Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Research recent developments involving this case. Summarize these developments in a bullet format. 2. Suppose that a large investment firm had approximately 10

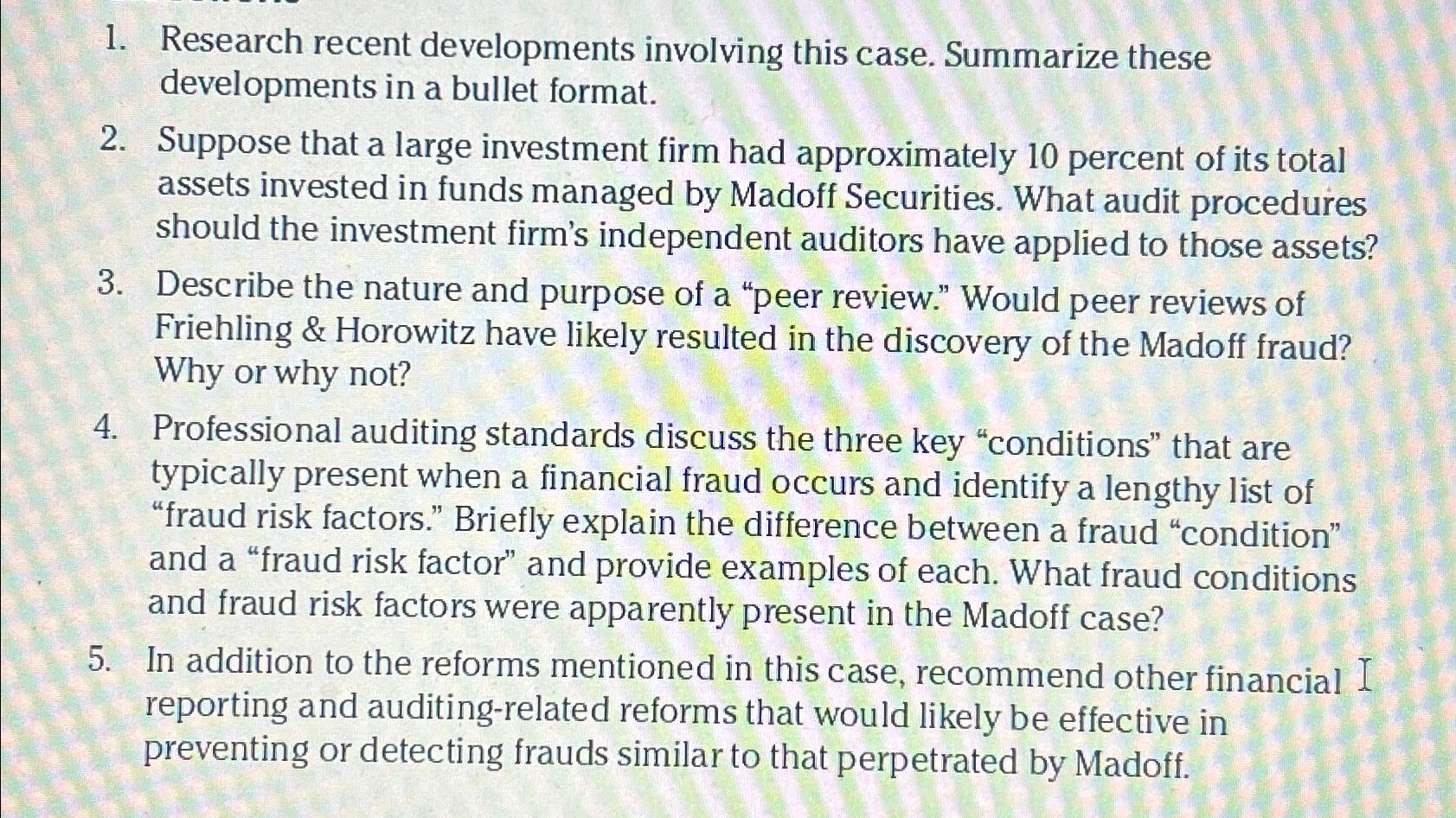

1. Research recent developments involving this case. Summarize these developments in a bullet format. 2. Suppose that a large investment firm had approximately 10 percent of its total assets invested in funds managed by Madoff Securities. What audit procedures should the investment firm's independent auditors have applied to those assets? 3. Describe the nature and purpose of a "peer review." Would peer reviews of Friehling & Horowitz have likely resulted in the discovery of the Madoff fraud? Why or why not? 4. Professional auditing standards discuss the three key "conditions" that are typically present when a financial fraud occurs and identify a lengthy list of "fraud risk factors." Briefly explain the difference between a fraud "condition" and a "fraud risk factor" and provide examples of each. What fraud conditions and fraud risk factors were apparently present in the Madoff case? 5. In addition to the reforms mentioned in this case, recommend other financial I reporting and auditing-related reforms that would likely be effective in preventing or detecting frauds similar to that perpetrated by Madoff.

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Recent developments involving the Madoff case as of my knowledge cutoff in September 2021 include In 2021 Bernard Madoff passed away while serving a 150year prison sentence for his role in orchestra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started