Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Ryan is investing $9000 in a CD at a bank. If the bank uses simple interest and the bank pays 3.1% annually, how

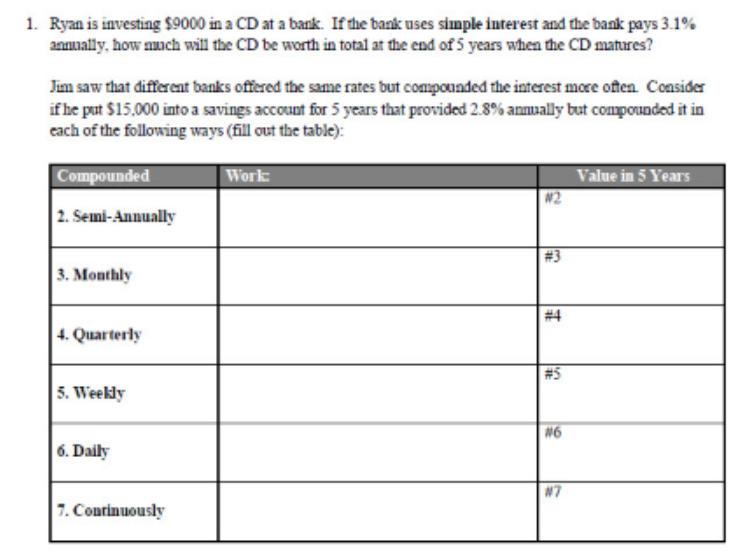

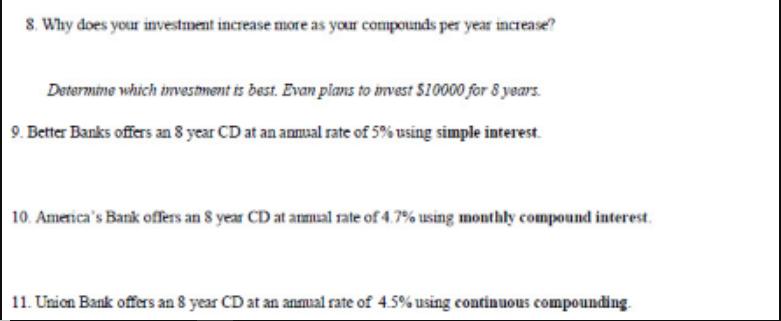

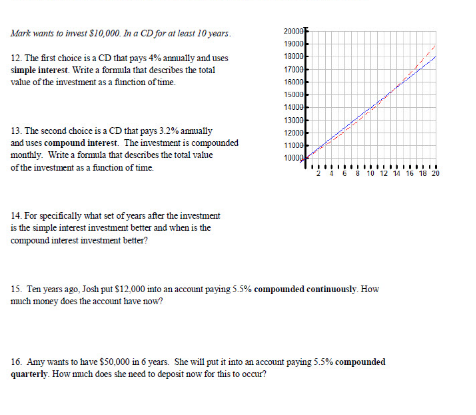

1. Ryan is investing $9000 in a CD at a bank. If the bank uses simple interest and the bank pays 3.1% annually, how much will the CD be worth in total at the end of 5 years when the CD matures? Jim saw that different banks offered the same rates but compounded the interest more often. Consider if he put $15,000 into a savings account for 5 years that provided 2.8% annually but compounded it in each of the following ways (fill out the table): Compounded 2. Semi-Annually 3. Monthly Work: #2 #3 #4 4. Quarterly #5 5. Weekly #6 6. Daily 7. Continuously #7 Value in 5 Years 8. Why does your investment increase more as your compounds per year increase? Determine which investment is best. Evan plans to invest $10000 for 8 years. 9. Better Banks offers an 8 year CD at an annual rate of 5% using simple interest. 10. America's Bank offers an 8 year CD at annual rate of 4.7% using monthly compound interest. 11. Union Bank offers an 8 year CD at an annual rate of 4.5% using continuous compounding Mark wants to invest $10,000. In a CD for at least 10 years. 12. The first choice is a CD that pays 4% annually and uses simple interest. Write a formula that describes the total value of the investment as a function of time. 20000 19000 18000 13. The second choice is a CD that pays 3.2% annually and uses compound interest. The investment is compounded monthly. Write a formula that describes the total value of the investment as a function of time. 14. For specifically what set of years after the investment is the simple interest investment better and when is the compound interest investment better? 17000 18000 15000 14000 13000 12000 11000 10000 2 4 6 8 10 12 14 16 18 20 15. Ten years ago, Josh put $12,000 into an account paying 5.5% compounded continuously. How much money does the account have now? 16. Amy wants to have $50,000 in 6 years. She will put it into an account paying 5.5% compounded quarterly. How much does she need to deposit now for this to occur?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started