Answered step by step

Verified Expert Solution

Question

1 Approved Answer

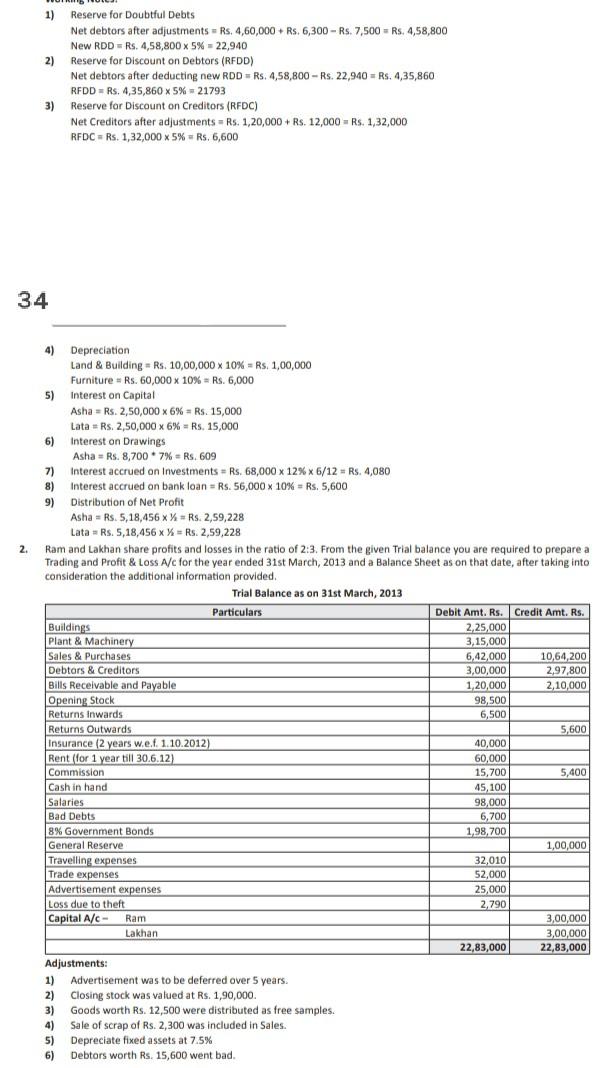

1) Reserve for Doubtful Debts Net debtors after adjustments = Rs. 4,60,000 + Rs. 6,300 - Rs. 7,500 = Rs. 4,58,800 New RDD = Rs.

1) Reserve for Doubtful Debts Net debtors after adjustments = Rs. 4,60,000 + Rs. 6,300 - Rs. 7,500 = Rs. 4,58,800 New RDD = Rs. 4,58,800 x 5% = 22,940 2) Reserve for Discount on Debtors (RFDD) Net debtors after deducting new RDD =Rs. 4,58,800 - Rs. 22,940 = Rs. 4,35,860 RFDD = Rs. 4,35,860 X 5% -21793 3) Reserve for Discount on Creditors (RFDC) Net Creditors after adjustments = Rs. 1,20,000 + Rs. 12,000 - Rs. 1,32,000 RFDC = Rs. 1,32,000 x 5% = Rs. 6,600 34 4) Depreciation Land & Building - Rs. 10,00,000 X 10% = Rs. 1,00,000 Furniture Rs. 60,000 x 10% = Rs. 6,000 5) Interest on Capital Asha = Rs. 2,50,000 x 6% Rs. 15,000 Lata = Rs. 2,50,000 x 6% = Rs. 15,000 = x . 6) interest on Drawings Asha = Rs. 8,700 * 7% = Rs. 609 7) Interest accrued on Investments = Rs. 68,000 x 12% x 6/12 = Rs. 4,080 8) Interest accrued on bank loan = Rs. 56,000 X 10% = Rs. 5,600 9) Distribution of Net Profit Asha = Rs. 5,18,456 % + Rs. 2,59,228 Lata = Rs. 5,18,456 x = Rs. 2,59,228 2. Ram and Lakhan share profits and losses in the ratio of 2:3. From the given Trial balance you are required to prepare a Trading and Profit & Loss A/c for the year ended 31st March, 2013 and a Balance Sheet as on that date, after taking into consideration the additional information provided Trial Balance as on 31st March, 2013 Particulars Debit Amt. Rs. Credit Amt. Rs. Buildings 2,25,000 Plant & Machinery 3,15,000 Sales & Purchases 6,42,000 10,64,200 Debtors & Creditors 3,00,000 2,97,800 Bills Receivable and Payable 1,20,000 2,10,000 Opening Stock 98,500 Returns Inwards 6.500 Returns Outwards 5,600 Insurance (2 years w.e.f. 1.10.2012) 40,000 Rent (for 1 year till 30.6.12) 60,000 Commission 15,700 5.400 Cash in hand 45, 100 Salaries 98,000 Bad Debts 6,700 8% Government Bonds 1,98,700 General Reserve 1,00,000 Travelling expenses 32,010 Trade expenses 52,000 Advertisement expenses 25,000 Loss due to theft 2,790 Capital A/c - Ram 3,00,000 Lakhan 3,00,000 22,83,000 22,83,000 Adjustments: 1) Advertisement was to be deferred over 5 years. 2) Closing stock was valued at Rs. 1,90,000 3) Goods worth Rs. 12,500 were distributed as free samples. 4) Sale of scrap of Rs. 2,300 was included in Sales. 5) Depreciate fixed assets at 7.5% 6) Debtors worth Rs. 15,600 went bad

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started