Answered step by step

Verified Expert Solution

Question

1 Approved Answer

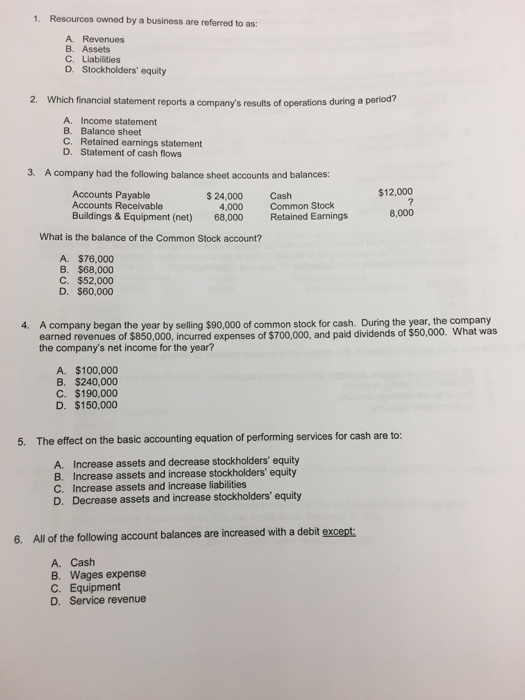

1. Resources owned by a business are referred to as: A. Revenues B. Assets C. Liabilities D. Stockholders' equity 2. Which financial statement reports

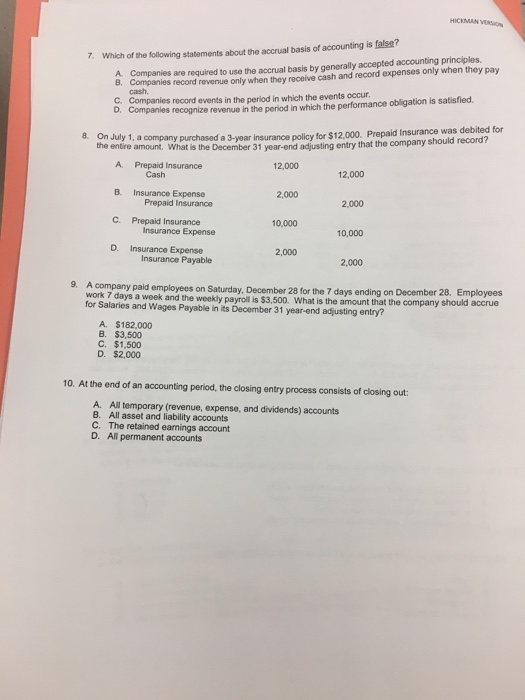

1. Resources owned by a business are referred to as: A. Revenues B. Assets C. Liabilities D. Stockholders' equity 2. Which financial statement reports a company's results of operations during a period? A. Income statement B. Balance sheet C. Retained earnings statement D. Statement of cash flows 3. A company had the following balance sheet accounts and balances: Cash Common Stock Retained Earnings Accounts Payable Accounts Receivable Buildings & Equipment (net) What is the balance of the Common Stock account? A. $76,000 B. $68,000 C. $52,000 D. $60,000 $ 24,000 4,000 68,000 A. $100,000 B. $240,000 C. $190,000 D. $150,000 4. A company began the year by selling $90,000 of common stock for cash. During the year, the company earned revenues of $850,000, incurred expenses of $700,000, and paid dividends of $50,000. What was the company's net income for the year? $12,000 ? 8,000 5. The effect on the basic accounting equation of performing services for cash are to: A. Increase assets and decrease stockholders' equity B. Increase assets and increase stockholders' equity C. Increase assets and increase liabilities D. Decrease assets and increase stockholders' equity 6. All of the following account balances are increased with a debit except: A. Cash B. Wages expense C. Equipment D. Service revenue 7. Which of the following statements about the accrual basis of accounting is false? A Companies are required to use the accrual basis by generally accepted accounting principles. B. Companies record revenue only when they receive cash and record expenses only when they pay cash. C. Companies record events in the period in which the events occur. D. Companies recognize revenue in the period in which the performance obligation is satisfied. 8. On July 1, a company purchased a 3-year insurance policy for $12,000. Prepaid Insurance was debited for the entire amount. What is the December 31 year-end adjusting entry that the company should record? 12,000 A. Prepaid Insurance Cash B. Insurance Expense Prepaid Insurance C. Prepaid Insurance D. Insurance Expense Insurance Expense Insurance Payable 2,000 A. $182,000 B. $3,500 C. $1,500 D. $2,000 10,000 2,000 12,000 2,000 10,000 HICKMAN VERSION 2,000 9. A company paid employees on Saturday, December 28 for the 7 days ending on December 28. Employees work 7 days a week and the weekly payroll is $3,500. What is the amount that the company should accrue for Salaries and Wages Payable in its December 31 year-end adjusting entry? 10. At the end of an accounting period, the closing entry process consists of closing out: A. All temporary (revenue, expense, and dividends) accounts B. All asset and liability accounts C. The retained earnings account D. All permanent accounts

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Answer B Assets Explanation Asset is an items possessed by an organization which may be used to pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started