1

1

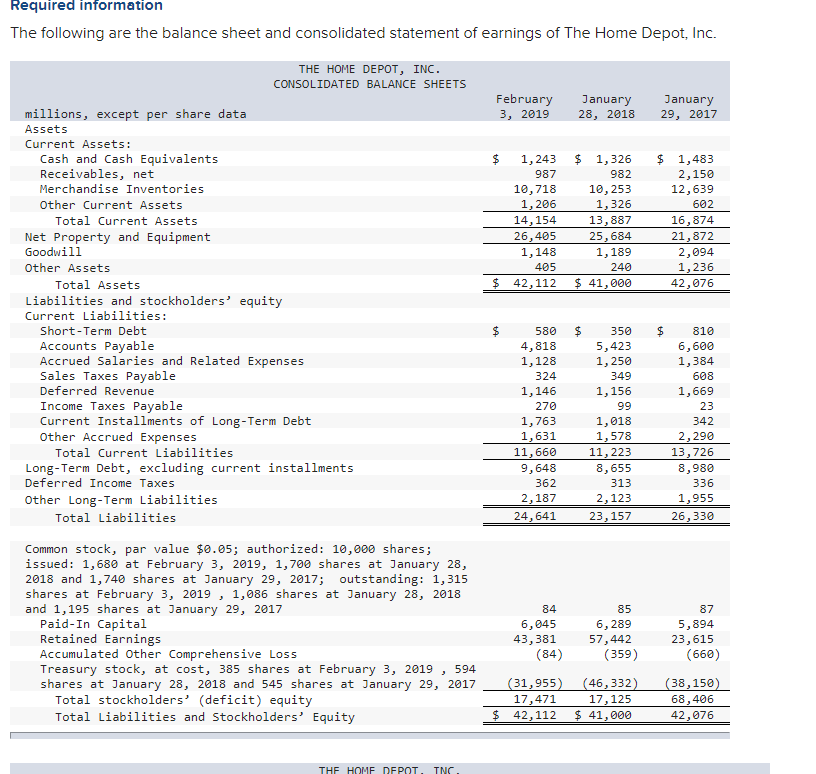

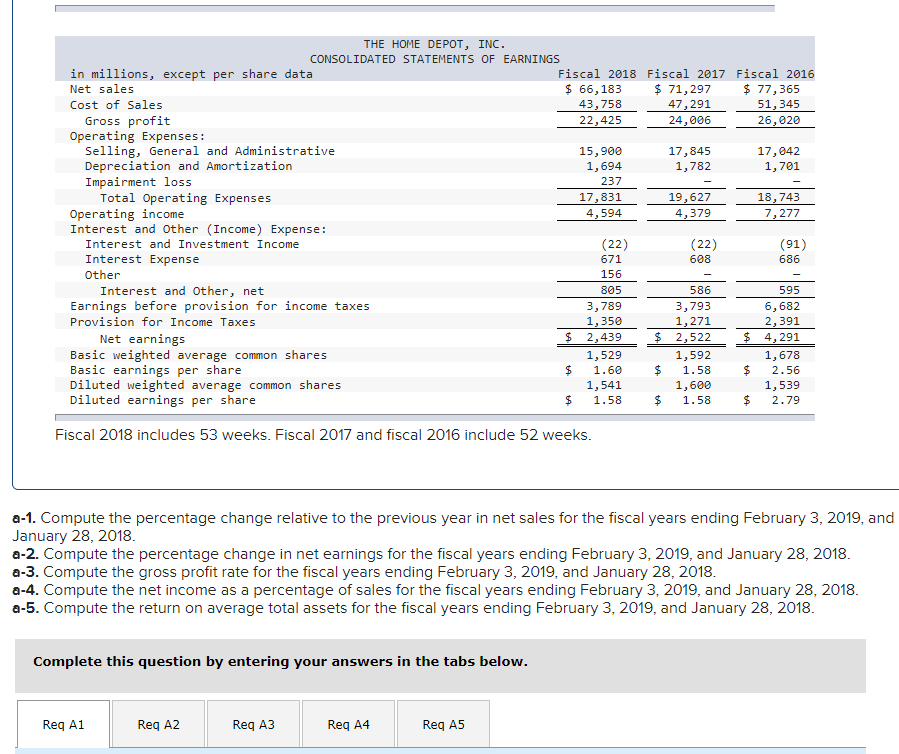

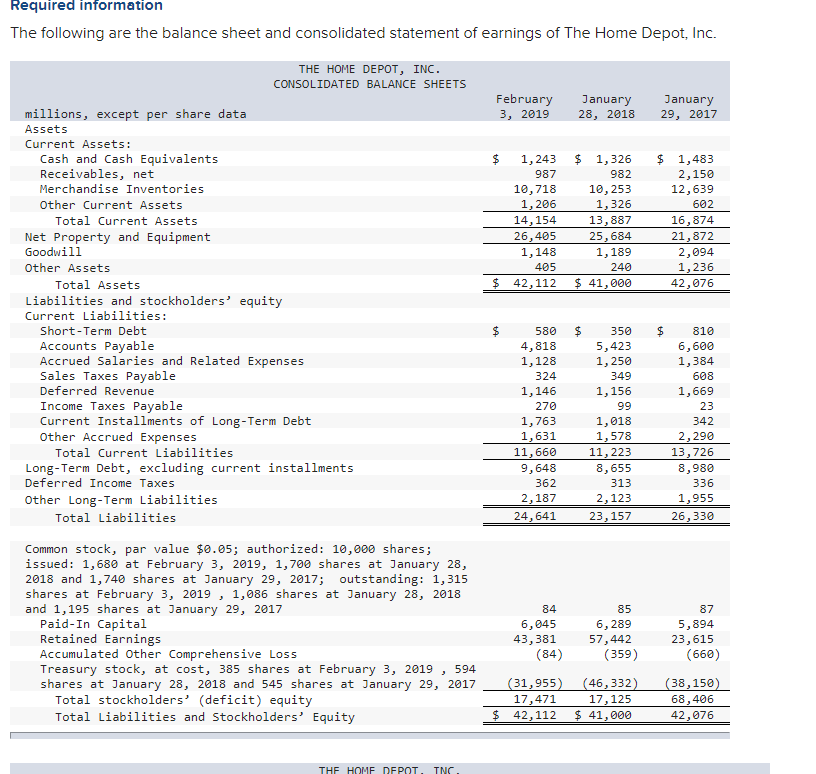

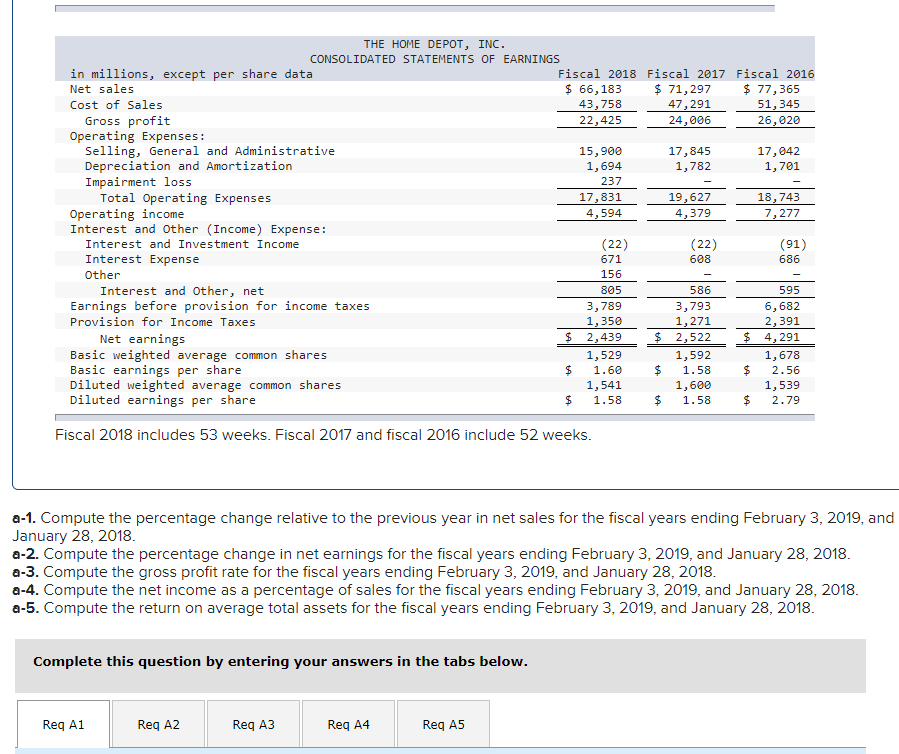

Required information The following are the balance sheet and consolidated statement of earnings of The Home Depot, Inc. THE HOME DEPOT, INC. CONSOLIDATED BALANCE SHEETS February 3, 2019 January 28, 2018 January 29, 2017 $ 1,243 987 10, 718 1,206 14,154 26,405 1,148 405 $ 42,112 $ 1,326 982 10, 253 1,326 13,887 25,684 1,189 240 $ 41,000 $ 1,483 2,150 12,639 602 16,874 21,872 2,094 1,236 42,076 millions, except per share data Assets Current Assets: Cash and Cash Equivalents Receivables, net Merchandise Inventories Other Current Assets Total Current Assets Net Property and Equipment Goodwill Other Assets Total Assets Liabilities and stockholders' equity Current Liabilities: Short-Term Debt Accounts Payable Accrued Salaries and Related Expenses Sales Taxes Payable Deferred Revenue Income Taxes Payable Current Installments of Long-Term Debt Other Accrued Expenses Total Current Liabilities Long-Term Debt, excluding current installments Deferred Income Taxes Other Long-Term Liabilities Total Liabilities $ 580 4,818 1,128 324 1,146 270 1,763 1,631 11,660 9,648 362 2,187 24,641 350 5,423 1,250 349 1,156 99 1,018 1,578 11,223 8,655 313 2,123 23, 157 $ 810 6,600 1,384 608 1,669 23 342 2,290 13,726 8,980 336 1,955 26,330 3 Common stock, par value $0.05; authorized: 10,000 shares; issued: 1,680 at February 3, 2019, 1,700 shares at January 28, 2018 and 1,740 shares at January 29, 2017; outstanding: 1,315 shares at February 3, 2019 , 1,086 shares at January 28, 2018 and 1,195 shares at January 29, 2017 Paid-In Capital Retained Earnings Accumulated Other Comprehensive Loss Treasury stock, at cost, 385 shares at February 3, 2019, 594 shares at January 28, 2018 and 545 shares at January 29, 2017 Total stockholders' (deficit) equity Total Liabilities and Stockholders' Equity 84 6,045 43,381 (84) 85 6,289 57,442 (359) 87 5,894 23,615 (660) (31,955) (46,332) 17,471 17,125 $ 42,112 $ 41,000 (38,150 68,406 42,076 THF HOMF DEPOT TNC THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF EARNINGS in millions, except per share data Fiscal 2018 Fiscal 2017 Fiscal 2016 Net sales $ 66,183 $ 71,297 $ 77,365 Cost of Sales 43,758 47,291 51,345 Gross profit 22,425 24,006 26,020 Operating Expenses: Selling, General and Administrative 15,900 17,845 17,042 Depreciation and Amortization 1,694 1,782 1,701 Impairment loss 237 Total Operating Expenses 17,831 19,627 18,743 Operating income 4,594 4,379 7,277 Interest and Other (Income) Expense: Interest and Investment Income (22) (22) (91) Interest Expense 671 608 686 Other Interest and Other, net 805 586 595 Earnings before provision for income taxes 3,789 3,793 6,682 Provision for Income Taxes 1,350 1,271 2,391 Net earnings $ 2,439 $ 2,522 $ 4,291 Basic weighted average common shares 1,529 1,592 1,678 Basic earnings per share $ 1.60 1.58 $ 2.56 Diluted weighted average common shares 1,541 1,600 1,539 Diluted earnings per share $ 1.58 $ 1.58 $ 2.79 156 Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks. a-1. Compute the percentage change relative to the previous year in net sales for the fiscal years ending February 3, 2019, and January 28, 2018 a-2. Compute the percentage change in net earnings for the fiscal years ending February 3, 2019, and January 28, 2018. a-3. Compute the gross profit rate for the fiscal years ending February 3, 2019, and January 28, 2018. a-4. Compute the net income as a percentage of sales for the fiscal years ending February 3, 2019, and January 28, 2018. a-5. Compute the return on average total assets for the fiscal years ending February 3, 2019, and January 28, 2018. Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Req A3 Reg A4 Req A5

1

1