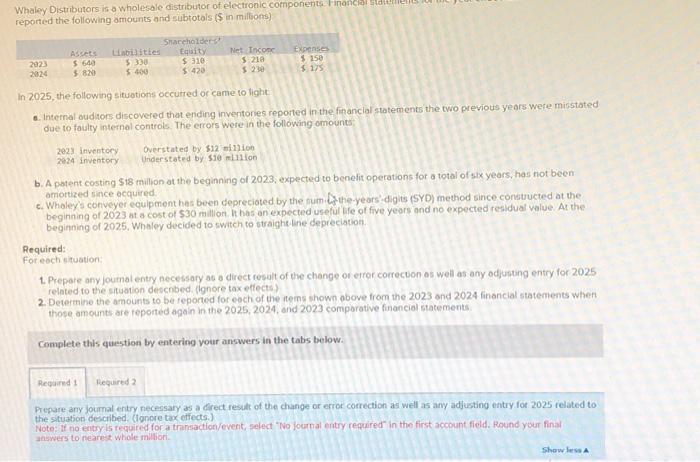

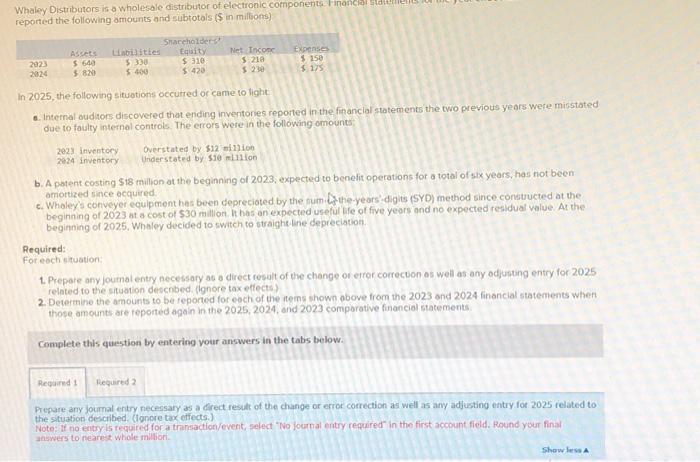

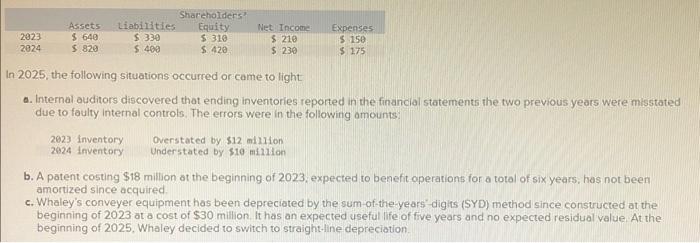

1. record the rectification for understatement and overstatement of inventory.

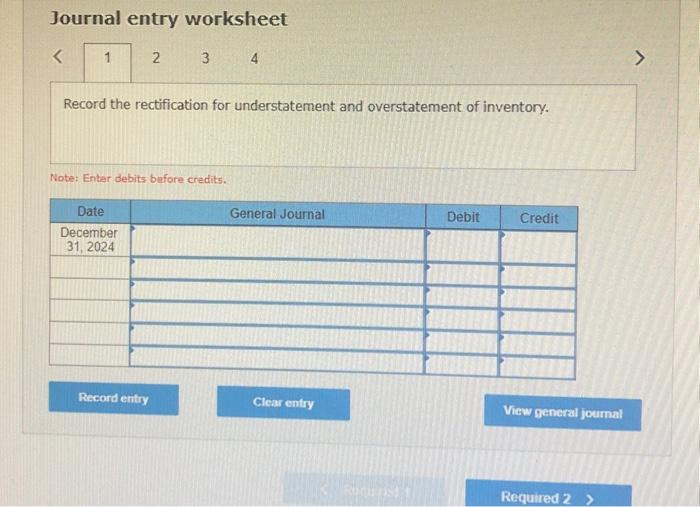

B. record amortization of patents since its acquisition

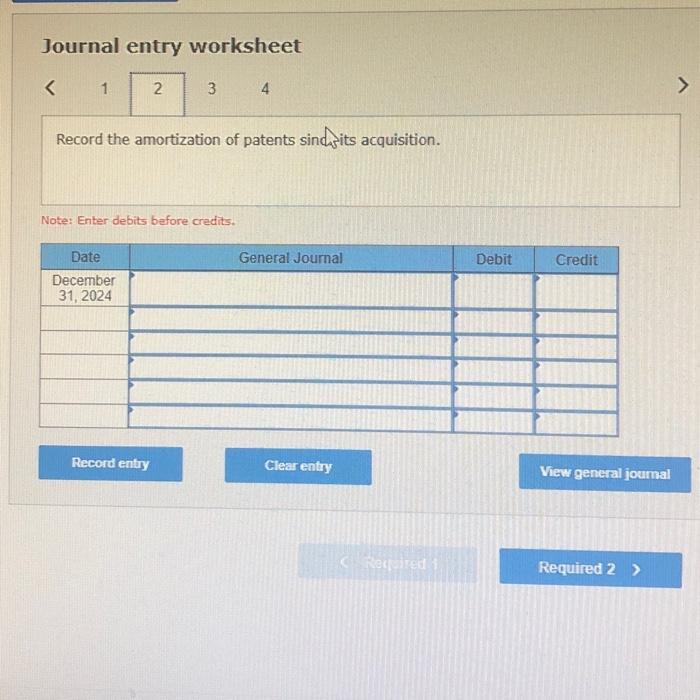

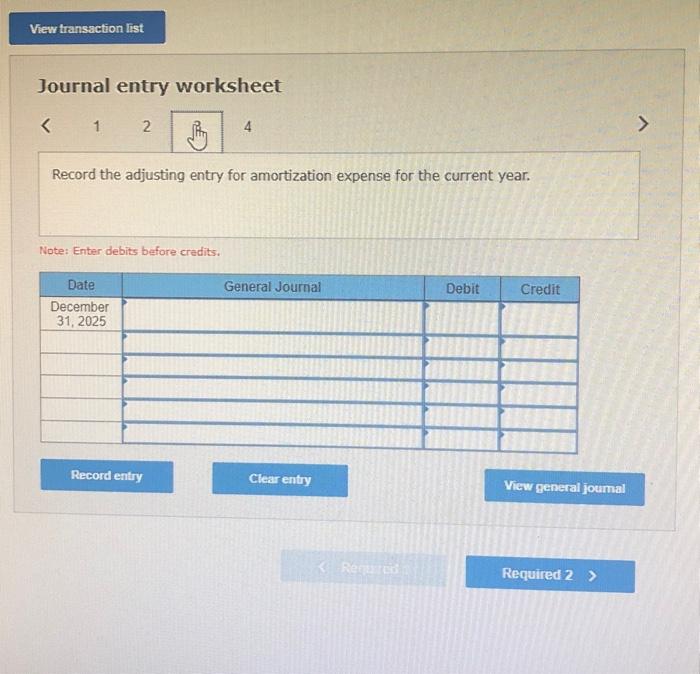

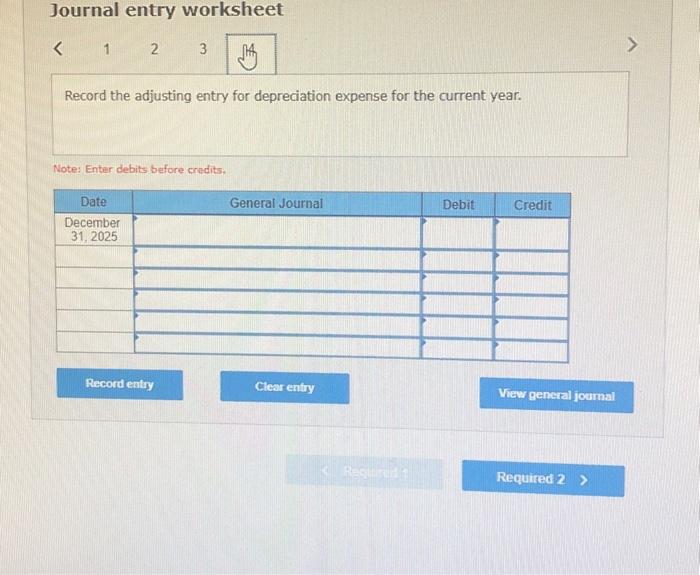

c. record adjusting entries for amortization and depreciation.

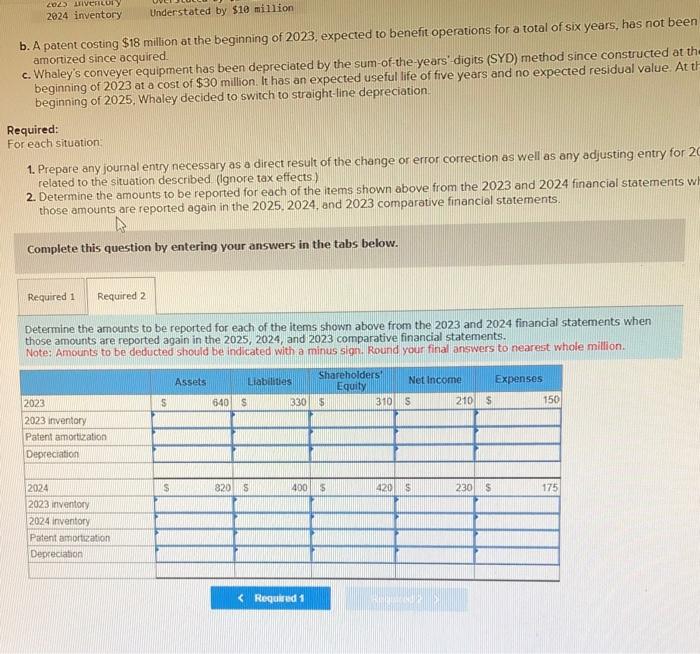

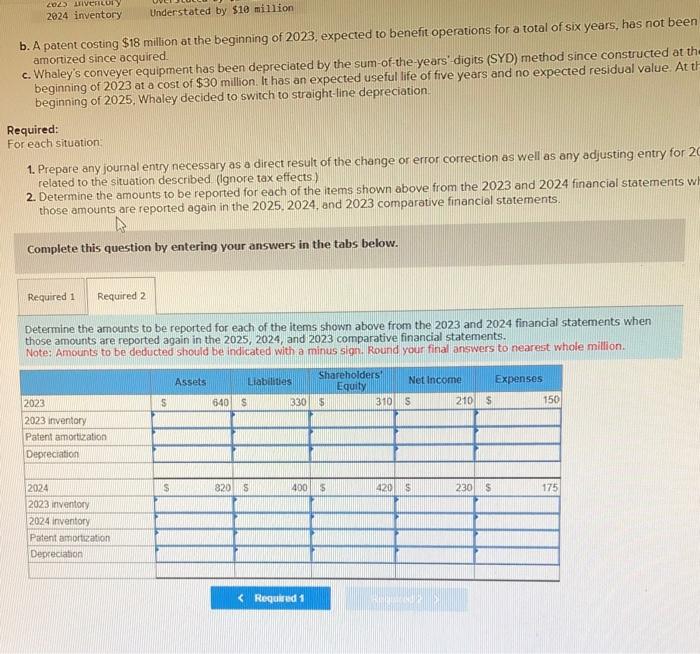

2. determine tbe amounts to be reported for each item shown above from 2023 and 2024 when those anounts are reported afain in the 2025,2024, and 2023 comparative statements.

All information given is in photo format jn the images.

Journal entry worksheet Record the adjusting entry for amortization expense for the current year. Note: Enter debits before credits. In 2025, the following situations occurred or came to light a. Internal auditors discovered that ending inventories reported in the financial statements the two previous years were misstated due to faulty internal controls. The errors were in the following amounts: 2023 inventory 2924 inventory Overstated by $12 milion Understated by sio milion b. A patent costing $18 million at the beginning of 2023 , expected to benefit aperations for a total of six years, has not been amortized since acquired. c. Whaley's conveyer equipment has been depreciated by the sum -of the-years'-digits (SYD) method since constructed at the beginning of 2023 at a cast of $30 million. It has an expected useful life of five years and no expected residual value. At the beginning of 2025 . Whaley decided to switch to straight-line depreciation. Journal entry worksheet Record the amortization of patents sindarits acquisition. Note: Enter debits before credits. In 2025, the following situotions occurred or came to light: a. Internal oudiors discovered that ending inventories reported in the financial statements the two previous years were misstoted due to fasity internal controls. The errors were in the following omounts: 2023 inventocy overstated by $12 mi13ion 2024 inventory Understated by sie milion b. A potent costing $18 milion at the beginning of 2023, expected to benefit operations for a total of six years, has not been omortized since ocquired: c. Whaley's conveyer equipment hes been deprecioted by the fum. A the-yeors'digits (SYD) method since constructed at the begining of 2023 at a cost of $30 million. hit has an expected useful life of five years and no expected residual value At the beginning of 2025, Whaley decided to switch to ovaight line depreciation. Required: For eoch situation: 1. Prepare any joumal entry necessary as o direct result of the change or error correcton os well as any odjubting entry for 2025 related to the situation described. (ignore tax effects) 2. Determine the amounts to be feported for eoch of the rems shown above fram the 2023 and 2024 financial statements when those amounts are feported ogain in the 2025,2024 , and 2023 comporative financial statements. Complete this question by entering your answers in the tabs below. Prepare any journal entry necessary as a Grect result of the change or error correction as well as any adjusting entry for 2025 related to the stuation described. (ignore tax effects.) Note: if no entoy is required for a transaction/event, select "No fournal entry required" in the first account field. Round your final answers to neares whole millori. Journal entry worksheet Record the adjusting entry for depreciation expense for the current year. Note: Enter debits before credits. b. A patent costing $18 million at the beginning of 2023 , expected to benefit operations for a total of six years, has not been amorized since acquired. c. Whaley's conveyer equipment has been depreciated by the sum-of-the-years'-digits (SYD) method since constructed at th beginning of 2023 at a cost of $30 million. It has an expected useful life of five years and no expected residual value. At t beginning of 2025 , Whaley decided to switch to straight-line depreciation Required: For each situation: 1. Prepare any journal entry necessary as a direct result of the change or error correction as well as any adjusting entry for 2 related to the situation described (Ignore tax effects) 2. Determine the amounts to be reported for each of the items shown above from the 2023 and 2024 financial statements w those amounts are reported again in the 2025, 2024, and 2023 comparative financial statements. Complete this question by entering your answers in the tabs below. Determine the amounts to be reported for each of the items shown above from the 2023 and 2024 financial statements when those amounts are reported again in the 2025, 2024, and 2023 comparative financial statements. Note: Amounts to be deducted should be indicated with a minus sign. Round your final answers to nearest whole million. Journal entry worksheet Record the rectification for understatement and overstatement of inventory. Note: Enter debits before credits