Answered step by step

Verified Expert Solution

Question

1 Approved Answer

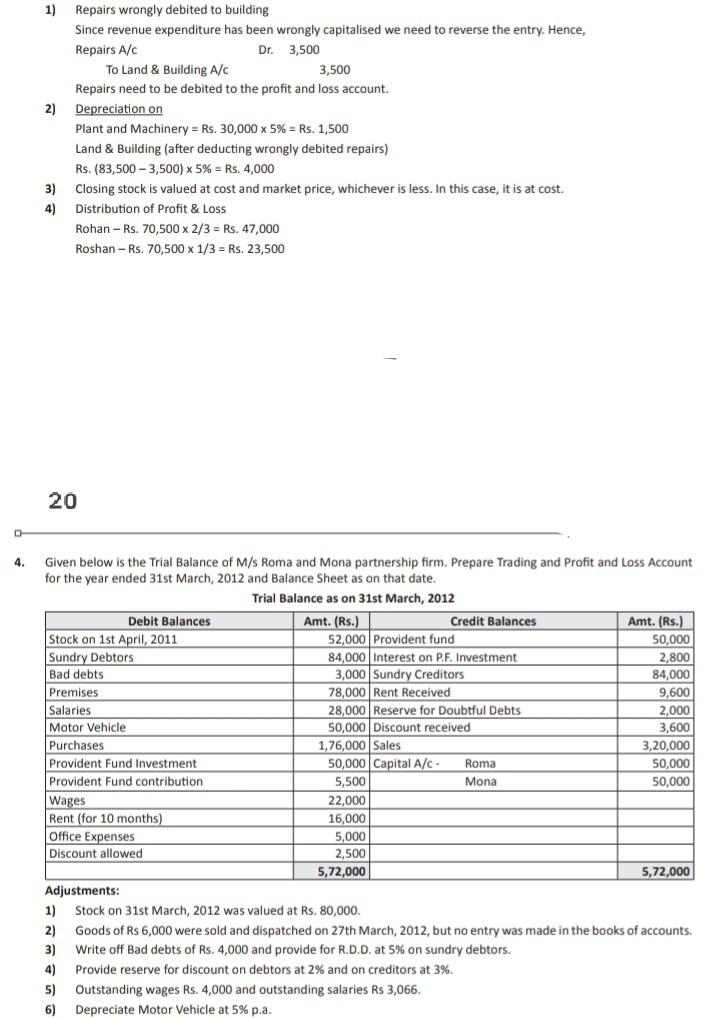

1) Repairs wrongly debited to building Since revenue expenditure has been wrongly capitalised we need to reverse the entry. Hence, Repairs A/C Dr. 3,500 To

1) Repairs wrongly debited to building Since revenue expenditure has been wrongly capitalised we need to reverse the entry. Hence, Repairs A/C Dr. 3,500 To Land & Building A/c 3,500 Repairs need to be debited to the profit and loss account. 2) Depreciation on Plant and Machinery = Rs. 30,000 x 5% = Rs. 1,500 Land & Building (after deducting wrongly debited repairs) Rs. (83,500 - 3,500) x 5% = Rs. 4,000 3) Closing stock is valued at cost and market price, whichever is less. In this case, it is at cost. 4) Distribution of Profit & Loss Rohan - Rs. 70,500 x 2/3 = Rs. 47,000 Roshan - Rs. 70,500 x 1/3 = Rs. 23,500 20 D 4. Given below is the Trial Balance of M/s Roma and Mona partnership firm. Prepare Trading and Profit and Loss Account for the year ended 31st March, 2012 and Balance Sheet as on that date. Trial Balance as on 31st March, 2012 Debit Balances Amt. (Rs.) Credit Balances Amt. (Rs.) Stock on 1st April, 2011 52,000 Provident fund 50,000 Sundry Debtors 84,000 Interest on PF. Investment 2,800 Bad debts 3,000 Sundry Creditors 84,000 Premises 78,000 Rent Received 9,600 Salaries 28,000 Reserve for Doubtful Debts 2,000 Motor Vehicle 50,000 Discount received 3,600 Purchases 1,76,000 Sales 3,20,000 Provident Fund Investment 50,000 Capital A/C - Roma 50,000 Provident Fund contribution 5,500 50,000 Wages 22,000 Rent (for 10 months) 16,000 Office Expenses Discount allowed 2,500 5,72,000 5,72,000 Adjustments: 1) Stock on 31st March, 2012 was valued at Rs. 80,000. 2) Goods of Rs 6,000 were sold and dispatched on 27th March, 2012, but no entry was made in the books of accounts. 3) Write off Bad debts of Rs. 4,000 and provide for R.D.D. at 5% on sundry debtors. 4) Provide reserve for discount on debtors at 2% and on creditors at 3%. 5) Outstanding wages Rs. 4,000 and outstanding salaries R$ 3,066. 6) Depreciate Motor Vehicle at 5% p.a. Mona 5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started