Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. S Let today be period and the future (or tomorrow) be period 1. Consider an investor consists of two stocks: A and B. The

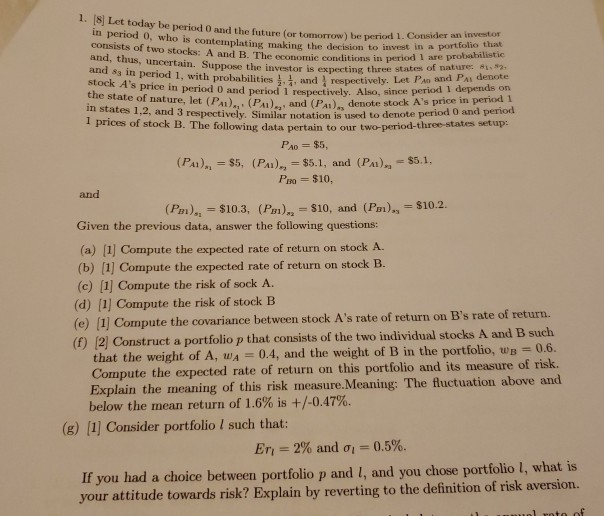

1. S Let today be period and the future (or tomorrow) be period 1. Consider an investor consists of two stocks: A and B. The economic conditions in period I are probabilistic and thus, uncertain. Suppose the investor is expecting three states of nature forte stock A's price in period and period i respectively. Also, since period 1 depends on the state of nature, let (P..)., (P.1),,, and (P.), denote stock A's price in periodo in states 1.2, and 3 respectively. Similar notation is used to denote period 0 and period 1 prices of stock B. The following data pertain to our two-period-three-states setup: PAO = $5, (PA). = $5, (Pu), = $5.1, and (PA). - $5.1, Pro = $10, and (Pm). = $10.3, (Pm). $10, and (Pm), = $10.2. Given the previous data, answer the following questions: (a) (1) Compute the expected rate of return on stock A. (b) (1) Compute the expected rate of return on stock B. (e) [1] Compute the risk of sock A. (d) (1) Compute the risk of stock B (e) (1) Compute the covariance between stock A's rate of return on B's rate of return. (f) (2) Construct a portfolio p that consists of the two individual stocks A and B such that the weight of A, WA = 0.4, and the weight of B in the portfolio, ws = 0.6. Compute the expected rate of return on this portfolio and its measure of risk. Explain the meaning of this risk measure. Meaning: The fluctuation above and below the mean return of 1.6% is +/-0.47% (g) [1] Consider portfolio I such that: En = 2% and 1=0.5%. If you had a choice between portfolio p and I, and you chose portfolio I, what is your attitude towards risk? Explain by reverting to the definition of risk aversion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started