1) Record the transactions listed below in a general journal.

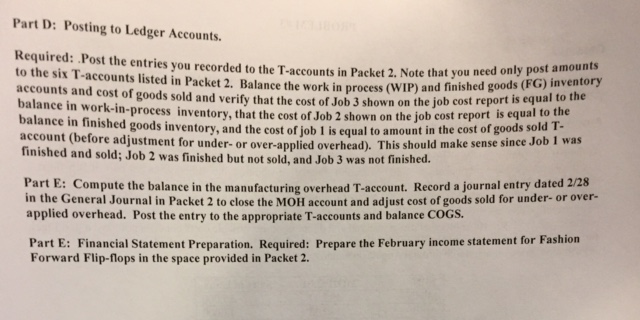

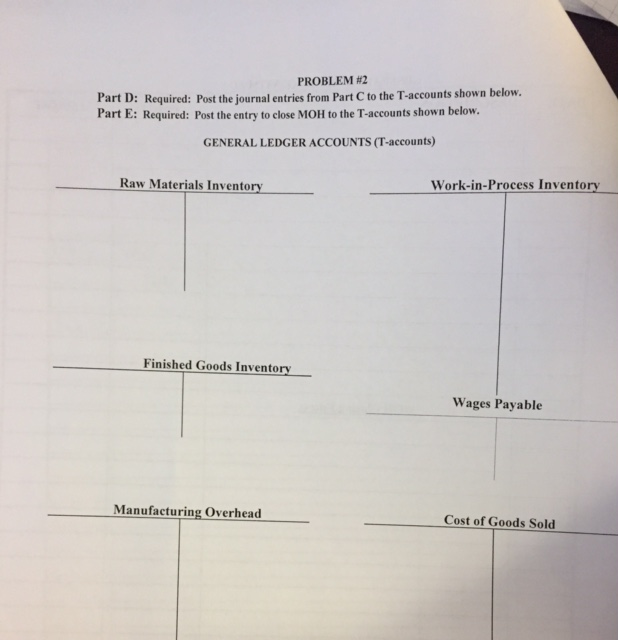

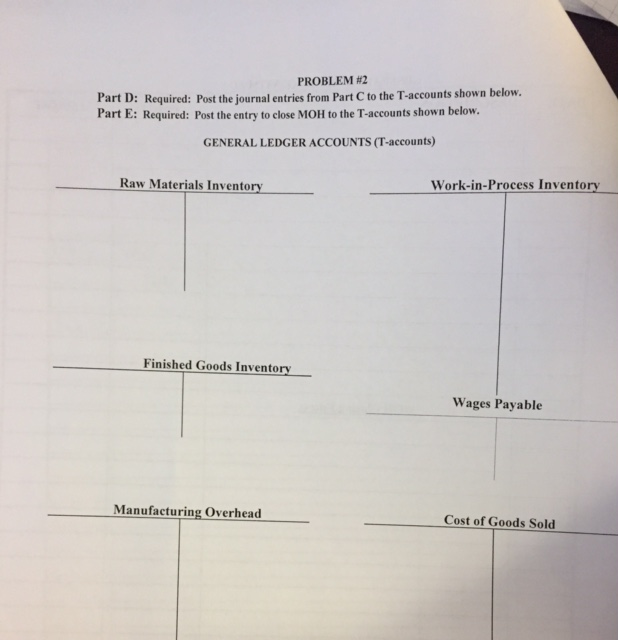

2) Recird entries in T-accounts pictured.

3) Compute the balance in the manufacturing T- account.

4) Prepare the February income statement.

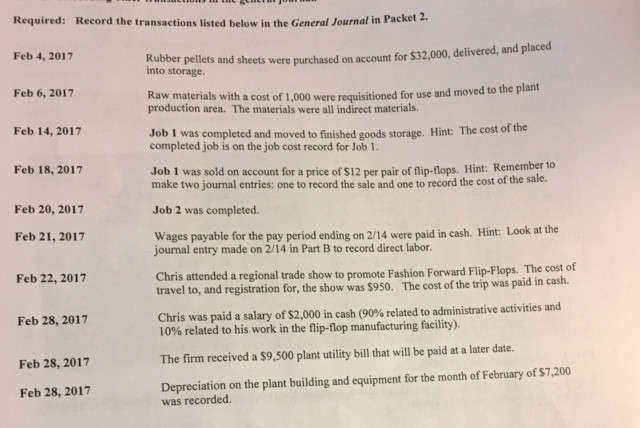

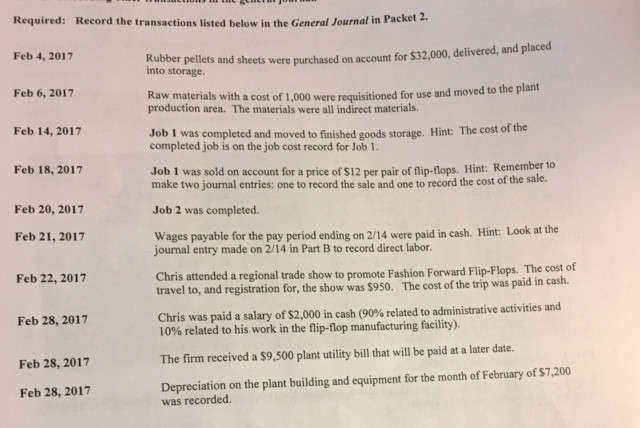

Required: Record the transactions listed below in the General Journal in Packet 2. Feb 4, 2017 pelets and sheets were purchased on account for $32,000, delivered, and placed into storage. Feb 6, 2017 Ra production area. The materials were all indirect materials. w materials with a cost of 1,000 were requisitioned for use and moved to the plant Feb 14, 2017 Job I was completed and moved to finished goods storage. Hint: The cost of the completed job is on the job cost record for Job 1 . ber to Job 1 was sold on account for a price of $12 per pair of flip-flops. Hint: Remem make two journal entries: one to record the sale and one to record the cost of the salfe Job 2 was completed. Feb 18, 2017 Feb 20, 2017 Feb 21, 2017 paid in cash. Hint: Look at the journal entry made on 2/14 in Part B to record direct labor Chris attended a regional trade show to promote Fashion Forward Flip-Flops. The cost of travel to, and registration for, the show was S950 The cost of the trip was paid in cash. Feb 22, 2017 Chris was paid a salary of $2,000 in cash (90% related to administrative activities and 10% related to his work in the flip-flop manufacturing facility). Feb 28, 2017 Feb 28, 2017 The firm received a $9,500 plant utility bill that will be paid at a later date Depreciation on the plant building and equipment for the month of February of $7,200 was recorded. Feb 28, 2017 Required: Record the transactions listed below in the General Journal in Packet 2. Feb 4, 2017 pelets and sheets were purchased on account for $32,000, delivered, and placed into storage. Feb 6, 2017 Ra production area. The materials were all indirect materials. w materials with a cost of 1,000 were requisitioned for use and moved to the plant Feb 14, 2017 Job I was completed and moved to finished goods storage. Hint: The cost of the completed job is on the job cost record for Job 1 . ber to Job 1 was sold on account for a price of $12 per pair of flip-flops. Hint: Remem make two journal entries: one to record the sale and one to record the cost of the salfe Job 2 was completed. Feb 18, 2017 Feb 20, 2017 Feb 21, 2017 paid in cash. Hint: Look at the journal entry made on 2/14 in Part B to record direct labor Chris attended a regional trade show to promote Fashion Forward Flip-Flops. The cost of travel to, and registration for, the show was S950 The cost of the trip was paid in cash. Feb 22, 2017 Chris was paid a salary of $2,000 in cash (90% related to administrative activities and 10% related to his work in the flip-flop manufacturing facility). Feb 28, 2017 Feb 28, 2017 The firm received a $9,500 plant utility bill that will be paid at a later date Depreciation on the plant building and equipment for the month of February of $7,200 was recorded. Feb 28, 2017