Answered step by step

Verified Expert Solution

Question

1 Approved Answer

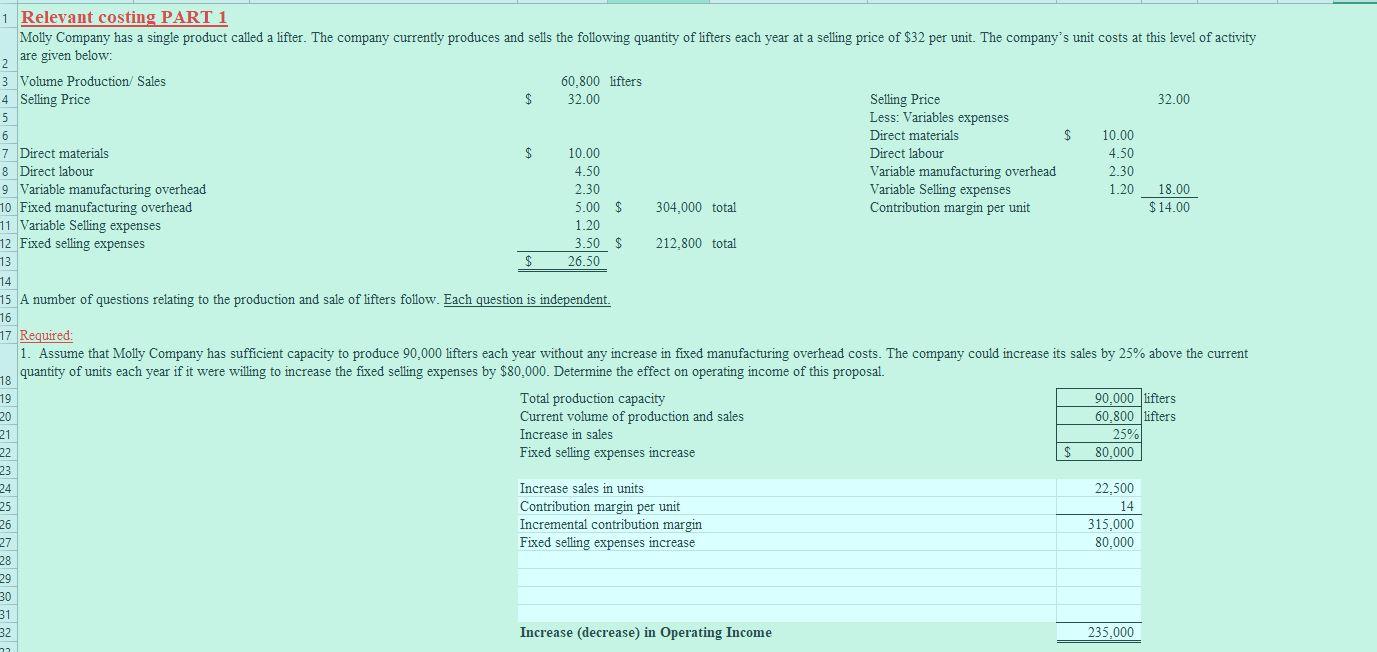

1 Relevant costing PART 1 Molly Company has a single product called a lifter. The company currently produces and sells the following quantity of lifters

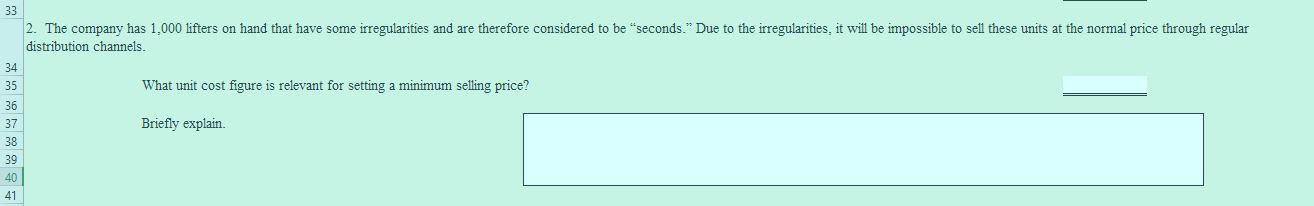

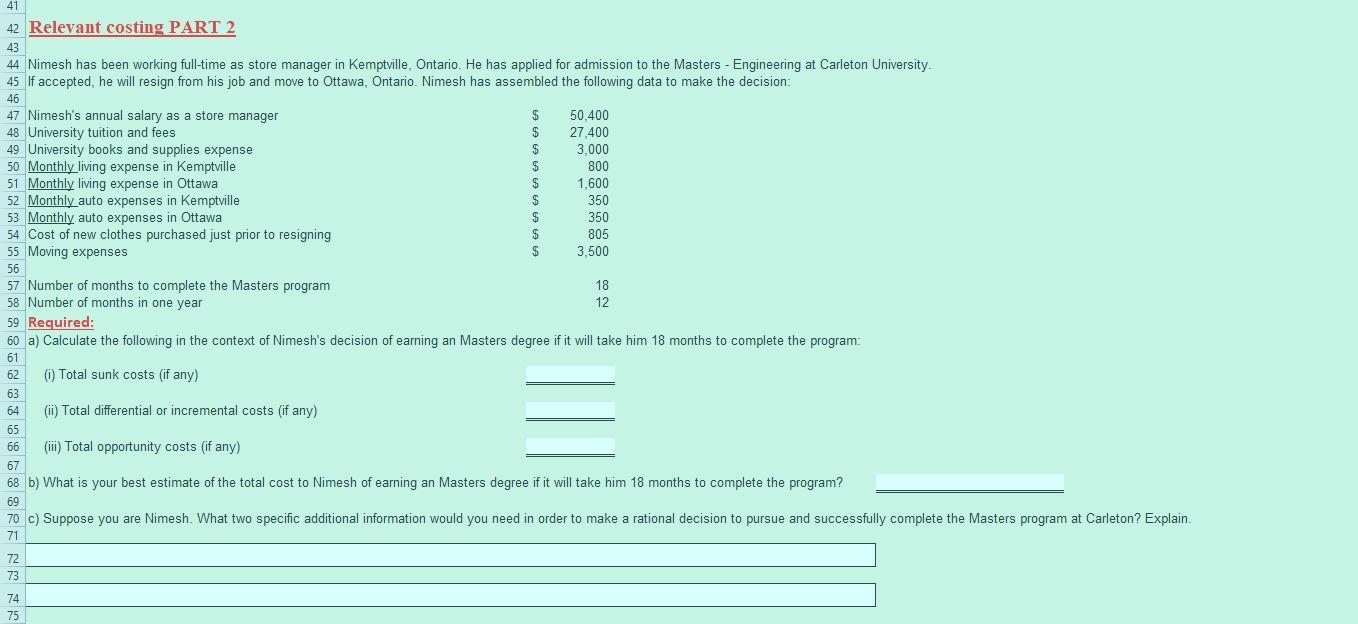

1 Relevant costing PART 1 Molly Company has a single product called a lifter. The company currently produces and sells the following quantity of lifters each year at a selling price of $32 per unit. The company's unit costs at this level of activity 2 are given below: 3 Volume Production Sales 60.800 lifters 4 Selling Price $ 32.00 Selling Price 32.00 5 Less: Variables expenses 6 Direct materials $ 10.00 7 Direct materials $ 10.00 Direct labour 4.50 8 Direct labour 4.50 Variable manufacturing overhead 2.30 9 Variable manufacturing overhead 2.30 Variable Selling expenses 1.20 18.00 10 Fixed manufacturing overhead 5.00 $ 304,000 total Contribution margin per unit $14.00 71 Variable Selling expenses 1.20 12 Fixed selling expenses 3.50 $ 212.800 total 73 $ 26.50 14 15 A number of questions relating to the production and sale of lifters follow. Each question is independent. 16 77 Required: 1. Assume that Molly Company has sufficient capacity to produce 90,000 lifters each year without any increase in fixed manufacturing overhead costs. The company could increase its sales by 25% above the current 18 quantity of units each year if it were willing to increase the fixed selling expenses by $80,000. Determine the effect on operating income of this proposal. 19 Total production capacity 90,000 lifters 20 Current volume of production and sales 60.800 lifters 21 Increase in sales 25% 22 Fixed selling expenses increase $ 80,000 23 24 Increase sales in units 22.500 25 Contribution margin per unit 14 26 Incremental contribution margin 315.000 27 Fixed selling expenses increase 80.000 28 29 30 31 32 Increase (decrease) in Operating Income 235.000 33 2. The company has 1,000 lifters on hand that have some irregularities and are therefore considered to be "seconds." Due to the irregularities, it will be impossible to sell these units at the normal price through regular distribution channels. 34 35 What unit cost figure is relevant for setting a minimum selling price? Briefly explain 36 37 38 39 40 41 41 S 42 Relevant costing PART 2 43 44 Nimesh has been working full-time as store manager in Kemptville, Ontario. He has applied for admission to the Masters - Engineering at Carleton University. 45 If accepted, he will resign from his job and move to Ottawa, Ontario. Nimesh has assembled the following data to make the decision: 46 47 Nimesh's annual salary as a store manager $ 50,400 48 University tuition and fees $ 27.400 49 University books and supplies expense $ 3,000 50 Monthly living expense in Kemptville $ 800 51 Monthly living expense in Ottawa $ 1,600 52 Monthly auto expenses in Kemptville $ 350 53 Monthly auto expenses in Ottawa 350 54 Cost of new clothes purchased just prior to resigning $ 805 55 Moving expenses $ 3,500 56 57 Number of months to complete the Masters program 18 58 Number of months in one year 12 59 Required: 60 a) Calculate the following in the context of Nimesh's decision of earning an Masters degree if it will take him 18 months to complete the program. 61 62 0 Total sunk costs (if any) 63 64 (ii) Total differential or incremental costs (if any) 65 66 (ii) Total opportunity costs (if any) 67 68 b) What is your best estimate of the total cost to Nimesh of earning an Masters degree if it will take him 18 months to complete the program? 69 70 C) Suppose you are Nimesh. What two specific additional information would you need in order to make a rational decision to pursue and successfully complete the Masters program at Carleton? Explain 71 72 73 74 75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started