Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Review Amazons capital structure and explain whether it is in alignment/supports its value proposition/current stage of development/cash flow characteristics of the business. Are there

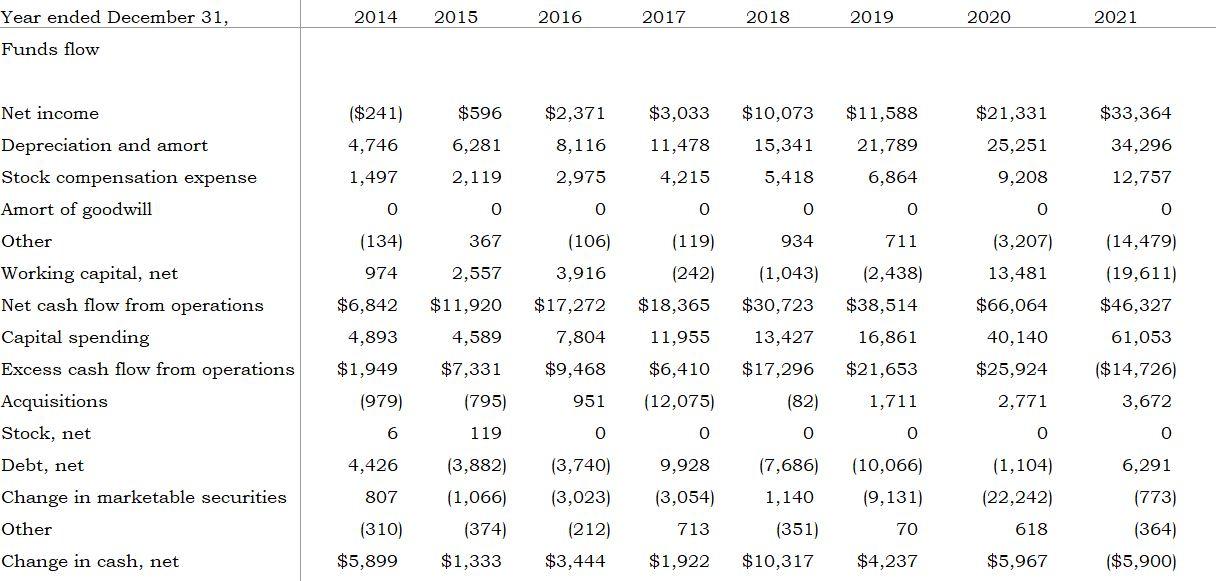

1. Review Amazons capital structure and explain whether it is in alignment/supports its value proposition/current stage of development/cash flow characteristics of the business. Are there any changes that you make that could potentially add value?

2. Review Amazons cash flow generation and how it has either allocated excess cash flow (dividends/share repurchases, acquisitions) or financed is cash flow deficit. Are there any changes that you would suggest and why? What has been the trend in working capital usage and capital spending over time?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started