Question

1) return that a bond:( might, will) 2) return that a bondholder: is (obligated, would like) 3) bond's intrinsic value: be (less than, exceed, equal)

1) return that a bond:( might, will) 2) return that a bondholder: is (obligated, would like) 3) bond's intrinsic value: be (less than, exceed, equal) 4) will trade at: par, a premium, a discount) variable name A: (bonds, annual coupon payment, bonds semiannual coupon payment, bonds market price) B:( bonds annual coupon payment, bonds per value, semiannual coupon payment)

variable value: A: (87.50, 175.00, 43.75, 65.63) C: (3.8125%, 7.2150%, 5.7525%, 5.2500%)

Based on this equation and the data, it is to expect that Olivers potential bond investment is currently exhibiting an intrinsic value less than $1,000. unreasonable, reasonable

If you round the bonds intrinsic value to the nearest whole dollar, then its intrinsic value of (843, 1265, 1054, 1370)

(rounded to the nearest whole dollar) is equal to, greater Than, less than

its par value, so that the bond:( trading at par, trading at premium, trading at a discount)

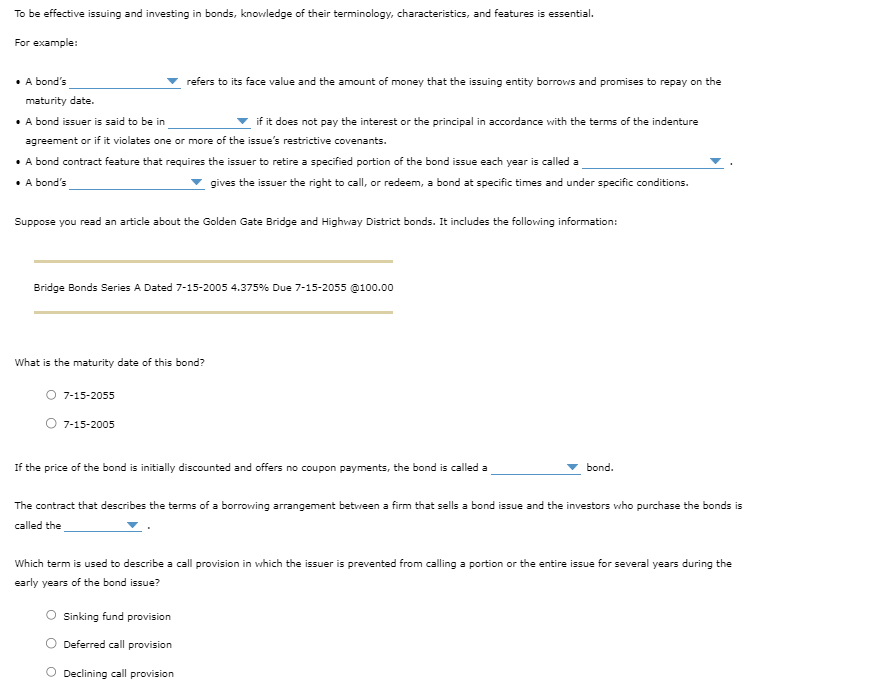

To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: - A bond's refers to its face value and the amount of money that the issuing entity borrows and promises to repay on the maturity date. - A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. - A bond contract feature that requires the issuer to retire a specified portion of the bond issue each year is called a - A bond's gives the issuer the right to call, or redeem, a bond at specific times and under specific conditions. Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375\% Due 7-15-2055 (@) 100.00 What is the maturity date of this bond? 7152055 7152005 If the price of the bond is initially discounted and offers no coupon payments, the bond is called a bond. The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called the Which term is used to describe a call provision in which the issuer is prevented from calling a portion or the entire issue for several years during the early years of the bond issue? Sinking fund provision Deferred call provision Declining call provision Given your computation and conclusions, which of the following statements is true? When the coupon rate is greater than Oliver's required return, the bond's intrinsic value will be less than its par value. A bond should trade at a par when the coupon rate is greater than Oliver's required return. When the coupon rate is greater than Oliver's required return, the bond should trade at a premium. When the coupon rate is greater than Oliver's required return, the bond should trade at a discountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started