Answered step by step

Verified Expert Solution

Question

1 Approved Answer

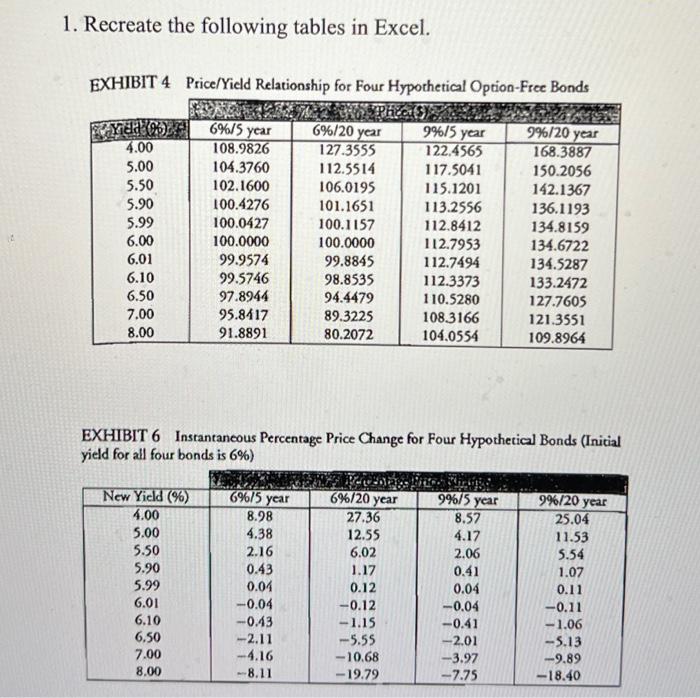

1. Recreate the following tables in Excel. EXHIBIT 4 Price/Yield Relationship for Four Hypothetical Option-Free Bonds Yud (96) 4.00 5.00 5.50 5.90 5.99 6.00 6.01

1. Recreate the following tables in Excel. EXHIBIT 4 Price/Yield Relationship for Four Hypothetical Option-Free Bonds Yud (96) 4.00 5.00 5.50 5.90 5.99 6.00 6.01 6.10 6.50 7.00 8.00 6%/5 year 108.9826 104.3760 102.1600 100.4276 100.0427 100.0000 99.9574 99.5746 97.8944 95.8417 91.8891 New Yield (%) 4.00 5.00 5.50 5.90 5.99 6.01 6.10 6.50 7.00 8.00 6%/5 year 8.98 4.38 2.16 EXHIBIT 6 Instantaneous Percentage Price Change for Four Hypothetical Bonds (Initial yield for all four bonds is 6%) 0.43 0.04 6%/20 year 127.3555 112.5514 106.0195 101.1651 100.1157 100.0000 99.8845 98.8535 94.4479 89.3225 80.2072 -0.04 -0.43 -2.11 -4.16 -8.11 9%/5 year 122.4565 117.5041 115.1201 113.2556 112.8412 112.7953 112.7494 112.3373 110.5280 108.3166 104.0554 6%/20 year 27.36 12.55 6.02 1.17 0.12 -0.12 -1.15 -5.55 -10.68 - 19.79 Bye Brow Thingy 9%/5 year 8.57 4.17 2.06 0.41 0.04 9%/20 year 168.3887 150.2056 142.1367 136.1193 134.8159 134.6722 134.5287 133.2472 127.7605 121.3551 109.8964 -0.04 -0.41 -2.01 -3.97 -7.75 9%/20 year 25.04 11.53 5.54 1.07 0.11 -0.11 -1.06 -5.13 -9.89 -18.40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started